NGS’ NG/LNG SNAPSHOT – Nov 16–30, 2022

NGS’ NG/LNG SNAPSHOT – Nov 16–30, 2022

National News Internatonal News

NATIONAL NEWS

City Gas Distribution & Auto LPG

Muktidham crematorium in Pune to switch to CNG fuel

The Pune Cantonment Board (PCB) Tuesday said the Muktidham crematorium near Dhobi Ghat will soon switch to environment-friendly CNG fuel. PCB CEO Sh. Subrat Pal informed media persons that the now non-functional crematorium is expected to be relaunched by mid-January next year.

The Pune Cantonment Board (PCB) Tuesday said the Muktidham crematorium near Dhobi Ghat will soon switch to environment-friendly CNG fuel. PCB CEO Sh. Subrat Pal informed media persons that the now non-functional crematorium is expected to be relaunched by mid-January next year.

read more

“This is a unique public-private sector initiative”, Sh. Pal said, adding that the Lions Club of Bibwewadi volunteered to raise funds to the tune of Rs 1 crore for the project and undertake the construction work.

At a press conference held in Pune Tuesday, members of Lions Club of Bibvewadi, including

secretary Sh. Govind Chauhan and spokesperson Sh. Mahendra Oswal, said residents in neighbouring areas like Salisbury Park, Gultekdi, and Market Yard, among others, were facing difficulties owing to the closure of the crematorium. The electric crematorium was not functioning for the last 10 months due to technical glitches, PCB officials said.

“We had to perform the last rites at other crematoriums or wait for hours to use the wooden pyre,” Lions Club members said.

The electric crematorium was set up in 2003 and by 2016 was in need of repairs, the PCB CEO told media persons. However, the board was unable to take up major works owing to financial constraints since 2017.

The crematorium receives at least eight bodies daily, Vijay Chavan, the head of the electricity department at the PCB, said. The number almost doubled during the covid pandemic, he added.

Chavan said the furnace has to be replaced. Thereafter, the PCB will be responsible for its

maintenance.

show less

Government policies to play big role in improving fortunes of shares of city gas distribution companies

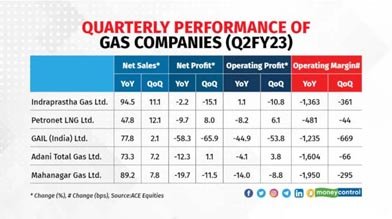

Gas/gas distribution companies reported a muted performance over the quarter ended September 2022. Though most of them witnessed robust year-on-year growth in their top line aided by growth in volumes, sequential growth was more or less flat with marginal increases for most players.

Gas/gas distribution companies reported a muted performance over the quarter ended September 2022. Though most of them witnessed robust year-on-year growth in their top line aided by growth in volumes, sequential growth was more or less flat with marginal increases for most players.

read more

However, margins came under severe pressure due to a sharp spike in global gas prices while the increase in realisations lagged.

Experts say that near-term outlook for gas companies look bleak as they cannot go for more price hikes now without it having an effect on volumes.

In the last revision effective April 2022 to September 2022, the price of natural gas from old and regulated fields was doubled to $6.1 per million British thermal unit (mmBtu). Price of gas produced from difficult fields like the KG-D6 block operated by the Reliance Industries-bp combine was hiked from $6.13 earlier to 9.92 per mmBtu for the April-September 2022 period.

“Local gas prices are at a record high and are expected to rise further due to a sharp increase in global gas prices triggered by the Ukraine-Russia conflict,” said Deepak Jasani, head of retail research, HDFC Securities.

With the likelihood of gas prices remaining elevated in the foreseeable future, the government is finalising a plan to make things easier for priority sectors such as city gas distribution (CGD, where companies supply piped natural gas or PNG to homes as an alternative to liquefied natural gas or LNG for cooking purposes), and fertiliser plants that use natural gas as feedstock, etc.

show less

Natural Gas/ Pipelines/ Company News

Gazprom-GAIL deal will be sorted out soon: Sh. Hardeep Puri

NEW DELHI: Petroleum minister Hardeep Singh Puri on November 17 said the government is hopeful that Russia’s Gazprom deal with the state-run Gas Authority of India Limited (GAIL) (India) to supply Liquefied Natural Gas (LNG) will be sorted out soon.

NEW DELHI: Petroleum minister Hardeep Singh Puri on November 17 said the government is hopeful that Russia’s Gazprom deal with the state-run Gas Authority of India Limited (GAIL) (India) to supply Liquefied Natural Gas (LNG) will be sorted out soon.

read more

The minister while addressing the press at the world LPG day also said, “India can’t be pressurised, we will purchase oil from wherever available at a reasonable price. Both the parties are discussing this issue (Gazprom and GAIL deal). I hope it will be resolved soon,” said Sh. Puri.

Gazprom’s former subsidiary Gazprom Marketing and Trading Singapore (GMTS) signed an

agreement with GAIL to supply 2.5 million tonnes (MT) of LNG per annum for 20 years starting 2018-19. However, following the Ukraine and Russia war, Gazprom stopped supply.

