Abstract

Is city gas really the most important driver for incremental growth in the gas sector? At least, it seemed to be at the beginning of the ongoing decade. The crude price was riding high, moving towards $100 a barrel and therefore, gas appeared to make much more economic sense against most of alternate fuels. Domestic gas supplies seemed to be promising and in abundance for upcoming projects. The Regulatory Board was just set up and it was thought that this would facilitate the fast roll out of City Gas networks (GAs) across the country. The result- PNGRB held multiple rounds of bidding to allot GAs; research and analytic firms pegged high numbers from city gas; GAIL charted out its plans to boost the infrastructure network and various joint ventures were planned to take up CGD projects across GAs; Government prioritized and increased gas allocation to the sector. As NGS reviews the sector today, in the middle of the decade from where we started, we could say that only little progress has really happened. The key reasons have been a complicated and ambiguous CGD bidding process, inadequate availability of domestic gas and import of high priced long term contracted LNG. Here in this paper, we present the current status of demand and supply, recent developments, opportunities and challenges in the city gas distribution sector.

Overview

Gas is universally recognized as the fuel of the future with the increased benefit to the environment and its efficiency of utilization. In recognition of its immense benefits, the importance of the CGD sector has been recognized by the government from time to time, with the increased allocation of domestic gas to the sector. The Gas Utilization Policy has accorded top priority to CGD sector. However, despite the support of the government the development of the CGD sector has been slow.

It was generally expected that after the formation of the PNGRB, the sector would develop faster; however, instead of accelerating the process the Board for a variety of reasons has been unable to provide the necessary impetus to the sector. One of the key reasons has been the Board’s rules & regulations including the CGD bidding process. And in combination with the inadequate availability of domestic gas, the CGD sector for now has remained not so upbeat.

Inadequate availability of indigenously produced gas is being augmented by increased import of LNG. In order to further augment the availability of gas, three more LNG terminals are in various stages of development on the east and west coast of India. Once completed, additional gas shall be available to the CGD sector, but the crucial point will be its affordability.

The affordability of imported LNG is widely accepted in the CGD sector because between 80-90% of CGD load is industrial, commercial and automotive (CNG) where high priced liquid petroleum is being replaced. However, with the sliding crude oil price, alternative liquid fuel is becoming an economic option. And, with the continuance of administered pricing regime (APM) for LPG to the residential sector, it remains a challenge to increase supply of piped natural gas to the residential sector. Though the slide in crude price has had a positive effect on the spot cargoes for LNG and price has dropped by around 50%, LNG procured under long term contracts (to which most of the current supply is tied up) is still to see a significant drop in price as it is linked to 60 months floating average price of crude.

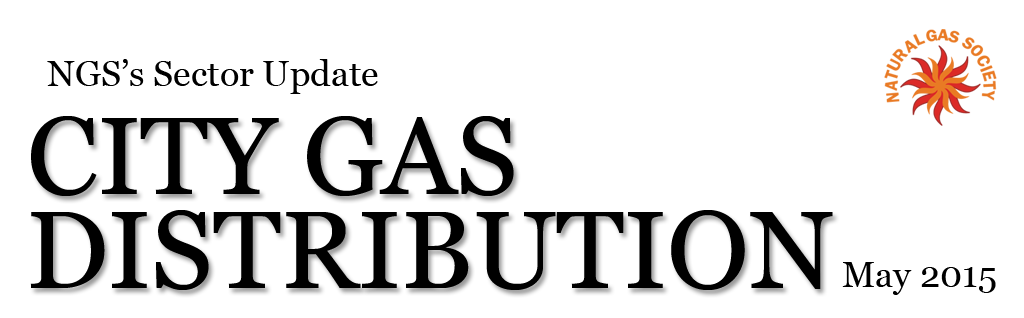

CGD – Demand and Supply

The current consumption of gas in the city gas distribution sector is around 16-17 mmscmd. Gas makes economic sense vis-à-vis competing fuels for most of the segments in the sector, viz. industrial, commercial and vehicular. Industrial and commercial segments are the most attractive consumer segments given large anchor load, high affordability and comprising 60-70 percent of total PNG volumes.  Vehicular segment is expected to consume 25-30 per cent of total CGD volumes while domestic consumer segment will have limited potential, given government subsidies on LPG, high servicing costs and the corresponding low volume off take. Demand for CGD is expected to be around 30 mmscmd by 2016-17 as per the current projections with addition of new cities, price advantage of CNG and increased use of PNG in industrial and commercial sectors.

