NGS’ NG/LNG SNAPSHOT – November 2020, VOLUME 2

National News Internatonal News

NATIONAL NEWS

City Gas Distribution & Auto LPG

Indraprastha Gas ltd net profit drops 8.4% in September quarter

Indraprastha Gas Ltd on Wednesday (Nov 11) reported an 8.4% drop in September quarter net profit as sales volumes got impacted amid graded

read more

relaxation in lockdown restrictions. Consolidated net profit of Rs 380.45 crore in July-September compared with Rs 415.82 crore net profit in the same period a year back, the company said in a filing to stock exchanges. With public transport and schools yet to resume, CNG sales fell 20% to 255 million kgs in the second quarter while piped natural gas supplies were 4% lower at 146 million cubic metres. Total sale volume stood at 506 million standard cubic metres, down 16% over the previous year. IGL, which retails CNG to automobiles and piped natural gas to households and industries in the national capital and adjoining cities, reported Rs 944 crore revenue from CNG sales, down from Rs 1,257 crore in July-September 2019. Piped natural gas sales revenue was down 17% at Rs 355 crore. Later in a statement, IGL said the average daily sales in the quarter was 5.50 MMSCMD as the lockdown restrictions started getting relaxed. The total gross sales value during the quarter was Rs 1,434 crore against Rs 1,865 crore during the second quarter of FY20. “Both physical and financial performance of the company reflect a strong recovery in the second quarter of the fiscal after the gradual easing of restrictions and beginning of unlock period leading to increased economic activity. “Sales have picked up significantly now and presently have almost touched pre-lockdown levels. The impact of the recovery shall further be observed in results of remaining quarters of the fiscal as educational institutions reopen,” it added.

show less

Rajasthan: RSGL to expand pipe gas network across state

Rajasthan State Gas Ltd. has doubled profit in 2020 by significantly reducing expenses. Chairman RSGL and principal secretary of mines

read more

and petroleum Ajitabh Sharma said that in the financial year of 2020, the profit of RSGL has increased from Rs 5.38 crore to more than Rs12.63 crore. Sharma also said that 10,000 new domestic gas connections will be given through pipeline in Kota by March, while the distribution of LPG through pipeline to domestic consumers, industries and setting up of CNG stations is in progress in 19 cities of the state by various companies. Sharma, while addressing the seventh annual general meeting, said developing PNG and CNG distribution networks is the need of the hour in view of increasing pollution and cost. He added that RSGL is working on the urban gas distribution system on a war footing in Kota city. Domestic gas is being distributed through pipelines to 10,000 households by establishing eight CNG stations in Kota city. CNG is being made available to industries and vehicles from Mother Station in Neemrana, Alwar and by setting up at Jaipur’s Dotter Booster Station, Kukas. A network of urban gas distribution system is also being developed by RSGL in Gwalior and Sheopur in Madhya Pradesh. He said that one CNG station has been established at both the places. Mohan Singh, MD RSGL said that with the doubling of CNG stations and better financial management, have resulted in reduction in expenditure resulted in achievement of over 130 per cent in pre-tax profit, post-tax profit and earnings per share.

show less

Demand for CNG vehicles up but fuel stations inadequate

Increasing fuel price and financial crisis induced by the pandemic have forced people, especially those who depend on vehicles for their livelihood, to look for economically

read more

more viable options to lessen their financial burden. It seems, ‘CNG only’ vehicles have come as a blessing in disguise for such people, proof of which is rise in registration of such vehicles in the district, especially within city limits, in the past few months, according to data from motor vehicles department. Thirty CNG vehicles were registered in Ernakulam RTO limit till first week of November this year, whereas it was just five in 2019. Of the 30, 27 vehicles were registered in the past few months. Aluva, Mattancherry and Tripunithura also witnessed similar trend. In 2019, no CNG vehicles were registered in Mattancherry and Tripunithura. This year, after lockdown restrictions were relaxed, both these places together witnessed 21 CNG registrations. Most of the vehicles registered were autorickshaws. But shortage of CNG fuelling stations in the district is a cause for concern for many owners. Only seven stations of the Indian oil corporation are functioning in Ernakulam. However, demand for the fuel has not picked up as movement of people have come down drastically, thanks to Covid-19. “We used to sell around 6,000kg of CNG fuel per day and most of our customers were auto drivers. Currently, we sell only around 2,000kg per day,” said Satheesh Kumar, supervisor of a fuel station in Cheranelloor. As on November 10, price of CNG is Rs.56.50 per kg. Whereas the price of diesel and petrol is Rs.74.28 and Rs.81.16 per litre, respectively. “Compared to diesel and petrol, pollution from CNG is minimal. However, new CNG stations are not expected in future as government’s thrust is on electric mobility,” says M B Symandabhadran, convener of Ernakulam auto drivers’ coordination committee.

show less

Rohtak MC’s plan to run CNG buses fails to take off

The Rohtak Municipal Corporation’s plan to run CNG buses in the city to facilitate residents and check air pollution has failed to take off.

read more

As of now, thousands of auto-rickshaws cater to the residents for local commute. Though the auto-rickshaws provide easily available and cost-effective travel, these pollute the air and cause traffic snarls too. Plying of e-rickshaws in the recent past has come as an eco-friendly alternative, but their number is miniscule as compared to that of the auto-rickshaws. In the given circumstances, introduction of the CNG city buses could have been a welcome step, but the officials concerned concede it had hit a roadblock even before its launch. “As of now, there is no proposal or project work in progress on the ground to operate CNG buses in Rohtak,” said Joginder Singh Rawal, General Manager, Haryana Roadways, Rohtak. Mayor Manmohan Goyal said the contractor to whom the project had been assigned had failed to take it forward. “He has been served a notice for the cancellation of the contract. Fresh tendering process will now be started.” — TNS

https://www.tribuneindia.com/news/haryana/rohtak-mcs-plan-to-run-cng-buses-fails-to-take-off-169052

show less

IOC, Gail, Adani Gas, others get 251-day more to complete city gas project work

Oil sector regulator PNGRB has given up to eight-and-a-half months of extra time to companies such as Indian Oil Corporation (IOC), GAIL and

read more

Adani Gas to fulfil their city gas project rollout commitments that had been impacted by COVID-19 lockdowns. On November 5, the Petroleum and Natural Gas Regulatory Board (PNGRB) issued an order granting more time to 41 city gas entities to complete their rollout commitment. The time granted varies from 129 days to 251 days across different geographical areas depending on the duration of the COVID-19 lockdown, the order said. In recent times, the entities have been facing a catastrophic situation due to the outbreak and the spread of COVID-19, a pandemic declared by the World Health Organization (WHO) that has affected every sector across the globe, including the city gas distribution (CGD) business. This resulted in CGD entities unable to perform their obligations. The regulator listed the pandemic as a condition for force majeure that entitles entities for extra time. PNGRB said it has “approved the extension considering the national lockdown by Government of India (69 days), additional lockdown/restrictions imposed by state governments or by district authorities and a restoration period of 60 days”. The board granted such extension to 41 CGD entities in respect of 185 GAs that have been considered eligible for force majeure extension on account of COVID-19. Earlier in September, PNGRB issued a fresh set of force majeure guidelines, listing events such as riots, natural disasters and restrictions by the government as conditions for allowing more time to complete city gas rollout obligations. The guidelines came after a nationwide lockdown to contain the spread of COVID-19 from March 25 and state-level lockdowns since June hampered city gas projects. Several city gas firms claimed force majeure after work on sites got stalled due to lockdown. Such claims, however, were not immediately accepted in absence of guidelines listing events that can trigger force majeure.

show less

Adani Gas signs pact to acquire defaulter Jay Madhok Energy’s 3 city gas licenses

