NGS’ NG/LNG SNAPSHOT – AUGUST 2020, VOLUME 1

National News Internatonal News

NATIONAL NEWS

City Gas Distribution & Auto LPG

Jefferies: City gas distribution space in fast recovery phase, says brokerage; Gujarat Gas, Mahanagar Gas top picks

City gas distribution remains a potential growth story for investors and global brokerage Jefferies believes that the niche sector is poised for a faster recovery

read more

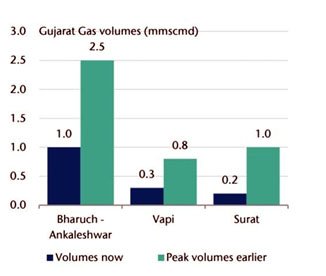

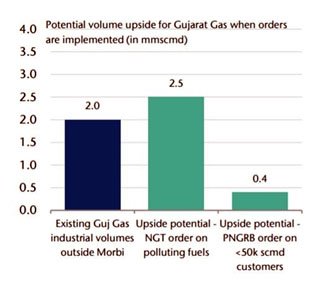

amid COVID-19 pandemic buoyed by three recent events. Within the sector, Jefferies suggests that Gujarat Gas (GUJGA) and Mahanagar Gas (MGL) remain well-positioned to make most from the situation. Since March lows, GUJGA and MGL shares have jumped 54 percent and 52 percent, respectively. Meanwhile, Indraprastha Gas Ltd (IGL) surged 43 percent during the same period. According to the Jefferies report, Petronet and Natural Gas Regulatory Board (PNGRB) order for GAIL and National Green Tribunal’s strict action on polluting fuels, could result in volume upside and market share gains for Gujarat Gas. Meanwhile, the hike in the price of CNG price in Mumbai bodes well for the margins of Mahanagar Gas.

Recently, PNGRB directed the GAIL to stop supplying gas directly to customers consuming less than 50,000 scmd in Dahej. These customers were directly connected to GAIL but were not handed over to GUJGA when the area was authorised to them in 6th round prompting them to raise the issue with PNGRB.

“The same order if replicated in other areas could result in incremental upside in volumes. Average volume offtake from these customers could be ~ 30-40k smcd so even if ten customers are captured, it could result in volume upside of ~ 0.3-0.4 msmcmd (~ 5 percent of industrial volumes of GUJGA),” explained Jefferies in its report.

Another positive trigger for GUJGA would be NGT’s new order on the usage of petcoke. The regulator had earlier passed an order in November 2019 warning against the usage of polluting fuels in critically polluted areas (Eg: Bharuch-Ankleshwar, Morbi, Vapi, Tarapur falls under GUJGA coverage).

From margins standpoint, MGL remains well-positioned as it has hiked the CNG price by Rs 1/kg citing recovery of fixed costs amid lower volumes and rupee depreciation.

“The net price cut since April now stands at Rs 1/kg vis-a-vis margin neutral price cut of Rs 3.4/kg. Thus gross margin expansion is on track and even if EBITDA margin remains subdued in the near term, the pricing action is unlikely to be rolled back potentially resulting in stronger EBITDA margins as well once volume normalizes keeping us positive on the margin profile,” the brokerage report added.

One risk for these two companies remains open access, which can be mitigated in the near-to-medium term earnings. Jefferies believes that the recovery in volumes amid COVID-19 is faster for GUJGA and MGL.

show less

Mumbai: Rs 1 hike for CNG, will hit autos, taxis and buses

CNG price will be hiked by a rupee in Mumbai metropolitan region from Saturday, which will impact public transport and those plying private vehicles on CNG. Taximen’s union,

read more

which will protest, has demanded a hike in minimum fare from Rs 22 to Rs 25. Auto unions have also demanded a hike from Rs 18 to Rs 20 for minimum fare. There has been no fare hike for over three years. CNG price in Mumbai, Thane and Navi Mumbai will increase from Rs 47.95 a kg to Rs 48.95 a kg at pumps. A Mahanagar Gas Limited official said even after the revision, CNG offers attractive savings of about 60% and 39%, compared to petrol and diesel.

show less

Secunderabad: Change in lease policy to help PNG project

A major hurdle in the acquisition of defence land in Secunderabad Cantonment Board (SCB) for the piped natural gas (PNG) project may be cleared soon, as the Ministry of Defence (MoD)

read more

has made an amendment in the land lease policy regarding transfer of defence land for public utilities and public infrastructure projects. The project will supply PNG for every household in the Cantonment area as well as the military residential quarters, and nearly one lakh families in SCB limits and another 300 defence families are expected to benefit from it. According to the new amendment, “no lease rents will be charged from either the state governments, organisations or local bodies with government funding for transfer of defence land, located in the Cantonment limits, for both underground sections of main petroleum and gas pipelines and underground tunnelling of metro projects.” The PNG project, initiated by Bhagyanagar Gas Limited (BGL), has been pending due to lack of clearance from the MoD. In 2018, a memorandum of understanding (MoU) was inked between BGL and the local military authority (LMA) for implementation of the PNG project. The BGL officials conducted a detailed survey of the defence land and locations to set up PNG stations and to lay underground main pipelines. “Works pertaining to the survey were completed in 2019 and we are awaiting the MoD’s clearance to begin laying of pipelines on defence land,” sources in BGL told TOI. “Work on the project is progressing at a snail’s pace because of inordinate delay in getting permission for digging on defence land,” added the sources. “Once the MoD gives its clearance, infrastructure works will begin. The project will be completed in a year,” said a BGL official.

show less

Karnataka: Gas pipeline gets damaged during repair work in Hubballi

A major mishap was averted in the Navanagar area of Hubballi on Monday (July 20) after a natural gas pipeline got damaged during an underground drainage (UDG) repair work.

read more

A major mishap was averted in the Navanagar area of Hubballi on Monday after a natural gas pipeline got damaged during an underground drainage (UDG) repair work. The pressurised gas gushed out of the damaged pipeline causing panic among the residents. The incident happened near Karnataka Circle. Ramesh Noolvi, zonal assistant commissioner, said that the residents alerted the police, firefighters. Meanwhile, Indian Oil-Adani Gas Private Limited staff (IOAGPL) rushed to the spot and plugged the leakage. One of the officials of the IOAGPL told TOI that the HDMC workers was digging the area to repair a UGD line, but they did not intimate us before initiating the work. Since the PNG is lighter than air, there is no threat from the gas leakage, the official said. Supply of gas to around 300 houses was disrupted due to the repair work, said the officer.

show less

Two outlets start sale of CNG in Nashik

The Maharashtra Natural Gas Ltd (MNGL) has started commercial sale of green fuel for vehicles in Nashik. The two fuel stations that are providing CNG are at Igatpuri and Sinnar.

read more

“The sale of CNG from these two locations started a few days ago. We have received a good response from customers. The two outlets are selling about 1,500kg of CNG on an average,” said head of MNGL, Nashik region, Sandeep Srivastava. He added that MNGL was in the final stage of starting sale of CNG from five other locations by the end of next month. Unlike conventional fuel, CNG is non-polluting and used by scores of four wheelers and autorickshaws. “The use of CNG will help in tackling the probelem of air pollution in Nashik,” said Srivastava. MNGL, a joint venture between GAIL and BPCL, has been received the Petroleum and Natural Gas Regulatory Board’s approval to supply green fuel in Nashik. Apart from CNG, the company is working to create infrastructure for supply of piped natural gas (PNG) to households. PNG will be a replacement for LPG that is used for cooking. Srivastava said that the Nashik Municipal Corporation was helping the company to create the necessary infrastructure for the supply of green fuel in the city.