Vehicular segment is expected to consume 25-30 per cent of total CGD volumes while domestic consumer segment will have limited potential, given government subsidies on LPG, high servicing costs and the corresponding low volume off take. Demand for CGD is expected to be around 30 mmscmd by 2016-17 as per the current projections with addition of new cities, price advantage of CNG and increased use of PNG in industrial and commercial sectors.

Slide in crude price

Given tumbling crude prices since June 2014 and costly LNG imports, industrial/commercial consumers are dumping cleaner but expensive gas in favour of cheaper liquid fuels. This is hurting volume off-take of gas suppliers and pushing up environmental costs for India. Crude oil prices have almost halved in a year, and are currently trading at around $65 a barrel. Consumers are showing increasing preference for the cheaper alternative – fuel oil (20% cheaper than gas) especially in glass, ceramics, chemicals, pharmaceuticals, agro, engineering and other industries and consequently most CGD companies including Mahanagar Gas, Gujarat Gas and Indraprastha Gas are under pressure. The switch for these clients has been smooth as factories increasingly use equipment that runs on both gas and liquid fuel. The switch has also been faster in the regions where environmental laws are not strictly implemented. The significant difference is mainly because suppliers are locked into long-term LNG purchase contracts with producers overseas. In some cases, companies such as Gujarat Gas are helping clients by purchasing cheaper spot LNG instead of relying on the long term tied up expensive LNG and others such as Indraprastha Gas is offering discounts to its off-takers to deal with it. The trend is likely to continue for at least until end 2015, after which gas price is expected to fall further and crude prices to rise a little leading to a market situation where the two become competitive.

Priority allocation to CGD

The MoPNG through its order in August 2014 has promised higher priority in gas allocation policy to the CGD sector. The Supreme Court and the High Courts of Gujarat and Mumbai have also instructed the government for priority allocation of to the CGD sector. This has given a new thrust to the CGD industry. Earlier to this, very few entities were allocated indigenous gas and others had to source their needs from RLNG and it resulted in large variation in selling prices of the CGD companies in different geographical areas. In some GA, the CNG price was even higher than that of diesel. The new gas allocation gave a uniform playing field to all CGD operators.