Adani Gas Ltd on Wednesday (Nov 4) announced the acquisition of city gas licences for Ludhiana, Jalandhar and Kutch (East) from Jay Madhok Energy for

read more

an undisclosed sum of money. Jay Madhok Energy Pvt Ltd has been show-caused by the oil regulator Petroleum and Natural Gas Regulatory Board (PNGRB) over defaulting on timelines and alleged irregularities in the acquisition of the city gas licence. “Adani Gas Ltd has signed a definitive agreement for acquisition of three geographical areas namely Ludhiana, Jalandhar and Kutch (East),” the firm said in a statement. It, however, neither disclosed the name of the city gas licence holder for the three cities nor the acquisition price. “All 3 GAs have high volumes potential in terms of demand of over 6.5 million standard cubic meters per day over a period of 10 years. These geographical areas’ (GA’s) are under Phase 1 of Bharat Mala Pariyojana by NHAI which will further boost the development and volume growth,” it said. Jay Madhok, according to PNGRB, made little progress on its commitments. PNGRB in 2016 cancelled its licences. Jay Madhok challenged the cancellation in Appellate Tribunal, which in April 2017 set aside the PNGRB order and asked the regulator to follow the set procedure for cancellation. Since then the matter is pending before PNGRB and Jay Madhok had been seeking adjournments on one pretext or the other. In March 2019, PNGRB issued another notice to Jay Madhok over alleged irregularities in the networth used to acquire the licence. It also alleged fraud in the furnishing of a loan sanction letter from Deutsche Bank AG, Singapore. Sources said PNGRB will now have to examine if a sale of the licence is permissible under the statute and what happens to the default by the original licensor. PNGRB can accord an approval if it concludes that such a deal is in the best interest of the development of the licence. With the acquisition, Adani Gas now has a licence for 22 GAs. It has another 19 licences in a joint venture with state-owned Indian Oil Corp (IOC). These GAs cover 74 districts. “With the strong parentage of AGL, the residents of Ludhiana, Jalandhar and Kutch (East) shall also be beneficiary of best in class CGD networks, operations, maintenance, digital and customer-centric approach with continued focus on health and safety, community development and better returns to the stakeholders,” he noted.

show less

Adani Gas Q2 net profit jumps 13 pc to Rs 136 cr

Adani Gas Ltd on Tuesday (Nov 3) reported a record net profit in the September quarter as sales returned back to pre-Covid levels quicker than anticipated,

read more

with the economy reinflating on easing of lockdown restrictions. Net profit in July-September quarter at Rs 136 crore was 13 per cent higher than Rs 120 crore profit a year ago, Adani Gas CEO Suresh P Manglani told reporters during an earnings call. The board of the company approved raising USD 400 million (about Rs 2,950 crore) in US dollar denominated bonds to fund capital expenditure for the next two years, he said. He said sales volume improved rapidly with the reopening of the economy. Industrial sales have risen above pre-COVID levels, but CNG sales are still 10% lower than normal, primarily because schools haven’t fully reopened and public transport is not back on roads yet. While sales were back to normal in September, volumes were lower than last year on an overall quarterly basis. The firm sold 131 MMSCM of gas in July-September, down from 146 MMSCM a year ago. “Average volume in September was 1.59 MMSCMD as compared to average volume in Q1 of 0.71 MMSCMD, showing significant volume recovery trend,” Manglani said, adding that September exit volume was 1.61 MMSCMD. The company’s revenue was 12 per cent lower at Rs 441 crore in July-September quarter. The firm, whose operations span 15 geographical areas, raised the number of CNG stations to 134 with the commissioning of 19 new CNG stations. Piped natural gas connections to households increased by 7,704 in Q2 to 4.46 lakh. The company’s board also approved altering its main object clause of Memorandum of Association (MOA) by inserting objects to carry on the businesses of bio-gas, bio-fuel, bio-mass, electric vehicle, hydrogen manufacturing of various equipment and provision of value-added services relating to city gas business, he said. Manglani said, “Adani Gas has reported highest ever financial performance with robust physical performance despite ongoing pandemic.”

show less

Karnal industrial units to get PNG supply

The Karnal industrial area is all set to get the supply of the piped natural gas (PNG), an eco-friendly gas, in the first week of November. The work to lay pipelines from

read more

Panipat to Karnal city and further to the industrial area has been completed. Besides, the testing work of the lines has also been done. In 2019, the National Green Tribunal (NGT) had directed the industries to switch to PNG instead of using existing fuel in the Delhi-National Capital Region (NCR) by August 2019. Indraprastha Gas Limited (IGL), a gas distribution company, has been assigned the work by the government to lay pipeline for PNG supply in Sector 4, 5, 6, 7, 8, 9, 13 and a part of Sector 13 extension along with industrial area in Sector 3. Apart from this, 10 CNG filing stations were also to be established. The company had started the work in March 2019 and the deadline was fixed as March 2020, but the work was delayed due to Covid-induced lockdown, said an official of the IGL. Manoj Arora, president, HSIIDC Welfare Association Karnal unit, said the NGT had already issued direction to the industries to switch to PNG and almost all major industrialists had made agreement with the gas providing company. Supply to benefit 1.5L Ambala Cantt LPG consumers

https://www.tribuneindia.com/news/haryana/karnal-industrial-units-to-get-png-supply-164614

show less

Electric Mobility & Bio- Methane

Hyundai plans India-centric EV’s

Riding high on the success of its SUVs, South Korean carmaker Hyundai Motor India Limited (HMIL) is planning to bring a mass electric vehicle

read more

to further strengthen its product portfolio and position itself as a smart mobility solution provider. It is currently developing a mass electric vehicle to take on the competition, a top executives told ETAuto in an exclusive interaction. “Currently EV segment is kind of a nice segment. So, we don’t see any deep pulling demand in that area. However, if more mass-market products are introduced in the segment it will surely gain traction. So we are preparing and developing a mass-market electric vehicle for India.” said Seon Seob Kim, MD & CEO, Hyundai Motor India told ETAuto. However, Kim emphasised that the research & development team is working on the most suitable body type for the Indian market in the electric vehicles class and the development is futuristic based on the needs of Indian customers. Two people aware of the matter informed that Hyundai India will most likely bring a mass-market electric SUV in the coming years.

HMIL is one the mass market brand which has launched electric SUV Kona in India. The company has so far sold 453 units of Kona till September since its July 2019 launch. The company which has pioneered in bringing new technologies such as connected and electric has planned investment of over $40 billion into innovation, new models, and technologies for electrified and autonomous vehicles. The huge investment coupled with an all-electric platform will play a crucial role in realising Hyundai’s future target – introducing 44 electrified models by 2025, with sales projected to touch a total of 1.67 million marks annually. With this bulk launch, the Korean carmaker intends to be “one of the world’s top three EV manufacturers” by 2025. In its blueprint to take on the Indian market, the carmaker will take the heavy localisation route to make electric vehicles affordable and mass-centric. It is currently working with many suppliers to localise electric vehicle parts to achieve a high localisation level of 90 percent. Moreover, for critical parts such as batteries, the carmaker is talking to potential suppliers such LG Chem. Even today HMIL localise some plastic parts and other parts of Kona to counter the recent hike in customs duties.

Source: ET Auto [Edited]

show less

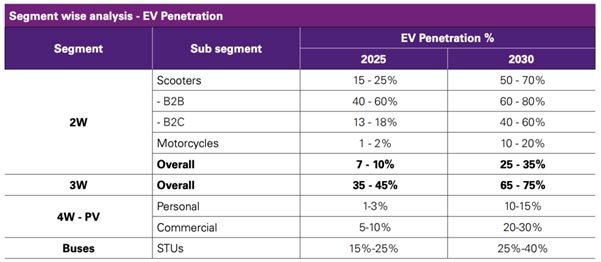

Only 10-15% penetration of electric cars is expected by 2030 in India: Report

The light mobility segments of 2/3-wheelers and commercial cars will be leading electric vehicle penetration in India by 2030.

The light mobility segments of 2/3-wheelers and commercial cars will be leading electric vehicle penetration in India by 2030.

read more

The reach of electric cars in the personal mobility segment will be only 10%-15%. However, electric cars for ride-sharing and taxis may see traction of 20%-30%, according to a KPMG and CII report titled ‘Shifting gears.’ By the end of this decade, the three-wheeler adoption is expected to be around 65%-70%. Electric two-wheelers, with a plethora of startups offering different ranges of products at an attractive price and ownership models, are expected to have only 25%-35% penetration. Their price and fuel economy make them commercially more viable. This development is similar to that in China, where electric bikes and scooters laid the foundation for growth. Intra-city transport buses are also ripe for EV adoption. These segments are likely to be followed by fleet cabs, and then others. India is the largest two-wheeler market, with more than 80% of ICE sales coming from the segment. The penetration of EVs in the four-wheelers segment has remained extremely low at ~0.1%. Several gaps in the four-wheeler EV market such as a limited number of products, high prices, insufficient battery promise, low performance and an underdeveloped charging ecosystem are yet to be filled. Given these impediments, the growth of EV four-wheelers is expected to lag behind other segments. Sales are expected to pick up once these gaps are plugged.