The reason being, Germany seized control of Gazprom Germania in April 2022. Following this, GAIL reported a 46 per cent dip in net profit during the second quarter (July-September 2022). Its net profit stood at Rs 1,537.07 crore in Q2FY23 as compared to Rs 2,862.95 crore in the same period a year ago. The profit was sequentially down 47.2 per cent from Rs 2,915.19 crore reported for the April-June quarter.

show less

Retired BPCL chairman Sh. Arun Kumar Singh to be next chief of ONGC

BPCL’s former chairman Sh. Arun Kumar Singh is likely to be the new chairman of India’s top oil and gas producer Oil and Natural Gas Corporation (ONGC).

BPCL’s former chairman Sh. Arun Kumar Singh is likely to be the new chairman of India’s top oil and gas producer Oil and Natural Gas Corporation (ONGC).

read more

BPCL’s former chairman Sh. Arun Kumar Singh is likely to be the new chairman of India’s top oil and gas producer Oil and Natural Gas Corporation (ONGC). He retired from BPCL after attaining the superannuation age last month and was already selected to head the Petroleum and Natural Gas Regulatory Board (PNGRB) before the August 27 interviews. This will be the first time that a person aged over 60 will be heading a top PSU board-level position.

Big name in Oil refining market, Singh was chosen by a search-cum-selection committee, constituted by the oil ministry. They zeroed in on Singh after interviewing six candidates on August 27, 2022. If his selection is approved, Singh will be heading a cash-rich PSU (Public Sector Unit) for three years.

Eligibility criteria for a board-level position at PSU provide for an internal candidate (applicant from within the PSU) should not be more than 58 years of age on the date of the vacancy. This eligibility for external candidates is the maximum age of 57 years on the date of the vacancy.

https://currentaffairs.adda247.com/retired-bpcl-chairman-arun-kumar-singh-to-be-next-chief-of-ongc/

show less

Policy Matters/ Gas Pricing/ Others

Kirit Parikh panel may recommend price caps to help moderate CNG rates

A government-appointed gas price review panel, led by Sh. Kirit Parikh, is likely to recommend price caps for natural gas produced from legacy fields of state-owned firms to help moderate CNG and piped cooking gas rates, while keeping the pricing formula for difficult fields unchanged.

A government-appointed gas price review panel, led by Sh. Kirit Parikh, is likely to recommend price caps for natural gas produced from legacy fields of state-owned firms to help moderate CNG and piped cooking gas rates, while keeping the pricing formula for difficult fields unchanged.

read more

The panel, which was tasked with suggesting a “ fair price to the end-consumer “ while ensuring “ market-oriented, transparent and reliable pricing regime for India’s long-term vision for ensuring a gas-based economy”, may opt to suggest two different pricing regimes, officials said.

For the legacy or old fields of Oil and Natural Gas Corporation (ONGC) and Oil India Ltd (OIL) — where the cost has long been recovered and which are currently governed by a formula that uses rates in gas-surplus nations such as the US, Canada and Russia — the committee is likely to recommend a floor or minimum base price and cap or ceiling rates.

This would ensure that prices do not fall below cost of production, as they did last year, or do not spike to record levels as currently.

Gas from legacy fields is sold to city gas distributors who had to raise rates of CNG and piped cooking gas by over 70 per cent after prices went up from USD 2.90 per million British thermal unit till March to USD 6.10 in April and further to USD 8.57 last month, reflecting a surge in global rates. This rise in rates, which narrowed the gap between CNG and polluting diesel, had prompted the review.

For the gas from difficult fields such as those lying in deepsea or which are in high-pressure, high-temperature zones, the committee is likely to suggest not tinkering with the existing mechanism of paying them higher rates based on a different formula to compensate for the greater risk and cost involved, officials said.

This would ensure that explorers, who are seeing a surge in cost of services due to the spike in global energy rates, are not put at a disadvantage.

This way the concerns over investments in exploration and production (E&P) being hit would also be addressed, they said, adding that market-driven pricing would also encourage new investments and attract global players.

KG-D6 fields of Reliance Industries Ltd and its partner bp plc of UK are governed by the pricing formula for difficult fields. Rates for difficult fields from October 1 is USD 12.46 per mmBtu.

The panel headed by former planning commission member Sh. Kirit S Parikh is in the final stages of finalising its report. It would be submitted to the government in the next few days, the officials said, adding the cap for the legacy fields is likely to be higher than USD 4.75 per mmBtu cost of production and the floor could be set at USD 3.50.

The oil ministry will process the recommendations before moving the Cabinet for approval for changes in the existing gas pricing regime.

Natural gas is a fossil energy source that is formed deep beneath the earth’s surface. It is used to generate electricity, produce fertilisers and petrochemicals, converted into CNG to run automobiles and piped to household kitchens for cooking and heating. It is also used in making glass, steel, cement, bricks, ceramics, tile, paper, food products, and many other commodities as a heat source.

show less

India’s crude import basket at 10-month low but pump prices to remain high

The price of the Indian basket of crude oil has hit a 10-month low of $88.6 a barrel in November, government data showed.

The price of the Indian basket of crude oil has hit a 10-month low of $88.6 a barrel in November, government data showed.

read more

However, officials say this may not translate into an immediate reduction in rates at pumps as state-owned retailers might need time to recoup losses incurred earlier.

