NGS’ NG/LNG SNAPSHOT – Jan 1-15, 2023

NGS’ NG/LNG SNAPSHOT – Jan 1-15, 2023

National News Internatonal News

NATIONAL NEWS

City Gas Distribution & Auto LPG

Assam CM flags off 100 CNG buses, inaugurates 1st green fuel station

Assam Chief Minister Sh. Himanta Biswa Sarma on Sunday flagged off 100 new CNG-run buses, as part of the Smart City Mission.

Assam Chief Minister Sh. Himanta Biswa Sarma on Sunday flagged off 100 new CNG-run buses, as part of the Smart City Mission.

read more

He also inaugurated the city’s first CNG fuel station.The CM said the launch of the CNG-run buses and the inauguration of the fuel station were decisive steps for “ gradual but firm mitigation” of the impacts of climate change and global warming. The CNG buses were gifted by Guwahati Smart City Ltd to Assam State Transport Corporation.

The passenger vehicles are equipped with air-conditioning, fire-detection, global positioning systems and several other features, and will be operated by ASTC.

Noting that excessive use of fossil fuel, such as petrol and diesel, is the prime reason for global warming, the CM said the carbon emission from the use of such energy is creating climatic imbalances in many parts of the globe, including Assam.

It is important that “all must unite to mitigate the impacts of climate change and work out a long-term and permanent solution”, he said, adding that green energy, such as compressed natural gas, is the answer to the problem.

The gradual transition towards clean and green fuel in the public transport system of Guwahati would ensure that the state contributes towards the nation’s commitments on capping carbon emissions, Sh. Sarma said.

Gradually, other public transport vehicles, such as auto-rickshaws, and vans, would also be brought under the ambit of CNG, while the possibility of allowing CNG-run private vehicles would also be explored, he said.

The CM hailed Prime Minister Sh. Narendra Modi for implementing the gas-grid project, without which the launch of CNG station in Assam wouldn’t have been possible.

show less

Andhra Pradesh gets its first Liquified Compressed Natural Gas station in Kadapa

Andhra Pradesh’s first Liquified Compressed Natural Gas (LCNG) station was launched by AG&P Pratham, one of the leading players in the Indian City Gas Distribution (CGD) industry, at APIIC Industrial Park in Kadapa of YSR district. The LCNG station was inaugurated by the Deputy Chief Minister of Andhra Pradesh, Sh. Amzath Basha Shaik Bepari.

read more

Launching the LCNG station the Deputy CM said, ”The use of CNG has several merits over traditional fuels like diesel and petrol and we want to promote its use and help create an environmental-friendly ecosystem in Andhra Pradesh. Natural gas helps reduce air pollution caused by vehicles and industries and helps the country move towards responsible growth and energy sufficiency.”

He further said the government of Andhra Pradesh encourages companies like AG&P Pratham to continue their work in the state to ensure the faster roll-out of natural gas for CNG, industrial, commercial and domestic segments.With the launch of this new station, the residents of Kadapa and nearby areas have a source of this green fuel. Through this LCNG station, people in the areas of APHB Colony, Prakash Nagar, Sankara Puram, Pakkirapalli, Arvind Nagar, Reddy Colony, Bhagyanagar Colony, NGO Colony, Yeramukapalli, Maruti Nagar. Sainik Nagar, Ramanjeya Puram, Tilak Nagar, YSR Colony, Telecom Nagar, Vidhyut Nagar, RK Nagar, and RTC Colony will have access to natural gas.

Sh. Abhilesh Gupta, the MD and CEO of AG&P Pratham, said the launch of the first LCNG station is a commitment to make Andhra Pradesh adopt natural gas as an alternate fuel in households, industries, commercial and transport segments. ”AG&P Pratham aims to develop 300+ CNG stations, serve 26+ lakhs houses, 10000+ commercial establishments and 150+ industries generating 7000+ employment in the next eight years across Andhra Pradesh,” he said.

With a capacity to handle 100 tons of natural gas a day, the Kadapa LCNG station will cater to the requirements of YSR and Annamayya districts. The company will develop a 150-km pipeline network in Kadapa town of YSR district by the end of FY23. The new station will benefit 4,000 households, three industrial and 10 commercial establishments across Kadapa by March 2023. AG&P Pratham plans to launch two more LCNG stations in Andhra Pradesh in Ojili, Tirupati district and in Rapthadu village, Anantapur district in the near future.