Rohan Rao, partner – industrials and automotive, KPMG in India, said, “Electric Vehicles (EVs) are on course to fulfil their promise as game-changers for the automobile industry. Two-wheeler (2W) and three-wheeler (3W) segments are likely to lead the adoption curve, followed by e-buses and passenger taxis. Directionally several factors, including the availability of charging infrastructure, robust financing ecosystem, reduced battery prices and increased customer awareness, are paving the way for a new era of EV adoption. The government is also pushing the EV policy to address some of the adoption barriers. EV is, thus, are emerging as a disruptive force, with several players experimenting with and discovering innovative business models and use cases. “

Source: ET Auto {Edited}

show less

Telangana rolls out 10-year EV policy, aims to attract $4bn investments

The Telangana State Government on Friday (Oct 30) launched the ‘Telangana Electric Vehicle & Energy Storage Policy’ with a vision to

read more

make the state a hub for electric vehicles (EVs) and energy storage systems (ESS). The policy aims to attract private investments worth USD4 billion in the EV sector and create employment for 120,000 people by 2030 through shared mobility, charging infrastructure development, and manufacturing activities. Telangana ministers KT Rama Rao and Ajay Kumar were present at the launch of the policy which will be effective for ten years from the date of notification and will be reviewed by the Steering Committee as notified in the policy. “Telangana has come out with an extremely comprehensive policy. We have ensured that the energy storage policy is clubbed with the EV policy because these two are tight-knit ideas which need to work cohesively. We have taken a pragmatic approach while designing this policy in consultation with industry leaders,” Rama Rao said after unveiling the policy. The policy incentivises EV and ESS sectors as per the subsidies and incentives available under the Electronics Policy 2016. Incentives have been made available for the manufacturing of electric vehicles, energy storage systems and related components in Telangana through capital subsidies, SGST reimbursements, power tariff subsidies, etc. The policy notifies 100% exemption of road tax and registration fee for the first 2lakh electric two-wheelers and first 20,000 electric three-wheelers purchased and registered within Telangana. A retro-fitment incentive has also been provided at 15% of the retro-fitment cost capped at INR 15,000 per vehicle for the first 5,000 retrofit 3-seater auto rickshaws. The policy added that financing institutions would be encouraged to provide a hire-purchase scheme at discounted interest rates. In the electric four-wheeler segment, there is a 100% exemption of road tax and registration fee for the first 5,000 units purchased and registered in the state. The first 500 buses are also given this exemption, and State Transport Units will also be encouraged to purchase electric buses. Electric tractors have also been exempted from road tax and registration fees as per the existing rules/guidelines applicable for tractors by the State Transport Department. Investment of more than Rs 200 crore in plant and machinery or providing employment to more than 1,000 people shall be categorised as mega project, according to the policy. Electronics Manufacturing Clusters (EMC) and Industrial Parks are identified for promotion of EV & Energy Storage manufacturing companies. Currently EMCs exist at Raviryal and Maheshwaram, a designated industrial park at Divitapally for Energy Storage manufacturing, with additional parks are being designated. The policy notified that the government would facilitate setting up of an initial batch of fast charging stations in Hyderabad and other towns in a phased manner, by state entities and private players. Telangana State Electricity Regulatory Commission will provide a special power tariff category for EV charging stations. In addition, TSREDCO (State Nodal Agency) is given the responsibility to evaluate directly or under the licensee/franchise/PPP model the establishment of public charging stations. Various public places such as airports, railway and metro stations, parking lots, bus depots, markets, petrol stations, malls, and electric poles will be examined for the same. A viable business model will be developed for private players to set up ARAI-compliant EV charging/swapping infrastructure. Specifications for charging infrastructure shall be defined by the Transport Department/ TSREDCO/ITE&C Department.

Source: ET Auto

show less

Gas/ Pipelines/ Company News

Hindustan Petroleum to invest ₹10,000 cr on gas value chain

State-run Hindustan Petroleum Corporation Ltd (HPCL) will invest ₹10,000 crore to create an end-to-end natural gas value chain, said an official from the company.

read more

The investment will be spread over the next five years, he added. “We are trying to create a value chain from end to end, right from liquefied natural gas (LNG) buying to LNG conversion to gas as well as LNG transportation. We have got a plan of around ₹10,000 crore of investment in various LNG-related facilities, through a combination of joint ventures or private participation,” Mukesh Kumar Surana, chairman and managing director, HPCL, told analysts. Currently, HPCL is setting up 11 LNG stations and is in talks with auto manufacturers to encourage them to build facilities for LNG-based trucks and buses. The company has also approved a project for around ₹100 crore to have a corridor, which can be used along with other oil marketing companies to use LNG as a fuel, in addition to CNG. HPCL said it is also working on a parallel mode of LNG and HCNG (hydrogen compressed natural gas). The company holds a stake in the infrastructure for LNG gasification terminal for cross-country pipelines for transportation of LNG. “Now whether its biofuel, whether it’s renewable, gas or whether it’s electric, we are working on all the floors, because ultimately, our business is to provide mobility and to cater to the energy needs of the customers. And the means–we will adopt as it develops,” added Surana. The third-largest state-run oil marketing company is also building a 5 MMTPA LNG regasification terminal at Chhara (Gir Somnath District) in Gujarat through joint venture company, HPCL Shapoorji Energy Pvt. Ltd in addition to participating in development of three cross-country natural gas pipelines (Mehsana to Bathinda, Bathinda to Srinagar and Mallavaram to Bhilwara) through joint venture companies viz. GSPL India Gasnet Limited and GSPL India Transco Ltd. Other oil marketing companies including Indian Oil Corporation Ltd (IOCL) and Bharat Petroleum Corporation Ltd (BPCL) are also bullish on the natural gas segment. IOCL has established itself as the second-largest player in natural gas in India with a licence to retail CNG and piped cooking gas in 40 Geographical Areas. IOCL is also aggressively promoting the use of compressed biogas, 2-G ethanol, and biodiesel produced from used cooking oil, besides integrating its refinery processes with biofuels production. BPCL, which is present in various segments of natural gas sales and supply, has been strengthening its gas business over the past few years. It is a co-promoter of Petronet LNG Ltd, along with Indian Oil Corp. Ltd, Oil and Natural Gas Corp. Ltd and Gail (India) Ltd and also a co-promoter of four city gas distribution (CGD) companies—Indraprastha Gas Ltd in Delhi with Gail; Sabarmati Gas Ltd in Gujarat with Gujarat State Petroleum Corp. Ltd; Maharashtra Natural Gas Ltd and Central U.P. Gas Ltd with Gail. The company has been importing LNG and supplying it to customers in the fertilizer, power, city gas distribution, steel and other industries across the country. BPCL also markets LNG by tank trucks from Dahej to some customers

show less

ONGC Q2 results: Net profit falls 19% YoY to Rs 4,335 crore; revenue declines 18%

ONGC said it has considered possible effects of low crude oil and natural gas prices on the recoverability of its cash generating units. Oil and Natural Gas Corporation (ONGC) on

read more

Friday (Nov 13) posted around 19 per cent year-on-year fall in consolidated net profit (attributable to owners of the company) at Rs 4,335.31 crore for the quarter ended September 30. The figure stood at Rs 5,349.20 crore for the corresponding quarter last year. Consolidated revenue from operations declined 17.70 per cent YoY to Rs 83,619.16 crore. ONGC said it has considered possible effects of low crude oil and natural gas prices on the recoverability of its cash generating units. As a result, the company has recognised an exceptional item towards impairment loss of Rs 1,238 crore in Q2FY21 to factor into estimated future crude oil and natural gas prices. “This impairment loss may be reversed in future as and when there is increase in crude oil and gas price,” ONGC said. On the other hand, standalone net profit of the company dipped by 54.60 per cent YoY to Rs 2,878 crore. In a release, ONGC said, “The revenue and PAT for Q2 and H1 of FY21 have declined as compared to corresponding period of FY20 mainly due to lower crude oil price realisation. Lower gas prices also contributed to lower topline and bottom line.”