Revision in domestic gas price

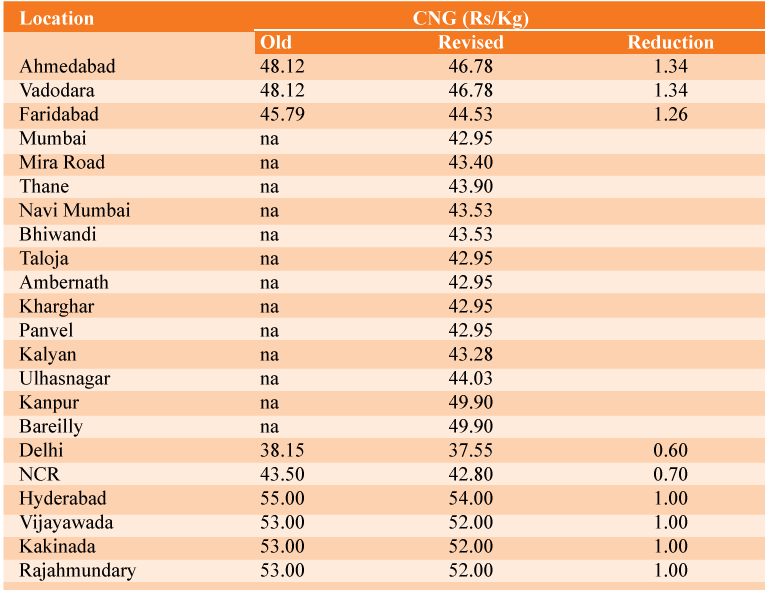

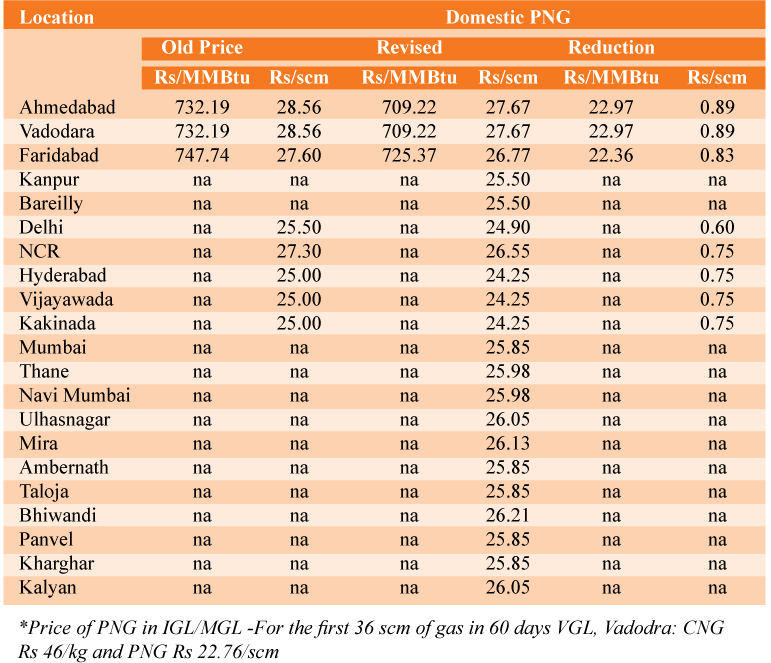

The CGD companies recently reduced the CNG and PNG prices following an 8% cut in the natural gas prices by MoPNG from April 1, 2015. The CNG and PNG prices have been reduced by 60 paisa per kg in the national capital region. CNG price in Delhi was reduced by Rs 0.60 per kg to Rs 37.55, while in adjoining Noida, Greater Noida and Ghaziabad it will now cost 70 paisa less at Rs 42.80. Also, the consumer price of PNG to the households in Delhi has been reduced by Rs 0.60 per scm from Rs 25.50 per scm to Rs 24.90 per scm up to consumption of 36 scm in two months. Beyond the consumption of 36 scm in two months, the applicable rate remains unchanged. Due to differential tax structure in Uttar Pradesh, the applicable price of domestic PNG to households in Noida, Greater Noida and Ghaziabad is now Rs 26.55 per scm up to consumption of 36 scm in two months, which has been reduced by Rs 0.75 per scm from Rs 27.30 per scm. The current prices after the reduction of CNG and PNG prices in different areas operated by CGD companies are given under Key Statistics at the end of the report.

With the revised price, CNG will offer nearly 55% savings towards the running cost when compared to petrol driven vehicles at the current level of prices. When compared to diesel driven vehicles, the economics in favour of CNG at revised price would be over 22%.

CNG Guidelines

The MoPNG in March 2015, sought comments on new draft guidelines seeking to grant marketing rights for CNG including setting up CNG Stations. The ‘Draft Guidelines for Granting Marketing Rights for CNG as transportation fuel, including setting up CNG Stations’ provides rights or licence to retail the fuel to automobiles by setting up CNG Stations to any entity that has invested or shall invest Rs 500 crore in oil and gas infrastructure. Prior to the Ministry draft guidelines, the union government had authorized entities like Indraprastha Gas and Mahanagar Gas for retailing CNG to automobiles in Delhi and Mumbai, respectively, in early 2000. However, after the establishment of PNGRB in 2006, the task of authorizing CNG stations came under its purview. Consequently PNGRB, as per the PNGRB Act, included CNG stations as part of the City Gas Distribution projects and “compression charge” was included as one of the biddable item for evaluating potential CGD projects through the bidding route adopted under Regulations on “Authorization to lay, build, operate and expand city or local natural gas distribution network”.

