NGS’ NG/LNG SNAPSHOT – MAY 2020, VOLUME 2

National News Internatonal News

NATIONAL NEWS

City Gas Distribution & Auto LPG

GAIL chief Manoj Jain appointed CMD of Mahanagar Gas as well

Manoj Jain, the chairman and managing director of national gas major GAIL, has been appointed as the head of the city gas distributor

read more

Mahanagar Gas as well. Jain took over as the chairman and managing director of Mahanagar Gas on May 6, the company, which supplies piped natural gas to households and auto and industrial gas in Mumbai and its suburbs, said in a statement on Thursday. Jain, a mechanical engineer and MBA, has vast experience of over 34 years with GAIL in various fields such as business development, projects, O&M, petrochemicals, pipeline integrity management and marketing. As the CMD of GAIL, he is also the chairman of GAIL subsidiaries such as GAIL Global USA Inc, GAIL Global USA LNG, GAIL Gas, Brahmaputra Cracker & Polymer, Konkan LNG and a director of Petronet LNG Jain spearheaded installation and commissioning of the USD 1.4 billion grassroots petrochemical complex, as chief operating officer of Brahmaputra Cracker. Mahanagar Gas Ltd (MGL) is the sole authorised distributor of compressed natural gas and piped natural gas in Mumbai, Thane, Navi Mumbai and its adjoining areas and is expanding further to Raigad district. It supplies PNG to over 1.27 million households and over 4,000 commercial and industrial establishments in its operational areas. It also supplies about 3.5 million kgs/day CNG through 256 CNG stations to about 0.75 million motor vehicles. For catering to its consumer base, MGL has laid down a network of about 5,630 km of steel and medium density polyethylene pipeline network.

show less

Covid 19 impact: CGD firms concerned over Force Majeure, demand destruction and labour shortage

Indian City Gas Distribution (CGD) companies are scrambling to deal with Force majeure notices, demand destruction, labour shortage and

read more

liquidity squeeze as a result of Covid-19, executives from three Indian CGD companies said. They said the time-line of pipeline and city gas distribution projects being implemented will be hit due to ongoing challenges faced by the industry. The executives from Indraprashta Gas Limited (IGL), GAIL (India) and Adani Gas were talking at a webcast on Gas Market Outlook- Navigating the Challenges organized by industry body Federation of Indian Petroleum Industry (FIPI) and consultancy firm EY. “Some of the challenges we see are invocation of force majeure, renegotiations to bring down the prices of old contracts. Project execution is at a standstill now during the lockdown. There is expected to be delay in restarting operations even after the lockdown is lifted owing to lack of adequate workers and equipment,” IGL MD E S Ranganathan said. He added a shortfall in achieving the minimum work programme is certain and all the CGD companies will witness an increase in working capital requirement as there are delays in realisation of receivables. Demand for Compressed Natural Gas (CNG) from the transport sector and the industrial and commercial sectors has been severely hit. Ranganathan said the average sale of CNG is down 85 per cent and only 50 per cent of IGL’s retail outlets are open with reduced workforce.

show less

Adani Gas reports 61% rise in Q4 net profit

Adani Gas Ltd on Friday reported a 61 per cent rise in standalone net profit to Rs 122 crore for fourth quarter ended March 31.

read more

The company had posted a net profit of Rs 76 crore in the year-ago period. Adani Gas, which retails CNG to automobiles and piped natural gas to household kitchens and industries, saw sales volumes rise 3 per cent to 145 million cubic metres, the firm said in a statement. However, revenue from operations was 1 per cent lower at Rs 490 crore. The company did not give reasons for lower revenues and higher profit. “The recent unfortunate COVID-19 event and the consequential nationwide lockdown in India has impacted the current ongoing demand of CNG and PNG (piped natural gas) by industrial and commercial segments,” the statement said. City gas distribution falls under essential services and Adani Gas Ltd (AGL) said it will ensure that during this period of crisis, the supply of PNG and CNG is maintained without any interruption. “Currently, with over 95 per cent of volume coming from the operational geographical areas (GAs), makes the business quite resilient,” it said. We expect to continue to generate healthy cash flows from operations going forward.” The company said capital contribution for infrastructure development in new GAs has been made from the accruals of the company.

https://www.energyinfrapost.com/adani-gas-reports-61-rise-in-q4-net-profit/

show less

.Electric Mobility& Bio- Methane

First lithium plant in India plans in progress

India’s first lithium refinery is forging ahead after Neometals Ltd. and Manikaran Power Ltd approved a feasibility study.

read more

The study will aim and focus to supply a nation set to become the fourth-largest electric-vehicle market by 2040. This refinery will have a capacity of 20,000 tons a year of lithium hydroxide, Australia’s Neometals said in a statement. The investment decisions for a potential 50:50 joint venture to develop the project will be supported by this study. India aims to become a global hub for EVs but facing a lot of issues such as lack of access to raw materials like lithium which is used in the production of the batteries. The project is a part of by the country to establish battery factories and secure supplies for the burgeoning EV industry.

Neometals Chief Executive Officer Chris Reed said in the statement that the project would also be time to hit a supply crunch in the lithium sector from the middle of the decade as it will have more demand. The present situation, the coronavirus pandemic has also taught us many things about dependency and how its effects if we don’t have domestic supply chains. Passenger EV sales in India are expected to rise to 2.6 million vehicles in 2040, from about 3,000 in 2018. In 2040, the fleet of electric passenger and commercial freight vehicles in India will displace 360,000 barrels of fuel demand every day.

Source: electricvehicles.in

show less

EV sales reach 2,80,000 units, Sales Report-Bajaj, MG Motor, Tata, MG Motor, TVS

The sales of electric vehicles have reached to 2,80,000 units till November in India. The sales list includes most of the three-wheelers that run on a lead acid-batteries.

read more

The Union government has made a decision that EVs with lead-acid batteries will be stopped from receiving benefits of government incentives in the second phase of the FAME Scheme. The government is looking towards promoting the manufacturing and use of electric vehicles to reduce India’s carbon footprint and crude oil imports. The Faster Adoption and Manufacturing of Hybrid and electric vehicles (FAME 2) Scheme were adopted to develop the commercial vehicle fleet with an outlay of ₹10,000 crores in March 2019. There are several states who have made their own EV policy to promote the electric vehicles in the last two years. The States includes Maharashtra, Karnataka, Andhra Pradesh, Delhi, etc. The sales of electric vehicles excluding e-rickshaws, in India grew by 20 per cent at 1.56 lakh units in 2019-20 by two-wheelers said Society of Manufacturers of Electric Vehicles (SMEV).

The total sales of EVs in India stood at 1.3 lakh units in 2018-2019. Out of them, the total sales in FY20, 1.52 lakh units were two-wheelers, 3,400 cars and 600 buses. The sale for 2018-19 was 1.26 two-wheelers, 3,600 cars and around 400 buses SMEV said in a statement. This figure does not include e-rickshaws which is still largely with the unorganized sector with a reported sale of around 90,000 units. The corresponding figures of the e-rickshaws sold in the previous year have not been documented said SMEV. The growth of EVs sales in India is due to electric two-wheelers. “In the E2Ws sold in FY2019-20, 97 per cents were electric scooters and a very small volume of motorcycles and electric cycles filled the rest of 3 per cent. Low-speed scooters that go at a max speed of 25km/hr and do not need registration with the transport authorities constituted a whopping 90 per cent of all the E2Ws sold,” it added.

Coronavirus impacts on sales of EVs

The SMEV said, “the acceptability of electric cars in the premium segment in the second half of the year was a positive signal of a quantum jump of a much higher volume of e-cars in FY 20-21.” Commenting on the sales performance, SMEV Director General Sohinder Gill said, “the EV industry is taking shape and we believe that despite the COVID-19, FY20-21 will be a defining year for all the EV segments.” At the year start itself, we have witnessed some great EVs launch in India. All the EV launches are from big manufacturers in India such as Bajaj Auto, Tata Motors, Ather Energy, etc. Read the article below to know in detail.

Top 5 electric vehicles launched in India 2020

Bajaj Auto- Bajaj electric scooter sales

The deliveries of the Bajaj electric scooter began in March 2020 and that too in the cities of Pune and Bengaluru. The company sold 91 units of the electric scooter in March 2020 under its brand Urbanite.

Bajaj electric scooter complete details

The Chetak is sold in two variants which are Urbane and Premium, priced at ₹ 1 lakh and ₹ 1.15 lakh respectively (ex-showroom, Pune).