AG&P Pratham is developing CGD networks in seven districts of Andhra Pradesh, including Sri Balaji, Chittoor, SPSR Nellore, YSR, Annamayya, Sri Sathya Sai and Anantapur. To date, AG&P Pratham has launched 21 CNG stations in Anantapur, YSR, Annamayya, and Sri Sathya Sai districts, 15 in SPSR Nellore and Sri Balaji Districts, and nine in Chittoor district. The company plans to launch seven more CNG stations in the state by March 2023.

show less

Natural Gas/ Pipelines/ Company News

R K Jain takes over as chairman of IGL

Sh. Rakesh Kumar Jain has taken over as the chairman of Indraprastha Gas Ltd, the firm that retails CNG to automobiles and piped natural gas to household kitchens in the national capital region and neighbouring towns. Jain, who is Director (Finance) at state gas utility GAIL (India) Ltd, took over as the company chairman on January 14, IGL said in a regulatory filing.

read more

IGL is a joint venture of GAIL and Bharat Petroleum Corporation Ltd (BPCL), and they hold 22.5 per cent stake each. The two firms appoint directors on the board and rotate chairmanship among themselves. Sh. Jain replaces Sukhmal Kumar Jain, Director (Marketing) of BPCL, who was chairman of IGL from October 23, 2022.

Sh. Sukhmal Kumar Jain will continue to be director of IGL, the filing said. “Sh. Rakesh Kumar Jain, nominee of GAIL is Director (Finance) of GAIL. He is a Cost and Management Accountant by profession,” the filing said.

“Sh. Jain has worked in the areas of corporate finance and treasury including forex risk management, capital budgeting, corporate budgets, corporate accounts, finalisation of long-term international LNG and gas agreements, pricing, liquefaction and regasification terminal service agreement, mergers and acquisitions, taxation and regulatory aspects”. Besides serving a long tenure at GAIL, he was on deputation to Petroleum and Natural Gas Regulatory Board (PNGRB), as Joint Director (Commercial and Finance).

show less

Indo-Bangla Friendship Pipeline likely to be commissioned in February

The ambitious 130-km long Indo-Bangla Friendship Pipeline (IBFPL), constructed at a cost of Rs 377.08 crore, is likely to be commissioned by next month, official sources said on Sunday.

The ambitious 130-km long Indo-Bangla Friendship Pipeline (IBFPL), constructed at a cost of Rs 377.08 crore, is likely to be commissioned by next month, official sources said on Sunday.

read more

The international oil pipeline, IBFPL, will carry fuel from Assam-based Numaligarh Refinery Ltd (NRL) marketing terminal at Siliguri in West Bengal to the Parbatipur depot of Bangladesh Petroleum Corporation (BPC).

The mechanical works of the bilateral project, being funded by India, was completed on December 12 last year, a senior official of NRL told PTI on condition of anonymity.

“We have set the commissioning target completion in February 2023,” he added.

The ground breaking ceremony for the 130-km IBFPL was held in September 2018 in the presence of Prime Ministers of India and Bangladesh through video conferencing. “ The project is in a true sense an engineering marvel. We faced lots of hurdles but with mutual cooperation and technological understanding between the two countries, this international project will see the light of the day,” another senior executive of the Northeast’s largest refiner said.

The IBFPL has been successfully implemented because of the true friendship between India and Bangladesh, and it will remain as a testimony of best relationship between the two South Asian nations, she added.

Indian Prime Minister Narendra Modi in his meeting with Hasina in 2017 had agreed to finance this pipeline with a capacity of one million metric tonne per annum (MMTPA).The total project cost for construction of the IBFPL is Rs 377.08 crore. Out of this, NRL's investment is Rs 91.84 crore for the

India portion of the pipeline, while the remaining Rs 285.24 crore for Bangladesh portion is being funded by the Indian government as grant-in-aid.

According to a recent report, prepared by Assam Assembly on the visit of a delegation of the legislators to the neighbouring country, Bangladesh will start importing gas and oil from NRL later this year.

The delegation met Bangladesh Prime Minister Sheikh Hasina, who said that “importing fuel oil from India through pipeline” will start from this year, it added.

“She said that Bangladesh wants to import oil from India through pipeline… The 130-km India-Bangladesh Friendship Pipeline (IBFPL) project aims to export oil products from India to Bangladesh,”

Later in October of the same year, the state-run NRL signed another 15-year agreement with the BPC for export of gas oil (diesel) to the neighbouring nation.

In NRL, Oil India Ltd has 69.63 per cent stake, while Assam Government and Engineers India Ltd have 26 per cent and 4.37 per cent holding respectively.

show less

After public consultation, PNGRB invites bids for laying of pipeline

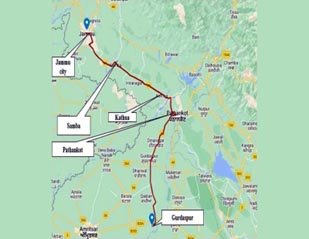

After completing the public consultation process, the Union Petroleum and Natural Gas Regulatory Board (PNGRB), has invited bids from the interested entities for laying of the 175 kilometres long gas pipeline from Gurdaspur in Punjab to Jammu, a senior PNGRB official said.