Since 2006, entities have been applying to PNGRB under a bidding system and not the government for rights to retail CNG alongside selling natural gas as fuel within a defined geographical area as part of the CGD bidding process laid down by PNGRB Regulations. While PNGRB has been issuing the authorization to set-up CGD projects including retail CNG as well as PNG to residential, commercial and industrial segments, the current draft guidelines appear to be in direct conflict with PNGRB regulations. The industry members including the Natural Gas Society have responded to the draft guidelines by writing to the MoPNG highlighting pitfalls of implementing the guidelines. The industry is still to hear from the Ministry on their final decision.

Key conflicting points-Draft Guidelines for Marketing CNG

- The guidelines in its current form will be in direct conflict with the PNGRB Act, where a CGD or Local Network is defined as “an interconnected network of gas pipelines and the associated equipment used for transporting natural gas from a bulk supply high pressure transmission main to the medium pressure distribution grid and subsequently to the service pipes supplying natural gas to domestic, industrial or commercial premises and CNG stations situated in a specified geographical area”.

- As per the PNGRB Act as well as the subsequent PNGRB Regulations on CGD, CNG stations are an integral part of the CGD network in a defined geographical area. In fact compression cost for CNG, is one of the biddable items of the CGD Bidding process.

- PNGRB may have to modify their Regulations on “Authorization to lay, build, operate and expand city or local natural gas distribution network” so as to accommodate the new directive. In such a case, the evaluation process adopted by PNGRB may have to undergo a change because of the reduced importance of “compression cost” in a CGD project. The viability of CGD projects shall be adversely affected.

- The introduction of independent CNG stations in existing as well as new gas network projects in a defined geographical area can potentially rock the economic viability of existing and future CGD projects. It will have a huge impact on the financial viability and operational revenue of CGD projects. And most certainly, the economics of new CGD projects will fall apart with the introduction of stand-alone CNG Stations of new entity(ies) other than the CGD entity. CNG forms the back-bone of an Indian CGD company and its financial viability and long term sustainability depends upon furthering CNG activities within the CGD.

- Interest of potential developers of CGD projects shall be impacted negatively. This will also have a significant effect on Government’s mission to replace LPG in the residential sector with piped natural gas. CGD industry will suffer and so will “Mission PNG”