MG Motor India- MG ZS EV sales

Whereas, on the other hand, MG Motor India registered zero domestic sales for the month of April 2020. MG Motor India sold a total of 1,518 units in March 2020, which is a growth of 10.32 per cent over sales figures of February 2020 which includes 116 units of the MG ZS EV and 1,402 units of the MG Hector.

The company sold a total of 1,376 units in February 2020 with 158 unit sales for the ZS electric SUV and 1,218 units of the MG Hector. in total MG Motor India sold 3,130 units in January 2020.

Tata Motors-Tata Nexon EV

The Tata Nexon EV has been the most sold car, the company sold about 198 Nexon EVs in March, despite the whole lockdown situation due to the Coronavirus pandemic outbreak. This electric SUV is available across 60 dealerships across 22 cities in the country.

Hyundai Kona EV

India’s longer-range electric SUV the Hyundai Kona EV has sold limited units. The South Korean carmaker managed to retail 14 units of the Hyundai Kona electric SUV in March.

But the company seems to be lucky in terms of plug-ins. After the first three months of 2020, Hyundai sold 17,351 plug-ins whereas last year the number was 17,036.

TVS Motor- TVS iQube

The TVS Motor was able to sell only 18 units in FY2020 from 1 April 2019 to 31 March 2020. The sales hit 212 and 62 units, respectively.

Electric three-wheelers sales grew to 21% more than ICE three-wheelers

Due to the COVID-19 pandemic worldwide, the growth of EVs and many sectors have been slow down. After the lockdown we can expect that the EVs sales will pick up automatically as people are witnessing how the mother earth is healing without the petrol or diesel vehicles emission is not mixing up in the air. Hopefully, people will realise the importance of electric vehicles and how they are helping us to keep our environment cleaner and greener.

Source: electricvehicles.in

show less

Gas/ Pipelines/ Company News

ONGC awards 49 marginal fields to 7 companies amid corona crisis

ONGC late on Thursday (May14) night awarded 49 marginal producing oil and gas fields to seven companies under a government plan to raise production from

read more

these acreages that are not economical for the state-run flagship explorer. The awarded fields make up 13 onshore contract areas spread across Gujarat, Andhra Pradesh, Tamil Nadu and Assam, the company said in a statement but did not identify the winners. The winners were selected through an international competitive bidding for 17 onshore contract areas. ONGC had invited bids for partnership to raise production from 64 marginal fields that were given to the company by the government without bidding. Being small in size, these fields are uneconomical for a large company for ONGC. The government had originally planned to farm out these fields but later changed tack and asked ONGC to induct partners with a view to ramp up production from these fields. ONGC had invited bids in June last year. The fields are being given on revenue-sharing basis, with the revenue being shared on incremental production over and above the baseline production under business-as-usual (BAU). The selected contractors will not be required to reimburse any expenditure on the fields already incurred by ONGC. These contracts will be for a period of 15 years, with an option to extend by five years. Royalty rate will be reduced by 10% in case of additional production of natural gas over and above BAU scenario, according the statement ONGC has issues after inviting the bids. The contract will allow complete marketing and pricing freedom to sell oil and gas on an arm’s length basis.

show less

Crude crash effect: Govt to sweeten oil and gas production sharing contracts, forms panel

With domestic crude production becoming increasingly unviable in the low global oil price regime, the government has decided to revise production sharing contracts (PSC)

read more

of private oil producers to spur investments. With domestic crude production becoming increasingly unviable in the low global oil price regime, the government has decided to revise production sharing contracts (PSC) of private oil producers to spur investments. In this regard, the Ministry of Petroleum and Natural Gas has formed a committee which will “suggest ways of attracting investment in exploration, enhancing production and eliminating obstacles”. As FE recently reported, the profit of private domestic crude oil producers from PSC fields has dwindled to as low as 20 cents per barrel. When crude ruled at $60 per barrel in January, these producers used to make a profit of around $6/barrel. “The scope of the committee would include to review existing PSCs, suggest methodology for increased exploration and production activities and changes required in existing policies/guidelines on implementation of these contracts,” the ministry’s order, reviewed by FE, said. According to sources, the industry has requested the government to defer and reduce the royalty, cess and profit it receives from domestic crude oil producers under the PSC regime. They also want PSCs, slated to be renewed in September, to be extended till FY21-end. Other demands include removal of the ceiling on gas price for deep water, ultra-deep water and high-pressure-high-temperature (HPHT) fields and zero GST on exploration and development activities. “We have opened up to policy reform our domestic sector,” Pradhan told IHS Markit vice-chairman Daniel Yergin, adding that “I am confident that when there is a resurgence in demand, domestic production will get priority and we are expecting a good amount of investment in that area due to our progressive policy.”The Centre, in February 2019, reformed the oil exploration and licensing policy to enhance exploration activities, attract domestic and foreign investment and accelerate domestic production of oil and gas from existing fields. However, domestic production has been falling with the ageing of existing fields and muted response from the industry to take up new projects, mainly due to lack of incentives.

show less

Domestic gas output falls 19% in April, crude production down 8%

The Domestic natural gas production fell 18.9% to 2,155 MMSCM in April. The 2.5 MMT of crude oil produced in the country in the month

read more

was also 7.7% lower than the production from a year-ago period. The development coincides with domestic consumption of petroleum products falling 46% y-o-y to 18.3 MT in April, when the lockdown to contain the spread of the coronavirus was implemented throughout the month. Indigenous crude oil production caters to about only 15% of the country’s requirements, while for natural gas, 51% of requirement has to be imported. Domestic natural gas output fell 5.2% y-o-y to 31,166 MMSCM in FY20, reversing the growth trend recorded since FY18. Also, the 32.1 MMT of crude oil produced in the country in the fiscal was 1.2% lower than the output from a year-ago period. Domestic production has been falling with the ageing of existing fields and muted response from the industry to take up new projects, mainly due to lack of adequate incentives. Other reasons for lower output in FY20, as admitted by the government recently to a parliamentary committee, include lack of buyers, inadequate evacuation infrastructure, technical constraints in hostile geographical terrains and protests against the Citizenship (Amendment) Bill in upper Assam oilfields. Lack of environmental permissions is also making new drilling difficult. As FE recently reported, the government has decided to revise the production sharing contracts (PSC) of private oil producers. In this regard, the Union ministry of petroleum and natural gas has formed a committee which would also ‘suggest ways of attracting investment in exploration, enhance production and eliminating obstacles’. PSC fields contribute about 26% of the country’s crude oil production.

show less

Coronavirus lockdown: Reliance to resume gas production from KG-D6 by June-end

Reliance said it expects to achieve a peak output of around 28 million standard cubic metres per day by FY24 when all three projects are up and running.