After completing the public consultation process, the Union Petroleum and Natural Gas Regulatory Board (PNGRB), has invited bids from the interested entities for laying of the 175 kilometres long gas pipeline from Gurdaspur in Punjab to Jammu, a senior PNGRB official said.

read more

“We have invited online applications-cum-bids from the interested and eligible entities for authorization of Gurdaspur-Jammu Natural Gas Pipeline with an initial system capacity of at least 2.0 million metric standard cubic metres of gas per day (MMSCMD) under Regulation 5 of PNGRB (Authorising Entities to Lay, Build, Operate or Expand Natural Gas Pipelines) Regulations, 2008,” Mohammad Tanweer Ahmed, Joint Secretary, PNGRB told the Excelsior. According to him, the public consultation process to lay the gas pipeline started on September 29, 2022 in terms of Regulations 5(1) of the PNGRB NGPL Authorization Regulations.

“The views/comments of the persons/stakeholders/entities as part of the public consultation process were invited in writing regarding the originating point, terminating point, route along with the indicative map/ minimum capacity and source of the gas for the proposed Gurdaspur-Jammu Natural Gas Pipeline within 30 days of publication of the notice on PNGRB website, on September 29,” he said.

Further, the PNGRB Joint Secretary, Mohammad Tanweer Ahmed said: “The views/comments received from various entities/stakeholders were web hosted on the website of the PNGRB for information of the public. An open house discussion with stakeholders who offered views/comments was also held on November 9, last year after which we’ve invited the bids from interested entities for laying of the pipeline.” Sh Tanweer said the bid document downloading and the process for the submission of the bids started on January 6, 2023. “A pre-bid conference for addressing the queries of the stakeholders/entities shall be held on February 7, 2023 while May 8, 2023 has been fixed as the last date for downloading the bid document and submission of the bids,” he added.

According to the senior PNGRB official, the technical bid opening date has been fixed as May 10,2023. “After the opening of the technical bid on May 10, this year”, he said: “The successful bidder will start the surveying process, preparation of the proposed gas pipeline route and come up with the expected expenditure figures to lay the pipeline between Gurdaspur and Jammu. Thereafter, the PNGRB will issue the authorization for laying of the pipeline.” As per a sample bid document available on the website of the PNGRB, the tentative route of the Main Trunk Pipeline shall be Gurdaspur-Pathankot-Kathua-Samba and Jammu City.

“The originating point of the 175 kilometres gas pipeline shall be Gurdaspur [GIS coordinates: Latitude: 31.668891, Longitude: 75.429860] and the termination point shall be Jammu City,” read the sample bid document.

It also read, “Under the Standard Operating Procedure (SOP) of PM Gati Shakti Master Plan, Network Planning Group in its 27th meeting held on July 19, 2022, had recommended the proposed pipeline project with the suggestion that realignment of the pipeline along the Right of Way (RoW) of the upcoming Amritsar-Katra expressway to the extent possible may be explored.”

Pertinently, the first time a gas pipeline project for Jammu and Kashmir, then known as Bathinda-Jammu Tawi-Srinagar Gas Pipeline Project, was conceived in the year 2011 when Omar Abdullah was heading a coalition Government with the Congress in Jammu and Kashmir.

The PNGRB on July 7, 2011 had even granted the authorization for laying, building, operating or expanding the natural gas pipeline along the route of Bathinda-Kathua-Jammu-Srinagar under the Petroleum and Natural Gas Regulatory Board (Authorising Entities to Lay, Build, Operate or Expand Natural Gas Pipelines) Regulations, 2008, to M/S Gujarat State Petronet Limited (GSPL).

But the project couldn’t move ahead due to tough terrain related challenges owing to which the PNGRB had to foreclose the contract of GSPL.

The fresh project to lay a 175 kilometres pipeline between Gurdaspur in Punjab and Jammu and Jammu and Kashmir was announced by Union Finance Minister Nirmala Sitharaman in her 2020 budget speech.

https://www.dailyexcelsior.com/after-public-consultation-pngrb-invites-bids-for-laying-of-pipeline/

show less

Policy Matters/ Gas Pricing/ Others

Adani firm hikes CNG price by Re 1 in Gujarat

Private player Adani Total Gas Limited hiked the price of compressed natural gas (CNG) in Gujarat by Re 1 per kilogram effective from Jan 10, 2023. .

read more

This has taken the price from Rs 79.34 to Rs 80.34 per kilogram, said Arvind Thakkar, president of Federation of Gujarat Petroleum Dealers Association.

The hike by Adani Total Gas Limited comes days after state-run Gujarat Gas raised the price of CNG by nearly Rs 3.5 per kg, Sh. Thakkar added.

show less

Crude check. Short build-up on MCX-Crude oil

Crude oil prices slumped last week and have begun the year on a weak note. The Brent futures on the Intercontinental Exchange (ICE) declined 8.6 per cent to end the week at $78.5 per barrel. Likewise, the continuous contract of crude oil on the Multi Commodity Exchange (MCX) tumbled 6.2 percent to close the week at ₹6,149 a barrel.

read more

Inventory build-up in the US weighed on the prices last week. According to the Energy Information Administration (EIA), the crude oil stocks in the US shot up by 1.7 million barrels for the week ended December 30, which was higher compared with an increase of 0.7 million barrels in the preceding week. Moreover, the latest data showed that the Manufacturing and Services PMI in the US were in the contraction zone, raising the demand concerns.