show less

GAIL Q2 results: Net profit falls 8.5% YoY to Rs 1,068 crore; revenue drops 24%

The natural gas processing and distribution company said its revenue from marketing of natural gas dropped to 12,330.68 crore, from 16,857.98 crore in the

read more

same quarter a year ago. State-run GAIL (India) on Tuesday (Nov 10) reported a net profit of Rs 1,068.16 crore for the quarter ended September, down 8.5 per cent from Rs 1,167.58 crore a year ago. Its revenue from operations dropped by 24.3 per cent to Rs 13,809.86 crore, from 18,249.90 crore a year before. The natural gas processing and distribution company said its revenue from marketing of natural gas dropped to 12,330.68 crore, from 16,857.98 crore in the same quarter a year ago. The company said its board also approved to borrow a total of up to Rs 10,000 crore in one or more tranches from time to time, including the money already borrowed. Such fund raising could be through rupee term loan, foreign currency term loan/bond , note, external commercial borrowing or issue of rupee denominated debentures or bonds. At 2:22 pm, Gail (India) shares were up 2.43 per cent at Rs 88.60, while the benchmark Sensex was up 1.19 per cent at 43,106.38 points.

show less

Oil India second quarter profit drops 42 per cent on blowout expense

Oil India Ltd, the nation’s second-biggest state oil producer, on Monday reported 42 per cent drop in September quarter net profit largely on account of lower

read more

oil prices and one-time expense it incurred on controlling a blowout in Assam. Net profit in July-September at Rs 381.75 crore was lower than Rs 661.53 crore net profit in the same period a year back, the company said in a stock exchange filing. OIL said a blowout occurred in a producing well (Baghjan#5) in Tinsukia district of Assam on May 27 and the well caught fire on June 9. “To control the blowout, all necessary remedial actions (have) been undertaken by the company,” it said adding the total losses/damages arising out of the blowout can be assessed on successful control of the blowout. The company is currently trying to control the blowout. “However, as on September 30, 2020 an amount of Rs 227.51 crore has been incurred to control the blowout and the same has been shown as an exceptional item in the statement of profit and loss,” it said. Out of Rs 227.51 crore, Rs 134.12 crore has been booked during September quarter. Turnover fell 32 per cent to Rs 2,175.87 crore in the second quarter of the current fiscal. A fall in international oil prices led to revenue from the sale of crude oil slump by 32 per cent and segment pre-tax profit more than halved to Rs 432.27 crore. Lower natural gas prices also saw revenues from its sales slump 41 per cent and pre-tax profit drop to Rs 51.70 crore from Rs 176.93 crore in July-September 2019.

show less

ONGC seeks 71 acres of land for pipeline project in E. Godavari

East Godavari Collector D. Muralidhar Reddy on Monday said a proposal was being prepared to allocate 71.22 acres of land sought by the Oil and Natural Gas Corporation

read more

for laying a pipeline from the sea to the land at Balusutippa village of Katrenikona mandal in East Godavari district. Mr. Muralidhar, Amalapuram MP Ch. Anuradha, Amalapuram Sub-Collector Himanshu Kaushik on Monday discussed the possibilities to spare the proposed land for the ONGC and compensation to be offered to the people affected by the pipeline project. “The ONGC’s proposal is to lay a pipeline connecting the pipeline system between the onshore and offshore locations as part of their ongoing operations. The package will be given, compensating the livelihood of the fisherfolk in and around the proposed site for the period of the ‘proposed work’. The compensation will also be offered to the fisherfolk in the event of any disturbance to the fishing activity,” Mr. Muralidhar said. The Collector directed the fisheries authorities to prepare a list of families living in the five villages that fall in the pipeline project area. District Revenue Officer Ch. Sattibabu, Joint Director (Fisheries) P.V. Satyanarayana, ONGC Executive Director Aravind Morbale and other officials were present.

show less

Reliance to start gas production from R-Series field in November/December

Billionaire Mukesh Ambani’s Reliance Industries plans to start the delayed production from the second wave of discoveries in its eastern offshore KG-D6 block in

read more

November/December, the company said in an investor presentation. Reliance is working on three projects in the Krishna Godavari basin KG-D6 block, where production from older fields stopped in February this year. R-Series will the first of the three fields to go live. Reliance and its partner BP are developing three sets of discoveries in KG-D6 block — R-Cluster, Satellites, and MJ by 2022. Peak output of around 28 MMSCMD is expected by FY24 when all three projects are up and running. R-Cluster will have a peak output of 12 MMSCMD while Satellites, which are supposed to begin output from the third quarter of 2021 calendar year, would produce a maximum of 7MMSCMD. MJ field will start production in third quarter of 2022 and will have a peak output of 12MMSCMD. Reliance in November last year auctioned the first set of 5 MMSCMD of gas from the newer discoveries in the KG-D6 block by asking bidders to quote a price (expressed as a percentage of the dated Brent crude oil rate), supply period and the volume of gas required. Sources said Reliance had in November set a floor or minimum quote of 8.4% of dated Brent price — which meant that bidders had to quote 8.4% or a higher percentage for seeking gas supplies. Considering current average Brent price of USD 40 per barrel, the gas will cost around USD 3.36 per MMBtu. Dated Brent means the average of published Brent prices for three calendar months immediately preceding the relevant contract month in which gas supplies are made. In the first round of auction in November 2019, Essar Steel, Adani Group and state-owned GAIL bought a majority of volumes on offer. The price at that time came to USD 5.1-5.16 per unit. But international oil rates have slumped as demand evaporated due to outbreak of coronavirus and lockdowns imposed by countries around the globe. Essar Steel had picked up 2.25 MMSCMD in the country’s first transparent and dynamic forward auction that lasted about five-and-a-half-hours on November 15, 2019, sources said. Gujarat State Petroleum Corp (GSPC) picked up 1.2 MMSCMD while Adani Group and Mahanagar Gas Ltd bought 0.3 MMSCMD, sources said, adding GAIL, acting on behalf of fertiliser companies, bought 0.3 MMSCMD of gas. Hindustan Petroleum Corp Ltd (HPCL) had bought 0.35 MMSCMD and 0.10 MMSCMD went to Gujarat State Fertilizers & Chemicals Ltd (GSFC)/Gujarat Narmada Valley Fertilizers & Chemicals Ltd (GNFC), sources said. In all, 15 customers across sectors such as steel, petrochemicals, city gas, glass and ceramic got gas in the tender, they added. In the November 15 auction, bidders quoted between 8.5 and 8.6% slope to corner all of the 5 MMSCMD supplies available. This translated into a price between USD 5.1 per MMBtu and USD 5.16 per MMBtu at the then prevailing Brent oil price of USD 60 per barrel. Initially, Reliance had set a floor quote of 9 per cent of dated Brent price, which translated into a gas price of USD 5.4 per MMBtu at USD 60 oil price. But consumers saw this as a very high price considering that imported LNG in the spot market is available at around USD 4 per MMBtu rate currently. Other discoveries have either been surrendered or taken away by the government for not meeting timelines for beginning production. Reliance is the operator of the block with 66.6 per cent interest while BP holds the remaining stake.

show less

A K Gupta takes over as MD & CEO of ONGC Videsh

ONGC Videsh Ltd (OVL), the overseas arm of Oil and Natural Gas Corporation (ONGC) today (Nov 2) announced A K Gupta has taken over as the Managing Director

read more

and Chief Executive Officer (CEO) of the company. Gupta has been serving as the Director-Operations of ONGC Videsh. He has over three decades of experience of handling domestic and overseas oil and gas exploration and production operations. “He possesses an extensive experience across the E&P value chain, especially in business development earned during his tenure as Head of New Businesses in Marketing in ONGC and Head Business development in ONGC Videsh and in handling commercial negotiations,” the company said in a statement. Gupta started his career in 1984 as a Graduate Trainee in ONGC’s corporate office after obtaining a degree in Mechanical Engineering from IIT-Roorkee. He subsequently acquired MBA in Finance & Marketing from FMS, Delhi University in 1999.https://energy.economictimes.indiatimes.com/news/oil-and-gas/a-k-gupta-takes-over-as-md-ceo-of-ongc-videsh/79001820

show less

Mukesh Ambani loses $5 billion as oil sinks Reliance shares

Mukesh Ambani, Asia’s richest man, lost as much as $5 billion from his net worth as Reliance Industries Ltd’s shares tumbled to the lowest price in more than

read more

three months following a drop in quarterly profit. The stock of India’s most-valuable company fell as much as 8.64% in Mumbai on Monday (Nov 2), slipping the most since May 12 and touching the lowest since July 20. The slide also shaved down Ambani’s wealth to about $73 billion to mark his worst day since March, according to the Bloomberg Billionaires Index. The refining-to-retail conglomerate reported a 15 per cent decline in quarterly profit to 95.7 billion rupees ($1.3 billion) late on Friday (Oct 30), as the coronavirus pandemic hit fuel demand. Revenue fell 24% to Rs 1.16 lakh crore. Reliance’s oil refining unit has suffered a plunge in demand for transportation fuels, with Covid-19 forcing people to stay home. The conglomerate is in the midst of a transformation led by Ambani, 63, as he looks to turn the oil-and-petrochemicals giant into a technology and digital services company by bolstering its telecom and e-commerce businesses. The slip in earnings backs Ambani’s strategy and highlights the increasing need for Reliance to reduce its dependence on the energy sector and boost businesses that seek to leverage India’s billion-plus consumers. Reliance’s gross refining margin — or profit from refining a barrel of crude oil into fuels — fell to $5.7 per barrel in the latest quarter compared with $9.4 a year earlier, the company said. Meanwhile, the profit at its telecom business under Reliance Jio Infocomm Ltd. nearly tripled over the same period. Reliance shares have rallied about 29% this year, while Sensex has slipped 4%, as investors cheered Ambani’s fundraising spree that saw Reliance mop over $25 billion by selling stakes in its digital and retail units. The jump also triggered one of the biggest wealth surges as Ambani amassed $19.1 billion in 2020 through Friday, becoming the world’s sixth-richest person, according to the Bloomberg Billionaires Index.