read more

Reliance Industries and its partner BP Plc of UK have pushed back the start of production from the second wave of discoveries in their eastern offshore KG-D6 block to end June because of restrictions on the movement of people and material the nationwide lockdown has imposed. At current Brent oil price of around USD 26 per barrel, the gas from R-Series field in KG-D6 block will cost about USD 2.2 per MMBtu – lower than even the government-mandated rate of USD 2.39 for gas from state-owned ONGC fields. In an investor presentation post its fourth-quarter earnings, Reliance said it is working on three projects in the KG-D6 block, where production from older fields stopped in February this year. “First Gas from R-Cluster field expected by June 2020 subject to lifting of lockdown,” it said. Gas production from R-Cluster was to start by mid-May but the coronavirus lockdown has delayed it. Reliance said it expects to achieve a peak output of around 28 MMSCMD by FY24 when all three projects are up and running. Reliance and BP are developing three sets of discoveries in KG-D6 block — R-Cluster, Satellites, and MJ by 2022. R-Cluster will have a peak output of 12 MMSCMD while Satellites, which are supposed to begin output from mid-2021, would produce a maximum of 7 MMSCMD. MJ field will start production in the second half of 2022 and will have a peak output of 12 MMSCMD. Reliance in November last year auctioned the first set of 5 MMSCMD of gas from the newer discoveries in the KG-D6 block by asking bidders to quote a price (expressed as a percentage of the dated Brent crude oil rate), supply period and the volume of gas required. Sources said Reliance had in November set a floor or minimum quote of 8.4 per cent of dated Brent price – which meant that bidders had to quote 8.4 per cent or a higher percentage for seeking gas supplies. Considering the current average Brent price of USD 26 per barrel, the gas will cost around USD 2.2 per MMBtu. Dated Brent means the average of published Brent prices for three calendar months immediately preceding the relevant contract month in which gas supplies are made. In the first round of auction in November 2019, Essar Steel, Adani Group and state-owned GAIL bought a majority of volumes on offer. The price at that time came to USD 5.1-5.16 per unit. But international oil rates have slumped as demand evaporated due to outbreak of coronavirus and lockdowns imposed by countries around the globe. Essar Steel had picked up 2.25 MMSCMD in the country’s first transparent and dynamic forward auction that lasted about five-and-half-hours on November 15, 2019, sources said. Gujarat State Petroleum Corp (GSPC) picked up 1.2 MMSCMD while Adani Group and Mahanagar Gas Ltd bought 0.3 MMSCMD, sources said, adding GAIL, acting on behalf of fertiliser companies, bought 0.3 MMSCMD of gas. Hindustan Petroleum Corp Ltd (HPCL) had bought 0.35 mmscmd and 0.10 mmscmd went to Gujarat State Fertilizers & Chemicals Ltd (GSFC)/Gujarat Narmada Valley Fertilizers & Chemicals Ltd (GNFC), sources said. In all, 15 customers across sectors such as steel, petrochemicals, city gas, glass and ceramic got gas in the tender, they added. In the November 15 auction, bidders quoted between 8.5 and 8.6 per cent slope to corner all of the 5 MMSCMD supplies available. This translated into a price between USD 5.1 per MMBtu and USD 5.16 per MMBtu at the then-prevailing Brent oil price of USD 60 per barrel. Initially, Reliance had set a floor quote of 9 per cent of dated Brent price, which translated into a gas price of USD 5.4 per MMBtu at USD 60 oil price. But consumers saw this as a very high price considering that imported LNG in the spot market is available at around USD 4 perMMBtu rate currently. To pacify the consumers, Reliance lowered the floor/minimum quote to 8.4 per cent of dated Brent price.

show less

GAIL India breakup proposed

The task force also wants a market-linked price discovery mechanism through a gas exchange and a gas transport system operator.

read more

A finance ministry task force to raise the share of natural gas in fuel consumption to 15% from 6% has suggested a number of measures such as the splitting GAIL India Limited and bringing natural gas under the GST.The task force also wants a market-linked price discovery mechanism through a gas exchange and a gas transport system operator. “To move towards gas economy by increasing the share of natural gas to 15 per cent in primary energy mix, India needs to focus on development of requisite gas infrastructure …..so as to improve the availability and accessibility of natural gas to public at large,” the task force said. The task force has suggested unbundling the gas transmission and distribution segments to make them more competitive, enabling non-discriminatory access to a transmission network. The petroleum ministry, as part of the unbundling of state-owned GAIL, has suggested two entities be formed one with marketing operations and the other, the pipeline company. The pipeline business would be hived off into a separate entity, which is expected to be considered for a strategic sale at a later date. GAIL’s core business after the unbundling exercise would be the marketing of natural gas and petrochemicals production. It will have to hire capacity in pipelines from the subsidiary and pay regulator-approved tariff. The task force has suggested the creation of a gas transport system operator (TSO), who would enable uninterrupted gas flows from any gas source (domestic and imported) to any gas consuming market. “The setting up a TSO, without any conflict of interest, is necessary. It will facilitate in catalysing the creation of new gas markets along with interlinking regional networks to develop a single gas market in the country,” the report said. The task force also suggested the need to establish a free gas market through trading hub/exchanges . “A gas trading platform will go a long way in enhancing trade transparency, boosting consumer confidence, and increasing market opportunities for suppliers,” thepanel said.

https://www.telegraphindia.com/business/gail-india-breakup-proposed/cid/1770179

show less

GAIL rules out paying AGR dues

State-owned gas transporter GAIL, which needs to cough up Rs 1.83 lakh crore as adjusted gross revenue (AGR) dues to the DoT, has said the amount is not payable

read more

as it is not related to the licence norms and has asked the department to withdraw the order.“The amount assessed in provisional assessment orders are not payable, being unrelated to the terms and conditions of the IP-II Licence obtained by the company and hence are also legally not tenable and the company had refuted these provisional assessment orders and requested for their withdrawal by the DoT,” the state-owned firm said in an exchange filing. They said GAIL obtained the ISP (internet service provider) licence in 2002 for a period of 15 years, which expired in 2017. However, GAIL has never done any business under the ISP licence. Since no business is done under ISP licence, there is no amount payable. The DoT had raised demands and issued provisional assessment orders on the non-telecom public sector undertakings (PSUs) for leasing out surplus optical fibre network that was primarily used for their internal communications under the National Long Distance Service licences. In provisional assessment orders, the DoT has raised a demand on GAIL of Rs 1.83 lakh crore towards annual licence fee, including interest and penalty on AGR. The DoT is demanding a licence fee from GAIL at 8 percent of its total revenue and not just on its miniscule optic fibre revenue. Oil minister Dharmendra Pradhan had said that the notices and assessments were served to non-telecom firms was because of a communication gap. The demand notices by DoT follow the SC’s judgement on 24 October 2019 that broadened the definition of AGR for telecommunications firms to include non-core operations. Non-telecoms companies such as GAIL (India) and Oil India are of the opinion that the expanded definition of AGR is not applicable to non-telcos.

The apex court had asked GAIL, from whom department of telecommunications (DoT) has demanded AGR dues, “to seek appropriate remedy before the appropriate forum”.

“Thus, the AGR issue is likely to remain an irritant until TDSAT or a higher court to which the matter may be taken rules on it. However, we expect the eventual ruling to favour GAIL establishing that it is not required to pay license fee on its non-telecom revenues,” ICICI Securities said in a report.

https://www.telegraphindia.com/business/gail-rules-out-paying-agr-dues/cid/1771493

show less

Collector D Muralidhar Reddy directs ONGC, GAIL to adopt safety measures in Kakinada

Kakinada: District Collector D Muralidhar Reddy instructed the Oil and Natural Gas Corporation (ONGC) and Gas Authority of India Limited (GAIL)

read more

to take precautionary measures for safety and keep vigilance on pipelines constantly. He convened a review meeting with industrial representatives here on Saturday. He advised the managements to follow strictly the safety measures in their operations in the gas pipeline areas. He further instructed them to continuously monitor the situation. He said that the pipelines should be inspected every week in order to prevent any unexpected leakage. Director of Mines and Geology Y Venkat Reddy said that emergency equipment should be made available on the premises of the industries. ONGC Chief General Manager C Ravi Kumar said that necessary precautionary measures have been taken in the organisation. GAIL Dy General Manager GSSRV Prasad said that after necessary scrutinyand inspections of the instalations certificates would be issued after one week.

show less

Policy Matters/ Gas Pricing/Others

Gas production to remain a loss-making proposition for upstream producers: ICRA

Ravichandran said the recent sharp drop in crude oil prices is a credit negative for the upstream sector as their realisations and

read more

cash accruals will decline. Domestic gas production is expected to remain a loss-making proposition for most Indian upstream producers in financial year 2020-2021 as prices are expected to remain subdued, rating and research firm ICRA said today. “Gas prices at various international gas hubs have declined, which would lead to lower domestic gas prices in FY2021,” K Ravichandran, senior vice-president at ICRA said. According to ICRA, the credit metrics of Indian upstream players will further weaken materially in the near-term unless the government provides some relief on fiscal levies like royalty, cess and profit petroleum, along with changes in domestic gas pricing formula. Price of domestically produced natural gas fell 26 percent to $2.39 per MMBtu for the period between 1 April 2020 to 30 September 2020, the lowest recorded price of domestically produced natural gas under the Administered Price Mechanism (APM). The country’s largest oil and gas producer Oil and Natural Gas Corporation (ONGC) is expected to face a loss of Rs 6,000 crore in financial year 2020-2021 on the back of subdued domestic natural gas prices. The company had last month said that low natural gas prices are making production unviable and gas pricing should be completely market based in order to incentivise production.