Over the past few days, a fresh Covid-19 outbreak in China has compounded fears of economic slowdown intensifying in major economies. As a result Brent crude spot prices fell on November 28 to their lowest since January 4, touching a low of $79.92 a barrel intraday. For India, every $1 per barrel dip in crude oil prices has an impact on its current account of about $1 billion.

However, petroleum ministry officials said oil marketing companies (OMCs) would need time to shore up earnings before retail prices can be reduced. “The government has decided to take a long-term view of the issue because the OMCs had kept prices low earlier this year when global prices had risen. We also have to see whether the current trend line holds”.

OMCs such as Indian Oil Corporation, Bharat Petroleum Corporation, and Hindustan Petroleum Corporation had a difficult September quarter, contending with high international crude and gas prices and low gross refining margins.

show less

LNG Use / LNG Development and Shipping

India to receive first LNG cargo from Indonesia’s Tangguh LNG

India will receive its first cargo from Indonesia’s Tangguh liquefied natural gas (LNG) plant at the Dahej terminal on Monday. The LNG cargo is being transported by the BW Helios tanker.

read more

“The vessel which had been acting as a floating storage since it lifted the cargo in mid-September is currently on a term charter to British oil major BP and is due to arrive at state-owned Petronet’s Dahej terminal on November 28.

The BW Helios picked up the cargo of 132,000 cubic metres at the Tangguh LNG loading facility on Sept. 18, according to Refinitiv data, and has a discharge date of Nov. 28.

The shipment was unusual as Indonesian LNG cargoes are typically exported to north Asia, and that India receives LNG cargoes from Qatar, Oman and the UAE. Japan, China and Korea are key LNG consumers in north Asia, but high inventories and muted spot demand in the region have weighed on Asia spot LNG prices in recent weeks.

https://www.naturalgasworld.com/india-to-get-first-lng-shipment-from-indonesias-tangguh-lng-102325

show less

PNGRB introduces three changes for United Tariff regulations effective from Apr 1, 2023

Petroleum and Natural Gas Regulatory Board (PNGRB) has brought out amendments in its three regulations namely Natural Gas Pipeline Tariff, Authorisation and Capacity Regulations.

Petroleum and Natural Gas Regulatory Board (PNGRB) has brought out amendments in its three regulations namely Natural Gas Pipeline Tariff, Authorisation and Capacity Regulations.

read more

Through these amendments the implementation of Unified Tariff regulations will be pushed which will be effective from April 1, 2023.

To accelerate the development of the natural gas infrastructure and usher rapid growth of the natural gas market in the country is the main goal of the board.

To address the settlement issues for implementation of Unified tariff, an industry committee has been constituted.

The objective of these changes is to provide access to natural gas in the far-flung areas at competitive and affordable rates to achieve the long-cherished objective of one nation, one grid and one tariff.

To simplify the implementation of unified tariff, entity level Integrated natural gas pipeline tariff has been introduced in the said regulations which will act as a building block for unified tariff at national level.

Further to protect the overall interest of consumers in different regions, the number of unified tariff zones have been increased from two to three.

In addition, other amendments like allowing unaccounted gas, moratorium period, ramp up in

capacity, etc., have been incorporated.

show less

India plans to spend $2.5BN on LNG storage infrastructure

India is planning to set up floating storage facilities for LNG at all its major ports with an investment of 200bn rupees ($2.45bn), Economic Times (ET) reported on November 25 quoting a senior government official.

read more

A plan is in the works. It would be finalised by the fiscal year-end [March 2023],” the official told ET. The project will be open for private sector participation.

India has 12 major ports of which Kochi in southern India and Kandla in western India already have accessible LNG storage facilities.

“LNG is soon going to be the preferred fuel for ships. The cryogenic storage being planned will receive and store natural gas in the liquid form and then refuel ships that come to the port,” the official said.

India is looking to boost the use of gas and is aiming to increase its share in the overall energy mix to 15% by 2030 from about 6-7% today.

https://www.naturalgasworld.com/india-plans-to-spend-2.5bn-on-lng-storage-infrastructure-102281

show less

Electric Mobility/ Hydrogen/ Bio- Methane

IOC plans to set up EV charging stations at 4,000 locations nationally

Indian Oil Corporation Ltd (IOCL) intends to set up electric vehicle (EV) charging infrastructure at 4,000 locations across India by 2024, said Sh. Manjeet Walia, the company’s Chief Divisional Retail Sales Head, speaking at the business line campus connect lecture series at Panjab University, Chandigarh.

Indian Oil Corporation Ltd (IOCL) intends to set up electric vehicle (EV) charging infrastructure at 4,000 locations across India by 2024, said Sh. Manjeet Walia, the company’s Chief Divisional Retail Sales Head, speaking at the business line campus connect lecture series at Panjab University, Chandigarh.

read more

Some 2,500-odd charging stations have already come up, he mentioned, while delivering his lecture on the topic ‘opportunities and challenges with EVs.’