On the charts too, the bearish bias is very evident as both Brent and MCX futures have formed a lower low after falling off a resistance level. The possibility is high to see more fall from here.

Brent futures ($78.5)

The Brent futures declined after facing a roadblock at $87. Also, $85 is a resistance level. Now it has fallen back below $80-mark and the nearest support from the current level is seen at $76. Given that the overall trend is weak, the contract might drop below $76 and head south towards $65. On the upside, a rally beyond $85 is difficult.

MCX-Crude oil (₹6,149)

The January futures of crude oil plummeted on the back of the resistance at ₹6,750. In addition to this, the presence of the 50-day moving average at around ₹6,700 helped the bears’ cause.

Notably, the contract has closed below the ₹6,200 support, opening the door for further depreciation. There is significant short build-up as the cumulative Open Interest (OI) of crude oil futures increased to 11,610 contracts from 6,138 contracts over the past week. This strengthens the bearish case and increase the probability of more downside.

The contract is likely to slip below the support at ₹5,900 and decline to ₹5,600 in the near term. A breach of this level can result in a fall to ₹5,400.

On the upside, the contract has a resistance at ₹6,400 and another strong one at ₹6,750. For the bulls to stand a chance against the bears, the prices should rise decisively above ₹6,750. Until then, bears are expected to dominate.

Trading strategy: One can consider initiating fresh short positions at the current level of ₹6,149. Add more shorts if the price moves up to ₹6,400. Place stop-loss at ₹6,750 at first. Revise it down to ₹6,050 when price falls below ₹5,900. Tighten it further to ₹5,900 when the contract goes below ₹5,750. Exit the shorts at ₹5,600.

show less

Price volatility may affect India’s target of increasing natural gas’ energy share

India’s target of increasing natural gas’ (NG) share of energy to 15 per cent by 2030, from 6 per cent in 2017, may be impacted by the price volatility and infrastructure constraints, a report by Fitch Ratings said.

India’s target of increasing natural gas’ (NG) share of energy to 15 per cent by 2030, from 6 per cent in 2017, may be impacted by the price volatility and infrastructure constraints, a report by Fitch Ratings said.

read more

The challenges might affect the goal despite resilient demand from city gas distribution (CGD) networks and rising domestic production.

Natural gas’s share of energy has remained at 6 per cent since 2021, as per the report.

As the sectors switch to cheaper alternative fuels, the NG demand from price sensitive industrial and power sectors may be limited in times of rising NG prices.

The pace of adoption of gas for mobility and household fuel may also slow in times when its price benefit against alternate fuels decreases.

“India’s inadequate gas pipeline infrastructure and potential execution delays in some projects under construction may delay NG demand growth. Underutilised existing LNG import infrastructure may slow new capex in the near to medium term. Still, the operationalisation of new CGD networks, the price advantage of NG against other fuels, and increased adoption of NG to comply with pollution norms would support long-term NG demand from CGDs,” said the report.

On the outlook, Fitch stated that energy growth, aided by India’s GDP growth estimate of 7 per cent a year over the next few financial years and the government’s efforts to increase natural gas and renewables’ share in the energy mix on its path of decarbonisation would support mid-single-digit natural gas demand growth over the medium term.

Prime Minister Narendra Modi committed to an ambitious five-part “Panchamrit” pledge, including reaching 500 GW of non-fossil electricity capacity, to generate half of all energy requirements from renewables, to reduce emissions by 1 billion tons by 2030, at the COP26 summit in Glasgow in late 2021.

India also aims to reduce the emissions intensity of GDP by 45 per cent. Finally, India commits to net-zero emissions by 2070.

Walking the talk, India has gone ahead and banned the use of several single-use plastics starting July 2022.

The adverse impacts of littered single-use plastic items on both terrestrial and aquatic ecosystems, including in marine environments are globally recognized.

show less

LNG Use / LNG Development and Shipping

Electric Mobility/ Hydrogen/ Bio- Methane

Guyana seeks Indian investment in it’s Hydrocarbon sector

Guyana wants Indian companies to invest in its oil and gas sector as the South American nation aims to expand its nascent energy sector, a senior Indian foreign ministry official said on Jan 10,2023.

read more

Guyana’s President Mohamed Irfaan Ali and Suriname‘s President Sh. Chandrikapersad ‘Chan’ Santokhi, who is visiting India, held discussions on Monday with Indian Prime Minister Narendra Modi at a conference in the central Indian state of Madhya Pradesh.