Ravichandran told ETEnergyWorld that India’s crude oil production is expected to be muted in 2020-202 as compared to the year ago period and natural gas production is expected to increase in the current financial year as major offshore gas projects are expected to come on stream this year. “Natural gas production may witness an increase as RIL is expected to start production from June and even ONGC is expected to ramp-up production from its offshore fields. We expect 8-10 MMSCMD growth over the previous year,” Ravichandran said. Gas production in 2019-2020 declined five per cent to 31,180 MMSCM, the lowest recorded output in at least 18 years, an analysis of historic data by ETEnergyWorld showed. Similarly, the country’s crude oil production last financial year also fell to its lowest level in at least 18 years.

show less

Pradhan hints at new gas policy, says low oil prices no answer

With current pricing formula making natural gas production economically unviable, Oil Minister Dharmendra Pradhan on Friday (May 8)

read more

hinted at bringing in a new gas policy as well as launching a gas exchange very soon as part of reforms to promote greater use of environment-friendly fuel in the world’s third-largest energy-consuming nation. Pradhan also said that India favours reasonable prices that give some space to the producer countries.“We have to have a reasonable price. India is a major consumer. But at this juncture, India’s viewpoint is the price should be reasonable and responsible. Very low prices are not the answer. Reasonable prices are the answer,” he said.Speaking in the latest edition of the CERAWeek Conversations series, he said, “Oil prices should give some space to the producer countries. It should be profitable for them; it should be viable for them.” The transcript of his address was provided by the organiser, IHS Markit.His views come days after international oil prices plunged to USD 18.10 a barrel, its lowest since November 2001. Rates have since rebounded to around USD 30 per barrel.On longer-term energy policy priorities following national lockdowns, he said, “We are moving towards a new gas policy, a new tariff policy. We are planning for a gas exchange very soon and we will be liberalising our distribution mechanisms.” Natural gas prices in India have fallen to their lowest in more than a decade, leading to producers like ONGC incurring losses in businesses.Prices of natural gas — that is used to produce fertilisers, generate electricity and gets converted into CNG for use in automobiles and piped natural gas for household cooking — were from April 1 cut to USD 2.39 per million British thermal unit — a rate about 37 per cent lower than the cost of production. The government was looking to push for city gas expansion once the nationwide lockdown imposed to curb the spread of coronavirus is lifted.

https://telanganatoday.com/pradhan-hints-at-new-gas-policy-says-low-oil-prices-no-answer[Edited]

show less

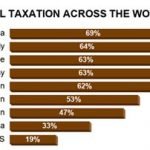

India now has the highest taxes on fuel in the world!

This after the steepest ever hike in excise duty by Rs 13 per litre on diesel and Rs 10 per litre on petrol on Tuesday night, repo.

This after the steepest ever hike in excise duty by Rs 13 per litre on diesel and Rs 10 per litre on petrol on Tuesday night, repo.

read more

On Monday, the government had also increased road cess on petrol and diesel by Rs 8 per litre. Further, additional excise duty was also hiked by Rs 2 per litre (on petrol) and Rs 5 per litre (diesel). Also on Tuesday, the state government in Delhi hiked value added tax which goes to its own kitty by Rs 7.1 per litre on diesel and Rs 1.6 per litre on petrol.That means every litre of petrol in Delhi that currently retails at Rs 71.26 includes taxes of Rs 49.42 while for every litre of diesel at Rs 69.39 it is Rs 48.09. Taxes now comprise over 69 per cent of the pump price of the two fuels — the highest in any part of the world.

Source: Petroleum Planning &

Analysis Cell, IOCLet’s put it in perspective. In Delhi dealers pay Rs 18.28 per litre for petrol, including the base price and freight. After levying VAT, excise and dealer commission, the retail price shoots up to Rs 71.26 for a litre. Similarly, for diesel, dealers pay Rs 18.78 a litre.

Excise duty: On petrol, the duty levied is Rs 32.98 a litre, while on diesel it is Rs 31.83 per litre.

VAT: It varies from state to state, with Madhya Pradesh, Kerala, Rajasthan, Karnataka levying over 30 per cent VAT — the highest among states. Dealer commission: Is different for petrol and diesel and varies a little with the location of fuel pumps, ranging from Rs 2-4/litre. In Delhi, the dealer commission is Rs 3.57 a litre, while on diesel it is Rs 2.51.Now, the government is expected to gain close to Rs 1.6 lakh crore in additional revenues this fiscal from the excise duty hikes. But while it has delayed the release of monthly GST figures, several state governments like Delhi, Andhra Pradesh, Assam and West Bengal have reported a 90 per cent drop in tax collections in April. However, the increase in duty on fuel is however unlikely to offer any major relief to the government as demand for oil in the country has also taken a big hit.

show less

India’s oil imports, product exports slow down in March

India’s March crude oil imports rose at the slowest pace this year, while refined product exports also rose but at a lower rate as some

read more

refineries cut back crude processing as the coronavirus outbreak crushed demand for fuel.Crude oil imports in March rose 1.8% to 19.52 MMT from a year earlier, having risen 9 per cent in the previous month, according to data on the website of Petroleum Planning and Analysis Cell (PPAC) on Friday (May 1). Oil products imports rose more than 7% to 3.92 MMT year-on-year, which was the lowest year-on-year percentage rise since January 2019. Oil product exports rose 7.4% to 5.93 MMT, sharply down from a 21.4% rise in February. Exports of diesel were also affected by the coronavirus crisis and rose only 11.7% in March, the lowest year-on-year increase since August. Petrol exports declined 5.2% in March as the virus hit economic activity and fuel demand for transportation globally.Asia’s third-biggest economy imports and exports refined fuels as it has surplus refining capacity. Rystad Energy expects COVID-19 to remove nearly 4 million bpd of road diesel demand worldwide in the second quarter, and diesel demand in other sectors to drop by another 1.2 million bpd. India on Friday extended its nationwide lockdown for another two weeks from May 4, but said it would allow “considerable relaxations” in lower-risk districts. The lockdown was put in place on March 24.The country’s crude processing in March fell 5.7% from a year earlier, the most since September, as the coronavirus crisis and travel restrictions to curb its spread dented fuel demand and forced refineries to cut output. India’s annual fuel demand in 2019/20 also grew at its lowest rate in more than two decades.

show less

Low prices soothe India’s oil and gas import bill in 2019-2020

Steep decline in global prices have helped India reduce its oil and gas import bill in 2019-2020, providing relief to the government

read more

at a time the Covid-19 pandemic has impacted economic activity. The decline in global commodity prices have helped the country increase imports of petroleum products and Liquefied Natural Gas (LNG) in 2019-2020 without inflating the import bill, data published by oil ministry’s statistical arm PPAC and the commerce ministry showed. India’s oil imports, including petroleum products, decreased 8.15 per cent to $129 billion in 2019-2020, as compared to the year ago period. In volume, oil imports increased four per cent to 270 MMT. The country’s import of LNG spiked 17 per cent to 33,680 Million Standard Cubic Meter (MMSCM) in 2019-2020. In value terms, however, imports declined 7.76 per cent to $9.5 billion. Refinery shutdown initiated by state-owned refiners in 2019-2020 meant to supply Bharat Stage VI fuel country-wide led to a spike in petroleum product imports last financial year, data showed. Imports of petroleum products last financial year grew 29 per cent to 42.8 MT. According to the oil ministry, imports of all petroleum products except naphtha and aviation turbine fuel increased last financial year. In value terms petroleum products’ imports increased to $17.8 billion in 2019-2020.Low commodity prices are helping the government maintain trade deficit. However, the 40-day lockdown to contain the spread of the Coronavirus is denting the country’s domestic oil demand and impacting the government’s revenue from taxes it imposes on crude oil and petroleum products, news agency Bloomberg said. It quoted an economist as saying the drop in consumption of fuel in April would lead to a revenue loss of $5.3 billion for the government.

show less

DGH approves investments worth $4.8 b during lockdown

The Directorate General of Hydrocarbons (DGH) has given investment approvals worth nearly $4.8 billion (approximately ₹36,000 crore)

read more

during the last two weeks for upstream oil and gas activities in India. Among the large investment proposals that have given approval are ‘work-plan budgets’ of projects in the Krishna-Godavari Basin, including projects of ONGC and Reliance Industries Ltd. Work-plan budgets of major investments in Rajasthan have also received approval. “Taking into account approvals for exploration activities too, investment approvals worth nearly $4.8 billion were given by the DGH in the last two weeks alone,” said a DGH official. “In the last two weeks, more than 55 management committee meetings have been conducted online,” the official added. There is also a DGH control room that operates round-the-clock, seven days a week. The control room coordinates with different levels of the government to ease movement restrictions for upstream projects during the lockdown, the official said. On the fall in crude oil prices and the viability of domestic projects, the official said: “The prices may remain low in the short-term, but not in the long-term. This is actually a big opportunity for domestic players. These domestic projects have been visualised assuming that the price of crude oil will remain at around $40 a barrel. It is expected that crude will regain those levels once normalcy resumes.”