Sh. Walia said that IOCL’s R&D team is also working on aluminium air batteries. This would look at replacing lithium — which is currently being imported — with aluminium which is currently available in abundance here. IOCL is also looking to set up battery swapping stations which would effectively save time associated with charging EV batteries. He also touched upon the company’s work in development of hydrogen cells for a “carbon neutral future of mobility.”

According to Sh. Akshay Sangwan, Director- Development & Commercial (Sonalika / ITL) and Executive Director (Sonalika Industries / ICML), who was also present at the lecture series organised by Panjab University, there is scope for start-ups to tap into the EV space. Pointing to opportunities, Sangwan said OEMs are currently relying on outsourcing knowledge — a segment that the various start-ups can now tap into.

Mrs Sonalika was willing to support such start-ups and also invest in them if the opportunity arises, he said. In fact, while taking up the issues associated with battery EVs and plug-in EVs — that include economic benefits, and environmental and safety concerns — Sh. Sangwan pointed to the retro-fitment feasibility of current vehicles that are in use.

Low power passenger and commercial vehicles are most likely to be the first adopters of EVs, he said. Students were also asked to tap into R&D on the EV segment with Sh. Veer Karan Goyal, research scholar at IIT Bombay and Power Electronics Design Engineer (R&D) at ElectroWaves Electronics, invited them to join him at his in-house production facility at Himachal Pradesh.

Most technology required in the EV sector was being outsourced and there was a need to make them within the country. Self-dependence in the vehicle charging and charger departments was important and this formed the backbone of Goyal’s interactive session.

show less

India’s green hydrogen plan will need an investment of ₹30 trillion by 2030

India is in the process of finalising the roadmap to a “green hydrogen economy” which will require an investment of ₹30 trillion by 2030, said Sh. Vivek Kumar Dewangan, chairman and managing director, REC.

India is in the process of finalising the roadmap to a “green hydrogen economy” which will require an investment of ₹30 trillion by 2030, said Sh. Vivek Kumar Dewangan, chairman and managing director, REC.

read more

The country’s green hydrogen plans would play a major role in achieving its goal of net zero emissions and becoming a developed nation by 2047.

“India has launched a green hydrogen project. Now, we are in the progress of finalising a roadmap for becoming a green hydrogen economy which would require ₹15 trillion and another ₹15 trillion is required to meet our middle-term goal by 2030. So in all, these initiatives would require an investment of ₹30 trillion by 2030,” Sh. Dewangan said.

show less

INTERNATIONAL NEWS

Natural Gas / Transnational Pipelines/ Others

Natural Gas /Transnational Pipelines/Others

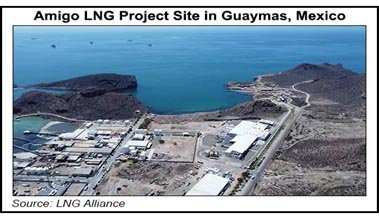

U.S. : U.S. Pipeline Constraints Could Hinder Mexico LNG Projects

Mexico has big plans to become an LNG export powerhouse, but it might not have the pipelines or available capacity to do so, according to experts.

Mexico has big plans to become an LNG export powerhouse, but it might not have the pipelines or available capacity to do so, according to experts.

read more

“Is there enough capacity and pipelines to support these projects? I don’t think so,” said the head of the Gadex consultancy, Eduardo Prud’homme, on Nov 14 at the LDC Gas Forums’ U.S.-Mexico show in San Antonio, TX.

Mexico plans to import gas from the United States for its liquefied natural gas export projects, which means securing upstream capacity. There is also competition for gas from around 10 other LNG export projects planned in the United States.

“There are a lot of moving parts that need to work in cohesion for these Mexico LNG projects to happen,” NGI’s Andrew Baker, senior editor, said during the event. Baker helmed a panel that included Prud’homme and Mexico energy expert Ms. Rosanetty Barrios.

“There is spare capacity in Mexico,” Barrios told the audience. The Comisión Federal de Electricidad (CFE) is “giving the signal it wants to use this spare capacity for LNG export projects.”

She said Mexico could still open up pipeline capacity to private sector companies, but only once the current administration of Andrés Manuel López Obrador is complete. The rules of the energy reform as enshrined in the constitution remain in place. “But if these LNG export projects go ahead, someone has to build new pipelines.”

So far, only the first phase of the 3 million metric tons/year (mmty) Energia Costa Azul (ECA) export project in Baja California, Mexico, is progressing, albeit with some delays. The project is sponsored by Sempra Infrastructure.

Mr. Prud’homme said New Fortress Energy Inc. (NFE) in conjunction with CFE could also see some advances. NFE executives last week said they expect to finish building their first “Fast LNG” unit by March. Operations could begin by mid-year offshore Mexico’s east coast, with several more units to follow. These include two at Altamira and one at the Lakach deepwater natural gas field off Veracruz state in a deal with state oil company Petróleos Mexicanos, aka Pemex.

Barrios, however, highlighted that Pemex has lost $43 billion so far in this administration, and theCFE another $7.59 billion, meaning the state companies may not be depended on for financing big-ticket projects.