show less

Electric Mobility & Bio- Methane

Praj, ARAI to jointly develop application technology for green fuels

Biofuels developed for mobility sector will have a positive impact on environment by way of reduced carbon footprint and improved tailpipe emissions,

read more

a joint statement said. Praj Industries (Praj) and Automotive Research Association of India (ARAI) on Wednesday (July 29) signed a Memorandum of Understanding (MoU) to jointly develop application technology for advanced biofuels for usage in industry and transportation. Biofuels developed for mobility sector will have a positive impact on environment by way of reduced carbon footprint and improved tailpipe emissions, a joint statement said. Biofuels are derived by processing bio-based feedstock such as agri residue, molasses, cane syrup among others. Through this collaboration, Praj and ARAI will jointly address technologies to propagate use of biofuels in a variety of applications, including usage in internal combustion engines (ICE) in the transportation sector, the statement said. Under the MoU, Praj will provide biofuel technology solutions through its TEMPO business model, while ARAI will bring its vast experience in the field of alternative fuels, green and sustainable mobility. “We are delighted to partner with ARAI, India’s premier institution, to develop application technologies to create a positive impact on the environment and society,” Praj Industries Executive Chairman Pramod Chaudhari said. “The projects we jointly undertake will reinforce our Bio-MobilityTM platform that offers technology solutions globally to produce carbon neutral transportation fuel from bio-based feedstock for all modes of mobility,” he added. SM RVK

show less

EVI Technologies ties up with RevFin for EV financing

The EV charging infrastructure startup EVI Technologies (EVIT) on Monday (July 27) announced its partnership with digital lending start-up, RevFin alongside electric three-wheeler

read more

manufacturing companies, Saarthi and Mayuri for funding lithium-based electric vehicle and swappable batteries. As part of the tie-up, EVI Technologies will provide swappable battery solutions and Revfin will help finance users to get EVs along with Swappable batteries. This partnership aims to have over 10,000 EVs on the roads this FY 20-21. The initiative will majorly cover states like Delhi-NCR, UP, Chhattisgarh, Haryana. Speaking on this partnership, Rupesh Kumar, Founder and CEO of EVI Technologies said, “We are excited to tie-up with RevFin along with Saarthi and Mayuri, as it will provide an easy solution to all challenges faced by EV drivers and the EV sector as a whole. Together, we hope to have over 10,000 electric vehicles with swappable battery options on the road by the end of this fiscal year.” Sameer Aggarwal, Founder & CEO, RevFin said, “EVI Technologies is helping bring the infrastructure and other arrangements to this segment, which will help in building up the scale. We are very excited to work with the team at EVI Technologies in building the future of mobility. We are also very happy that popular brands like Saarthi and Mayuri will be participating in this endeavour.” EVI Technologies had also signed an MOU with Bharat Sanchar Nigam Ltd (BSNL) before lockdown to set up battery swapping and charging stations across the country, covering major cities. As part of the 10-year memorandum of understanding (MoU) inked between the two entities, EVIT would install battery swappable charging infrastructure at 5,000 locations of BSNL.

Source: ET Auto

show less

UP leads in setting up biogas plants

According to the data cited above, 75 of these plants are being set up in Maharashtra, 59 in Haryana, 35 in Andhra Pradesh, 24 in Punjab, and seven in Delhi.

read more

The government has issued 515 letters of intent so far for setting up compressed biogas (CBG) plants across the country with a bulk of them–126–in Uttar Pradesh, according to official data. The plants are being set up as part of efforts to reduce dependence on imported fuel and to check pollution from crop residue burning that exacerbates air quality crisis in the National Capital Region (NCR) every winter, officials said. The estimated cost for the 515 plants is about Rs 18,000 crore. A petroleum ministry spokesperson said under the Sustainable Alternative Towards Affordable Transportation scheme, 5,000 plants are expected to be set up by 2023. The plants have the potential of producing 15 million metric tonne CBG and to proportionately reduce India’s dependence on energy imports, the spokesperson added. Bio-mass sources such as agricultural residue, cattle dung, sugarcane press mud, municipal solid waste, and sewage treatment plant waste produce biogas through the process of anaerobic decomposition. The biogas is purified to remove hydrogen sulfide, carbon dioxide, and water vapour to produce and compress CBG, which has more than 90% methane content, the (spokesperson?) said. India imports nearly 83% of crude oil its processes. About 50% of its natural gas requirement is also imported. The government has set a target to reduce this import dependence by 10% over the next two years. Commercial sale of CBG from seven Indian Oil Corporation (IOC) outlets have started for the first time an alternative to natural gas. Two of these outlets are in Maharashtra (Pune and Kohlapur) while five others are in Tamil Nadu (two in Salem and one each in Namakkal, Rasipuram, and Puduchatram), the (spokesperson?) said. The business is lucrative for entrepreneurs as state-run oil majors such as IOC and GAIL India take offtake guarantee to such plants. The government is also considering giving it a priority sector lending tag for easy and cheaper finance. It subsidies setting up of CBG projects, which could be availed up to 2020-21, the spokesperson said. According to the oil ministry, 5,000 CBG plants are expected to produce 50 million metric tonnes of bio-manure. The spokesperson said countries like Germany, Italy, UK, France and Switzerland are promoting biogas usage. “The number of biogas plants in Germany has doubled to nearly 9,000 plants from 4,136 plants in 2010. The total biogas production capacity of the plants is 8.98 BCM, which is equivalent to 6.6 MMT.”

show less

GAIL to invest in CBG start-ups

In a bid to support start-ups operating in the area of Compressed Bio Gas (CBG), GAIL (India) Limited announced plans to invest in such companies through

read more

its start-up initiative Pankh. It has opened a fresh fifth round for solicitation of investment proposals from start-ups operating specifically in the area of CBG. Start-ups that provide technology or are planning to expand their existing CBG plants or setting-up new CBG plants can submit their investment proposal on GAIL web portal https://gailebank.gail.co.in/GSUICBG/index.aspx. The solicitation round is open till July 24. India has vast biomass resources and the government is giving special emphasis on its utilisation by encouraging setting-up of CBG plants. Further, oil and gas companies are ready to give commitment for offtake of CBG through issue of Letter Of Intent (LOI). Thus, it provides good business opportunity to start-ups operating in this area. The initiative was launched in July 2017 to invest in promising start-ups. So far, GAIL has made investments in 24 start-ups operating in various areas through four solicitation rounds.

https://www.dailypioneer.com/2020/vivacity/gail-to-invest-in-cbg-start-ups.html

show less

IOC plans more compressed biogas units in Tamil Nadu

Indian Oil Corporation (IOC) has planned to set up more number of compressed biogas (CBG) units in the country. In a video conference with reporters

read more

from Puduchatram in Namakkal district on Thursday (July 16), executive director and state head of Indian Oil Corporation (IOC) P Jayadevan said IOC would be responsible for the compressed biogas and this can be consumed as a green renewable energy for automotive and industrial applications. “Through central government’s sustainable alternative towards affordable transportation (SATAT), IOC envisages a target production of 15 million metric tonne of compressed biogas from 5,000 plants across the country by 2023,” he said. Jayadevan said CBG is a cost-effective biofuel to the vehicle owner. The state currently has five compressed biogas units and it is being sold through the outlets at the cost of Rs59.42 per kilo. A small car with compressed biogas would give a mileage of 27km/kilo translating to a running cost of Rs.2.20 per kilometer which would result in substantial savings in the fuel bill. Talking about compressed biogas producing plant in Puduchatram, he said the outlet was expected to process about 300 tonnes of feed stock including pressed mud and chicken litter every day to produce 15 tonnes of CBG. “This would be supplied to five IOC retail outlets including Namakkal and Salem districts in this region,” he said, adding that, this plant also would supply compressed biogas to few industries in this area as industrial fuel.

show less

Reliance to replace auto fuels with electricity, hydrogen; targets carbon-zero co by 2035

Reliance Industries, operator of the world’s largest refining complex, will replace transportation auto fuels with clean electricity and

read more

hydrogen as it set a target to become net carbon-zero by 2035, its chairman Mukesh Ambani said on Wednesday (July 15). The oil-telecom-to-retail conglomerate, which has pivoted away from energy to the new economy in recent years, will use technology to convert carbon dioxide into valuable chemicals and other material building blocks. In a conventional refinery, three products (petrol, diesel and ATF) comprise 60-70 per cent of the product slate. As refiners increase in size and have access to more capital, they come up with complex projects like delayed coker (or petcoke gasifier). This converts low-value products into high-value products. Globally, a conventional refinery produces around 8% of naphtha, which may be used as a chemical feedstock. This rises to 17-20 per cent in refinery-cum-petrochemical complexes. Comparatively, Reliance has a 24% conversion rate of ‘oil-to-chemicals’ currently and may be targeting 70% conversion. The trend of increasing the percentage of chemicals in the overall production is due to the vast difference in profitability combined with an increased threat from electric vehicles to petrol and diesel. Ambani said substantial progress has already been made on photosynthetic biological pathways to convert carbon dioxide emissions at Jamnagar into high-value proteins, nutraceuticals, advanced materials, and fuels. “We will develop next-gen carbon capture and storage technologies,” he said. “We are evaluating novel catalytic and electrochemical transformations to use CO2 as a valuable feedstock.” Reliance has proprietary technology to convert transportation fuels to valuable petrochemical and material building blocks. “And at the same time, we will replace transportation fuels with clean electricity and hydrogen,” he said. “We will combine our strengths in digital, power electronics, advanced materials and electrochemistry to build full-stack electrolyser and fuel cell solutions in India.” Reliance, he said, will build an optimal mix of reliable, clean and affordable energy with hydrogen, wind, solar, fuel cells and battery. “On successful implementation of this strategy, we target to become net carbon-zero by 2035,” he said. “We have a 15-year vision to build Reliance as one of the world’s leading new energy and new materials company.” The new energy business based on the principle of carbon recycle and circular economy is a multi-trillion opportunity for India and the world, he said, adding this was also an opportunity to make clean and green energy abundantly available at an affordable price. “More than a business, this is our seva to save Planet Earth from the ravages of climate change. We shall spare no effort in realising this dream. From time to time, I shall apprise you of our progress in this business,” he added.