show less

Centre sets up six-member panel to review production sharing contracts

The ministry of petroleum and natural gas has set up a six-member expert committee to review the existing production sharing contracts (PSCs)

read more

owing to the fall in crude oil prices and the Covid-19 lockdown. Because of lower oil and gas price environment, there is a need to find ways of attracting investment in exploration and production of oil and gas. The committee’s scope includes suggesting methodology for increased production and activities and changes required in the existing policies. The panel has members from ONGC, OIl India, directorate general of hydrocarbons (DGH), ministry of petroleum, and former DGH officials, with expertise in the operational aspects of hydrocarbon industry. “Industry needs relief from cess, royalty, and other incentives. The first decision should come in the form of cess by removing it, because the Hydrocarbon Exploration and Licensing Policy (HELP) has no cess component. The government may not tamper with royalty because it goes to the state. The committee should also consider giving a relief on profit petroleum by offering a moratorium,” said P Elango, managing director, Hindustan Oil Exploration Company. The Covid-19 pandemic has curtailed activities and downsized the global energy demand, resulting in excess supply and low prices. However, this lower price regime is denting the profits of domestic producers. Based on industry estimates, domestic producers save the country more than Rs 1.7 trillion annually with their production and consequent reduced imports.“We are happy that the government is looking into enhance the production from domestic sources. We expect some positive recommendations on fiscal front,” said Ashu Sagar, secretary general, the Association of Oil and Gas Operators.The price of Brent crude was seen at $30.97 a barrel at one point on Sunday (May10). The dip in international prices is positive for India as the country’s import dependency in 2019-20 was around 85%, up from 83.8% in 2018-19. Owing to lower prices, the import bill, too, dropped from $111.9 billion in 2018-19 to around $102 billion in 2019-20. The members of the committee include Yash Malik, advisor to the ministry of petroleum, Sanjay Chawla, ED of ONGC, A R Patel, advisor (finance) of DGH, K S Shaktawat former DGH official, Joydev Lahiri from Oil India, and M B Doja from the geology department of ONGC.“The problem is it is a PSU-DGH-dominated panel. There is no representation from the private sector, industry bodies, and from top bureaucratic circles. Hence, it has to be seen how fast the suggestions would be converted into decisions,” said an industry source.Several companies had raised concerns about the pricing of natural gas, too. The natural gas selling price for the period starting from April 1, 2020 came down to $ 2.39 per MMBtu from $3.23 a unit.

show less

LNG Development and Shipping

Not cancelled any long-term contract for LNG or crude oil: Dharmendra Pradhan

Indian energy companies have deferred some cargoes and spot bookings but not cancelled any long-term contracts for procuring Liquefied Natural Gas (LNG) or

read more

crude oil supplies, oil minister Dharmendra Pradhan said. In a conversation with Daniel Yergin, Vice Chairman of research and consultancy firm IHS Markit, Pradhan said India has 5.3 MMTPA of strategic storage capacity. “By mid-May it will be full. Apart from that, our companies have 7 MMT of floating oil in their contracts. We have booked them, we have purchased them. With our domestic online capacity in crude oil or products we have storage of around 25 MMT,” Pradhan said. He added India has around 38 MMT of product and crude oil storage facility which is 18 per cent of the country’s annual energy requirement. Talking about the impact of Covid-19 on India’s oil and gas industry, the minister said Indian refiners are currently grappling with reduced demand and inventory losses. “A few weeks back we decided to start our economic activities, transportation activities, industrial activities in the rural areas of the countryside and gradually we are edging out from the lockdown. Our demand is picking up,” Pradhan said.

show less

India’s LNG imports jumped 18 per cent in 2019-2020

In an indication of increasing demand for natural gas in the country, India’s import of Liquefied Natural Gas (LNG) jumped 18 per cent to 33,680 Million

read more

Standard Cubic Meter (MMSCM) in 2019-2020, as weaker global prices of LNG prompted the local industry to consume more, data analysed by ETEnergyWorld showed. Despite higher volumes, the LNG import bill witnessed a decline last fiscal indicating a sustained weakness in global LNG prices. According to data published by Petroleum Planning and Analysis Cell (PPAC), the country’s LNG import declined 8 per cent to $9.5 billion in 2019-2020. According to analysts many refiners, gas marketing companies and gas-based power plant operators aggressively grabbed distressed LNG cargoes during the first quarter of 2020 in anticipation of robust natural gas demand. All the major sectors which consume imported LNG witnessed a major jump in demand last financial year. Data showed LNG imports by the power sector increased 26 per cent to 3,595 MMSCM.

Spot LNG imports by gas-based power plants peaked at 10.63 Million Standard Cubic Meter per Day (MMSCMD) in March 2020, the highest for 2019-2020. Analysts had last month told ETEnergyWorld the decline in domestic natural gas production in the last couple of quarters may have pushed gas-based power plants to increase buying of spot LNG cargoes. LNG imports by City Gas Distribution (CGD) companies increased 19 per cent to 4,746 MMSCM in 2019-2020. Similarly, the petrochemical industry witnessed a 15 per cent increase in LNG imports at 3,016 MMSCM.

https://www.energyinfrapost.com/indias-lng-imports-jumped-18-per-cent-in-2019-2020/

show less

Natural Gas / Transnational Pipelines/ Others

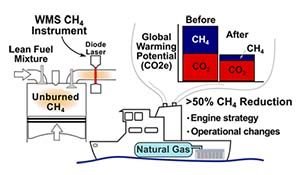

Canadian initiative unveils solution for low emission natural gas engines

Natural Gas Futures (NGF) is an industry-led applied research and education initiative of the University of British Columbia to provide reliable,

Natural Gas Futures (NGF) is an industry-led applied research and education initiative of the University of British Columbia to provide reliable,

read more

evidence-based recommendations and technology solutions for the safe and environmentally responsible use of natural gas. NGF announced that a new project focusing on emissions mitigation for in-use natural gas engines has been recently launched. NGF researchers forged a collaboration with FortisBC Inc., Seaspan Ferries Corporation, and Solaris Management Consultants Inc. to provide technologies for low-emissions engine systems, and quantitative emission characterization for inventory and policy development purposes. A total of $356,566 research grants were awarded by NSERC (Natural Sciences and Engineering Research Council of Canada) and Mitacs (nonprofit national research organization) programs. To reduce the climate impacts of transportation systems, several approaches have been identified through which greenhouse gas (GHG) emission can be reduced, primarily through CO2 emission reduction. These approaches include electrification of powertrains and fuels with lower carbon content. For large engine applications (e.g., marine, stationary power generation, remote applications), electrification is not yet realizable, and bio-fuels carry energetic penalties and may require significant engine modifications. For such applications, natural gas and renewable natural gas are attractive alternatives because of their lower CO2 and NOx emissions, and the significant North American gas reserves. While natural gas is an attractive engine fuel to reduce these pollutants, it can also result in exhaust-stream CH4 emissions, which have a global warming potential (GWP) 28 times that of CO2 (on a 100 year timescale). Thus, all GHG emissions must be considered to ensure that the benefits of natural gas and biogas are realized, without also incurring unintentional increases in GHG or other emissions. This research will support the use of natural gas and renewable natural gas for engine applications by assessing and ultimately improving the in-use engine operation and emissions.

show less

Construction to start of gas pipeline from Norway to Poland

Duda said the Polish-Danish-Norwegian project will also supply gas to other countries in central and eastern Europe, and especially to Ukraine,

read more

easing its dependence on Russian gas. Construction of a major gas pipeline from Norway is to begin in the coming days and will be a “milestone” in giving Poland independence from Russian gas, Polish President Andrzej Duda said Monday (May4). Duda said that the Baltic Pipeline will be operational in October 2022 and its capacity will be 10 billion cubic meters (353 billion cubic feet) of gas per year. Duda called it “very good news.” Duda said the Polish-Danish-Norwegian project will also supply gas to other countries in central and eastern Europe, and especially to Ukraine, easing its dependence on Russian gas. The move comes despite a crash in the price of oil and gas in recent weeks that has cut energy producers’ revenues and led to cuts in production around the world. talian engineering company Saipem is to lay the part of the pipeline that will lie on the floor of the North and Baltic seas. Saipem said the contract is worth some 280 million euros ($307 million). Poland has been gradually reducing its heavy dependence on Russian gas, inherited from the communist era. One of the elements is a new liquefied gas terminal in Swinoujscie that receives imports from the US and Qatar, among others.