There are other LNG export projects planned, too. President López Obrador said in September an LNG terminal could potentially be built in the port of Coatzacoalcos in southern Veracruz to export supply to Europe.

https://www.naturalgasintel.com/u-s-pipeline-constraints-could-hinder-mexico-lng-projects/

show less

Europe : Eastward gas flows on Yamal-Europe pipeline, Russian flows Via Ukraine rise

Eastbound gas flows rose on November 15 morning on the Yamal-Europe pipeline to Poland from Germany as did Russian supplies to Europe via Ukraine, pipeline operator data showed.

read more

Exit flows at the Mallnow metering point on the German border stood at 5,598,525 kilowatt hours(kWh) per hour between 0800 CET and 0900 CET, up from around 4,670,000 kWh/h seen the previous day.

Nominations for Russian gas into Slovakia from Ukraine via the Velke Kapusany border point rose to 41.2 million cubic metres (mcm), up from at 36.8 mcm the previous day, Ukrainian transmission system data showed.

Russian gas producer Gazprom said it will ship 42.4 million cubic metres (mcm) of gas to Europe via Ukraine on Tuesday, similar to levels over recent days.

Gas flows via the Nord Stream 1 pipeline, which crosses the Baltic Sea from Russia to Germany, remained at zero.

The pipeline was shut on Aug. 31 for what was supposed to be three days of maintenance but has not reopened, with Moscow blaming the situation on Western sanctions and technical issues.

Russia said it was unable to restart the pipeline but since then the pipeline has also been damaged by suspected sabotage. https://www.naturalgasworld.com/eastward-gas-supplies-on-yamal-europe-pipe-russian-deliveries-through-ukraine-rise-102089

show less

Natural Gas / LNG Utilization

China : Petrochina completes 1st LNG bunkering at Yantian port

PetroChina completed its first ship-to-ship (STS) bunkering of an LNG-fuelled ship at the Shenzhen Yantian Port on November 22, its parent company CNPC said on November 24.

read more

About 7,000 m3 of LNG was supplied to a containership owned by CMA CGM Group and the whole operation lasted for six hours, CNPC said. Yantian Port is located in the southern Chinese province of Guangdong.

State-owned CNPC said that the move will open up the market for LNG offshore bunkering in the Guangdong-Hong Kong-Macao Greater Bay Area, which extends across the two Chinese special administrative regions and nine Pearl River Delta cities.

The use of LNG as a fuel in the shipping industry has been gaining traction in China and the world amid a global push to reduce carbon emissions.

https://www.naturalgasworld.com/petrochina-completes-1st-sts-bunkering-at-yantian-port-12279

show less

GE and Shell to collaborate on LNG decarbonization pathway

GE gas power and Shell Global Solutions, a pioneer in liquefied natural gas (LNG) for more than 50 years, announced today they have signed a development agreement to pursue potential pathways aiming to reduce the carbon intensity of Shell’s LNG supply projects around the world.

read more

With global LNG demand projected to almost double by 2040, decarbonization is crucial in helping the company meet the world’s growing energy needs.

The largest source of emissions in an LNG facility stems from firing natural gas in the power generation and mechanical drive gas turbines. Therefore, one of the possible paths to decarbonize LNG production is to use hydrogen as a low carbon fuel in these engines.

However, the source and nature of this fuel matters as well, and Shell’s Blue Hydrogen Process is a leading technology that can deliver the lowest carbon intensity fuel of its kind, with technologies and building blocks tested and commercially proven at a large scale, that have been used in various industries for many decades.

“Having worked on hydrogen combustion technologies for many years, we are conscious that progress in this area will be the result of careful, dedicated research and collaboration by industry leaders and today’s announcement is a model of this approach,” said John Intile, Vice President, Engineering at GE Gas Power.

https://www.geospatialworld.net/news/ge-gas-power-shell-lng-decarbonization-hydrogen/

show less

Global LNG Development

TES targets German LNG launch within 12 months

LNG developer Tree Energy Solutions (TES) has signed a contract with ECOnnect Energy to secure infrastructure to connect its planned floating storage regasification unit (FSRU) with an onshore terminal in the German port of Wilhelmshaven, the company said on November 15, estimating that the project will be ready to receive gas within 12 months.

read more

TES’ terminal is one of five LNG import projects that Germany is looking to develop over the coming years to replace Russian gas. ECOnnects IQay solution” will substitute a conventional jetty, fast-tracking deployment while minimising construction costs and environmental impacts,” TES said.

“The IQuay solution allows for incredibly fast installation and natural gas import into Wilhelmshaven, while also enabling a future hydrogen hub,” said Morten Christophersen, CEO at ECOnnect. "We are proud that our flexible import solution is consistent with TES’s vision to address Germany’s immediate energy demand and also its long-term carbon-neutral energy import strategy.”

The terminal is expected to be up and running in autumn 2023, TES said.

https://www.naturalgasworld.com/tes-targets-german-lng-launch-within-12-months-102091

show less

China : China builds largest LNG bunker vessel by converting gas carrier

China completed the first conversion project of an LNG gas carrier into an LNG bunker vessel.

read more

The Hai Yang Shi You 301 (16,250 dwt) became, according to Chinese media reports, the largest LNG bunkering vessel and the first in China to support the broader international ocean-going ship market.