show less

Gas/ Pipelines/ Company News

GAIL opposes government’s hive-off plan

Oil ministry officials said they were considering a bifurcation to resolve the conflict arising out of the same entity owning the two businesses. State-owned gas transporter GAIL India is

read more

against the government move to split it into a marketing and a pipeline company as this would impact its ability to take business risk even as the Modi government moves ahead with the bifurcation plan. GAIL sources said they have flagged the PSU’s concerns with the oil ministry and expressed the hope that the unbundling would not weaken the PSU and its ability to take business risk. They pointed out that “businesses of gas trading and transportation are in compliance with the existing regulatory framework and the third party has access to its pipeline infrastructure, in a fair, transparent and equitable manner. The tariff is regulated and vetted by an independent regulator PNGRB”. “The integrated structure of the company is a source of strength as the company manages its business risk more efficiently than a split entity could do. All Indian energy majors are fully integrated in production, refining and marketing of petroleum products,” they said. GAIL is India’s biggest natural gas marketing and trading company and owns more than 70 per cent of the country’s 16,981-km pipeline network, giving it a stranglehold on the market. The users of natural gas have often complained about not” fairly” getting access to GAIL’s 12,160-km pipeline network to transport their fuel. GAIL’s core business after the unbundling would be gas marketing and petrochemicals production. The petroleum ministry, as part of the unbundling of state-owned GAIL, has suggested two entities be formed — one with marketing operations and the other, the pipeline company. The pipeline business would be hived off into a separate entity, which is expected to be considered for a strategic sale at a later date. GAIL’s core business after the unbundling exercise would be the marketing of natural gas and petrochemicals production. It will have to hire capacity in pipelines from the subsidiary and pay regulator-approved tariff. It will continue to execute the gas sales agreements it has already signed and will be responsible for the discharge of the obligation under purchase pacts including for import of LNG. Sources said the pipeline subsidiary may be sold off to a strategic investor but the sale is not likely before 2022 as the thinking in the government is that the gas market will not be mature before that and state support would be needed for GAIL to accomplish building a national gas pipeline grid. The government had recently approved viability gap funding for a gas pipeline grid in the North-East which a consortium comprising GAIL and other state-owned firms will be executing.

https://www.telegraphindia.com/business/gail-opposes-hive-off-plan/cid/1787552

show less

Dozens of queries show investor appetite for India Oil Firm sale

India’s biggest asset sale program is drawing interest from global investors despite the volatility in the oil markets and devastating fallout of the coronavirus pandemic.

read more

As many as 81 queries were sent by prospective bidders vying for state-owned oil refiner-cum-fuel retailer Bharat Petroleum Corp., according to officials with knowledge of the matter. While the questions from multiple international oil majors is a reflection of interest, it doesn’t mean they will translate into bids, they said, without disclosing how many companies have sought clarifications. A government official had previously said that several top oil producers from the Middle East and Russia’s Rosneft PJSC have shown interest in buying BPCL, which is India’s third-biggest refiner and second-largest fuel retailer. The Indian government is in the process of clarifying these queries through a corrigendum to the offer document, and will go ahead with the privatization. The process can rake in a sizable amount and support its coffers depleted by sluggish tax revenues and dole outs to shield the poor from the virus fallout. BPCL is a high-quality asset and its value hasn’t eroded despite the fall in share price, the people said, asking not to be identified as the information is not public. Spokespeople at the Ministry of Finance and Ministry of Petroleum and Natural Gas didn’t respond to queries seeking comment. The government doesn’t plan to dilute the $10 billion net worth clause for bidders, showing the administration’s confidence in getting bigger players for the transaction. Only two Indian companies make the cut, of which only one is in the oil and gas sector, the people said, referring to Reliance Industries Ltd. The last date for submitting initial bids for Indian government’s 52.98% holding in BPCL is July 31.

Prime Minister Narendra Modi’s government is offering employees shares at a discounted price as an incentive for the privatization, they said.

show less

Reliance overtakes Exxon to become world’s 2nd most valuable energy firm

Reliance Industries has overtaken ExxonMobil to become the world’s second most valuable energy company after its market capitalisation scaled to a record high of over Rs 14 lakh crore.

read more

The oil-to-telecom conglomerate is now ranked 46th globally on market cap, according to stock market data. On Thursday (July 23), Reliance was ranked 48th and was behind ExxonMobil. Its share price on Friday scaled an all-time high of Rs 2,163 before settling at Rs 2,146.20, taking the company to 46th position. The Rs 13.6 lakh crore m-cap of Reliance together with Rs 54,262 crore m-cap of its partly-paid shares that were issued in the recent rights issue and are traded separately, puts the company’s combined market value at Rs 14.1 lakh crore or $ 189.3 billion. This was enough to race past ExxonMobil which has an m-cap of $ 184.7 billion. Globally, Saudi Aramco has the highest market cap of $ 1.75 trillion, followed by Apple ($ 1.6 trillion), Microsoft ($ 1.5 trillion), Amazon ($ 1.48 trillion), and Alphabet ($ 1.03 trillion). Reliance is now the second most valuable energy firm. Aramco being the top energy company. No Indian company has ever crossed an m-cap of Rs 14 lakh crore. Besides being higher than ExxonMobil in m-cap, Reliance is also above Chevron which has an m-cap of about $ 169 billion as well as likes of Oracle, Unilever, Bank of China, BHP Group, Royal Dutch Shell and SoftBank Group. Reliance is the 10th highest m-cap company in Asia. China‘s Alibaba Group is ranked 7th globally. At 46th rank, Reliance is just below PepsiCo which has an m-cap of $ 189.8 billion. Reliance share price had touched a bottom of Rs 867 on March 23, 2020, when the total market value of the company stood at Rs 5.5 lakh crore or $ 73.5 billion. It added $ 115.9 billion to shareholder wealth within just four months – one of the highest value creation feats in the world in such a short time – mostly on the back of record fundraising from equity dilution in its digital unit, Jio Platforms. The firm added $ 39 billion market value within five weeks and $ 29 billion in the last 14 trading sessions. Reliance PP or the partly paid-up shares issued in recently concluded Rights Issue have generated over 4.1 times returns to investors in less than two months. The issue closed on June 4, 2020, when investors had to pay Rs 314.25 to own each of the partly paid-up share. The Reliance PP shares listed on stock exchanges on June 15, 2020. Reliance raised a total of Rs 2,12,809 crore through Rights Issue, equity sale in Jio Platforms, and investment by BP in its fuel retailing venture. The combined capital raised has no precedence globally in such a short time.

show less

Unified tariff on gas pipelines from September

In yet another reform initiative in the oil and gas sector, pipeline operators in the country may shift to a unified or pooled tariff regime for inter-connected cross-country gas pipelines from

read more

September 1. A unified tariff may do away with levy of multiple tariffs on customers, ensuring equitable distribution of gas and uniform gas-based economic development across the country. The current system of tariff determination leads to multiple pipeline tariffs on customers who have contracted for gas which flows from multiple pipeline operators. According to official sources, downstream oil and gas regulator, the Petroleum and Natural Gas Regulatory Board (PNGRB) has finalised the draft regulation on unified tariff and would fix the tariff by August-end and implement it from the first day of September. With this, one nation, one gas grid, one pricing would be implemented across the country, bringing relief to customers in far-flung areas who were being charged extra for gas transmission but raising charges for other existing customers to bring about price equalisation. According to a report by ICICI Securities, unified tariff mechanism would boost utilisation on GAIL‘s Jagdishpur-Haldia-Bokaro-Dhamra pipeline (JHBDPL) by virtue of lowering of tariff under pooling of transmission prices. When the Cabinet Committee on Economic Affairs approved the JHBDPL, GAIL had proposed unified tariff to ensure viability of this pipeline, and had estimated unified tariff on the JHBDPL and other inter-connected pipelines at Rs 57/MMBtu vs Rs 173/MMBtu, if fixed separately for the JHBDPL.

