City Gas Distribution –

Successful Ninth Round Brings Reason To Cheer But Also Challenges

By V C Chittoda & Deepak Sharma

In August 2018, the Petroleum & Natural Gas Regulatory Body (PNGRB) completed the ninth round of bidding for City Gas Distribution (CGD) sector in India. The bidding targeted 86 Geographical Areas (GA) which covers population of 364.95 million (or 29% of India’s total population) spread over 787,401 sq. km. of area (or 24% of India’s total geographical area). The 86 GAs cover 174 districts (156 complete and 18 part), spread over 22 states and Union Territories (UTs) and cover over 75 million households.

The latest round was till now the biggest and the most successful round undertaken. Of the 106 GA offered for bidding under the previous eight rounds, only 56 had got awarded. The worst bidding rounds were 2nd, 4th, 5th, 6th & 7th wherein a cumulative of 86 GA were offered for bidding and only 38 got awarded. To put things into perspective, the 9th round of bidding is targeting a population which is more than that of the United States of America (approximately 329,256,465) and covers an area which is slightly more than the combined area of Spain & United Kingdom (approximately area for Spain & UK is 505,992 & 244,820 sq. km. respectively). The enormity of perspective further gets magnified when the combined commitment of successful bidders is compared with the existing status (Refer Table at the end)

The bidding process saw participation from leading public and private sector companies in India as well as foreign bidders for the first time. There were a total 38 bidding companies and the total number of bids received for 86 GAs was 406. For 39 GAs, the number of bids received for each GA was >= 4. There was not even a single GA which did not receive any bid. The total bid-bond received under 406 bids for 86 GAs was ~ US$300 million. The total performance bank guarantee for the 86 GAs was ~ US$464 million.

One of the reasons for the success was the consultative approach by PNGRB. It held meetings with various stakeholders and based on feedback, it incorporated necessary modifications in its regulations for promoting participation in CGD sector.

The Ministry of Petroleum and Natural Gas, National Green Tribunal (NGT) and the Supreme Court of India have also contributed by continuing with key enabling policies for the growth of CGD in India.

India should also consider adopting LNG as a potential marine fuel.This would be mainly a reflection of the price advantage of LNG over oil based fuels. In the marine sector, the reinforcement of emissions regulations will force ship-owners to move to less polluting fuels or technology and LNG offers a number of advantages over other compliance solutions. However, the development of LNG as a transport fuel also faces a number of challenges and will have to go hand in hand with the development of refueling infrastructure. Facilities for bunkering activities/retailing of LNG need to be created at key locations along the Indian coast and national waterways to provide support to the marine vessels.

With better parameters of the bidding criteria and enabling environment the ninth round of bidding resulted in much better response than the previous rounds. The round commenced in April 2018 followed by roadshows in major financial cities of India and abroad. Bid submission deadline was July 10, 2018 and by July 18, 2018, all technical bids were opened and almost all GAs were awarded by September

Notable steps taken by PNGRB to incentivize investment in ninth round of CGD

- Financial Closure & Gas Tie-up: Time for financial closure and gas tie-up increased to 270 days from 180 daysearlier.

- Marketing Exclusivity: Increased from 5 years earlier to 8 years and, subsequently extendable by upto 2 years, based on physical performance.

- Pipeline Connectivity: Gas pipelinecompany to provide connectivity within 180/270 days.

- Performance Bank Guarantee (PBG): PBG capped at Rs 50 crore (approx US$7.5 million) and is linked to population of GA; ‘Additional Bid Bond’ (it was the basis on which winning bid was decided in case bidders quote were same) has been discontinued. PBG was a big deterrent with potential bidders since the big companies would give higher guarantees and would deter smaller companies to enter the game. Et det vit, consusse

Critical enablers by MoPNG and Supreme court

- Support for CNG in public transport

- Ban on petcoke and FO in prominent areas – Delhi, Haryana, Uttar Pradesh andRajasthan and hopefully more states will follow

- Domestic gas allocation for PNG supply to household and CNG

- Designated CGD as “Public Utility”

- State governments’ commitment for facilitation of CGD Networks

- Government of India’s drive to connect 10 million households to PNG by 2020

- Restriction on the import of petcoke

Emerging Players in CGD Industry

LoIs for 84 GAs have been issued to 22 entities out of which 3 entities participated for the first time. After the latest round, ‘Adani Gas, IOC, BPCL-Bharat Gas Resources, IOC-Adani Gas, GAIL Gas, GAIL India, Torrent Gas and Megha Engineering have emerged as leading contenders to existing established CGD companies such as Gujarat Gas, Indraprastha Gas and Mahanagar Gas. These companies, it seems can be expected to have the necessary resources and competence to undertake the projects. The successful bidders have given a combined commitment of about 21million domestic PNG connections and 4,346 CNG stations for transport sector by 30th September 2026 (subject to macro & micro enabling factors that are required for the growth of CGD sector). It is hoped that this initiative would help in creating a robust city gas distribution infrastructure at an estimated investment of about Rs. 70,000 crore (about US$ 10.5 billion).