Guyana is home to one of the largest oil discoveries in the last decade. It currently produces 340,000 barrels per day (bpd) of oil and aims to raise it to 1.64 million bpd by end of the decade, said Sh. Saurabh Kumar, a secretary in the Indian external affairs ministry.

He said Guyana has sought the participation of Indian state-run and private companies in its hydrocarbon sector.

“We are looking for cooperation with Guyana, and Suriname, particularly with Guyana,” Kumar said, adding Ali would meet India’s oil minister Hardeep Singh Puri during his trip to New Delhi.

“In the next 3-4 months, you will see a massive expansion of the Indian investment footprint in Guyana,” Ali said in an interview with broadcaster NDTV, adding that oil and gas will be among the sectors that will witness expansion of investment.

India, the world’s third biggest importer and consumer of oil, is diversifying its crude import sources and in 2021 imported Guyanese Liza crude. (Reporting by Nidhi Verma; Editing by Andrew Heavens, Susan Fenton and Marguerita Choy)

show less

NTPC starts blending green hydrogen with piped natural gas in Surat

National Thermal Power Corporation (NTPC) on Tuesday commissioned its first green hydrogen blending project in Gujarat.

National Thermal Power Corporation (NTPC) on Tuesday commissioned its first green hydrogen blending project in Gujarat.

read more

The project, which is a joint effort between NTPC and Gujarat Gas (GGL), has started blending Green Hydrogen into piped natural gas (PNG) in Surat network of NTPC Kawas.

“NTPC and GGL have worked relentlessly towards achieving this milestone in record time after the foundation stone laid by the Hon’ble Prime Minister of India on 30th July 2022. This set-up is geared up to supply H2-NG (natural gas) to households of Kawas township at Aditya Nagar, Surat,” the company said in a statement. The first molecule of green hydrogen from the project was set in motion by Sh. P Ram Prasad, head of project, Kawas in presence of other senior executives of NTPC Kawas and GGL.

The company further said that NTPC Kawas held awareness workshops for township residents with help of GGL officials after the start of blending operation. Green Hydrogen in Kawas is made by electrolysis of water using power from an already installed 1 MW floating solar project.

The Petroleum and Natural Gas Regulatory Board (PNGRB) has given approval for 5% vol./vol. blending of green hydrogen with PNG to start with. The blending level would be scaled phase wise to reach 20%, NTPC said in a press release.

Green Hydrogen, when blended with natural gas, helps reduce carbon-dioxide emissions while keeping net heating content the same. Only a few countries like the UK, Germany, and Australia have been able to achieve this feat.

“This would bring India at the centre stage of the global hydrogen economy. India would not only reduce its hydrocarbon import bill significantly but can also bring forex ashore by being a green hydrogen and green chemicals exporter to the world,” NTPC said.

show less

INTERNATIONAL NEWS

Natural Gas / Transnational Pipelines/ Others

Egypt: Wintershall Dea discovers gas in Egypt’s east Damanhour block

Wintershall Dea has found gas in its East Damanhour exploration block in the onshore Nile Delta in Egypt, the company said on January 12.

read more

The licensees, operator Wintershall Dea (40%) and partners Cheiron Energy (40%) and INA (20%), as well as the Egyptian Gas Holding Company (EGAS), will assess the discovery as a possible tie-back development towards the nearby infrastructure at Disouq.

The Disouq gas project is operated by DISOUCO, a joint venture between Wintershall Dea and EGAS.

Wintershall Dea started exploration at East Damanhour in November 2021. The discovery was made as the second exploration well in this licence. The ED-2X well is located around 3 km north of the existing Disouq field.

The well encountered a 43-metre thick gas bearing reservoir with a gas-water contact at 2,627 m. “A thorough and fit for purpose data acquisition program has been carried out in the well and the discovery has been tested at peak production of 15mn ft3/day,” the company said.

https://www.naturalgasworld.com/wintershall-dea-discovers-gas-in-egypts-east-damanhour-block-103131

show less

Turkey: Türkiye to supply LNG from its terminals to Bulgaria

Türkiye is set to sell natural gas to Bulgaria, Energy and Natural Resources Minister Mr. Fatih Dönmez said Jan 1,2023 adding that the agreement in this regard will be signed between the countries on Jan 2, 2023.

Türkiye is set to sell natural gas to Bulgaria, Energy and Natural Resources Minister Mr. Fatih Dönmez said Jan 1,2023 adding that the agreement in this regard will be signed between the countries on Jan 2, 2023.

read more

Bulgarian Energy Minister Mr. Rossen Hristov previously said that negotiations are considering using 1 billion cubic metres of capacity from Türkiye’s Liquefied Natural Gas (LNG) terminals. Mr. Hristov, in a statement to reporters on Dec. 23, maintained that they did not have any problems in purchasing LNG, but that they had problems with the area where it will be unloaded.