show less

India’s October gasoline, gasoil sales exceed pre-coronavirus levels

India’s gasoil consumption in October rose 6.6% from a year earlier, the first such increase since COVID-19 restrictions were imposed in late March, preliminary data showed

read more

on Sunday, signalling a pick-up in industrial activity. Diesel sales by the country’s three state fuel retailers totalled 6.17 MMT in October, according to provisional data compiled by Indian Oil Corp (IOC), the country’s biggest refiner and fuel retailer. Sales of gasoil, which account for about two-fifths of India’s fuel demand, rose 27.5% from September. Rising diesel sales in the world’s third-biggest oil consumer and importer should help refiners, who had to cut crude-processing runs during the coronavirus crisis. IOC hopes to operate refineries at full capacity in a couple of months, up from 95% now, as local fuel demand is rising, company chairman S.M. Vaidya said on Friday (Oct 30). Rising gasoline and gasoil demand in India should also aid other markets hit by slow demand recovery.

Local gasoline sales in October rose above pre-pandemic levels for a second month in a row. Gasoline sales rose 4% from a year earlier to about 2.4 MMT, about 8.6% higher than September, the data showed. State companies IOC, Hindustan Petroleum Corp and Bharat Petroleum own about 90% of India’s retail fuel outlets. State retailers sold 3.8% more cooking gas in October than a year ago, at about 2.44 MMT, while jet fuel sales halved to 328,000 tonnes.

show less

Oil & Gas reform – Firms will soon be able to sell gas via auction platforms: Secy

As part of the larger reforms in the natural gas sector aimed at smooth trade of natural gas in the country, companies will soon be allowed to sell gas through auction platforms,

read more

oil secretary Tarun Kapoor said. “The policy and regulatory framework has to come very fast, so that buying and selling of gas becomes easy. Auction platforms will be there. There will be a panel made by the DGH and thereafter those who produce gas can use any of these platforms to bid out gas,” Kapoor said, speaking at the Virtual Natural Gas Conclave organized by PHD Chamber of Commerce and Industry. He added this is a major step towards marketing freedom which is being given to the producers of gas in India. The government had recently issued a notification allowing producing companies to sell natural gas through open auction. The secretary also said a formal natural gas exchange will become a reality soon. “There is a platform where gas exchange in a very elementary form has already come and some transactions are taking place but PNGRB has brought out the regulations and with that a formal exchange would come up,” he said. The ministry is also working to set up a Transport System Operator (TSO) for gas. In order to transition India towards a gas-based economy and boost the share of natural gas in India’s energy basket from the current 6 per cent to 15 per cent, the government is trying to establish the supporting infrastructure. As part of the plan a gas grid is coming up through a trunk pipeline system which will be 34,000 kilometers long. Of this, work on around 17,500 kilometers of pipelines has already been completed. Kapoor said this massive expansion of gas supply infrastructure is a major business opportunity for the domestic manufacturing companies and also a chance for industries currently using fuels like diesel and petcoke to shift towards gas as a clean fuel.

show less

Policy Matters/ Gas Pricing/Others

More trouble for PNGRB’s open access proposal

After facing opposition for its proposed transportation tariff for the city gas distribution (CGD) network, the Petroleum and Natural Gas Regulatory Board (PNGRB)

read more

is facing further push back from top CGD companies of the country who allege that the proposed regulation for open access in the sector sidesteps those who have already invested heavily in the sector. The PNGRB’s open house on Monday (Nov 2), inviting comments on the draft open access guidelines, part of the public consultation process, saw companies like Torrent Gas Pvt Ltd, Adani Gas Pvt Ltd, GAIL Gas Ltd, Gujarat Gas Ltd (GGL), Mahanagar Gas Ltd (MGL) and Indraprashtha Gas Ltd (IGL) raising concerns about the PNGRB’s move that aims to end exclusivity of supplier after five years of operations. Any infringement on the infrastructure exclusivity of an entity is not appropriate and will severally harm the interests of the CGD entities who are spending huge amounts on creating infrastructure, Torrent Gas said in its representation. “The issue of open access has stirred a hornet’s nest in the CGD sector, opening up more disputes rather than finding a solution for increasing CGD penetration in the country,” said a senior bureaucrat in the know of the matter. The existing draft regulation shall lead to making the overall CGD development project as economically unviable for the authorized entity by making it the supplier of first and last resort for PNG domestic segment only, according to the IGL. Many of the companies are of the view that despite having repeatedly raised concerns over cherry picking by new entrants, the PNGRB has been ignoring them. “The Draft Access Code will allow third party marketers and shippers to ‘Cherry Pick’ customers, and thus endeavour to be opportunistic and endeavour to serve a very select customer type or population,” according to the Adani Gas. Allowing other entities to set-up CNG stations (including dispensers) within such authorized geographical area will be a gross infringement on the interests of CGD entities and against the very understanding under which such CGD entities have bid and been authorized geographical areas, the Adani further said in its representation to the regulator. The PNGRB shall take due cognizance of pending litigations and order passed by the Courts till date, before finalizing the proposed regulations, the Gujarat Gas said in its comments. The CGD projects are very capital intensive with a long gestation period. In acknowledgement of the same, the PNGRB has also extended the market exclusivity period from initial five years to eight years during ninth and tenth bidding rounds, according to the GAIL Gas. “It is to be appreciated that the CGD industry is still in growing phase and we are yet to achieve market maturity. The CGD sector needs Board’s support and hand holding is necessary for the growth of the sector,” the company said in its feedback to the PNGRB. “The feedback processes including open houses seem to be eyewash, a mere formality,” said a senior state government official.

show less

India’s state-run refiner Hindustan sees more energy stability under Biden

The election of Joe Biden as US president should bring more stability to energy, and will promote crude oil and LNG trade between India and

read more

the US, the chairman of India’s third-biggest state-run refiner Hindustan Oil Corp. told S&P Global Platts on Nov. 8. The nature of the verdict will propel the policy framework towards more stability as far as energy is concerned,” M.K. Surana said. India is the world’s third biggest energy consumer, and state-owned gas utility major GAIL regularly sources LNG from the US while state-run refiners buy crude from the US when the price turns competitive against other sources. “India and US partnership has grown in recent times,” Surana said. “This partnership can only grow further with the US turning an exporter of crude oil and LNG, and also because India being the market with the largest potential for both fossil and non-fossil energy sources.” BP recently reiterated it was planning to play a much bigger role across India ‘s energy transition, including in renewables . “India is set to nearly double its energy consumption over the long term,” Prime Minister Narendra Modi told the recent India Energy Forum by CERAWeek. “Our energy sector will be growth-centric, industry friendly and environment-conscious.” Modi said plans are in place to grow the country’s refining capacity from about 250 million mt/year currently to 400 million mt/year by 2025. Terming Biden’s victory “spectacular,” Modi said in a Nov. 8 tweet: “As the VP, your contribution to strengthening Indo-US relations was critical and invaluable. I look forward to working closely together once again to take India-US relations to greater heights.”