Guangzhou Shipbuilding International (GSI), a division of China State Shipbuilding Corporation(CSSC), undertook the conversion which lasted approximately 80 days. A former gas carrier, built in 2015 and according to Chinese media, was operating transporting LNG in China’s coastal regions. The ship had the capacity to transport 30,000 cubic meters of LNG.

The vessel, which is 605 feet long, was delivered to the shipyard at the beginning of August 2022, to begin the conversion. According to CNOOC Energy Technology & Services which will be operating the Hai Yang Shi You 301, the renovation project included adding cryogenic units, gas combustion devices, front bunkering stations, reliquefaction systems, and other equipment for LNG bunkering operations. They also altered the mooring equipment and added anti-collision capabilities necessary to operate as a bunkering vessel.

The vessel now has the capability to conduct ship-to-ship transfers with a fueling capacity of 1,650 cubic meters of LNG per hour. The Hai Yang Shi You 301 will be operated by CNOOC from a base in the Nansha district of Guangzhou. CNOOC reports it will be fueling large, ocean-going containerships, ore carriers, crude tankers, and Ro-Ros.

Previously, Avenir had reported that its 20,000 cbm LNG bunker vessels were the largest by capacity. The newbuilds were built in China for the company with the first vessel introduced in 2021. They surpassed the Gas Agility, operated by TOTAL in Northern Europe, which claimed the title of the largest LNG bunker vessel with a capacity of 18,600cbm.

DNV’s Alternative Fuel Insights database reports that there are currently 40 bunker vessels in operation to service the fleet of primarily LNG-fuel dual vessels emerging using alternatives. They expect in the next three years that the fleet will increase by 50 percent with 20 additional bunker vessels on order. They also report that another 17 are believed to be under discussion.

While gas carriers are in demand for the LNG export market, conversion of some of the vessels might also provide a quicker solution to expanding the LNG bunker fleet to meet the growing demand as more ocean-going carriers build vessels designed to operate on LNG. DNV reports that LNG-fueled vessels are expected to more than double from the current 323 in service to over 800 by 2025.

show less

Germany completes construction of its first floating LNG terminal

Liquefied natural gas facility will be central to securing energy supplies this winter, says minister

read more

Germany has completed construction of its first floating terminal to receive liquefied natural gas(LNG), which its economy minister said would be vital to securing energy supplies to the country over the winter months.

Mr. Robert Habeck described the first of five planned floating terminals at the North Sea port of Wilhelmshaven as “a central building block for the security of our energy supplies this coming winter”, as Germany races to find alternatives to Russian pipeline gas, on which it had relied for years until supplies were halted during the invasion of Ukraine.

A pier at Wilhelmshaven has been expanded to provide a mooring place for a floating storage and regasification unit (FSRU), the central component for transporting LNG via sea and transferring it to land. Before the end of this year, the first FSRU is due to be in operation to regasify LNG, arriving on special tankers from around the world. The first FSRU, the Esperanza, is expected to arrive with a full load in about a month and to be unloaded.

Olaf Lies, the economy minister of the northern state of Lower Saxony, in which Wilhelmshaven is located, said as more LNG tankers arrived the Esperanza would be moored accordingly, in order to process their supplies.

Mr. Habeck said the building of the mooring site had happened at “enormous speed” and called it proof that Germany was able to “quickly and with a high degree of decisiveness progress infrastructure projects”, crediting the cooperation between central government and the state of Lower Saxony, which he said had “pulled together”.

The government is working on introducing a total of five swimming LNG terminals to German ports, each with a capacity of at least 5bn m3 per year.

The terminal at Wilhelmshaven, and another at Brunsbüttel, are expected to be operational early next year.

The third and fourth FSRUs are to be opened at the ports of Stade and Lubmin, and are expected to be operational by the end of 2023. The fifth will be in Wilhelmshaven and is due to be up and running by the fourth quarter of next year.

In addition, a private special ship is planned for Lubmin with an annual capacity of 4.5bn m3 a year, to be ready from the end of 2022, according to the economics ministry.

A spokesperson said an annual total of 25bn m3 would be provided by state-run FSRUs, and together with the privately run FSRU would cover about a third of Germany’s gas needs, based on 2021 levels.

In addition to LNG, Germany has gas storage facilities around the country that are full. They are capable of covering about 28% of the country’s entire gas requirements.

The government and the Federal Network Agency responsible for power hopes existing supplies, the LNG, together with savings that industry and private homes are making, will be sufficient to get Europe’s largest economy through the winter.

show less

Seapeak orders LNG newbuilds from Samsung Heavy Industries

Seapeak LLC has entered into shipbuilding contracts for the construction of five, 174 000 m3 M-type, electronically controlled, gas admission (MEGA) propulsion LNG carrier newbuildings.

read more

The LNG carriers will be constructed by Samsung Heavy Industries Co., Ltd for a total fully built-up cost of approximately US$1.1 billion and are scheduled for delivery in 2027.

Upon their deliveries, the five LNG carriers will each operate under a fixed-rate time-charter contract with an international energy major for a firm period of 10 years, each of which can be extended at the option of the charterer.