show less

Global LNG Development

Japan spot LNG import prices hit record low amid coronavirus outbreak

Prices for spot liquefied natural gas (LNG) cargoes imported into Japan, the world’s biggest buyer of the fuel, fell in April to their lowest

read more

since the country’s trade ministry started compiling data in 2014. The latest low for LNG cargoes into Japan – reflecting actual prices paid rather than those derived from surveys or indices – highlights the evisceration of demand for gas, along with other commodities, brought about by the coronavirus pandemic. The outbreak has turned markets on their heads, with U.S. oil prices slipping into negative territory during April and in Japan, electricity prices effectively hitting zero on regular occasions as industrial activity has slowed. The average contract price for spot LNG cargoes shipped to Japan in April fell to $2.40 per MMBtu according to data released by the Ministry of Economy, Trade and Industry (METI) on Thursday (May 14). That was the lowest since the METI started publishing the data in March 2014 and was down from $3.40/MMBtu in March. Asian spot LNG prices LNG-AS fell to a record low of below $2/MMBtu earlier this month, with buyers in Asia and Europe cancelling cargoes from the United States, usually the cheapest source for gas to turn into LNG before shipping costs. While some countries are starting to ease lockdowns put in place on billions of people, secondary outbreaks in South Korea and China have raised fears that the pandemic will be protracted, putting further pressure on commodity prices. METI surveys spot LNG cargoes bought by Japanese utilities and other importers, but excludes cargo-by-cargo deals linked to benchmarks such as the U.S. natural gas Henry Hub index. It only publishes a price if there is a minimum of two eligible cargoes reported by buyers.

show less

Global LNG-Asian LNG price drops as deals done at record lows

Asian spot prices for liquefied natural gas (LNG) fell this week with some deals done at record lows, as demand was depressed globally amid

read more

coronavirus-related lockdowns. The average LNG price for June delivery into northeast Asia LNG-AS was estimated at a new record low of around $1.85 per MMBtu on Friday (May1), $0.10 per MMBtu lower than the estimate last week. As lockdown restrictions reduced industrial demand and prompted buyers to reschedule long-term LNG deliveries, sellers were left with excess volumes, flooding the market with offers in the past several weeks. This week, Inpex Corp sold a cargo from Australia’s Ichthys plant for loading in May at $1.70-$1.75 per MMBtu on a delivered ex-ship (DES) basis, which traders said was a record low price. Kuwait Foreign Petroleum Exploration Co (KUFPEC) offered a spot cargo from the Wheatstone plant in Australia for June 21 to 26 loading. The tender was awarded to BP at around $1.70 per MMBtu on an free-on-board (FOB) basis, two sources said. Papua New Guinea LNG export plant offered a cargo for loading on June 3 if bought on a free-on-board (FOB) basis or for delivery on June 12-15 to Japan, Korea, Taiwan or China if purchased on a delivered ex-ship (DES) basis. The project also sold a June cargo, via bilateral talks, to BP at around $1.85-$1.90 per MMBtu, a market source said. Nigeria Liquefied Natural Gas (NLNG) awarded a tender for two June cargoes to U.S. producer Cheniere and German’s Uniper, three sources said. The prices were between $1.10 and $1.50 per MMBtu on an FOB basis, they added. Russia’s Sakhalin 2 plant awarded its tender for six cargoes loading between June 2020 and February 2021. Some cargoes were sold at a premium to the S&P Global Platts Japan Korea Marker (JKM), market sources said. The plant also offered a cargo for June loading this week, one of them said. Offers also came from Argentine oil company YPF SA which offered a cargo for loading in May and Angola’s LNG project which was selling a cargo for delivery in May. Global demand for LNG remains low, with only few buyers seeking cargoes, trade sources said. Mexican state power utility CFE was seeking a cargo for delivery in May to the Manzanillo LNG terminal on Mexico’s west coast. Colombia’s Calamari LNG import project was looking for a partial cargo for delivery in the first half of May. Europe has become this week an epicentre of vessels used as floating storage as the coronavirus pandemic has severely disrupted gas demand, leading to delays in tanker discharges, analysts said. Up to 11 tankers out of 15 floating with cargoes on board globally were piling up off the shores of Europe or were expected to deliver cargoes there, data intelligence firm Kpler said.

Source: LNG Global

show less

Australia’s Woodside not cutting LNG output

Australian independent Woodside Petroleum said there are no plans to cut LNG production in response to weaker gas demand because of

read more

the impact of the Covid-19 pandemic on economic activity and energy demand. Around 80% of Woodside’s output from the three Australian LNG plants it is involved in is sold through a mixture of medium and long-term contracts, with the remaining 20% exposed to the spot market. The contracts do not include scope to cut supplies without incurring penalties, Woodside chief executive Peter Coleman said today. “We will not be cutting production,” he said. Woodside is the operator of the 16.3 MMTPA North West Shelf (NWS) LNG and the 4.3 MMTPA Pluto LNG and has a 13% stake in the Chevron-operated 8.9 MMTPA Wheatstone LNG, all offshore Western Australia (WA). Woodside also has an agreement to acquire 846,000 T/yr from the second production train at the Corpus Christi LNG export terminal in Texas which is operated by US LNG firm Cheniere Energy. “I can’t comment on what we are doing in the US,” Coleman said. Some LNG producers have announced production cuts. Shell said this week that expects to reduce LNG production by 8-17pc in the April-June quarter as global LNG demand slows because of the Covid-19 outbreak. Woodside largely agreed with the IEA forecast this week that global gas demand could fall by 5pc this year if lockdowns persists. “There are a range of scenarios we are looking at that relate to gas demand and that view is within that range,” Coleman said. Woodside’s share of LNG production rose in the January-March quarter from a year earlier with NWS LNG operating near full capacity and Pluto operating above nameplate capacity. The collapse in the oil price prompted Woodside to defer plans to develop the Scarborough gas field in the Carnarvon basin offshore WA to provide feedstock for a second Pluto train. It also deferred the development of the Browse backfill gas project to provide feedstock for NWS LNG. “It will be hard to keep the North West Shelf full in the not so distant future unless there is some agreement to provide backfill gas,” Coleman said. But Woodside has no intention of moving from its deferred project timeline, he said.

https://www.argusmedia.com/en/news/2101605-australias-woodside-not-cutting-lng-output

show less

Freeport LNG achieves Train 3 start of commercial operations

Freeport LNG on Monday (May 4, 2020) announced that it began commercial operations for its third liquefaction train on Friday, May 1,

read more

with the commencement of liquefaction services to Total S.A. and SK E&S under their tolling agreements with Freeport. “The start of commercial operations for Freeport LNG’s Train 3 marks the full commercial operation of our $13.5 billion, three train facility. After over five and a half years of construction, which began in December 2014, we are thrilled to now have all three trains operating safely, and capable of producing in excess of 15 MMTPA. I want to congratulate and thank our teams who have worked diligently throughout our development and construction process, navigating many challenges along the way. Freeport LNG’s success would not be possible without the dedication, hard work and discipline of our employees,” said Michael Smith, Founder, Chairman and CEO. Freeport LNG’s liquefaction facility is the seventh largest in the world and the second largest in the United States. In order to produce 15 MMTPA of LNG, the Company’s three train export facility will process more than 2 percent of the total annual U.S. production of natural gas. Freeport LNG’s economic investment will result in 24,000 to 30,000 direct and indirect jobs created across the U.S. through increased natural gas exploration, drilling and production, as well as incremental expenditures for goods and services in other industries. Freeport LNG’s liquefaction project spanned over 60 million work hours with a total recordable rate of 0.17. The project’s safety statistics rank in the top quartile in the industry. Freeport LNG’s Train 1 and 2 have been in commercial operation since mid-December and mid- January, respectively.

