India – LNG as a Potential Marine Fuel

– by Afsir Ahmad & Deepika Lal

Introduction

India is naturally blessed with 7516 Km of coastline and is also home to 14500 Km of navigable inland waterways. Gujarat has the longest coast line of 1214 Km with the maximum number of major and minor ports. Of the 111 notified inland water ways only three waterways have been operational. Cargo movement has been mostly limited touching around 9 million tonnes annually. According to the Ministry of Shipping, the share of coastal cargo movement through coastal shipping and inland waterways is expected to double by 2025. Currently in India, about 54% of cargo is moved by road, 33% by rail, 7% by pipelines and 6% by shipping. We also know that compared to road and rail, coastal shipping is most cost effective, energy efficient and environmentally green and clean mode of transportation. Government has been taking adequate measures to promote coastal movement of goods. Promotion of coastal shipping and inland navigation can help reduce congestion by road and rail and further enhance efficiency and reduce emission by encouraging the use of liquefied natural gas (LNG).

Increasingly, major shippers around the world are looking for environmentally friendly international supply chains in response to consumer, policy and societal pressures.

Many companies, such as Unilever, IKEA and Volkswagen (VW), have publically stated that they are aiming to ‘green’ their entire marine and land transportation logistics. For example, in January 2016, Unilever announced that, wherever possible, it intends to move its transport contracts to companies that operate LNG-powered trucks and ships. Similarly, in October 2016, the VW Group stated that, from 2019, the VW Group Logistics will use two LNG-powered charter vessels from Siem Car Carriers for the marine transport of vehicles.It is expected that with more pressure due to the recent IMO decision, others will follow and environmental stewardship will become a more central element of the commercial negotiations between shippers and their maritime vendors. We are confident that in the future India/Indian corporations too will need to take a similar course to meet with environmental commitments.

Why LNG as fuel for marine vessels?

LNG, termed as the fuel of the future, is growing in popularity as a marine fuel. Studies have shown that LNG reduces Nitrogen Oxide (NOx) emissions by about 90% while Sulphur Oxide (SOx) and particulates emissions are negligible. LNG engines also reduce CO2 emissions by 25-30% in general, compared to diesel or heavy fuel oil powered vessels.With the prevailing market value of LNG in commercially viable regions such as the US and Europe, LNG has been offered at a competitive price when compared to heavy fuel oil or HFO and even more attractive when compared to the low-sulphur gas oil, as fuel on ships. LNG far out-performs conventional marine fuels on a local emissions basis, effectively insulating companies from the impact of future, more demanding, regulation.

LNG as a marine fuel gaining traction around the world – Gaining acceptance worldwide as a marine fuel (environmentally friendly)