The successful bidders have given a combined commitment of about 21 million domestic PNG connections and 4,346 CNG stations for transport sector by 30th September 2026. The round is expected to bring investment of about Rs. 70,000 crore (about US$ 10.5 billion)”

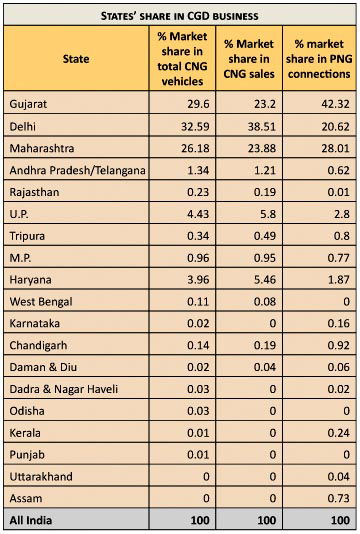

Post ninth round of bidding, CGD is expected to be available in 179 GAs comprising 280 districts (263 complete and 17 part) spread over 26 states and UTs covering more than 50 percent of India’s population and 35 percent of its geographical area.This will be a notable achievement because unlike upto now, 80% of existing CGD was limited to western India (Gujarat & Mumbai) and National Capital Region (NCR) in northern India and postninth round eastern and southern India have been brought on the CGD map.

It is interesting that the existing three big ones viz Indraprastha Gas Limited, Mahanagar Gas Limited and Gujarat Gas Limited, who among them and their joint ventures account for almost over 80 per cent ofthe industry business today, have been given serious challenge by some of the Oil Marketing Companies (OMC) of India and the newcomers combined. In a way OMC participation is understandable because gas would be supplementing liquid petroleum mostly, therefore the need to protect their revenue.As CNG would impact on their petrol sales directly plus they would have the advantage of starting CNG dispensing quickly from their existing retail outlets and at minimal cost.

CGD sector is now entering a different growth period with the success of the ninth round and on the face of it, there appears to be reason for being positive. 406 bids for 86 areas is extremely encouraging. There had been some skepticism in various quarters when PNGRB had announced the intention to invite bids for nearly 86 GAs. NGS however, had largely welcomed it as a bold move. Apart from that, as NGS had said before, the Regulator had interacted in a very positive frame with the industry on the bidding criteria and other aspects and introduced modifications wherever possible to remove or at least ease some of the irritants and anomalies in the previous rounds’ criteria and followed this up with first-ever sequence of road shows. All this seems to have borne some result going by the responses and the soundness of the major bidders.

Challenges… Tough task ahead

Though NGS remains extremely hopeful, however in the initial years, progress would need to be monitored and studied carefully as irrespective of the resources at the command of the entities – working simultaneously in so many areas will not be an easy task and it could lead to highly stretched resources.

Then, there are questions of viability and thevast differences in the feasibility of the areas and the time frames. There could be serious constraints like obtaining timely permissions for project execution, availability of skilled/technical manpower at several levels, adequate number of qualified contractors, inspection and quality assurance agencies, equipment and pipeline suppliers. Connectivity to the City Gate Station from the nearest gas pipeline could be a challenge and will largely depend upon the distance and the volume of gas.

Specifically to overcome these challenges NGS has been exploring various framework to identify ‘Critical Success Factors’ for successful completion of the City Gas Distribution Projects, and we have identified ‘Critical Success Factors’ (not in any particular priority) as (i) Statutory Approvals (ii) Fund Management (iii) Inventory Management (iv) Skilled Manpower. These ‘Critical Success Factors’ will form the foundation of a successful CGD project.