show less

CNG, smart cards can plug leakage of fuel & fare revenue: Nitin Gadkari

Theft of diesel and bus conductors making money by charging less than the fare from passengers to allow ticketless travel are some of the reasons

read more

which have left the public transport system in financial ruin, road minister Nitin Gadkari said on Friday (Nov6). The minister said running buses on clean gas and compulsory use of smart card-based ticketing will help improve the financial health of state transport corporations. “We all know how the transport corporations across cities have been ruined because of huge losses. This can be turned around by converting these buses to use CNG, LNG or bio-CNG. There is no scope for stealing such fuel. Introducing a smart card-based fare collection system in buses will reduce overhead cost and there will be no leakage of revenue,” Gadkari said. According to the latest report on the financial health of State Road Transport Undertakings (SRTUs) for 2016-17, the cumulative loss of 56 SRTUs was Rs 13,957 crore and it was 24% higher than 2015-16. Only seven SRTUs made profit and these were Andhra Pradesh SRTC, UPSRTC, Kanpur City TSL, Bihar SRTC, PUNBUS of Punjab, Sikkim NT and Odisha SRTC. The reports of the last three years have not yet been published by the Transport Research Wing of the road transport ministry.

show less

LNG Development and Shipping

India’s Petronet has no plans to invest in LNG developers

India’s Petronet LNG Ltd has no plans to invest in liquefied natural gas (LNG) developers as the market is awash with cheaper fuel, its finance chief said, indicating it may shelve plans to invest in Tellurian Inc’s U.S. project.

read more

Petronet, the country’s top gas importer, has time until December-end to consider investing $2.5 billion for 5 MMTPA of LNG in Tellurian’s Driftwood project to end-2020. “Right now, we get LNG at throwaway prices so there is no need to go for an investment … you should be more concerned with LNG than investment,” VK Mishra said at an analyst conference on Thursday (Nov 12). This is a non-binding memorandum of understanding and there is no commitment, Mishra said, adding that the company is in talks for new long-term LNG contract linked to spot prices. India has been scouting for cheap gas for price-sensitive consumers as Prime Minister Narendra Modi wants to raise the share of natural gas in the national energy mix to 15% by 2030 from the current 6.2% to reduce pollution. Petronet has a deal to purchase 7.5 MMTPA of LNG from Qatar and 1.44 MMTPA from Exxon Mobil Corp’s Gorgon project in Australia. Spot LNG prices are currently high due to the surge in demand during winters, he said, adding that the prices would drop to $4-$6 per MMBtu after January. To meet India’s growing gas demand, Petronet is looking at constructing a new LNG terminal on the country’s east coast and also plans to raise annual capacity at its Dahej terminal in western India to 19.5 MMT from 17.5 MMT. Petronet is also awaiting for a final approval from Sri Lankan authorities to build a floating LNG terminal in the island nation for about $300 million, Mishra said.

Source: LNG Global/Reuters

show less

Dharmendra Pradhan: Consensus on including LNG under GST soon

According to a government release, Pradhan said the call from industry to include LNG under the indirect tax regime was a genuine demand and that a consensus was

read more

likely to develop on the issue soon. There is likely to be a consensus on including liquefied natural gas (LNG) under the ambit of the Goods and Services Tax (GST) soon, Petroleum Minister Dharmendra Pradhan said on Friday (Nov 6). According to a government release, he said the call from industry to include LNG under the indirect tax regime was a genuine demand and that a consensus was likely to develop on the issue soon. He was speaking at a webinar on boosting awareness of benefits of LNG among end-users and promoting its use as a transport fuel. He asked industry to identify sector-specific requirements for expansion of LNG markets in India.

show less

Dharmendra Pradhan calls for launching a campaign for making users aware about the benefits of LNG as fuel

Union minister of Petroleum and Natural Gas & Steel Dharmendra Pradhan has called upon the various stakeholders in the LNG sector to mount a campaign

read more

to make people/users aware about the benefits of this fuel. Addressing a webinar on “LNG as a Transport Fuel” here today, he said that LNG is a fuel of the future, and its cost benefit and other advantages over other fuels must be communicated in an aggressive and specific manner. He said that less cost of the LNG will attract the bulk and large consumers, if the message reaches them properly. Pradhan said that there is abundant availability of the LNG commodity and the Government is providing all facilities for its growth. He said that the opportunity of promoting LNG as the preferred fuel should be harnessed at the earliest. The environmental dividend, economic dividend and Convenience aspect, associated with the usage of LNG, should be highlighted. The minister said that the Government, in its focus on moving the country towards the gas-based economy, is making huge investments in the gas infrastructure- terminals, pipelines, Stations, and CGD network, and LNG is integral part of this focus. “We are focused on realising Prime Minister Narendra Modi’s vision of transforming India into gas-based economy and are extending every support required to aid this transition.” The Minister exhorted the industry to come out of the subsidy-based model, and focus on LNG’s commercial viability, by going in for scale of operation. On the issue of bringing LNG within the ambit of GST, the Minister said that it is a genuine demand, and a consensus is likely to develop on this soon. He asked the industry to probe and identify sector specific requirements of LNG for expansion of LNG markets in India. This will create a win-win situation for fleet owners, vehicle manufacturers & stakeholders in the gas value chain and also ensure a better environment, he added. The Webinar was also addressed by the Secretary, Ministry of Petroleum and Natural Gas Tarun Kapoor. He said that the scenario world over regarding use of LNG has undergone massive change, as the fuel being under high pressure and low temperature, can be transported over a long distance, thereby eliminating the need of laying pipelines. Officers from GAIL, Controller of Explosives, and senior functionaries of SIAM, automobile companies and other stakeholders also shared their views during the webinar.

show less

GAIL India invites bids for charter of LNG tanker: Sources

GAIL (India) is inviting bids from interested companies to charter the liquefied natural gas (LNG) tanker Meridian Spirit for a period of one year, two industry sources said

read more

on Wednesday (Nov 4). The 163,000-cubic metre tanker will be available from March 2021 to March 2022, and companies are requested to submit bids by Nov. 6 with bids remaining valid until Nov. 9, the sources said. They spoke on condition of anonymity because they are not authorised to speak with the media. The Indian importer has been using the ship to transport gas from the United States where it has 20-year deals to buy 5.8 million tonnes a year of LNG, split between Dominion Energy’s Cove Point plant and Cheniere Energy’s Sabine Pass site in Louisiana. A GAIL official could not immediately be reached for comment on the matter.

Source: ET EnergyWorld

show less

India’s October LNG imports surge as demand rebounds to pre-Covid levels

Indian imports of liquefied natural gas (LNG) surged in October, shiptracking data from Refinitiv Eikon and data intelligence firm Kpler showed,

read more

as the country’s gas demand bounced back to pre-COVID levels. LNG shipments to India in October rose to about 2.5 million tonnes, the highest monthly volumes on its record, Refiniv Eikon data showed. Kpler pegged October arrivals at the second highest on record at 2.75 million tonnes, just under February’s imports of 2.79 million tonnes. “City gas, gas-based power sector as well as revival from other sectors is boosting LNG imports into the country,” an India-based gas importer told Reuters. “We are already back to pre-Covid levels with additional demand being seen from city gas and power sectors.” Spot gas imports by the electricity generation sector, which account for over a fifth of India’s total consumption of the fuel, doubled in the June quarter to the highest in at least 14 quarters. India’s natural gas prices fell to their lowest since 2014 for the October-March 2021 period which meant reduced costs for gas for fertilisers, automobiles and households. Asian LNG spot prices had also until recently been near record lows, which boosted appetite for imports of the super-chilled fuel, traders said, adding that this could slow from December, however, with spot prices rebounding to a more than one-year high. India has also been receiving at least one LNG cargo a month from Russia’s Yamal LNG plant since September, this year, after the last such flow was seen only in March, Refinitiv data showed. LNG shipments from Oman to India in October were also at a record high, the data showed. The South Asian country’s factory activity expanded at its fastest pace in over a decade in October as demand and output continued to recover strongly from coronavirus-related disruptions, in turn boosting gas demand.