show less

Gas consumers object to government’s pipeline tariff rationalisation plan

However, PNGRB’s draft amendment proposes that unified tariff would be applicable only on the integrated trunk pipeline network of state-run GAIL and Gujarat State Petronet Ltd (GSPL),

read more

leaving out 30% of the current gas pipeline capacities. Industry representatives also pointed out that since the new tariff structure will not be imposed on all the gas pipelines in the country, it will lead to market distortion as customers will end up paying under multiple tariff regimes, depending on the pipelines used by them. In order to develop new gas markets in far flung areas, the government has decided to rationalise gas pipeline tariff structure as the current additive pricing system raises pipeline charges every 300 kilometres, discouraging potential consumers located in areas far from the gas production facilities and import terminals (injection points). To that end, the petroleum and natural gas regulatory board (PNGRB) is seeking to make amendments to pipeline tariff regulations for the determination of “unified tariff”, wherein transport rates beyond 300 kilometres of the injection points would be the same all across the country. Under the proposed mechanism, gas produced or imported at west coast and transported through the integrated networks will be subjected to single tariff, but gas procured from the eastern or southern regions (such as KG Basin, Cauvery Basin, Mahanadi Basin) which needs to be transported using pipelines outside the ambit of unified tariff regime, will be subjected to additive tariffs. “A unified transportation tariff unduly favours the customers who are located at a distance from the gas source as this results in cross subsidy to them from customers who are located at the source,” the federation of Indian chambers of commerce and industry (FICCI) told PNGRB when it sought stakeholders’ comments on the proposal. FICCI also pointed that unified gas pricing would be against the producing states, as they will lose their advantage for attracting industrial investment that consume gas.State-run oil refining and marketing company Indian Oil Corporation Ltd (IOCL) pointed out that most of its refineries are within 300 kilometres of injection points and if the proposed structure is implemented, the company will end up paying “considerably high transportation cost for its captive consumption”. IOCL refineries use more than 2 million metric tonne of gas per annum and the consumption will rise as it plans to connect more refineries to the gas network. “By not including Kakinada to Gujarat pipeline in integrated pipeline system, the proposed unified tariff regime inadvertently incentivises (imported) LNG over east coast domestic gas resulting in adverse impact on exploration and production activity and goes against the Prime Minister’s ‘Make in India’ and ‘Atmanirbhar’ vision,” BP Exploration (Alpha) Ltd stated.

show less

Policy Matters/ Gas Pricing/Others

NGT asks CPCB to ensure states, UTs ban use of petcoke, furnace oil

A bench of the NGT, headed by its chairperson AK Goel, on Thursday (July 16) sought an action taken report (ATR) from the CPCB within four months and

read more

listed the matter for further hearing on January 15, 2021. The National Green Tribunal (NGT) has asked the Central Pollution Control Board (CPCB) to ensure that states and Union Territories (UTs) ban the use of petcoke and furnace oil as fuel to prevent damage to the environment and public health. The tribunal was hearing two petitions, filed by Sumit Kumar and Amarjeet Kumar, seeking regulations and to control the use of petcoke and furnace oil as fuel to prevent damage to the environment and public health. The tribunal has observed that the Supreme Court, in its order dated October 24, 2017, banned the use of petcoke and furnace oil in the national capital. On November 17, 2017, the top court had suggested other states and UTs take similar measures. Earlier, the NGT had directed the CPCB to adopt measures for regulation and control. The green tribunal had noted there are huge emissions of SO2 (sulphur dioxide) and other pollutants on account of the use of petcoke and furnace oil by the industries. It also noted that some states are continuing using it. The tribunal has directed the industries to switch over to alternatives and cleaner fuels. “Orders of the tribunal be given effect and CPCB may ensure compliance by issuing such further direction as may be necessary for the exercise of its statutory power,” the NGT held.

show less

Several agreements signed at US-India Strategic Energy Partnership ministerial meeting

Union Minister of Petroleum and Natural Gas Dharmendra Pradhan and US Secretary of Energy Dan Brouillette in a virtual ministerial meeting of the US-India Strategic Energy Partnership (SEP)

read more

prioritised new areas for cooperation. A number of agreements and partnerships were announced to advance the strategic and economic interests of both countries. An official release said that two sides signed a Memorandum of Understanding (MOU) to begin cooperation on Strategic Petroleum Reserves operation and maintenance, including exchange of information and best practices. They also discussed the possibility of India storing oil in the US Strategic Petroleum Reserve to increase their nation’s strategic oil stockpile. The two sides launched a public-private Hydrogen Task Force to help scale up technologies to produce hydrogen from renewable energy and fossil fuel sources and to bring down the cost of deployment for enhanced energy security and resiliency. They also signed an MOU to collaborate on India’s first-ever Solar Decathlon India in 2021, establishing a collegiate competition to prepare the next generation of building professionals to design and build high-efficiency buildings powered by renewables. Pradhan said he has invited the US Government and US companies to join the Atmanirbhar Bharat Mission, which aims to transform India into a global manufacturing hub of the 21st century, particularly in the development of energy infrastructure. The USAID announced a partnership with Power System Operation Corporation (POSOCO) to develop India’s National Open Access Registry (NOAR). MOU was signed between the US Agency for International Development (USAID) with Indian Society of Heating Refrigeration and Air Conditioners (ISHRAE) for professional skill development for practitioners on energy-efficient design of air conditioning systems. MOU was signed between EESL, NTPC, and USAID for retrofit of buildings to improve indoor air quality, safety, and efficiency. Statement of Intent was signed between the US Department of State and India’s Ministry of Power under the Flexible Resources Initiative of the US-India Clean Energy Finance Task Force to enhance the flexibility and robustness of India’s grid to support the country’s energy transition and mobilise the private investment to deliver reliable, low-cost power for the people of India. The US Department of Commerce also launched an Energy Industry Working Group for India under the Asia EDGE initiative to facilitate private sector connections and ideas for US-India energy cooperation, including on innovative and disruptive technologies. Under the US-India Gas Task Force, the Federal Energy Regulatory Commission (FERC) and Petroleum Natural Gas Regulatory Board (PNGRB) signed MoU on information exchange in oil and gas regulatory frameworks. “MoU between Bloom Energy and Indian Oil on fuel ell technology, and Agility Fuel Solutions LLC and Indrapastha Gas Limited (IGL) to explore the viability, usefulness, and feasibility of advanced clean fuel systems including Type IV cylinders in India were also signed,” the release said. It said the US.-India Comprehensive Global Strategic Partnership has never been more vital in the midst of a global pandemic with an enormous human toll that is also affecting energy demand, global energy markets, and sustainable energy growth. (ANI)

show less

India’s new deepwater supply could face pressure from low spot LNG prices

India’s new deepwater gas production could be under pressure from low spot LNG prices, says Wood Mackenzie. Deepwater is expected to drive India’s gas production growth,

read more

adding over 1 billion ft3/d of new supply by 2023. However, only 15% or 200 million ft3/d of this supply has been contracted to date. With market demand impacted by Covid-19, and low spot LNG prices expected to persist at least until 2022, the full commercialisation of these deepwater volumes is at risk. Wood Mackenzie principal analyst Alay Patel said: “Gas from the deepwater fields will be sold in Andhra Pradesh and the much larger Gujarat/Maharashtra where it will compete against spot LNG directly. The critical period for producers will be the 2020/2021 period when spot prices are set to remain low. “We estimate that around 35% of uncontracted volumes in 2022 are at a higher risk of being replaced by spot LNG.” The eastern states of Andhra Pradesh and Telangana do not have access to LNG, with the regional pipeline network supplied primarily by ONGC and Reliance’s fields at Kakinada port. With no competition from spot LNG, sellers only need to ensure that gas prices are viable for industrial or power consumers who can absorb incremental volumes. The western region of Gujarat and Maharashtra, however, remains mature and competitive due to robust LNG storage and pipeline infrastructure, along with ready access to LNG and domestic gas supply. The next 176 million ft3/d of deepwater gas which is going to be marketed will be costlier than spot LNG at 8.4% indexation (at well-head) after adding the East-West pipeline tariff. Wood Mackenzie senior analyst Vidur Singhal said: “Indian gas buyers have generally preferred oil-linked contracts which tend to be more transparent and less volatile vis a vis gas hub or spot LNG prices. “However, procuring spot LNG mitigates the risk of ‘take or pay’ obligations compared to the new deepwater domestic gas contracts, as buyers are indebted to pay for a minimum 80% of contracted gas volumes regardless of seasonal demand changes. Historically, price-sensitive Indian buyers have increased spot purchases when prices drop, and we see this trend playing out through next year.” LNG appears to be more competitive economically compared to deepwater domestic gas over the next two to three years. However, not all volumes are at equal risk. Regional market, upstream competitiveness and strategic decisions of buyers will influence the level of spot, which replaces domestic gas. Patel said: “Upstream companies might have to face difficult decisions when they auction their volumes through to 2022. Either accept lower prices and consequently low returns or delay sales until the prices are more attractive.”

