Australian gas cheaper in Japan? No way

Claims that Japanese customers are paying less for Australian gas than we are at home make for good headlines but there’s one big flaw – they’re not true.

The Institute for Energy Economics and Financial Analysis, an anti fossil fuel lobby disguised as an energy economics research firm, made headlines last week with findings that Australian consumers were paying 65 per cent more than Japanese users for Australian gas.

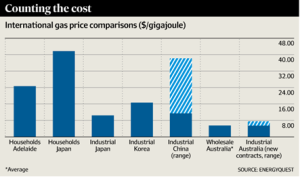

Gas was sold in Adelaide at an average price of $13.90 a gigajoule in July, while in Japan, even after the costs of liquefying it and shipping it thousands of kilometres, the gas cost $8.42, the firm said.

Outrageous, IEEFA concluded, and accused gas producers such as Santos, Origin Energy and the ExxonMobil/BHP Billiton Bass Strait venture of holding “a cartel-like grip on pricing which they are exploiting to the full”, to the detriment of good ol’ Aussie manufacturers. The group went on to label the industry’s push to open up onshore gas production as “unnecessary”.

International gas price comparisons

Queensland MP Bob Katter seized on the findings, using them to revive his calls for a protectionist gas reservation policy. “Every fertiliser plant on earth” bought gas for less than $4 a gigajoule, Katter claimed, while Australian plants paid $14. Huh?

Others have also rushed to quote the IEEFA figures or similar price comparisons, including radio host Alan Jones as part of his anti-coal seam gas campaign.

The problem is the analysis appears to be based on a comparison of two wildly different figures: the average of the spot wholesale gas prices in Adelaide for the month of July and the raw Japanese import price for LNG.

In reality, the Adelaide spot price bears little relation to any price paid by consumers and industrial gas users in July: households paid much more, and industry much less. And in Japan, certainly no one paid $8.42. The prices for households as well as industrial customers were some multiples higher.

Counter-analysis

Adelaide-based Consultancy EnergyQuest has completed a counter-analysis, to be published on Friday, which finds that Tokyo Gas quotes a standard residential price of ¥4600 a month for 32 cubic metres of gas, which works out to $41.67 a gigajoule for households. That’s 69 per cent higher than the average price paid by EnergyQuest principal Graeme Bethune’s household in the May-July quarter.

Similarly, for industrial customers Tokyo Gas quotes the equivalent of $10.45 a gigajoule. In Australia’s other key LNG export markets South Korea and China, industrial gas prices are also much higher, EnergyQuest notes, citing International Energy Agency figures for Korean prices at the equivalent of $16.65 a gigajoule, while Chinese industry can pay as much as $26.69. Those are all several times more than the $6-$8 for new industrial contracts in Australia.

Meanwhile, the average price of wholesale gas sold by Origin in the June quarter, excluding its LNG project in Queensland, was just $5.48.

An unfortunate consequence of the misinformation peddled by IEEFA is that it detracts from the real problems faced by industrial gas users in Australia. They are struggling with rising prices, inadequate offers of contract duration and a lack of choice on supply.

On a more valid international comparison, their gas costs are indeed hugely unfavourable relative to peers in the US, where the average industrial gas price was $US2.91 per thousand cubic feet in May, or about $3.62 a gigajoule.

And with the Asian LNG market in oversupply, the unhappy truth is that Australian manufacturers are facing increasing prices for gas just when spot LNG prices are hitting rock bottom.

It is that situation that has driven Manufacturing Australia to examine the costs of importing LNG into south-east Australia, just as the country is on its way to challenging Qatar as the world’s biggest gas exporter. Consultancy Gaffney Cline has found the economics could stack up – at least at today’s US gas prices – as long as enough demand can be brought together.

There’s no need for twisted price comparisons to make the point that Australia’s gas market has a problem.

https://www.afr.com/business/energy/gas/australian-gas-cheaper-in-japan-no-way-20160824-gqzuyw