Source: LNG Global

show less

Gujarat: Swan Energy acquires India’s first FSRU, to commission Jafrabad terminal by 2021

Moving closer to its plans of setting up the country’s first FSRU (floating, storage and re-gasification unit) based LNG port near Jafrabad in Gujarat, Swan Energy Ltd has

read more

recently acquired FSRU named Vasant 1. The FSRU, with 180,000 cubic metres of storage capacity is the first Indian-owned and Indian Flag FSRU which shall be used for storage and re-gasification of the liquified natural gas, according to a company official. Swan Energy has recently submitted a proposal to the state government for pushing its plans by another year for completion of construction of Jafrabad Port facility. According to Swan’s earlier plans, it aimed to complete the project by 2019. There have been some delays in construction on account of Vaayu cyclone last year and Covid-19 crisis this year, said a company official. The company aims to complete the port facility and commission the FSRU at Jafrabad by 2021. Vasant–1 vessel is a dual-purpose vehicle that can operate as LNG carrier and can switch to FSRU mode for re-gasification purposes. “Till the time the port is built, Vasant-1 will be utilized as LNG carrier in international as well as Indian waters. Presently, it is in Malyasia,” according to the official. It will be brought to Jafrabad a little closer to commissioning of the port, he added. Swan LNG Private Limited (SLPL), another subsidiary of Swan Energy Limited, will use the FSRU under 20 years Bare Boat Charter Agreement for the LNG-dedicated Port Project being implemented near Jafrabad, Gujarat. The FSRU is owned by Triumph Offshore Private Limited (TOPL), a subsidiary of Swan Energy Limited with 51% equity stakes and balance 49 per cent is held by Indian Farmers Fertilizers Cooperative (IFFCO) Limited. Swan LNG Private is developing the all-weather port at Jafrabad in Amreli district with a total capacity of handling 10MMTPA of LNG. The project cost has been downsized from Rs 5,900 crore to about Rs 4,000 crore, said sources. Swan Energy Limited is the lead promoter for the project with 63 per cent equity stake and 11 per cent equity held by FSRU Venture India One Pvt Ltd, the Indian subsidiary company of Mitsui OSK Lines, Japan which is also the technical partner for the project. The other shareholders in the project include Gujarat Maritime Board with 15 per cent and Gujarat State Petronet Ltd holding 11 per cent equity stake. The port project by Swan LNG Pvt Ltd is based on ‘Tolling Model’ where the company has entered into firm long-term re-gasification agreements for 90% capacity booking on “Use or Pay” basis with the PSU oil and gas companies including GSPC (1.5 MMTPA), BPCL, IOCL and ONGC (1 MMTPA each).

show less

IOC director A K Singh to head Petronet LNG

Indian Oil director (pipelines) Akshay Kumar Singh will head India’s largest gas importing company, Petronet LNG, sources close to the company’s board-appointed selection committee said.

read more

Singh will succeed Prabhat Singh, who completed his 5-year term in September but did not get extension for two years that he was eligible for. In March, the oil ministry told Parliament in a written reply it had received several allegations of alleged corruption and irregularities against Prabhat Singh. This will mark Singh’s return to the gas business as he was executive director in state-run gas utility GAIL before joining the IndianOil board in 2018 as in charge of the company’s substantial pipeline network. This will mark Singh’s return to the gas business as he was executive director in state-run gas utility GAIL before joining the IndianOil board in 2018 as in charge of the company’s substantial pipeline network. A mechanical engineer from MIT, Muzaffarpur (Bihar) and a post-graduate in turbomachinery from South Gujarat University, Singh has about 34 years of experience in the oil and gas industry. At IndianOil, Singh red-flagged a move to hive off the company’s vast network of pipelines and storage depots, a vital infrastructure that gave India’s largest fuel refiner and retailer an edge in the market. At Petronet, his primary challenge will be tackling the pricing conundrum of long-term contracts in the backdrop of falling spot prices. Singh has experience in executing challenging, complex and large-size cross-country pipeline networks. He is also experienced in design engineering, planning, execution and operation of hydrocarbon pipeline systems and process plants.

show less

Natural Gas / Transnational Pipelines/ Others

Cheniere says natural gas to play a key role in lower carbon future

U.S. liquefied natural gas (LNG) company Cheniere Energy Inc said on Friday that natural gas and LNG has a key role to play in the global transition to a lower carbon future.

read more

“Natural gas is an affordable, reliable, cleaner burning global fuel source, and we are confident in gas playing an increasingly important role in the global energy mix for many years,” Cheniere CEO Jack Fusco told analysts in an earnings call. “Cheniere delivers abundant, cleaner burning gas from North America to the rest of the world so it can displace dirtier fuel sources like coal and oil, helping these countries achieve their environmental goals,” Fusco said. He said his comments followed “an increasing number of questions from shareholders regarding the global energy transition and the role of gas and LNG in a lower carbon future.” In response to an analyst question about reports that French energy company Engie SA pulled out of a deal to buy LNG from U.S. LNG developer NextDecade Corp due to French government concerns about its environmental implications, Fusco said “It hasn’t come up with us yet, but we are anticipating it.” “The focus on decarbonization is here, it’s here to stay … We’re moving forward with quantifying what we can do to make our product much more desirable in the event that we need to,” Fusco said. Cheniere continues “to seek ways to further reduce the environmental footprint of our operations” and help the company’s suppliers and customers meet their environmental goals by offering products like LNG for the marine fuel market. “We are confident that gas and particularly LNG has a key role to play in the global transition to a lower carbon future, given its place at the intersection of reliably powering economic activity and providing a cleaner energy source,” Fusco said.

show less

Rising gas demand through 2040 needs $2 trillion in capital -Woodmac

Rapid gas demand growth expected through 2040 as countries implement clean air policies will require capital of $2 trillion to develop about 200 billion barrels of

read more

oil equivalent of new gas resources, consultancy Wood Mackenzie said. Asia’s gas demand is growing by an average of nearly 3% a year over the next two decades with gas demand expected to double in China and India by 2040, as current low prices boost pro-gas policies, the company said in a white paper released on Thursday. This in turn will need about $1.36 trillion of capital investment to bring both discovered reserves and yet-to-find resources on-stream with proposed liquefied natural gas (LNG) projects requiring another $0.6 trillion, WoodMac said. However, a Paris Agreement goal of limiting a rise in average world temperatures to well below 2 degrees Celsius before the end of the century, could see gas demand peaking earlier and “dramatically alter this outlook” and require a much lower capital of $700 billion of new investment, it added. As investors globally increasingly focus on low-carbon projects, the gas market’s carbon intensity will come under scrutiny, WoodMac said. Though burning natural gas emits less planet-warming carbon dioxide than coal per unit of energy produced, climate scientists have warned that the industry’s rapid growth as well as leaks of methane, a potent greenhouse gas, threaten progress in limiting climate change. LNG buyers in Asia are increasingly asking for more transparency on carbon emissions with some requesting for carbon-neutral deliveries. “Future legislation and project finance will likely require that all LNG cargoes come with detailed information about the emissions associated with their production and delivery,” the WoodMac analysts said.

show less

Russia’s Novak calls for closer cooperation with OPEC on natural gas

Russian Energy Minister Alexander Novak said on Tuesday it was important for Russia and members of the oil producing group OPEC

read more

to strengthen cooperation in the natural gas industry. Cooperation between the Organization of the Petroleum Exporting Countries and another energy group, the Gas Exporting Countries Forum (GECF), could be enhanced, Novak told an online conference of Russian and OPEC officials. Russia has been an active member of the GECF, which some analysts dubbed a “gas OPEC”, and Moscow has also been working closely with OPEC on reducing crude output to boost oil prices. Novak also told the OPEC-Russia Energy Dialogue, being hosted by the OPEC Secretariat, that a recovery of the global economy and oil market had been “difficult” in the face of uncertainties, including lockdowns in relation to the pandemic. OPEC and other large oil producers led by Russia, a group known as OPEC+, meet on Nov. 30-Dec. 1 to decide on ways to stabilise the oil markets as demand has been hammered a slump in demand caused by the coronavirus crisis.

show less

Global LNG Development

Global LNG-Asian prices slip as more cargoes expected from the U.S.

Asian spot prices for liquefied natural gas (LNG) fell this week (Nov 7-13) on lower Chinese demand and expectations of more cargoes from the United States,

read more

although loading delays from a Malaysian export plant supported prices. The average LNG price for December delivery into Northeast Asia LNG-AS was estimated at about $6.70 per MMBtu, down 80 cents from the previous week. Loadings of LNG cargoes have been delayed from Malaysia’s Bintulu plant, several sources said, although it was not immediately clear what issue the plant was facing. Plant operator Petronas did not immediately reply to a Reuters query on the matter. There are currently seven vessels waiting to load from the plant, compared with the usual 3 to 5, data intelligence firm Kpler said, adding that only one cargo has been exported so far this week, suggesting production issues. A train in Chevron Corp’s Gorgon LNG plant in Australia, which had been facing production issues, is now expected to resume production in the second half of November. Kuwait Petroleum Corp is seeking a cargo for Dec. 16 to 17 delivery in a tender that closes on Nov. 9 while Mexico’s CFE is seeking two cargoes for delivery in November, traders said. Taiwan’s CPC Corp was earlier this week seeking 3 to 4 cargoes for delivery over December to January, though it was not clear if the tender has been awarded. Gail (India) issued a tender offering two cargoes for loading from the Cove Point plant in the United States and is seeking two cargoes for delivery into India, over January to February, sources said. Vitol placed the best offers for four of six cargoes sought by Pakistan LNG for delivery in December, a source at Pakistan’s procurement body said. Trafigura and Socar offered the lowest price for the other two cargoes.