Statutory Approvals

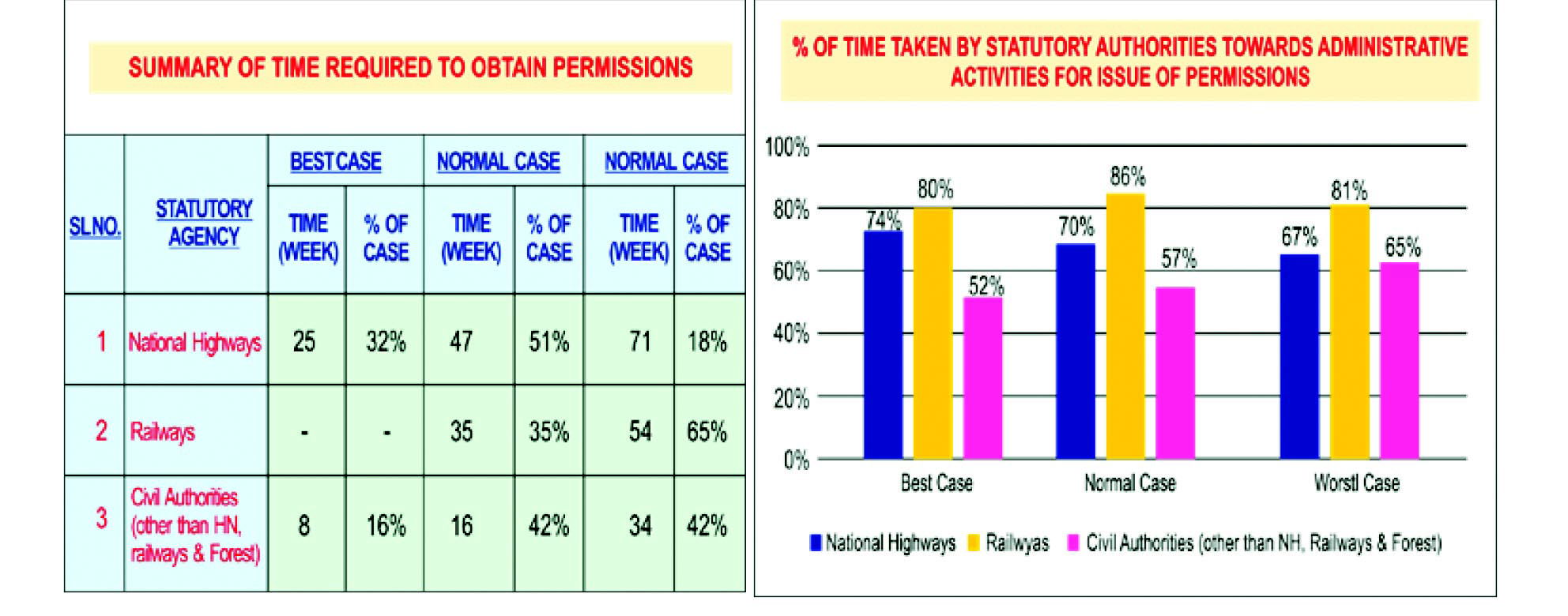

It is very well known that one of the major problems the industry has faced is the issue of approvals. Although things have improved somewhat, but the issue remains. NGS conducted a study regarding time required for obtaining pipeline laying permissions

(off-line mode) from statutory agencies and, (i) The summary of time required to obtain permissions from some of the statutory agencies; (ii) The % of time taken by statutory authorities towards administrative activities for issue of permissions; is highlighted below for ready reference. In case of online mode of obtaining permissions, the time taken to obtain permissions is much lower as it considerably brings down the time required for administrative activities.

In addition to statutory permissions for pipeline laying there are many other permissions that are required by CGD entities and it will be very difficult to coordinate the same in a synchronized manner. Therefore, it is essential that CGD entities synchronize their efforts, so that ‘Ministry of Urban Development, Local Municipal Body, State Governments and other Statutory Agencies’ agree and implement

(i) Fixed Time Frame for approvals: This time frame needs to be fixed & monitored online so that CGD entities can smoothly plan out the execution project. Granting permissions/NOC’s for CGD sector could be covered under “Public Charter Services”:

(ii) Issue of permission by default: If the application of permission

by CGD entity is not objected-to/questioned with reasons, within a specified time from the date of application, then permission should be consideredto have been granted to CGD entity by default:

(iii) Single Window clearance: Single Window clearance along with single point responsibility for release of permissions in time bound manner for all umbrella permissions for expeditious implementation: (iv) Online mode of permissions: Online mode of permission process may be adopted for the issuance of permissions & NOC’s by statutory authorities:

(v) Standardization of permission process: Standardization of the process of granting permissions by Local/Municipal Authorities for laying CGD infrastructure– ‘Establishment of Nodal Agency, Standardization of permission process, Applicable Rates/Charges and envisaging E-permission system through Nodal Agency: (vi) Uniform and reasonable Restoration Charges: The lack of ‘Uniform Restoration Charges’ is a common issue for all CGD companies, and Ministry of Urban Development, Govt. of India, could evolve a national policy in the said matter:

(vii) Digital mapping of existing utilities: It is pertinent to mention that existing utilities must be mapped and made available on-line for permission related matters.