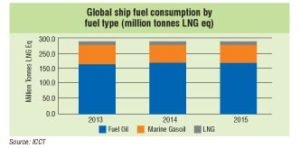

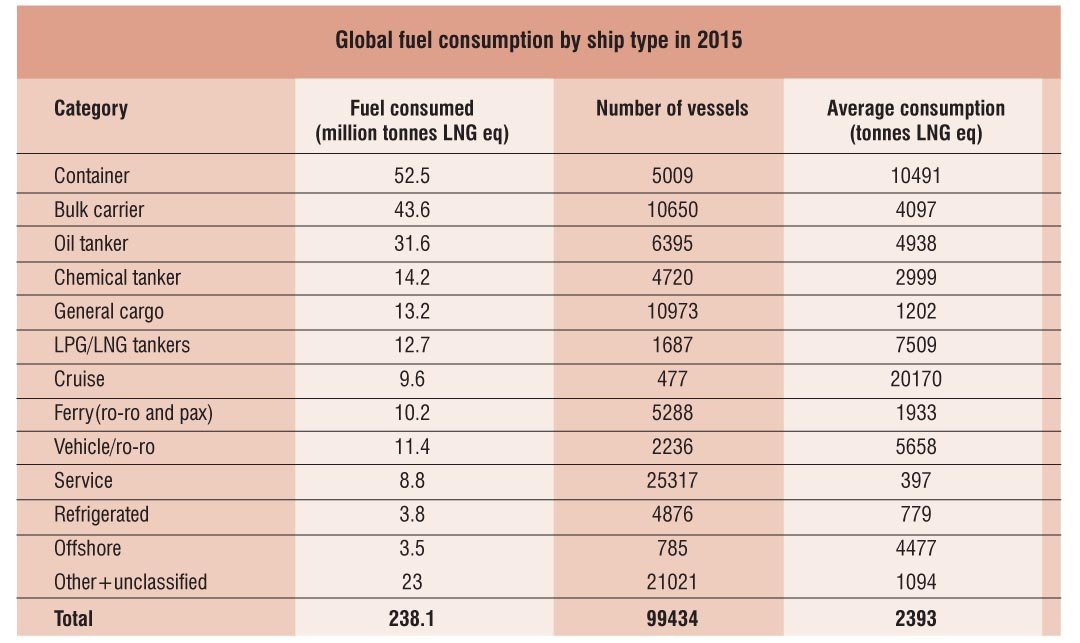

Globally, fuel oil currently has dominant share in the fuel consumption by shipping industry followed by marine gas oil. A breakdown of consumption by fuel category for the period from 2013 to 2015 is given. A small quantity of LNG is used as fuel, approximately 6.5 million tonnes – of which around 97 per cent in consumed by LNG carriers, presumably in the form of boil-off gas.

However, lately, worldwide, there is an increased use of LNG not only as a road fuel for HDVs but also for the marine industry. LNG as a potential transport fuel, especially in shipping and trucking, is attracting considerable interest. Today LNG offers huge advantages, especially for ships in the light of ever-tightening emission regulations around the world.

Even though conventional oil-based fuels will remain the main fuel option for most vessels in the near future, but potentially more opportunities will be available for LNG because of its environmentally friendly characteristics. While different technologies can be used to comply with air emission limits, LNG technology is a smart way to meet existing and upcoming requirements for the main types of emissions (SOx, NOx, PM, CO2).

Source: The Oxford Institute for Energy Studies, Report on “A review of demand prospects for LNG as a marine transport fuel”, ICCT (columns 1 and 2) and author’s calculations (column 3) – Note conversion is on the following basis: 1 tonne of LNG contains 52 MMbtu, 1 tonne of fuel oil 40.7MMbtu and 1 tonne of marine gasoil 43.3MMbtu

India should also consider adopting LNG as a potential marine fuel.This would be mainly a reflection of the price advantage of LNG over oil based fuels. In the marine sector, the reinforcement of emissions regulations will force ship-owners to move to less polluting fuels or technology and LNG offers a number of advantages over other compliance solutions. However, the development of LNG as a transport fuel also faces a number of challenges and will have to go hand in hand with the development of refueling infrastructure. Facilities for bunkering activities/retailing of LNG need to be created at key locations along the Indian coast and national waterways to provide support to the marine vessels.

Global Experience – Commercial and Economic use

LNG-fuelled propulsion is already proving to be a cost-effective solution to meeting emissions limits in certain US and European ECAs (Emission Control Areas). It can also be an economic solution for deep-sea shipping trades where vessels spend an estimated 50% or more of their time in ECAs.The economics are currently more challenging in the deep-sea container and bulk commodity shipping sector. However, the implementation of the IMO’s 0.5% global sulphur cap will support LNG uptake, as it is likely to drive up demand and therefore prices for Marine Gas Oil (MGO) and Low Sulphur Fuel Oil (LSFO). By contrast, scrubbers require significant additional capital expenditure, are operationally complex and have waste management issues. According to SEA\LNG (multi-sector industry coalition), there is considerable scope to drive down capex costs for key LNG gas equipment, for example tanks and new vessel designs. This will be driven by scale, experience, OEM investments in R&D, and shipyard innovations in designs for both new-build and retrofit as confidence grows in demand and participants better plan and co-ordinate their investments.

Bunkering Infrastructure

Serving existing ECAs, the LNG bunkering infrastructure is currently concentrated in north-west Europe (for example, in the ports of Rotterdam, Stockholm and Zeebrugge) and the US Gulf and East coast (including the ports of Jacksonville and Fourchon). We see signs of this in the growing number of bunkering initiatives. Key Asian ports serving deep-sea shipping routes are in the process of establishing LNG bunkering facilities and looking to co-ordinate activities with their European and North American counterparts. This is most evident in the infrastructure being developed by the world’s busiest bunker port, Singapore and in the activities in ports in eastern China, for example Ningbo-Zhoushan, the world’s biggest cargo port.