show less

LNG Development and Shipping

GAIL in talks with US, Russian LNG suppliers to sweeten long-term contracts

GAIL India, the public sector gas transmission major, is in talks with US and Russian LNG suppliers to secure relaxation in long term contracted gas prices, and

read more

volumes to mitigate the losses, due to drop in consumption after Covid induced lockdown since March 24. As against the higher long term contracted price of LNG the spot prices of gas on the US benchmark, Henry Hub fell 12.31% year-to-July 20, to $ 1.71 per MMBtu. According to company sources close to development, the oversupply of gas and the drop in consumption of gases in India due to Covid, has given rise to concern over prices of gas. “Per-se, we are not terminating any of the contracts because we will consume them later when the new fertilizer plants will come up in places like Durgapur and Gorakhpur. We are taking up the matter with the suppliers to give relaxations in prices and in the supply of LNG as per our requirement and consumption pattern,” sources said. Gail’s gas supply to fertilizer sector has increased to 43 MMSCMD as of today from the average of 37 MMSCMD in FY20. “Power sector has also caught up, but the city gas distribution sector is still down, barring the piped natural gas segment that supplies to residential areas. We expect to an increase of 11-12 MMSCMD of gas supplies once all the five Fertiliser plants come up by December 2021,” sources said. The company is also taking up the matter with suppliers to reschedule, as well as postpone some of the cargoes to reduce their losses. “As of now we have got very little in terms of relaxations, but we are pursuing with them to secure the relaxation in pricing and quantity as domestic consumption and spot prices have dropped substantially,” sources said. “Though we want to match the long term contracted price to the current spot price, it is going to be difficult,” sources said. The current landed price for long term contract is around $7-$8/MMBtu and the landed price for a spot gas is around $5/MMBtu. The company plans to get around 90 cargoes from the US in FY21, which accounts for 36% of the total 250 cargoes or 14 MMTPA that will be sourced during FY21. GAIL has a long-term contract for 5.8 MMTPA of US-origin LNG, along with long-term swap contracts in place until March 2022. India has long-term LNG supply contracts with countries like Qatar, Australia, and Russia. From Russia, GAIL sources around 2.5 MMTPA of gas which will increase to 2.75 MMTPA in coming years. Petronet LNG, another state-run company, is expected to supply around 70 cargoes or around 4-4.5 MMTPA, to GAIL in fiscal 2020-21. India, the third-biggest energy consumer after the US and China, aims at securing 15% of its total energy mix from natural gas by 2030, up from current levels of about 6%. The Prime Minister Narendra Modi-led government’s focus on raising the share of gas in the overall energy mix has attracted the interest of global giants like ExxonMobil and Total in the Indian gas market.

Source: LNG Global

show less

Petronet plans to cancel 10-year LNG import tender: Sources

India’s top gas importer Petronet LNG is set to cancel its offer to buy an annual 1 MMT of liquefied natural gas (LNG) for 10 years, two sources said, as signing long-term contracts are not

read more

attractive in the current scenario. India is scouting for cheap gas for price-sensitive consumers as Prime Minister Narendra Modi wants to raise the share of natural gas in the national energy mix to 15% by 2030 from the current 6.2% to reduce pollution. Earlier this year, Petronet invited bids to buy LNG with pricing linked to Henry Hub natural gas futures in the United States and Dutch TTF gas futures and shipped on a delivered ex-ship basis. “This month in an internal committee it was decided to cancel the tender. Soon the proposal will be placed for approval by the board,” said one of two sources familiar with the matter who both confirmed the plan to end the tender. “Long-term deals don’t make sense in current scenario. Doesn’t make sense to lose precious foreign exchange,” the source added. GAIL (India) is struggling to sell its costly LNG sourced under long term deals with US companies. Asian spot LNG prices <LNG-AS> have been languishing near record low levels, which were first reached in May, due to new supply entering the market from the United States and the coronavirus pandemic slamming gas demand globally. Petronet’s chief executive Prabhat Singh last month said his firm was close to finalising the deal with prices near to spot markets. It is renegotiating pricing under long-term deals with Qatargas after spot prices declined. Petronet has deals to annually buy 7.5 MMT of LNG from Qatar. Petronet did not respond to an emailed request for comment on plans to cancel the tender. GAIL and Italy’s ENI were the only two companies that qualified for Petronet’s long term LNG tender, the two sources said. Singh last month said 13 companies had submitted bid for the tender. GAIL and ENI did not respond to emails seeking comment on whether they were frontrunners for the tender.

show less

GAIL urges government to use diplomacy to help rework expensive US LNG deals

GAIL has urged the government to use its diplomatic ties with the US to help rework the company’s expensive gas purchase deals with the American suppliers at a time the liquefied natural gas (LNG)

read more

rates in the spot markets have fallen to record lows, according to people familiar with the matter. GAIL has contracts for the purchase of 5.8 MMTPA of LNG with two US suppliers, deals that were signed between 2011 and 2014 as LNG prices roared across the world. A global price reversal since leading to a recent collapse in the spot market has made it harder for GAIL to market the expensive US gas. GAIL has written in a recent letter to the government that the US suppliers should consider aligning contract prices with current market realities and reduce annual volumes, according to the people familiar with the matter. GAIL wants the total supplies for the contracted 20 year-term to be stretched over 25 years, the person said. GAIL is banking on strengthening ties between India and the US, and hopes a government-to-government dialogue could get private US suppliers to the negotiating table, he said. “GAIL is contract-bound to buy US LNG but if it can’t further sell this to customers, how long can it keep buying and paying for US LNG. The US suppliers should understand this,” said the person. The rate for US LNG brought to Indian shores is about thrice that of the one bought in the spot market these days. Spot rates for India delivery have dived to $2 per MMBtu and a global supply glut is expected to keep rates low for long. GAIL’s costs mainly include Henry Hub gas price, liquefaction and transport costs and the company primarily wants modification in liquefaction rates, which are about $3 per MMBtu, according to people cited above. GAIL has tried in the past to renegotiate LNG deals but was always faced with unyielding US suppliers. By contrast, it has been able to rework its contract with Russia’s state-run Gazprom. Petronet LNG, India’s largest gas importer, too has successfully renegotiated with ExxonMobil and Qatar for long-term LNG supplies.

show less

India’s Petronet renews investment deal with Tellurian

India’s top gas importer Petronet LNG has renewed its initial deal to consider investing $2.5 billion in U.S. liquefied natural gas (LNG) developer Tellurian Inc’s Driftwood project,

read more

Indian sources familiar with the matter said. Petronet and Tellurian now have time until the end of December to finalise the deal, they said. The memorandum of understanding, which lapsed on May 31, was renewed last week ahead of a virtual meeting between Indian oil minister Dharmendra Pradhan and U.S. Energy Secretary Dan Brouillette.

show less

Gail India issues swap tender to buy and sell LNG in 2022 – sources

Gail (India) has issued a swap tender offering liquefied natural gas (LNG) cargoes for loading in the United States and seeking cargoes for delivery into India, in 2022,

read more

two industry sources said on Friday (July 17). It has offered to swap one cargo a month in 2022 in a tender that closes on July 27, they said. The cargoes it is offering will load from the Sabine Pass plant on a free-on-board (FOB) basis and the cargoes it is seeking will be delivered into India on a delivered ex-ship (DES) basis. The Indian importer has 20-year deals to buy 5.8 million tonnes a year of U.S. LNG, split between Dominion Energy’s Cove Point plant and Cheniere Energy’s Sabine Pass site in Louisiana.