Saying the Revithoussa LNG Terminal is used in Greece, Mr. Hristov added: “This terminal is very busy. Our agreement for the floating LNG storage and gasification unit (FSRU) in Alexandroupoli begins in 2024. We still need an extra billion cubic metres of capacity.”

He said they were negotiating to reserve a capacity of 1 billion cubic metres per year from the LNG terminals in Türkiye and to transfer the gas from Türkiye’s Petroleum Pipeline Corporation (BOTAŞ) network to their border.

Noting that they can use any terminal in Türkiye, Hristov said the agreements will be signed with different LNG suppliers for supply security. Türkiye currently transfers pipeline gas to Bulgaria and further Europe via TurkStream natural gas pipeline.

With an annual capacity of 31.5 billion cubic metres, the TurkStream was commissioned in early 2020. The pipeline comprises two 930-kilometre (577.88-mile) offshore lines, and two separate onshore lines that are 142 and 70 kilometres long.

The first line with a capacity of 15.75 bcm is designated for supplies to Türkiye’s domestic customers, while the second carries Russian gas further to Europe through Bulgaria.

show less

Natural Gas / LNG Utilization

Russia: Novatek eyes more Baltic LNG shipments to Europe

Russia’s largest gas producer Novatek will be issued permits to boost production capacity at its Vysotsk liquefied natural gas plant on the shores of the Baltic Sea.

Russia’s largest gas producer Novatek will be issued permits to boost production capacity at its Vysotsk liquefied natural gas plant on the shores of the Baltic Sea.

read more

Moscow-based state review board Glavgosexpertiza said it issued its positive conclusion after reviewing a blueprint of the Novatek-proposed Vysotsk LNG modernisation project, in the Leningrad region.

Under a plan which foresees the arrival of additional natural gas from Russia’s Gazprom-operated trunk pipeline network, the nameplate capacity of the plant will increase from 660,000 tonnes to 895,000 tonnes per annum of LNG.

To enable more gas supplies to the LNG production site, Novatek has proposed building an additional booster pumping station to serve the 40-kilometre connector between the LNG plant and Gazprom’s network.

Vysotsk LNG, where Novatek has a 51% shareholding, was already working above its nameplate capacity in 2022, with cargoes being delivered to Scandinavia, Lithuania and other European countries.

Demand for LNG in Europe rose following Gazprom’s decision to drastically reduce its gas pipeline supplies to the continent.

LNG shipments from Vysotsk and the Novatek-led Yamal LNG in West Siberia are exempted from the sanctions that western nations imposed on Russia as a result of Moscow’s invasion of Ukraine in February.

Russian LNG accounted for close to 16% of European LNG imports in 2022 according to Bruegel, a Brussels-based think tank, even though buyers have faced criticism and protests as a result.

The Vysotsk LNG facility went into operation in 2019 with two liquefaction trains that use a liquefaction process commercially known as Liquefin provided by France’s industrial gases player Air Liquide.

According to Novatek, it has LNG storage capacity of 42,000 cubic metres, with a loading jetty capable of serving mid-sized LNG carriers.

In September 2022, Air Liquide announced its intention to withdraw from Russia, signing a memorandum of understanding to allow a buyout by its Russian management team.

Novatek has not responded to an Upstream request to provide an update on the timeline of the upgrade project that will be based on Russian supply and services.

Last year, international sanctions prohibited western contractors to deliver equipment for Russia’s LNG industry and also to export what is called “dual-use” goods that may be used for civil and military purpose.According to the Skolkovo Energy Centre in Moscow, changes to the configuration of the two identical 330,000 tpa LNG chains are constrained by limited space on the existing site of the Vysotsk LNG plant.

The plant was built on a small island in the Baltic Sea next to a major oil products export terminal operated by Russian oil producer Lukoil.

Gazprom has surplus onshore gas pipeline transportation capacity in this region and this has increased following the explosions that ruptured the Nord Stream 1 subsea pipeline September. Nord Stream 1 had capacity for shipping about 55 billion cubic metres of Russian gas per year across the Baltic Sea to Germany.

https://www.upstreamonline.com/lng/novatek-eyes-more-baltic-lng-shipments-to-europe/2-1-1386478

show less

Canada: Canadian PM cool to meeting Japan’s LNG needs

Canadian prime minister Mr. Justin Trudeau seemed cool to the idea of contributing to Japan’s future natural gas needs, instead pushing Canada’s cleantech ambitions forward in meetings on January 12 with Japanese prime minister Mr. Fumio Kishida.

read more

Ahead of a joint news conference with Trudeau and his Japanese counterpart, some of Kishida’s staff indicated to reporters that the island nation has “high expectations” that Canada can help supply Japan with LNG, most immediately from the 14mn metric tons/year LNG Canada terminal, set to begin exporting to Asia in 2025.

Japan’s Mitsubishi holds a 15% interest in the LNG Canada consortium through its subsidiary, According to a CTV News report, Kishida told a luncheon audience in Ottawa that LNG will play a “crucial role” in Japan’s energy transition, and the LNG Canada terminal – and others under development on the country’s west coast – are among the ways Canada can help in that transition.