Fund Management and Geographical areas/density

During the road show of 9th round of CGD bidding process, PNGRB had indicated operating margins of Indraprastha Gas Limited and Mahanagar Gas Limited (for FY13 to FY17) in the range of 22% to 32 % while return on capital employed for these two companies were in the range of 17% to 22%. However, the operating margins for GAIL Gas Limited & Gujarat Gas Limited indicated is in the range of 8% to 14% and for return on capital employed, it is 4% to 10% (for Gujarat Gas Limited it is for FY15 to FY17). This is indicative of financial challenges in the business model of CGD business. NGS further researched on the same and it noticed that one of the possible reasons could be ‘the high population density’ in the areas in which Indraprastha Gas Limited and Mahanagar Gas Limited are operating. The population density of Delhi-NCT is approximately 11,250 while for Mumbai-Mega City, it is approximately 20,500. A quick comparison with GAs being authorized by PNGRB in 9th round of bidding indicate that majority of GAs (about 75%) fall in the population density range of 250 to 1,000 which is less than 10% of Delhi-NCT & 5% of Mumbai-MegaCity.

The second possible reason could be the area of GA. The area of Delhi-NCT is approximately 1,500 sq.kms. while for Mumbai-Mega City, it is approximately 600. A quick comparison with GAs being authorized by PNGRB in 9th round of bidding indicate that about 50% of GAs are greater than 4 times and about 30% of GAs are greater than 2 times, when compared to Delhi-NCT & Mumbai-MegaCity. Low population density and large area of operations, lead to high project & operating cost, and the combination of both these factors, has a very high likelihood of reduced operating margin and return on capital.

One of the key reasons for time overrun are statutory approvals, and this critical factor is beyond the control of CGD entities. This further complicates inventory management because of uncertainty of time factor. Fund management gets really complicated as – it has strong correlation with time overrun & inventory management.

Inventory Management

CGD industry predominantly operates either in public or private areas. Therefore majority of time, it is operating in areas which are neither owned by it nor under its direct/indirect control. This complex nature creates huge problems in planning which ultimately creates a scenario of either stock-out or inventory levels being many times more than the required stock levels. As inventory is synonymous with – ‘cash remaining idle’, therefore NGS is of the view that inventory management could play a critical role in the development and operation of the CGD sector. Inventory management is likely to get more complicated going forward as the reliability of suppliers will be a major concern due to the newly approved 86 GAs that are expected to shortly enter into the project phase.

Skilled Manpower

The commitments undertaken for the new GAs (i.e 21 million domestic connections and 4364 CNG stations) would require skilled manpower such as gas fitters, pipe welders (for steel pipeline), fusion welders (for MDPE), CNG dispending personnel, compressor operators, etc. This manpower would be sourced mostly locally and would need adequate skill development programmes in the awarded areas. Apart from direct skilled manpower needed, manpower would also be needed for CNG conversion of vehicles and local CNG cylinder testing certification. Thus, synergized skill development programmes would be essential for successful implementation of CGD projects.

CGD Project management and innovation could be the key to success of the new CGD projects on the anvil. Of course, at the macro level, a constant focus is needed on pushing gas for the sectoral growth in government policies and a coordinated/integrated approach across sectors to drive the demand for gas since the sector is going to face many challenges including regulatory, fiscal and competition from alternate fuels. Efforts must be made to increase natural gas production while also creating import infrastructure to meet the growing domestic demand. City gas should be made more market friendly with less intervention from the regulators.

NGS feels that the sector is entering into an interesting phase as the successful bidders of PNGRB’s 9th round have given a combined commitment of about 21million domestic PNG connections and 4346 CNG stations for transport sector by 30th September 2026. Those CGD entities that are able to manage & synergize the critical success factors – ‘Statutory Approvals, Fund Management, Inventory Management and Skilled Manpower’ will have a high chance of achieving its commitment given to PNGRB. It will clearly be a challenge but given the tools available to the CGD sector we hope that the industry will meet the challenges and come out on top. It will be a good beginning for the PNGRB to monitor the development of 86 new GA and also the 93 existing GAs so as to continuously identify critical success factors for the CGD sector.

A good beginning has been made and it is hoped that it gives the necessary impetusto the CGD sector.

Sources:

- Press releases by PNGRB during its 9th round of bidding process.

- Information shared by PNGRB during its roadshow events for its 9th round of bidding process.

- NGS Gas Statistics for July 2018.

- NGS study on ‘Statutory Approvals’ and ‘ Inventory Management’.