show less

Petronet LNG expects to double gas volumes at Kochi

Petronet LNG Ltd (PLL) is betting big on the completion of gas pipelines to Mangaluru from its Kochi terminal to enhance its business volumes.

read more

The connectivity to Mangaluru is to be completed by the GAIL any time soon. This is expected to double PLL’s capacity utilisation to 40-45% from the current 20 per cent, said Yogananada Reddy, Chief General Manager and Vice President, PLL, Kochi terminal. The ₹4,700-crore terminal in Kochi was languishing for a long time after its commissioning in 2013 and, it was last year, that the five-million tonne terminal operated at 20 per cent growth in capacity and achieved sales of one million tonnes per annum. Reddy told BusinessLine that Mangalore Chemicals and Fertilisers has evinced interest in availing gas from Kochi once the 444-km pipelines are ready. Since Managaluru is a good consumption point for natural gas, he said companies such as MRPL, ONGC Mangalore Petrochemiclas Ltd (OMPL) and several other customers can take sizeable quantity of gas to meet their production requirements. However, the quantity of gas to be sold will be decided by GAIL, which is heading the marketing part. PLL is also engaged in the supply of gas by road to PSU companies in Kerala such as HLL, KMML in the southern part of the State as well as for city gas distribution network. “We have recently entered into a contract with Saint Gobain in Chennai for the supply of 1,500 tonnes of gas up to December”, he said, adding that a pilot fishing boat conversion to LNG fuel with the support of KSIDC has also been taken up. On the availability of gas, Reddy said there are no constraints right now as the company has entered into a long term contract with Exxon Mobile in Australia.Sources in the BPCL, engaged in the road movement of natural gas to Chennai, also urged the Kerala Government to reduce the VAT rates for LNG presently charged at 14.5 per cent to get more customers. The VAT rate in neighbouring Tamil Nadu is only 5 per cent.

show less

Natural Gas / Transnational Pipelines/ Others

Occidental in talks to sell $4.5 bln energy asset to Indonesia’s Pertamina – BBG

Oil and gas producer Occidental Petroleum Corp is in talks to sell $4.5 billion worth of energy assets in Africa and the middle east to Indonesia‘s PT Pertamina in a bid to ease its debt load,

read more

Bloomberg News reported on Wednesday (July 29). Pertamina is negotiating the acquisition of oil and gas stakes in countries including Ghana and the United Arab Emirates, the report said, citing people with knowledge of the matter. The Indonesian company has also expressed interest in buying some of Occidental’s assets in Algeria and Oman, the report said, adding that it has been discussing a purchase price of about $4.5 billion. Occidental has been trying to sell assets to reduce the $40-billion debt it took on after its $38-billion purchase of Permian rival Anadarko Petroleum last year, an ill-timed bet on rising oil prices. The company’s shares have plunged more than 60% this year amid the worst oil-and-gas industry downturn in years, and the company has cut staff and reduced expenses to deal with its massive debt levels. Shares were trading up 2.6% up before markets opened on Wednesday. Occidental and Pertamina did not immediately respond to a Reuters request for comment.

show less

Italy’s biggest gas distributor sees no major impact from COVID-19 on business this year

Italy‘s biggest gas distributor Italgas said on Monday (July 27) it did not expect COVID-19 to impact its business significantly this year after reporting first-half earnings just above forecasts.

read more

In the first six months, Italgas reported a 6.6% rise in core earnings to 462.7 million euros ($542 million) compared to an analyst consensus of 461 million euros. But the company warned it was not in a position to estimate the negative impact on business in the coming years of any significant prolongation of the health emergency. Italy was one of the countries hardest hit by COVID-19 and there has been some concern about the risks for key energy facilities should the crisis persist. Like other energy grid companies, Italgas has been spending on technology to run its grids more efficiently and offer clients services such as remote gas meter readings and gas leakage detection. In the first six months investments rose 16% to almost 370 million euros. “Thanks to the digital transformation of the last three years … we have been able to ensure safety and continuity of service during lockdown,” CEO Paolo Gallo said. Italgas, which manages 73,000 kilometres of network, said it would continue plans to expand in Italy by competing in gas distribution tenders. It also said further acquisitions could be completed this year following those it made last year.

show less

PetroChina to sell major pipeline assets to PipeChina for $38 bln

Beijing started considering reforming the sector nearly a decade ago but only approved the plans early 2019, spurred by a national campaign to boost consumption of the cleaner

read more

burning natural gas and curb dirtier coal

PetroChina, China’s state-owned oil and gas firm, said on Thursday (July 23) it would sell its major oil and gas pipelines and storage facilities to the newly launched China Oil and Gas Pipeline Network for 268.7 billion yuan ($38.36 billion). The creation of the new company, also called PipeChina, marks the largest industry reshuffle in the country in the past two decades, aimed at providing fair market access to infrastructure and boost investment in oil and gas production. Beijing started considering reforming the sector nearly a decade ago but only approved the plans early 2019, spurred by a national campaign to boost consumption of the cleaner burning natural gas and curb dirtier coal. As part of Thursday’s deal, PetroChina said it will get a stake of about 30 per cent, worth 149.5 billion yuan, in PipeChina and that the new entity would pay the rest in cash. The sale excludes the assets of Kunlun Energy, in which PetroChina has a 54.4 per cent stake, it said in a statement. Upon completion of the transactions, PipeChina will become an associate company of PetroChina, a listed arm of CNPC. PetroChina expects to book a gain of 45.82 billion yuan from the disposal of its assets, which it will use to pay dividend and for capital expenditure, it said in a statement. Earlier in the day, China Petroleum & Chemical Corp (Sinopec) also announced plans to sell some of its oil and gas pipeline assets for 47.11 billion yuan to PipeChina, of which 22.89 billion yuan will be injected into PipeChina for an equity interest.

show less

Israel’s Tamar gas field to start paying taxes on profit in 2021Delayed Romanian Black Sea gas projects pose risk to pipeline

Delek Drilling said on Wednesday (July 22) the partners in the Tamar natural gas site will start paying taxes on profit in early 2021, which could help Israel move forward

read more

with plans to create a sovereign wealth fund. Prime Minister Benjamin Netanyahu has said that tens of billions of dollars raised from taxing natural gas sales would be invested abroad via a sovereign wealth fund, with proceeds brought home for education, welfare and other services. The fund, aimed at preventing Israel’s currency from overheating because of the sudden influx of natural gas revenues, was due to be set up in 2018, but political turmoil and a slower stream of revenue have caused delays. The minimum needed to begin investing will not be reached before the end of 2021, Andrew Abir, the Bank of Israel’s deputy governor, told Reuters this month. Delek Drilling and Noble Energy own 47% of the Tamar field off Israel’s Mediterranean coast that began production in 2013, while Isramco holds 28.5%. Delek said it would start paying the tax in early 2021 and that by the end of 2025, the state’s income from the levy alone was expected to reach about 8 billion shekels ($2.3 billion) and some 15 billion shekels including royalties and taxes. The company said its best estimate of reserves in the field — which earlier this month began supplying gas to Egypt — is 10.7 trillion cubic feet (302BCM). Tamar has a value of $6.57 billion, Delek said. On Monday, Chevron Corp said it would buy Noble for about $5 billion in stock. Noble’s flagship field is Leviathan offshore Israel, the largest natural gas field in the eastern Mediterranean.

show less

Delayed Romanian Black Sea gas projects pose risk to pipeline

Romania’s gas grid operator Transgaz will likely finalise work on a European Union-backed pipeline this year, but with no progress on tapping offshore gas

read more

reserves it may have little to transport, an energy regulator said on Tuesday (July 21). The pipeline to connect Bulgaria, Romania, Hungary and Austria (BRUA) and ease reliance on Russian gas will be able to carry 1.75 billion cubic metres of gas in its first phase, which cost an estimated 479 million euros ($550.4 million) to build. “We hope BRUA will be finalised this year, but since we did not solve Black Sea gas extraction, I am wondering what we will be transporting through this pipeline,” Maria Manicuta of energy regulator ANRE told a Focus Energetic conference. Several gas producers have spent years and billions of dollars preparing to tap Romania’s Black Sea gas, but were blindsided by price caps, taxes and export restrictions pushed by a previous centre-left government. The current centrist minority government has overturned some of the changes, but potential investors are still waiting for tax changes on offshore projects. In January, U.S. energy major Exxon Mobil confirmed it was weighing an exit from the long-stalled Neptun Deep offshore project it holds jointly with Romania’s OMV Petrom . Petrom, majority-controlled by Austria’s OMV said in April it remains committed to the project, but that it needed the tax changes, as does smaller project Black Sea Oil & Gas, controlled by private equity firm Carlyle Group LP. “I am sure that ultimately BRUA will be used, but in the very near future there is some risk,” Manicuta added.