But at the news conference, Trudeau appeared cool to the idea of exporting LNG, instead suggesting that as the world is looking to decarbonise, Canada needs to be prepared to meet those demands.

Last summer, during a state visit by German chancellor Olaf Scholz, Trudeau said a business case for LNG exports to Europe “could not be made” and suggested instead Germany look to green hydrogen exports from a proposed Newfoundland project still several years away from fruition.

On January 11, Alberta premier Danielle Smith sent a letter to Trudeau urging him to stress her province’s “strong desire” to supply affordable, reliable and sustainable energy – including LNG – to Japan.

“Japan is the second largest global importer of LNG, and nearly 10% of its total LNG imports in 2021 originated from Russia, presenting significant challenges given the ongoing conflict in Ukraine,”

Smith wrote in her letter. “Alberta is proud to be one of the most responsible producers of oil and gas globally and we can be the supplier of choice for our global allies. Our unparalleled energy resources, commitment to emissions reduction and historical connections with Japan position us to be a key contributor to Japan’s efforts to diversify its LNG supply to one that is responsibly developed by a key ally.”

As Canada’s provinces – like Alberta – are the owners and stewards of natural resources within their boundaries, it’s only logical that any discussions regarding potential energy exports to Japan would need to fully involve impacted provinces.

“Alberta would be pleased to help the federal government develop the business case and participate in the development of (a memorandum of understanding) with Japan for the increased export of clean Albertan LNG,” Smith’s letter concluded.

https://www.naturalgasworld.com/canadian-pm-cool-to-meeting-japans-lng-needs-103155

show less

Nigeria: Greenville LNG fuels Sagamu retail station

Greenville LNG, a pioneer Liquefied Natural Gas (LNG) production and distribution company in Nigeria, has fueled its first liquefied natural gas retail station in Sagamu, Ogun state. Greenville LNG is the first company in Nigeria to operate its fleet of trucks/ tankers using LNG as fuel. Greenville currently operates a fleet of more than 500 trucks which are all 100% powered by LNG.

Greenville LNG, a pioneer Liquefied Natural Gas (LNG) production and distribution company in Nigeria, has fueled its first liquefied natural gas retail station in Sagamu, Ogun state. Greenville LNG is the first company in Nigeria to operate its fleet of trucks/ tankers using LNG as fuel. Greenville currently operates a fleet of more than 500 trucks which are all 100% powered by LNG.

read more

The company’s innovative logistics approach has improved access to clean and affordable fuel for automotive uses across Nigeria and has become a driver of the Federal Government’s Gas Expansion policy and Decade of Gas initiatives. With 5 L/CNG refuelling stations completed and operational, and an additional 42 under construction, long haul trucks, and small vehicles in major cities in Nigeria will soon have the choice to completely switch to L/CNG which is locally produced and a cheaper alternative than the more expensive, imported petrol or diesel.

The company hopes that the country can begin to gradually eradicate the growth-stunting subsidy with this initiative. Natural gas is the cleanest-burning fossil fuel; therefore vehicles running on LNG produce lower levels of toxic emissions and air pollution than equivalent diesel engines. Nitrogen Oxides (NOx) emissions are reduced by 40-50% and Particulate Matter (PM) emissions are reduced by approximately 80%. In a statement on Monday,the company said Sinoma Cargo International Nigeria Limited has purchased a few LNG-fueled trucks to start, and the first truck was fueled at our Sagamu LNG refuelling station on Sunday. It added: “There are other companies who have procured a few LNG-fueled trucks from different OEMs and the trucks will arrive in Nigeria shortly.

Greenville LNG has 5 LNG retail stations strategically located across Nigeria, at Sagamu, Ogun state, Rumuji, Rivers state, Koton Karfe, Kogi state, Kakau, Kaduna state & Ikpoba LGA (Benin) in Edo state”

https://www.thenigerianvoice.com/news/316173/greenville-lng-fuels-sagamu-retail-station.html

show less

Global LNG Development

Oman: Oman LNG inks LNG supply deal with Shell

State-owned Oman LNG has signed an agreement with Shell to supply 0.8mn metric tons/year of LNG for ten years starting from 2025, the official Oman News Agency reported on January 10. Shell is already a shareholder in Oman LNG.

read more

“We are delighted to sign this term-sheet agreement with Shell, who has been our partner in the industry for many years,”Mr. Hamed Al Nu’amani, CEO of Oman LNG, said. “This agreement leverages the opportunities to place Oman LNG in a very competitive market, with strong partners allowing us to grow our market access.”

The Shell deal was announced just days after Oman LNG signed binding term sheet agreements to deliver a total of 2.35mn mt/year of LNG to three Japanese companies.