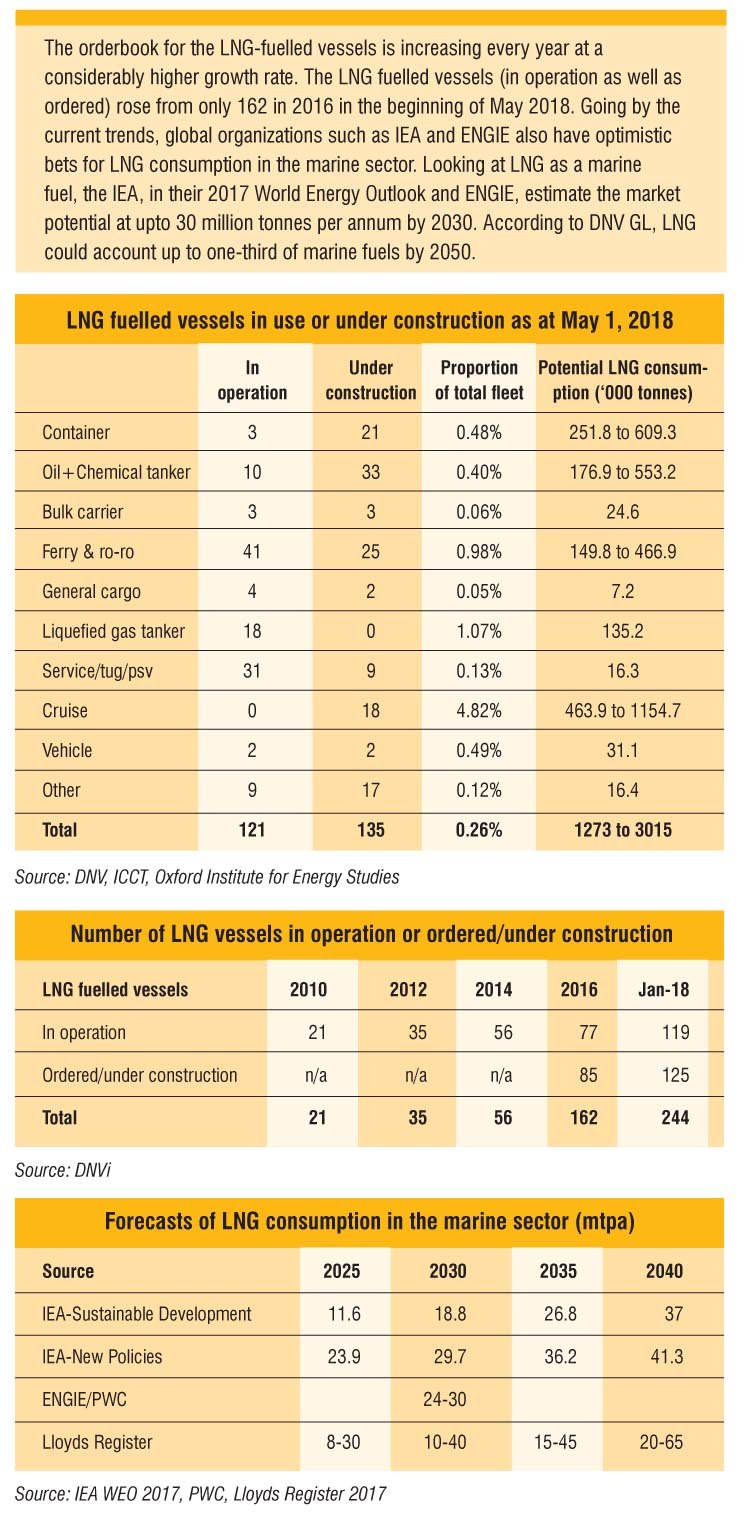

Global trends: As of May 2018, the world LNG fleet totalled 254 vessels, comprising 122 ships in service and 132 on order. The majority of the new contracts lately have been for large vessels with bunker tanks of unprecedented size. Compare this with 77 LNG-fuelled ships in operation and 85 on order in 2016, mostly smaller vessels such as ferries, operating extensively in the ECAs of north-west Europe and North America.

Europe: Current EU policy requires at least one LNG bunkering port in each member state. About 10% of European coastal and inland ports will be included, a total of 139 ports. Coastal port LNG infrastructure will be completed by 2020 and for inland ports by 2025. While marine engines capable of utilising LNG as a fuel have been used in the LNG carrier industry for decades, the first non-LNG carrier vessel – the LNG-fuelled ferry GLUTRA with gas engines and storage – came into service in 2000, in Norway.

America: There are several ports under development in North America, mostly in the south east, the Gulf of Mexico and around the Great Lakes, but also for ferry and deep-sea operations in the Pacific Northwest. The world’s first dual-fuelled container vessels entered service in late 2015 for TOTE Maritime in the trade between the U.S. and Puerto Rico. These vessels again prove that the technology works safely and effectively.

Asia: China is extending LNG bunkering infrastructure from inland waterways to coastal areas and should be able to service the LNG demand of all vessel types. South Korea offers LNG bunkering in the port of Incheon and is considering a second facility in Busan. Elsewhere in Asia, in addition to Singapore, Japan and Australia are also working to develop LNG bunkering facilities.