show less

US oil & gas rig count falls to record low for 11th week: Baker Hughes

The US oil and gas rig count, an early indicator of future output, fell by five to an all-time low of 253 in the week to July 17, according to data on Friday from energy services firm

read more

Baker Hughes Co going back to 1940. US energy firms cut the number of oil and natural gas rigs operating to a record low for an 11th week in a row though they have slowed the reductions as some consider returning to the well pad with crude prices up from historic lows. The US oil and gas rig count, an early indicator of future output, fell by five to an all-time low of 253 in the week to July 17, according to data on Friday from energy services firm Baker Hughes Co going back to 1940. That was 701 rigs, or 73 per cent, below this time last year. US oil rigs fell one to 180 this week, their lowest since June 2009, while gas rigs dropped by four to 71, their lowest on record according to data going back to 1987. Even though US oil prices are still down about 34 per cent since the start of the year due to coronavirus demand destruction, US crude futures have jumped 115 per cent over the past three months to around $40 a barrel on Friday on hopes global economies will snap back as governments lift lockdowns. Analysts said higher oil prices will encourage energy firms to slow rig count reductions and possibly start adding some units later this year. “US rig activity will bottom near 250 rigs or roughly today’s levels,” analysts at Raymond James said, noting they expect the rig count to average 270 in the second half of 2020, “amounting to a small recovery as some operators slowly resume drilling in some basins.”

show less

Investors in Russian pipeline projects at risk of US sanctions, Pompeo says

US Secretary of State Mike Pompeo on Wednesday (July 15) warned investors in two Russian natural gas pipeline projects that they could face sanctions as the

read more

Trump administration seeks to curb the Kremlin’s economic leverage over Europe and Turkey. Pompeo told a news conference that European investors in the Nord Stream 2 and a branch of the Turkstream pipelines could be “put at risk” of US sanctions under the Countering America’s Adversaries Through Sanctions Act of 2017. The pipelines will carry gas from Russia to Europe and Turkey. “It’s a clear warning to companies aiding and abetting Russia’s malign influence projects will not be tolerated. Get out now, or risk, the consequences,” Pompeo said. The United States, which has a glut of natural gas, is trying to export LNG to Europe. It has also supported efforts by Europe to diversify its imports of LNG from other sources, including Norway. Russia’s foreign ministry spokeswoman Maria Zakharova said sanctions on the two pipelines equated to political pressure, TASS news agency reported. “This is the use of political pressure for unfair competition,” Zakharova said. “It is an indicator of the weakness of the American system. Apart from forceful methods, there are no effective tools.” Nord Stream 2 suspended construction last December after Swiss-Dutch company Allseas, which specializes in subsea construction, pulled out following US President Donald Trump‘s signing of a defense policy bill that contained other sanctions on the project. Two Russian-owned pipe-laying vessels may finish the remaining 100 miles (160 km) of the project, led by Russia state-run company Gazprom. Gazprom is financing half of the project worth about 9.5 billion euros ($10.5 billion). Gazprom did not immediately reply to a request for comment. Last month, a bipartisan group of US senators led by Jeanne Shaheen, a Democrat, and Ted Cruz, a Republican, introduced a sanctions bill on Nord Stream 2. The measures, which only become law after being passed by Congress and signed by Trump, would expand existing sanctions to include penalties on parties providing underwriting services, insurance or reinsurance, and pipe-laying activities.

Nord Stream 2, which would take 55 billion cubic meters of gas per year to Germany under the Baltic Sea, bypassing Ukraine and depriving it of potentially billions of dollars in transit fees, aims to double the Nord Stream route’s existing capacity. Nord Stream 2 chafed at the US move. Efforts to obstruct the project “reflect a clear disregard for the interests of European households and industries, who will pay billions more for gas if this pipeline is not built,” said spokesperson Steffen Hartmann. Other partners in Nord Stream 2 are Austria’s OMV, German firms Uniper and Wintershall, Anglo-Dutch energy major Royal Dutch Shell Plc and France’s Engie. The sanctions are opposed by Germany, Europe’s largest economy, which needs cheap gas as it weans itself off of coal and nuclear power plants. Analysts pointed out that the sanctions remain optional. “In short, we would describe today’s change as loading and aiming of the sanctions weapon without cocking or firing it,” said analysts at ClearView Energy Partners, LLC in a note to clients.

show less

Israel approves pipeline deal to sell gas to Europe

The Israeli government on Sunday approved an agreement with European countries for the construction of a subsea pipeline that would supply

read more

Europe with natural gas from the eastern Mediterranean. The Eastmed pipeline, which has been in planning for several years, is meant to transport gas from offshore Israel and Cyprus to Greece and on to Italy. A deal to build the project that was signed in January between Greek, Cypriot and Israeli ministers had still required final approval in Israel. The countries aim to reach a final investment decision by 2022 and have the 6 billion euro ($6.86 billion) pipeline completed by 2025 to help Europe diversify its energy resources. A land and sea survey is currently underway to determine the route of the 1,900-km (1,200-mile) pipeline. The European Union and the pipeline’s owner IGI Poseidon, a joint venture between Greek gas firm DEPA and Italian energy group Edison, have each invested 35 million euros in the planning. “The government approval of the framework agreement for laying the Israel-Europe natural gas pipeline is another historic milestone for making Israel an energy exporter,” said Energy Minister Yuval Steinitz. The pipeline is planned to initially carry 10 billion cubic meters of gas a year with the possibility of eventually doubling the capacity.

read more

show less

show less

Chevron to buy Noble for $5 billion in stock, biggest oil deal since price crash

Chevron Corporation said on Monday (July 20) it would buy oil and gas producer Noble Energy Inc for about $5 billion in stock, the first big energy deal since

read more

the coronavirus crisis crushed global fuel demand and sent crude prices to historic lows. The oil price crash has decimated shares of many energy companies, making them attractive targets for those that have weathered the downturn and have the resources to buy. Chevron ended the first quarter with a cash pile of $8.5 billion after withdrawing a $33 billion bid for Anadarko last year and then being among the first big oil companies to slash spending during the downturn. The purchase boosts Chevron’s investments in U.S. shale, and gives it Noble’s flagship Leviathan field off the shore of Israel, the largest natural gas field in the eastern Mediterranean. The deal makes Chevron the first oil major to enter Israel. Chief Executive Officer Mike Wirth told Reuters “We certainly are mindful of the fact that there are political differences and tensions” between Israel and neighbors where Chevron also has business including Saudi Arabia, Kuwait, Qatar and the Kurdish region of Iraq. He said Chevron was “apolitical” and “a commercial actor” in the region. “We engage with all of our different stakeholders as we go through something like this,” Wirth said, declining to detail the timing of discussions with partner governments. Israel’s Energy Minister Yuval Steinitz called the deal “a tremendous expression of confidence in the Israeli energy market.” The Israeli assets “will rebalance the portfolio towards gas and provide a springboard” in the region, said Tom Ellacott, senior vice president at Wood Mackenzie. Oil companies are under pressure to reduce their carbon footprint. Gas is seen as a cleaner burning fuel. Last year, Chevron dropped its offer for Anadarko when Occidental Petroleum Corp bid more. Noble “offers an unique combination of shale as well long-cycle assets,” much as Anadarko would have, said Jennifer Rowland, analyst with Edward Jones, adding that she thought the deal was unlikely to spark a wave of consolidation. A bidding war for Noble was unlikely, said Pavel Molchanov, analyst with Raymond James. He noted the smaller scale of this deal – $5 billion versus the $33 billion Chevron had offered for Anadarko. He said other “prospective buyers would find it easier to replicate via other means.”

The acquisition will give Chevron a bigger presence in the shale patches of Colorado as well as the Permian Basin, the top U.S. shale field. Chevron has been expanding there, and was under pressure to show how it planned to expand output when existing Permian assets are depleted. Just seven months ago, Noble had a market capitalization of about $12 billion compared to $4.63 billion on Friday (July 18). Shares of Noble closed up 5.4% to $10.18, after falling more than 60% this year through Friday’s close. Chevron fell 2.2% to $85.27.