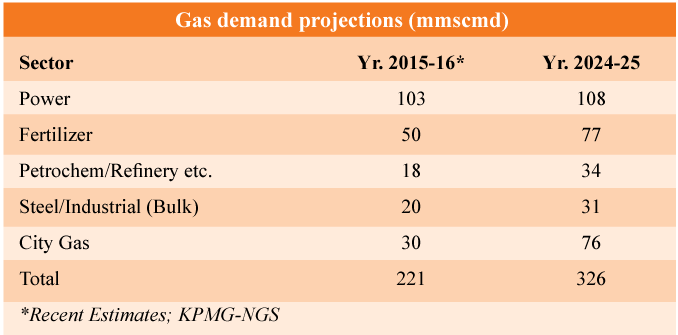

Authorisation of more GAs

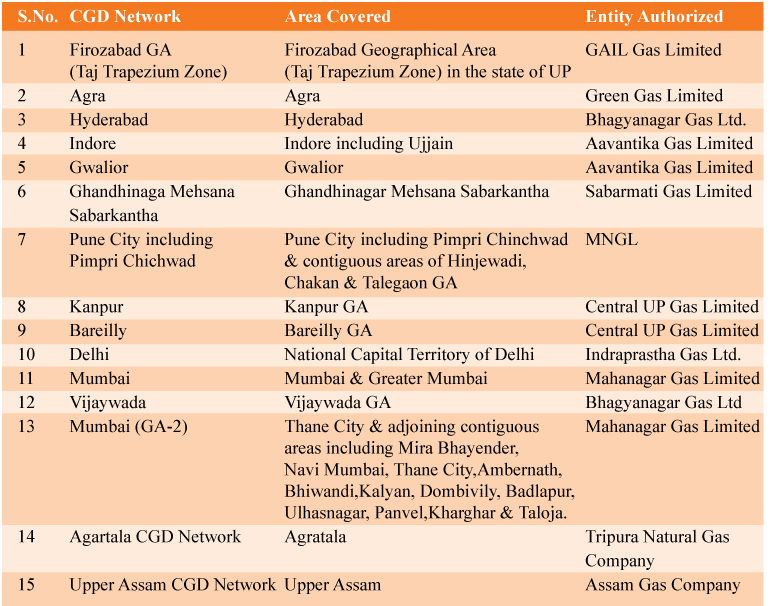

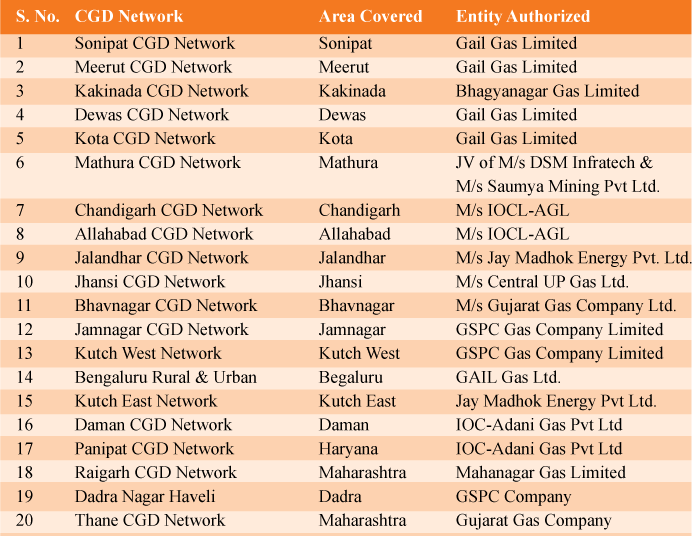

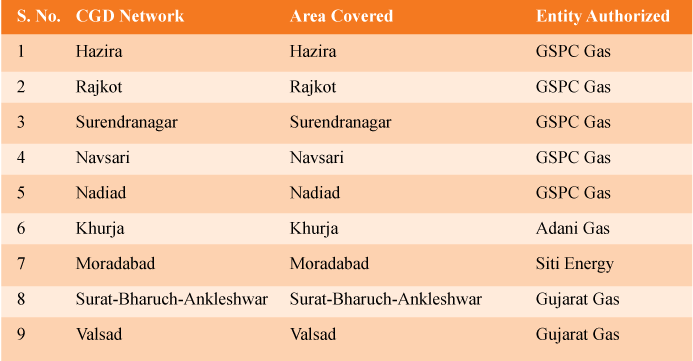

The PNGRB has granted authorization to several CGD entities for laying, building, operating or expanding the following CGD network subject to the PNGRB (Authorizing entities to lay, build, operate or expand city or local gas distribution networks) Regulations 2008 with certain terms and conditions. Needless to say, PNGRB will be required to play a key role in the development of this infrastructure in the sector. The positive triggers will have to come from PNGRB with added support from State governments to expand base of CNG and PNG supplies across the country.

Opportunities and Challenges

Over the years the CGD industry has faced several challenges including declining availability of domestic natural gas, increasing imports of high cost LNG, gas pricing (administered vs market driven), change in gas utilization policy, regulatory issues, pipeline integrity and safety concerns, multiple clearances, and at times standards based on existing legislation not precisely suited to the industry. These have impacted adversely on the economics of the business. In order to develop the CGD sector, efforts are required to increase availability of indigenous gas, import affordable LNG and develop requisite infrastructure. PNGRB has envisaged a roll out plan of CGD network development through competitive bidding in more than 300 possible GAs on the basis of EOIs submitted to the Board and on sou motu basis. The execution of this plan would only be possible once the above issues are resolved.

- Availability of natural gas – Domestic gas availability has shown a declining trend, and is unlikely to go up substantially in the near future. The recent initiative of the Petroleum Ministry to promote CGD to the top of the priority list of the gas utilization policy is a step in the right direction and will have a positive impact on the sector.