https://seanews.co.uk/shipping/tanker/freeport-lng-achieves-train-3-start-of-commercial-operations/

show less

LNG faces underlying troubles beyond Covid-19 – analyst

While the Covid-19 pandemic has played a role in driving down LNG prices, the market also faces existing and emerging “underlying troubles”,

read more

including weaker Asian demand, renewables competition and oversupply, according to consultancy Eurasia Group. The group said on Monday the natural gas market was “cratering”, with spot prices for LNG in Asia falling below USD 2/MMBtu (EUR 6.27/MWh) for the first time. The Asian benchmark JKM front-month price last closed at USD 2/MMBtu, marginally up from late-April levels. As with other markets, the drop in spot LNG prices was in part triggered by the global Covid-19 recession, as most LNG supplies, especially in Asia, are still supplied under long-term contracts, the consultancy said. “The spot market largely serves to meet short-term needs on the demand side or to replace supply disruptions.” Amid a global recession, short-term demand spikes are few and far between, and orders for spot LNG cargoes are drying up,” it said. The consultancy pointed in particular to reports of an Australian cargo recently selling at below USD 1.73/MMBtu. During the pandemic and the accompanying recession, LNG imports by the world’s top three consumers — Japan, China, and South Korea — are down from pre-crisis and peak winter monthly demand levels of about 20 MMT (27.2 bcm) in December and January, according to Eurasia estimates. “That said, at a joint 18.1 MMT in March, they are still 2% higher than this time last year.” It noted that with China gradually reopening its economy, Europe also taking first steps to revive its industry, and Japan and South Korea seemingly better prepared and less affected by Covid-19, the LNG sector should come out of the coronavirus pandemic less scathed than the oil industry.

Yet Covid-19 was not the only factor driving down LNG prices, Eurasia Group said.

“Other factors have been at work, evidenced by the fact that prices were chasing record lows even before the global outbreak,” it said, citing in particular the record rise in LNG supply over the past five years. “Even before the pandemic, an LNG supply overhang was expected to last until the mid-2020s,” it said. The consultancy also pointed to “a future of tepid demand growth”, in part linked to demographic changes in established markets, where stagnant or declining populations are eroding long-term demand.LNG also faced increased competition from renewables, political pressure to clean up the energy industry and the effects of climate change, it added.

https://www.hellenicshippingnews.com/lng-faces-underlying-troubles-beyond-covid-19-analyst/

show less

Total to cancel, defer summer LNG cargoes

Total plans to cancel or defer some LNG cargoes in the second and third quarters amid weakened demand and low global prices.

read more

The firm is considering cancelling some LNG cargoes in the summer in order to limit losses, chief executive Patrick Pouyanne said today. Total also anticipates deferrals of some LNG cargoes in the second and third quarters because of lower demand as a result of the “global economic slowdown” caused by the Covid-19 outbreak, the firm said. Total holds offtake agreements from the Sabine Pass and Cameron LNG facilities for an aggregate volume of 6.5 MMTPA. The company expects the current low oil prices to “negatively impact” its LNG business more significantly in the second half of the year, as most of the firm’s contracts are oil-indexed with a six-month indexation period, Pouyanne said. Earlier this year, Total rejected a Chinese LNG buyer’s request to declare force majeure following the virus, the firm said in February, with some Chinese buyers possibly trying “to play” with force majeure to turn down cargoes under long-term contracts and buy on the spot market instead, it added. Total has also planned to cut upstream oil and gas production by 5pc from previous 2020 forecasts to 2.95mn-3mn b/d of oil equivalent (boe/d). The firm did not specify which assets would reduce production. The firm recorded a rise in LNG sales to 9.8 MMT of LNG in the first quarter, up from 7.7 MMT a year earlier, with total gas production for LNG increasing to 2.61bn ft³/d (73mn m³/d) from 2.46bn ft³/d (69mn m³/d) a year earlier. The increase in LNG sales was largely driven by ramp-ups at the Novatek-operated Yamal LNG in Russia, in which Total holds a 20% stake, and the Inpex-operated Ichthys terminal in Australia, in which it holds a 26% stake, and the start-up of the second train at Sempra’s Cameron LNG in the US, in which it has a 16.6% stake, Total said. The firm is still expecting to move forward with the Energia Costa Azul (ECA) liquefaction project in Mexico “in the coming months”, as its location on the country’s Pacific coast provides a strategic advantage by reducing shipping costs to Asia by about $1/MMBtu, Pouyanne said. But the firm does not consider it a priority to invest more in US merchant projects in the current market environment, he added. Total has secured 1.7 MMTPA offtake from the 2.5 MMTPA ECA LNG project, which is being developed by US firm Sempra Energy. The project is on track to complete funding this quarter, Sempra said earlier this week.

https://www.argusmedia.com/en/news/2102619-total-to-cancel-defer-summer-lng-cargoes

show less

LNG buyers cancel cargoes as US natgas becomes most expensive in world

LNG buyers in Asia and Europe have already canceled the loading of around 20 cargoes from the United States in June as government lockdowns to

read more

stop the spread of coronavirus have cut gas demand around the world. US natural gas prices topped benchmarks in both Europe and Asia for the first time ever this week, giving buyers of US liquefied natural gas (LNG) another reason to cancel cargoes. Front-month gas futures for June delivery at the Henry Hub benchmark in Louisiana settled over both the Japan/Korea Marker (JKM) and the Title Transfer Facility (TTF) in the Netherlands for the first time on May 5, according to the most recent pricing data available for all three contracts on the Refinitiv Eikon. Henry Hub futures for June settled about 11 cents per MMBtu over JKM on May 5, the first time the US contract ever topped the Asian benchmark.US futures also closed about 32 cents per MMBtu over the June TTF contract on May 5. Henry Hub has settled above the European benchmark every day since April 30, which was the first time it closed over TTF in 10 years. LNG buyers in Asia and Europe have already canceled the loading of around 20 cargoes from the United States in June as government lockdowns to stop the spread of coronavirus have cut gas demand around the world. Those buyers canceled US cargoes when forward prices made it more expensive to buy gas in the United States than it could be sold for in parts of Europe and Asia. Energy traders said the latest front-month price moves for the June front-month contracts marked the point at which the spot market finally caught up to trading in forward markets. US gas for the summer has been trading over some European and Asian hubs for weeks. Most US LNG, however, has already been sold forward years in advance to utilities consuming the fuel, so some US cargoes will continue to go to Europe and Asia. “The forward curve in the European market still shows an uptick in the winter. So, if you have storage, you can bring the gas to Europe, store it until the winter and make money,” said Nikos Tsafos, senior fellow at the Center for Strategic and International Studies (CSIS). Refinitiv said US LNG exports averaged 7.0 billion cubic feet per day (bcfd) so far in May, down from a four-month low of 8.1 bcfd in April and an all-time high of 8.7 bcfd in February. One billion cubic feet of gas is enough to supply about 5 million US homes for a day.

show less

Global LNG: Asian spot prices recover a little on improving demand

Asian spot liquefied natural gas (LNG) prices recovered a little this week as demand appeared to improve amid the easing of coronavirus lockdowns in a few countries,

read more

trade sources said.The average LNG price for June delivery into northeast Asia rose to an estimated $2 per MMBtu this week, up 20 cents from the previous week, traders said.That followed three straight weeks of decline.While lockdowns are easing in some markets, such as in China and South Korea, containment policies elsewhere are hampering their manufacturing exports and dragging on recoveries. South Korea’s GS Energy entered the spot market, seeking two cargoes for delivery in June, while Chinese utility Guangdong Energy group, previously known as Guangdong Yudean Group, was seeking a cargo for July, sources said.Chinese buyers were also participating in sell tenders by other companies, one of the sources said.Thailand’s PTT issued an expression of interest to seek a cargo for delivery in late June, industry sources said.India’s Bharat Petroleum Corp Ltd likely bought a cargo for delivery on May 25 at about $2.10 to $2.20 per MMBtu, an industry source said, though this could not immediately be confirmed.India’s LNG demand may be improving slightly on the back of higher demand for summer residential use, though overall power demand is down by a third due to lower industrial activity, a source based in India said.Still, supply is ample globally, which is expected to keep spot prices depressed, trade sources said.Angola LNG offered a cargo for delivery to as far as Singapore over May to June in a tender that closes on May 13, an industry source said.The number of vessels being used to temporarily store LNG is also swelling, trade sources said.There are currently eight Nigerian-laden LNG cargoes which have been floating for between three and 25 days, said Kaleem Asghar, director of LNG Analytics at ClipperData. Seven of them are in the Atlantic, floating offshore Spain, while one is off the west coast of India, he added.US natural gas prices also topped benchmarks in both Europe and Asia for the first time ever this week, giving buyers of US LNG another reason to cancel cargoes.LNG buyers in Asia and Europe have already cancelled the loading of around 20 cargoes from the United States in June, while many are expecting cancellations to continue for cargoes loading in July.