Source: LNG Global/Reuters

show less

Japan spot LNG import price rises to highest this year

Prices for spot liquefied natural gas (LNG) cargoes imported into Japan, the world’s biggest buyerof the fuel, rose to a 2020 high in October, recovering from

read more

record lows earlier this year as demand recovers from the COVID-19 pandemic. The average contract price for spot LNG cargoes shipped to Japan in October rose to $6 per MMBtu, according to data released by the Ministry of Economy, Trade and Industry (METI) on Wednesday (Nov 11). That was higher than $4.50 MMBtu in September and $2.20 MMBtu in May, the data showed. The price for LNG cargoes imported into Japan – reflecting actual prices paid rather than those derived from surveys or indices – has more than doubled since its May low, when the pandemic eviscerated demand for gas and other commodities. The world’s third-largest economy is slowly recovering from its biggest post-war economic contraction and now has relatively low numbers of new daily coronavirus infections, even as a fresh wave ravages Europe, the United States and other parts of the world. Industrial activity is returning, driving demand for electricity, with LNG being one of Japan’s main fuels for powergeneration. METI surveys spot LNG cargoes bought by Japanese utilities and other importers, but excludes deals linked to benchmarks such as the U.S. natural gas Henry Hub index. It only publishes a price if there is a minimum of two eligible cargoes reported by buyers.

Source: LNG Global/Reuters

show less

China inks first term deal for U.S. LNG since trade war erupted

China inked its first term deal to buy liquefied natural gas from an American exporter since the trade war disrupted deliveries, a sign of confidence

read more

that relations with the U.S. could be normalizing. Foran Energy Group said it signed a framework agreement with U.S. producer Cheniere Energy Inc. to purchase 26 cargoes between 2021 and 2025. The deal was made during the annual trade fair in Shanghai, a signature project of President Xi Jinping designed to showcase China’s openness to the world. Prices will be linked to the U.S. Henry Hub benchmark. Chinese firms had stopped signing longer-term supply contracts with U.S. exporters after Beijing slapped tariffs on shipments in retaliation to U.S. levies on Chinese goods in 2018. A long-negotiated supply deal between Cheniere and Sinopec, China’s refining and petrochemicals giant, never materialized due in part to the trade spat.

American LNG sales to China stopped completely between May 2019 and March this year. Imports have since resumed as Beijing looks to

honor its commitments to the phase-one trade deal signed with Washington in January, even as broader political relations between the world’s two largest economies have been stretched almost to breaking point. Earlier this year, China introduced a tariff waiver program that included LNG in a bid to increase imports. But China’s largest buyers have been uneasy about making long-term pledges in case relations with Washington were to suddenly sour. Cheniere sent nine LNG cargoes to China between March and August of this year, U.S. Department of Energy figures show. The company’s deal with Foran comes shortly after the PipeChina natural gas project was completed in the third quarter. The pipeline system allows third-party access to Chinese LNG terminals and natural gas pipelines, Cheniere Executive Vice President and Chief Commercial Officer Anatol Feygin said during a Friday investors call. “It’s in a great market in South China for us that we can access and continue to support,” Feygin said. “We do not see this as a one-off. We think this as a whole cadre of companies that we can engage with for years and look forward to continued success and continued traction there.”

Source: LNG Global/Bloomberg

show less

Cleaning up LNG becomes EU target in blow to U.S. shippers

The European Union is looking at ways to put pressure on global exporters of liquefied natural gas to reduce their greenhouse gas footprint,

read more

part of the continent’s effort to slash fossil-fuel pollution. Officials at the European Commission, the union’s executive arm, are assessing ways to reduce pollution from gaseous fuels as part of the Green Deal, an environmental clean-up of the entire economy. The goal is to step up reductions of carbon dioxide and methane emissions as the 27-nations bloc tightens it climate goals and looks to scale up innovative energy technologies such as hydrogen. “LNG trade and gas will remain the main topic of our cooperation with the U.S. in the years to come,” Anne-Charlotte Bournoville, head of the international relations and enlargement unit at the EC’s energy directorate, said on a webinar on Thursday (Nov 5). “At the same time, you see the direction of EU energy and climate policy. We need to achieve our 2050 ambition of climate neutrality.” While the EU’s effort would apply worldwide, it would add a source of tension with the U.S. government. President Donald Trump has sought to promote LNG exports to Europe as a way to diversify the continent’s sources of energy. The number of U.S. cargoes arriving in Europe has surged in the past two years, with eastern members of the bloc prodded to buy “freedom gas,” instead of fuel from Russia. At the same time natural gas and LNG, once touted as bridge fuels to smooth the transition away from coal, have come under increased scrutiny as governments chase more ambitious climate targets. Last month, Engie SA shelved plans to buy LNG from U.S. exporter NextDecade Corp., handing a victory to an environmental group that had urged the French utility to drop the deal on pollution concerns. The French decision shouldn’t be seen as “the beginning of a huge wave in a push to change things in Europe,” said Fred Hutchison, president and chief executive officer of the U.S. nonprofit association LNG Allies. A number of European companies from Royal Dutch Shell Plc to Total SA and Centrica Plc have long-term U.S. LNG contracts, he said.

“The notion that somehow were moving in a situation where it’s going to be unacceptable we don’t think that’s the case,” Hutchinson said.

The consultant Kayrros SAS estimates the visible methane intensity of U.S. LNG from the Permian Basin is nearly 20 times more than supplies from Russia, according to 2019 emissions data observed by the European Space Agency’s Sentinel-5P satellite. The spacecraft doesn’t capture all methane leaks but can detect large releases and clusters.

The consultant Kayrros SAS estimates the visible methane intensity of U.S. LNG from the Permian Basin is nearly 20 times more than supplies from Russia, according to 2019 emissions data observed by the European Space Agency’s Sentinel-5P satellite. The spacecraft doesn’t capture all methane leaks but can detect large releases and clusters.

©

The EC is analyzing policy tools to reduce greenhouse gases from the gas sector under a legislative package to be proposed next year. One of the options under investigation is an introduction of green certificates for LNG cargoes, according to Bournville. The Brussels-based commission already adopted a strategy to improve the measuring, reporting and verifying methane emissions last month. While this initiative will not directly impact U.S. LNG sales into Europe, the issue of tackling methane leaks is set to become a prominent topic in discussions with the U.S. “Indeed we’re implementing equivalent standards that are either enforced at state or federal level in the U.S,” Bournoville said. “However, European purchasers may show a preference for the best in class and so there could be impacts within the U.S. market with those with the best performance getting the best terms in the European markets.”

Source: LNG Global/Bloomberg

show less

Snam’s DESFA buys 20% stake in Greek offshore LNG terminal

Greek gas grid operator DESFA, 66%-owned by a consortium led by Italy’s Snam, on Wednesday (Nov 4) signed a deal to buy

read more

a stake in an offshore liquefied natural gas (LNG) terminal in northern Greece, DESFA said. DESFA took a 20% stake in the consortium which is developing the Alexandroupolis LNG project, it said in a statement. The floating terminal, dubbed a project of “common interest” by the European Commission, is expected to be operational by 2023. It will have a capacity of around 6 billion cubic metres of gas per year and will cost around 380 million euros ($445.06 million). In Greek waters close to the Turkish border, the offshore storage and regasification unit will be able to feed gas into other pipeline systems planned in the area, including the Trans Adriatic Pipeline (TAP). The Alexandroupolis gas project is 40% owned by Copelouzos, while DEPA, Gaslog and Bulgartransgaz each have 20%.

show less

Vitol places best offers for 4 of 6 LNG cargoes for Pakistan, says source

Global trader Vitol on Monday (Nov 2) placed the best offers for four of six cargoes of liquefied natural gas (LNG) sought by Pakistan in December,

read more