Seapeak expects to finance the initial new building construction instalment payments by way of an equity contribution from investment funds managed by its sponsor, Stonepeak. In due course, Seapeak expects to secure long-term debt funding to finance the remaining construction costs.

show less

LNG as a Marine Fuel/Shipping

Mozambique : BP begins LNG shipping from Mozambique’s FLNG project

BP has started the shipping of liquefied natural gas (LNG) cargo from the $8bn Coral South floating LNG (FLNG) project in the Rovuma basin, off the coast of Mozambique.

BP has started the shipping of liquefied natural gas (LNG) cargo from the $8bn Coral South floating LNG (FLNG) project in the Rovuma basin, off the coast of Mozambique.

read more

According to the long-term contract signed in 2016, BP will purchase 100% of the LNG produced from the Coral Sul FLNG, which is expected to produce 450 billion cubic metres of natural gas.

The 20-year offtake contract was signed with the Coral sellers comprising Mozambique Rovuma Venture, a joint venture between ExxonMobil, Eni, CNPC, GALP, KOGAS, and Mozambique state entity Empresa Nacional de Hidrocarbonetos (ENH).

The Coral Sul FLNG facility is said to be Mozambique’s first LNG project.

In a press statement, BP said: “As BP aims for an LNG portfolio of 30 million tonnes by 2030, the new Mozambique supply source expands BP’s flexible, high-quality LNG portfolio and further enhances the company’s capability to deliver LNG to markets globally.”

Located at a water depth of nearly 2,000m, the FLNG facility is equipped to liquefy 3.4 million metric tonnes per annum (Mmtpa) of gas. It produces through six subsea wells.

BP trading and shipping executive vice-president Carol Howle said: “The start of production from the Coral Sul FLNG facility represents a major milestone for Mozambique, the project partners, and BP as the LNG buyer.

“As the world seeks secure, affordable, and lower carbon energy, global demand for LNG is expected to continue to grow. This new supply source further enhances BP’s capability to deliver LNG to markets across the world and we look forward to continuing our close collaboration with all those involved in the project.”

BP recently reported underlying profits of $8.2bn for the third quarter of 2022, making it one of the company’s most profitable years ever.

https://www.offshore-technology.com/news/bp-mozambiques-flng/

show less

Singapore : ExxonMobil completes two commercial bio-based marine fuel oil deliveries in Port of Singapore

ExxonMobil successfully delivered two commercial bio-based marine fuel oil bunkering operations in the Port of Singapore on 13 August 2022 and 27 September 2022.

ExxonMobil successfully delivered two commercial bio-based marine fuel oil bunkering operations in the Port of Singapore on 13 August 2022 and 27 September 2022.

read more

PAPUA, chartered by Papua New Guinea Liquefied Natural Gas Global Company LDC (PNG LNG), received ExxonMobil’s marine biofuel via ship-to-ship transfer in Singapore waters as part of the two deliveries. The bio-based marine fuel oil was consumed during PAPUA’s voyages in the Asia Pacific region.

The marine biofuel used is a 0.50% sulphur residual-based fuel (VLSFO) processed with up to 25% waste-based fatty acid methyl esters (FAME). The resulting blend meets International Organization for Standardization ISO 8217:2017, while the FAME content complies with EN 14214. The bio-component has been accredited by the International Sustainability and Carbon Certification (ISCC) organisation.

This trial phase is an important step as we continue to test viable marine biofuels as an engine-ready alternative to conventional fuel oil, said Mr. Andre Kostelnik, President of SeaRiver Maritime, Inc., a wholly owned subsidiary of ExxonMobil.

show less

China : China’s first LNG carrier and refuelling vessel put into service

China’s first liquefied natural gas (LNG) carrier and refuelling vessel, “Offshore Oil 301”, completed its refitting and was put into use on Tuesday, which will provide flexible refuelling service for the country’s offshore LNG vessels, China National Offshore Oil Corporation (CNOOC) said.

China’s first liquefied natural gas (LNG) carrier and refuelling vessel, “Offshore Oil 301”, completed its refitting and was put into use on Tuesday, which will provide flexible refuelling service for the country’s offshore LNG vessels, China National Offshore Oil Corporation (CNOOC) said.

read more

LNG refuelling vessels are an important class of infrastructure to promote the use of LNG as shipping fuel. This latest development kicks off the water-based refuelling business using LNG, and will play a positive role in building an international ship refuelling centre for LNG and promoting energy

transformation and green development, experts noted.

The “Offshore Oil 301” was originally a LNG carrier, measuring 184.7 metres in length and 28.1 metres in width, with a capacity to carry 30,000 cubic metres of LNG.

The refuelling function is realised by adding key equipment such as gas combustion device, ship-to-ship refuelling system and re-liquefaction device, together with supporting security systems, fire-fighting system and other systems, among which a number of technologies such as LNG refuelling system and gas combustion device are the first of their kind in China.

Following its refitting, the design refuelling capacity of "Offshore Oil 301" reaches 1,650 cubic metres per hour, which can provide LNG refuelling service for large container ships, crude oil carriers and ro-ro carriers, and is the largest LNG carrier refuelling vessel in the world.