show less

TCEQ approves Texas LNG air permit

The Texas Commission on Environmental Quality (TCEQ) has ruled in favour of authorising the issuance of an air permit to Texas LNG Brownsville LLC,

read more

allowing the construction and operation of an LNG export facility in the Port of Brownsville, Texas. Vivek Chandra, Founder and CEO of Texas LNG LLC said, “We appreciate the hard work and effort from TCEQ and are pleased to have reached this important achievement that paves the way for a 2021 final investment decision (FID) and construction of an LNG facility consistent with all air emission regulations. Though current LNG markets are unusual in terms of pricing and supply dynamics, Texas LNG is confident that its low-cost, flexible commercial model, and realistically-sized production volumes will be key differentiators, ideally suited for global customers when operations begin in 2025.” Langtry Meyer, Founder and COO of Texas LNG LLC stated, “We are pleased with the TCEQ decision. Texas LNG is committed to operating in an environmentally responsible manner, including use of electric motors instead of conventional gas turbine compressors to minimise air emissions, making the facility one of the world’s cleanest LNG liquefaction plants. By delivering clean, safe, low-cost Texas natural gas energy to our customers around the world, Texas LNG can contribute to a cleaner global environment.” Receiving the TCEQ air permit will represent another significant regulatory milestone for Texas LNG. On 22 November 2019, the Federal Energy Regulatory Commission (FERC) authorised Texas LNG to site, construct, and operate the facility. The company has also previously received authorisations from the US Department of Energy (DOE) to export US-sourced LNG to any country with which trade is not prohibited by US law or policy.

https://www.lngindustry.com/liquid-natural-gas/07052020/tceq-approves-texas-lng-air-permit/

show less

Nuclear power to be replaced with LNG, Renewable Energy Powers

Four-fifths of the coal power generators scheduled to go out of service will be turned into LNG generators in South Korea.

read more

The South Korean government is planning to reduce the number of nuclear power plants in South Korea to 17 and halve the number of coal power generators to 30 by 2034. Four-fifths of the coal power generators scheduled to go out of service will be turned into LNG generators. Those in the energy industry, however, are pointing out that the plan is too optimistic and the government is giving no consideration to the price of electricity, ultrafine particulate matter emissions, demand-supply instability, etc. The government implemented seasonal particulate matter control from December last year to March this year in order to reduce particulate matter emissions. It used LNG to offset the resultant shortage of power generation. The thing is, the cost of LNG power generation is high. According to Korea Electric Power Corporation (KEPCO), the LNG purchase cost was 115.6 won per kilowatt-hour in February this year, when that of bituminous coal was 91.29 won. In addition, that month, the unit costs of hydroelectric power generation and nuclear power generation were 107.83 won and 60.84 won, respectively. Another variable is the ongoing low oil price trend. The LNG price changes in line with the international oil price and this means a rebound in oil price can lead to an increase in LNG power generation cost in the long term. South Korea currently imports 100 percent of the LNG it uses and, as such, more LNG power generation can result in more risks related to supply and demand although the JKM index indicating the LNG price in Northeast Asia dropped from US$9 to US$2 per MMBtu from early January 2019 to late last month. Another problem is posed by various policy costs that will increase in the process of renewable power generation expansion. The government is currently using the Renewable Portfolio Standard for the expansion and the standard forces major power producers to maintain a certain ratio of renewable power generation. As the ratio goes up, the financial burden of KEPCO as a power purchaser cannot but increase, and then the burden is likely to be shifted onto consumers. According to the government’s prediction, the average annual increase in South Korea’s power demand is 1 percent from this year to 2034. However, many point out that the prediction is groundless. “Although economic and industrial activities have shrunk due to COVID-19, its impact on the power demand is likely to disappear within this year,” one of them mentioned.

Source: LNG Global

show less

Natural Gas / LNG Utilization

States of Indiana and Texas help fleets deploy cleaner fuel vehicles

The Indiana Department of Environmental Management (IDEM) and the Indiana Volkswagen Environmental Mitigation Trust Fund Committee (Committee)

read more

announced Round 2 of the Indiana Volkswagen Environmental Mitigation Trust Program’s grant funding which will distribute awards ranging from $50,000 to $2 million. Total available funding for this round is $9.83 million. Public and private entities may submit applications, and the Request for Proposals (RFP) deadline is May 31, 2020. Grant money will be awarded to clean air projects that significantly reduce diesel emissions across Indiana, such as replacing older, higher emission diesel garbage trucks or old diesel school buses with newer, cleaner natural gas vehicles. Some of the Round 1 projects included replacing diesel-powered transit buses with electric and CNG transit buses and diesel-powered refuse haulers with CNG refuse haulers. Moreover, the Texas Commission on Environmental Quality (TCEQ) announced that up to $7.7 million in grants is being made available to encourage entities that operate large fleets of vehicles in Texas to replace diesel-powered vehicles with alternative fuel or hybrid vehicles. The eligible alternative fuels under the Clean Fleet Program include CNG, LNG and hydrogen. Applications will be accepted until June 30, 2020. The TCEQ Texas Clean Fleet Program grants are part of the Texas Emissions Reduction Plan and are available to owners of fleets of 75 or more vehicles operating in Texas. Grant applicants must commit to replace at least 10 diesel-powered vehicles with hybrid or alternative fuel vehicles. Projects eligible for funding under this program must include vehicles that will be operating within the Texas Clean Transportation Zone and that will result in a reduction of NOx emissions of at least 25%.

show less

Natural gas trucks will continue to travel toll-free on German highways

Karl Holmeier, Member of Germany’s Parliamentary Traffic Committee and Member of the German parliament, confirmed plans for the extension of toll-free

read more

travel for heavy-duty natural gas trucks on motorways, which was first introduced on January 1 2019. If the proposal is approved by the German Parliament and Federal Council as expected, CNG and LNG vehicles above 7.5 tons will be exempt from motorway tolls until December 31 2023. The extension will benefit transporters who operate IVECO’s Natural Power heavy-duty trucks in their fleets, both on German and international routes, due to the country’s central position at the crossroads of the main European long-haul corridors. The toll exemption will further reduce the Total Cost of Ownership (TCO) of IVECO’s trucks, increasing the financial advantages and improving the return on investment on these vehicles. Together with the expansion of the natural gas distribution network, this will boost the transition to this clean and significantly quieter technology. Thomas Hilse, IVECO Brand President, stated: “We welcome the news that the Germany Parliamentary Traffic Committee has put forward a new proposal for discussion in Parliament to extend the toll exemption for natural gas heavy-duty trucks. The final decision, expected in June, would mean a clear recognition of the environmental benefits of this technology on the path towards zero emissions. The LNG infrastructure is growing, with an increasing number of new refueling stations coming on stream, like the one that recently opened in Berlin Potsdam. Together with the expanding distribution network and the existing government subsidies supporting this fuel, this extension would give our customers a clear signal that the transition to LNG transport is unstoppable – and with biomethane, it can be emission free.” The new long-haul IVECO S-WAY NP in the full LNG version is the perfect vehicle to benefit from the exemption: the only heavy-duty truck specifically designed for long-haul transport, it has the longest autonomy in the market with a range of up to 1,600 km. Launched in 2019, the IVECO S-WAY has very quickly become a favorite among owners and drivers. IVECO has pioneered natural gas technology for over 20 years, resulting in its industry-leading full line of Natural Gas vehicles and the experience acquired by its dealer network by supporting the more than 7,000 LNG vehicles sold across Europe. Today, the natural gas distribution network already covers the main transport routes across Europe, and its development is gathering pace, with the number of LNG refueling stations expected to rise from 249 in 2019 to over 450 in 2022. Trucks travelling on routes crossing Germany will not only have the financial benefit of the toll exemptions, but also the operational advantage of a well-developed infrastructure, which will be further extended in the short term as a result of the German Federal Government’s focus on natural gas as a key element of its strategy to achieve its Climate targets. Beyond German borders, a further signal in favor of the adoption of natural gas technology in transport comes from Austria, which has introduced an exemption from the sectoral driving ban in the Tyrol for LNG trucks. A change to taxation rules on natural gas have also come into force on January 1 2020, with LNG now classified as a gas instead and therefore no longer subject to fossil fuel tax.

show less

Natural & renewable gas, key actor for European sustainable recovery