- Price of gas – Additional gas availability through LNG imports. The price of LNG is clearly a challenge especially with respect to replacing subsidized LPG in the residential segment and liquid fuels.

- Subsidy on LPG supplied to the domestic sector – Given the current subsidy policy of the Government of India vis a vis domestic supply of LPG and the high cost of imported LNG, the task of replacing existing LPG residential customers by PNG is becoming more and more challenging. Considering New Delhi price of Rs 24.90 per scm of PNG to a domestic customer and the price of LPG of Rs 417.00 per cylinder of 14.2 kg, the economics of supply works out to price of LPG to a residential customer in Delhi at US$ 10.59/mmBtu and price of PNG to a residential customer in Delhi at US$ 11.80/mmBtu. Considering a LPG import price of US$ 632/MT (Q4, 2014-15) and assuming that domestic forms 80% of our current consumption of 16.337 million tonnes of LPG, the Government loss on account of subsidy would work out to about US$ 2.00 billion.

- Regulations – Process of regulation development and adoption has been slow in CGD sector. The current regulations are not very supportive to speedy development. Regulation needs to support/encourage development. Major changes in bidding process will need to be done to encourage development and growth.

- Fiscal and tax issue – State government should provide tax incentives to the sector to incentivise investments in the sector. CGD business is a long gestation activity and returns are low because of the high upfront investments required.

- Inadequate State Government Support – The roadblocks encountered with local Municipal Authorities and State bodies, like, PWD, Police etc. Inadequate cooperation of local government bodies during the project development and execution phases. Streamlining of procedures and norms to encourage faster development.

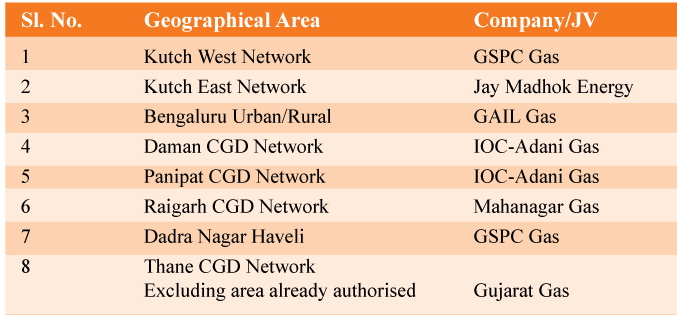

KEY STATISTICS- STATUS of PNG SUPPLIES

(as of September 30, 2014)

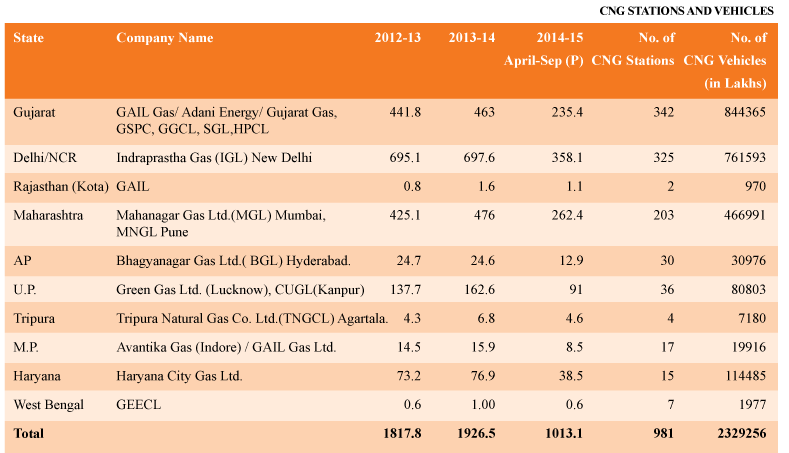

State-wise CNG Sales (‘000 MT)

(as of September 30, 2014)

Revised prices of CNG wef April 2, 2015

Revised prices of PNG wef April 2, 2015*

Authorisation of GAs for City Gas Distribution till date-Central Govt Authorisation under Regulation 17 of PNGRB Regulations

PNGRB Authorized under regulation 5 (through bidding process

PNGRB Authorization under regulation 18(1) process

Source: All data in above tables has been collected from PPAC or CGD companies