As the global community heightens focus on environmental protection, the use of LNG as a clean energy source is gaining more and more attention. Data shows that the number of global ocean-going LNG-powered vessels reached 251 in 2021, more than double compared to 119 in 2017.

Orders for LNG-powered vessels totaled 225, an increase of 300 percent compared to 56 in 2020, the China Media Group reported.

The conversion of LNG carriers into transport and refuelling vessels is the first of its kind in China.

Compared with traditional refuelling, ship-to-ship refuelling can realise the synchronous operation of cargo loading and unloading and fuel refuelling, which shortens the time of ship’s port call and greatly enhances the international competitiveness of ports.

CNOOC is actively building international LNG refuelling centres in the Pearl River Delta and Yangtze River Delta regions. After delivery, the vessel will complete the first LNG refuelling operation for international vessels as soon as possible.

https://www.globaltimes.cn/page/202211/1279580.shtml

show less

Technological Development for Cleaner and Greener Environment Hydrogen & Bio-Methane

Fast EV charging using natural gas offered by entrepreneur Mr. Stevan Bratic

Serial entrepreneur Mr. Stevan Bratic, owner of Bratic Enterprises, has developed an electric vehicle charging system that uses natural gas, instead of electricity, to recharge EVs.

Serial entrepreneur Mr. Stevan Bratic, owner of Bratic Enterprises, has developed an electric vehicle charging system that uses natural gas, instead of electricity, to recharge EVs.

read more

These EV “PODS” can be permanently mounted, or mobile depending on the commercial customers’ needs. They also can be used as a profit centre by allowing commercial clients, such as shopping malls and restaurants, to allow their clients to charge EVs for a fee while they shop or dine. The rapid charging feature can get an EV to 80 percent charge in just 15 minutes.

Low-cost financing and leasing also are provided by Bratic.

show less

Saudi : Red Sea Global signs deal for sustainable electric mobility network

Saudi sustainable tourism development company Red Sea Global has signed a deal with Electromin and Energy International Corporation to deliver a carbon-neutral, electric mobility network to its Red Sea development.

Saudi sustainable tourism development company Red Sea Global has signed a deal with Electromin and Energy International Corporation to deliver a carbon-neutral, electric mobility network to its Red Sea development.

read more

Electromin will assist in the supply of an electric bus fleet in collaboration with the Chinese company Yutong and the European manufacturer and supplier of electric vehicles, EURABUS.

The fleet of zero-emission electric buses, which will be used initially to transport employees around the site, marks the company’s first smart sustainable integrated transport network.

“This deal is the first step on the road to a fully integrated mobility network spanning land, sea and air, which will enable safe movement of visitors, residents, and goods,” said Andreas T. Flourou, RSG’s executive director of mobility operations.

To conveniently service regular routes for employees, the fleet will consist of two types of vehicles: a smaller vehicle with a range of around 250 km and a larger bus with a range of roughly 350km when fully charged.

Emission-free transport at RSG corresponds with its larger ambition to power the entire destination with solar energy, thus reducing carbon emissions by about 500K tons per year.

Commenting on the deal, RSG’s group CEO Mr. John Pagano said: “Our mission has always been to set the standard for regenerative tourism. Carbon-neutral operations across the Red Sea are a key part of achieving this.”

RSG’s moves toward sustainable mobility across its development aligns with the Kingdom’s Vision 2030 goals towards reducing carbon emissions and driving sustainability to address the impact of climate change.

In addition, RSG said it will establish a new resort, Faena The Red Sea, in its tourist destination, with operations starting in 2024.

Furthermore, RSG’s mandate has expanded to oversee upwards of a dozen projects stretching the length of the Red Sea coast of Saudi Arabia, with the potential to expand beyond the Kingdom in the future.

Earlier this month, Saudi Arabia’s Crown Prince Mohammed bin Salman launched the first Saudi EV brand Ceer. Ceer is set to directly contribute $8 billion to Saudi Arabia’s GDP by 2034.

Part of the Saudi Public Investment Fund’s strategy is to diversify Saudi Arabia’s gross domestic product increases by investing in promising growth industries — Ceer will attract over $150 million of foreign direct investment, and create up to 30,000 direct and indirect jobs.

Speaking at the Saudi Green Initiative, which took place on the sidelines of the UN Climate Change Conference last week, PIF’s Governor, Yasir Al-Rumayyan said that the Kingdom plans to build 328,000 EVs per year, with investments in the electronic vehicles sector.

He added that the Kingdom has a target to generate 50 percent of its energy from renewable sources by 2030, and PIF is responsible for developing 70 percent of this renewable energy.

Elaborating on the expansion of EV plans in Saudi Arabia, Cadillac, a division of the US automobile manufacturer General Motors Corp., is also planning to launch its first EV in the Kingdom during the first half of 2023, said Mr. Kristian Aquilina, MD of Cadillac Middle East and international operations.

“We are talking to some government authorities, and their target of electrifying 30 percent of Riyadh’s transportation by 2030 is driving a lot of momentum,” Mr. Aquilina said last September.

https://www.arabnews.com/node/2200226/business-economy

show less