The offer values Noble at $10.38 a share, a 7.5% premium to its Friday close. Including the company’s debt pile, the deal is worth roughly $13 billion. Chevron is paying a “moderate premium” reflecting a cautious outlook for oil and gas deals, said Andrew Dittmar, senior M&A analyst at data provider Enverus. Noble shareholders will own about 3% of the combined company, after the deal closes, expected in the fourth quarter. The deal will help save about $300 million on an annual run-rate basis and add to free cash flow and earnings one year after closing, if global oil prices LCOc1 stay at $40, Chevron said. It would add about 18% to Chevron’s proved reserves. Noble had proved reserves of 2.05 billion barrels of oil and gas, while Chevron reported 11.4 billion.

Source: LNG Global/Reuters

show less

Total seeks buyers for stake in North Sea gas pipeline, sources say

French energy company Total is seeking to sell its 25.7% stake in the Shearwater Elgin Area Line (SEAL) natural gas pipeline in the British North Sea, industry sources said.

read more

The sale could raise about $200 million, one of the sources said. Total has engaged in direct discussions with several interested parties in recent weeks, the sources said. A spokesman for Total declined to comment. The SEAL pipeline, operated by Royal Dutch Shell, transports natural as from the Shearwater and Elgin Franklin platforms to the Bacton Gas Terminal on the Norfolk coast. The recent collapse in oil and gas prices due to the coronavirus epidemic and the uncertain outlook have led to a sharp slowdown in deal making in the energy sector. But energy pipelines and infrastructure remain attractive assets for investors as they often guarantee steady returns over long periods of time. Private-equity group HitecVision recently renegotiated its deal to buy North Sea oilfields from Total.

show less

Global LNG Development

Global LNG-European price slump drags down Asian LNG

Asian spot prices for liquefied natural gas (LNG) were dragged down this week (July 25-31) by a sharp drop in European gas prices and global oversupply.

read more

The average LNG price for July delivery into northeast Asia LNG-AS was estimated at between $1.85 and $2.00 per MMBtu on Friday (July 31) compared to the $2.40 per MMBtu assessment of June delivery last week. “European gas prices are taking LNG prices lower across the globe,” an LNG trader said. The front-month price on the Dutch market dropped by almost 30% in the past week, trading close to $1.00 per MMBtu on Friday. The day-ahead dropped below $1.00 per MMBtu. “It’s a rolling oversupply that is getting worse and worse,” a gas trader in Europe said. The low prices globally have forced buyers of U.S. LNG to cancel up to 45 cargoes for July loading as delivery became unprofitable, after at least 20 June cargoes were cancelled last month. However, demand from some Asian buyers is recovering. Buyers in China are taking advantage of low prices and are looking for cargoes for delivery from July onwards. PetroChina likely bought a cargo from Russia’s Novatek that operates the Yamal LNG plant at $2.50 per MMBtu for the second half of July delivery. It also bought a cargo from BP at $1.85 per MMBtu for mid-July delivery at S&P Global Platts’ Market on Close window on Friday. Seven U.S. cargoes are expected to be delivered to China in May, the highest number of cargoes for this route since January 2018. Some Indian companies were seeking cargoes too, including Gujarat State Petroleum Corp (GSPC) and Reliance Industries , while Taiwan’s CPC was looking to buy LNG for delivery from 2022 onwards, trade sources said. Sell tenders came from Angola LNG, Indonesia’s Pertamina and Australia’s Ichthys, with the latter cancelling its offer citing changes in its production forecast.

Source: LNG Global/Reuters

show less

Record U.S. LNG output jump lifts exports in weak market

A sharp increase in U.S. liquefied natural gas output in the past year has protected the country’s status as the world’s third largest exporter of the chilled fuel,

read more

despite multiple cargo cancellations this summer. Over 21 MMTPA of U.S. LNG capacity was added in 2019 and more than 16 MMT in 2020, contributing heavily to a global gas glut. As the coronavirus pandemic pressured demand and prices, flexibility built into U.S. LNG contracts allowed buyers to cancel multiple cargoes. However, although exports have been dropping throughout 2020 and individual projects have been impacted by rejections, U.S. exports and deliveries to Asia and Europe remain much higher than a year ago. Analysts said massive production capacity supported U.S. LNG, with strong exports achievable when the price differential between the U.S. and other markets is wide enough. “What we saw in the first half of the year…was primarily the result of newly expanded terminal capacity and low prices, wherein a spread still existed to Europe and Asia from the Gulf (of Mexico),” said Jack Weixel, Senior Director for gas, power and energy futures at IHS Markit. The U.S. exported 26.5 MMT of LNG in January to July this year, a 41% jump on the year earlier period, Refinitiv Eikon data showed. Xi Nan, vice president, gas and power markets at Rystad Energy, said he expects the U.S. to produce 55 MMT of LNG in 2020, a 53% increase from 2019. The summer dip has impacted U.S. deliveries to Latin America, but exports to Asia in June and July were 67% above last year’s level and supply to Europe fell by just one cargo. Overall, total European LNG imports were lower in June and July, while Asian deliveries were stable, suggesting the U.S. has increased its market share. The dip in U.S. exports is expected to continue next month, with July and August cancellations yet to be reflected in deliveries. Winter cargoes are likely to go primarily to Asia where prices are expected to rise, traders said. “We expect to see less cancellations in September and October, because even if prices are low, a price contango will pay for floating a cargo and delivering it at a higher price in winter,” said Trevor Sikorski, head of natural gas and carbon research at consultancy Energy Aspects.

Source: LNG Global/Reuters

show less

Ukraine opposes U.S. LNG pricing formula

Ukraine’s state-held gas firm Naftogaz is reportedly opposed to the pricing formula for U.S. liquefied natural gas (LNG) it could receive under a long-term contract,

read more

while there isn’t enough infrastructure ready to ship American LNG from Poland into Ukraine, analysts have told DW. The U.S. is eager to supply its LNG to central and eastern European markets, especially Poland and Ukraine, arguing that American gas is superior to gas from Russia, which binds economic contracts with politics. However, talks between Louisiana Natural Gas Exports Inc and Ukraine’s Naftogaz have stalled, reportedly because the Ukrainian company doesn’t agree with the U.S. firm’s proposal to have the price of the LNG under a 20-year contract linked to the U.S. natural gas benchmark Henry Hub, without any reference to European gas prices, analysts told DW. In May, the government of Ukraine, which is keen to wean itself off Russian energy supplies, approved a plan to import LNG from the United States. Under the memorandum approved by the government, Ukraine would be importing at least 5.5 billion cubic meters of LNG annually, while the seller will be Louisiana Natural Gas Exports, according to acting energy minister Olga Buslavets. Ukraine has been seeking for years to diversify its oil and gas supplies away from Russia after Russia annexed Crimea in 2014. The Russian annexation of Crimea drew reactions from the U.S. and the EU, which imposed sanctions on some Russian energy firms and projects, prohibiting Western firms and banks from working with Russian projects. Ukraine and Poland, both of which seek diversified energy supplies, signed in August last year a trilateral memorandum of cooperation with the United States to enhance the regional security of natural gas supply. Earlier in May, the Ukrainian port Odessa on the Black Sea also received its first-ever crude oil cargo of WTI Crude from the United States, after the U.S. shipped its first oil to Ukraine just last year. Ukraine’s first-ever U.S. crude oil cargo was received in July last year when a tanker carried 80,000 tons of Bakken crude to the port of Odesa.

https://oilprice.com/Latest-Energy-News/World-News/Ukraine-Opposes-US-LNG-Pricing-Formula.html

show less

Total Mozambique LNG completes nearly $16 billion financing

Total SA’s Mozambique liquefied natural gas project has completed as much as $16 billion in funding involving a score of banks, despite a slowdown in energy investment as the coronavirus hammers the global economy.

read more

It is the biggest foreign direct investment in Africa yet, according to law firm White & Case LLP, which advised the financiers. Financial close is expected by the end of September, it said. The African Development Bank will provide $400 million in senior loans and the Japan Bank for International Cooperation signed a loan agreement for as much as $3 billion for the scheme in northern Mozambique, they said Thursday in separate announcements. The amount raised, which includes a loan from the Export-Import Bank of the U.S., matches the African nation’s gross domestic product. Oil India Ltd., a partner, also confirmed the financing in a statement. A Maputo-based spokeswoman for the Total-led project didn’t respond to a request for comment.