Issues with LNG as a fuel and how they have been and can be mitigated

More safety features required in a LNG system

Unlike CNG, LNG does not contain an odorant, so an LNG leak is difficult to detect. This is why LNG vehicles and garages include electronic methane sensors to detect leaks. The cold natural gas vapors are also heavier than air when they initially leak from storage, so they may cling to the ground or pool, causing a potential fire hazard, as well as an asphyxiation hazard in enclosed spaces. For these reasons, gas detectors should be installed near the ground and ceiling in areas where LNG or LNG vehicles are stored. LNG maintenance facilities should be equipped with both floor- and ceiling-level ventilation to exhaust any potential leaks.LNG is also different than CNG because LNG tanks may occasionally vent off natural gas if stored unused for a long period of time. LNG tanks are typically designed to hold a full tank of LNG for a week or more without venting, but once the fuel warms sufficiently, the LNG begins to vaporize and the pressure will rise in the tank until the relief valve opens to release or “vent” some natural gas. For this reason, the facility should be equipped with proper ventilation to safely remove any vented LNG.

Another safety concern with LNG is related to the very cold temperatures at which it is stored. Cryogenic or freeze burns can be caused by coming into contact with LNG liquid, LNG vapor, or the cold surfaces of pipes or tanks containing LNG. LNG fueling systems and tanks require minimal maintenance but should be inspected regularly for leaks and to ensure proper functioning of the tank’s pressure gauge and LNG level indicator. The bulk LNG transportation industry, where LNG is commonly used as a fuel for the transporting vessel, has an excellent safety record. Over the past 50 years, more than 90,000 commercial LNG cargoes have been safely delivered and global LNG shipments have covered more than 100 million miles without any major safety incidents in port or at sea. This is testament to the LNG industry’s rigorous design guidelines for ships and shore facilities, as well as high standards of training and operational procedures. The use of LNG as a marine fuel outside the LNG carrier business is a relatively new technology, as are gas only and dual-fuelled engines. However, since its introduction as a marine fuel at the turn of the century, LNG-fuelled vessels and associated bunkering operations have had an exemplary safety record. For example, the Viking Grace Cruise ferry has bunkered, without incident, more than 1,000 times in Stockholm since its entry into service in 2012.

Conclusions and growth drivers

According to CEDIGAZ, LNG will emerge as a transport fuel in the future because of three reasons (i) its environmental benefits (ii) its ability to meet with strict emission norms and (iii) the commitment made by countries to the Paris Agreement.

- Environmental legislation will be the key in the use of clean fuel in the marine sector

- And the commitment which India has made to the Paris Agreement should be the impetus for introduction of LNG in the marine sector.

- There is little doubt that the use of LNG as a fuel will grow in the marine sector, though the rate and pace of growth will be highly dependent on the timing and geographical scope of emissions restrictions set out in the MARPOL treaty together with Government of India policies.

- Compliance with the new emissions limits and adherence to emission norms will be key driver of LNG to switch to LNG.

- Today the fleet of LNG-fuelled vessels plying the world’s oceans comprises passenger ferries, offshore service vessels, coastguard vessels, tankers and many other types. Even a DNV GL-classed high-speed catamaran with LNG-powered gas turbine is in operation.

- These need to be duplicated in India.

Some of the challenges however are:

- Inadequate infrastructure along waterways

- Inadequate infrastructure for LNG dispensing at port locations as well as inland waterways terminals

- Development of bunkering facilities at LNG import locations

- Government policies and long term commitments for cargo

- IMO restriction kicking in 2020

- Development of additional inland waterways

In India, LNG as a fuel is expected to appear commercially the most attractive when compared to LSFO or MGO of 2020 including the extensive long term availability of natural gas. From 2020 onwards we will have to compare the LNG prices with those for higher cost distillates or blends. It is expected that the investment costs for LNG retrofit will achieve very fast pay-back times once the fuel price differences become visible in India. Policy directives towards conversions to LNG including favourable policy initiatives encouraging use of LNG could be the game changer. The importance of LNG as a marine fuel has been recognized by almost all major shipping companies across the world and India too must take note of the development and kick start the process of introducing LNG as a fuel for inland waterways as well as coastal movement.

Acknowledgements and Sources:

1. Inland Waterways Authority of India web site

2. Shipping Ministry web site

3. www.marineinsight.com

4. SEA\LNG

5. International Council on Clean Transportation

6. Oxford Energy Institute web site

7. DNVGl