Oman LNG is 51% owned by the government of Oman, 30% by Shell, 5.4% by Total, 5% by Kogas, and Japanese and Omani firms own other stakes of under 3%.

https://www.naturalgasworld.com/oman-lng-inks-lng-supply-deal-with-shell-103092

show less

UK: UK’S $1.15 BLN funding for Mozambique LNG project

The British government’s funding of up to $1.15 billion for a liquefied natural gas (LNG) project in Mozambique is lawful, a London court ruled on Friday, dismissing an appeal by Friends of the Earth.

read more

The environmental campaign group had asked London’s Court of Appeal to rule the British government wrongly decided funding the project, led by French energy company TotalEnergies , was incompatible with the Paris Agreement on climate change.

UK Export Finance (UKEF) has committed to provide direct loans and guarantees to banks to support the design, build and operation of the $20 billion project.

Friends of the Earth’s legal action over the decision failed in a lower court and was dismissed by the Court of Appeal in a written ruling on Jan 13.

show less

Japan: Inpex to accelerate expansion of LNG production & sales

Inpex Corp, Japan’s biggest oil and natural gas explorer, aims to accelerate its expansion of production and sales of liquefied natural gas (LNG) on the premise that the LNG market will remain tight in the mid-term, its CEO said on Jan 12.

read more

“Global LNG market is expected to remain tight in the mid-term due to the structural change of the global natural gas market, especially LNG, since the Russian invasion of Ukraine,” Inpex CEO Takayuki Ueda told Reuters in an interview.

The global gas supply chains have changed, with European countries seeking to import more LNG to replace Russia’s pipeline gas and the United States boosting export of the super-chilled fuel, while Russia is looking at providing more gas to India and China, possibly through pipelines, he said.

https://www.naturalgasworld.com/inpex-to-boost-expansion-of-lng-production-and-sales-ceo-103139

show less

Brazil: Brazil’s Blueshift to deploy LNG terminal in Rio de Janeiro state

Brazilian firm Blueshift Gás & Energia will deploy a liquefied natural gas storage and transfer terminal in Rio de Janeiro state’s Sepetiba bay, according to a source familiar with the matter.

read more

Named Tagoahy with an extension of 76,500m2, it will be of the offshore type, where a floating storage unit (FSU) ship with a storage capacity of approximately 125,000m3 will remain anchored, the source told BNamericas on condition of anonymity.

It will be deployed near Martins island, the access channel to Itaguaí port, and demand an investment of 52mn reais (US$10.2mn).

Tagoahy will be used for reception, storage and transfer of LNG as part of the distribution system in Rio de Janeiro and other states in the south, southeast and northeast regions.

The imported gas will be received through an LNG carrier vessel (LNGC) with capacity of between 70,000m3 and 135,000m3, which will transship the gas in liquid phase to the FSU via the ship-to-ship modality. The stored LNG will then be transferred to small carrier vessels for transportation to other states.

The LNG can also be moved to ISO containers with capacity of 45m3 that will then be transported for unloading at Sepetiba port.

https://www.bnamericas.com/en/news/brazils-blueshift-to-deploy-lng-terminal-in-rio-de-janeiro-state

show less

LNG as a Marine Fuel/Shipping

Norway: Knutsen welcomes new LNG carrier for charter with Shell

Norwegian shipping company Knutsen has taken delivery of a newbuild liquefied natural gas (LNG) carrier Ferrol Knutsen from South Korean Hyundai Samho Heavy Industries (HSHI) shipyard.

read more

The delivery of another 174,000 cbm LNG carrier was confirmed in a social media update by Knutsen Group on 12 January.

Ferrol Knutsen is the fifth unit in a series of nine LNG carriers going into a long-term contract with energy major Shell.

The fourth vessel Huelva Knutsen was delivered on 12 October 2022.

With the latest delivery, Knutsen said it now has an LNG carrier fleet of 21 vessels and 21 more newbuildings underway.

The LNG carriers are equipped with efficient dual-fuel X-DF engines, boil-off management plants, air lubrication systems and shaft generators for auxiliary power. Finnish technology group Wärtsilä has been contracted to provide the reliquification technology for the vessels.

It is worth reminding that Knusten ended the previous year with keel laying ceremonies for two LNG carriers on the same day at Hyundai Samho Heavy Industries shipyard.

According to the information on Knutsen Group’s website, the ships are slated for delivery in 2024.

Prior to this, the Norwegian company took delivery of 174,000 cbm LNG Carrier Lech Kaczynski, chartered by PGNIG Poland, an ORLEN Group company.

https://www.offshore-energy.biz/knutsen-welcomes-new-lng-carrier-for-charter-with-shell/

show less

Germany: First LNG cargo arrives at Germany’s LNG terminal in Wilhelmshaven

On Jan 3,2023 Uniper brought Germany’s first full cargo of liquefied natural gas (LNG) to the new LNG terminal, operated by Uniper, in Wilhelmshaven. The LNG ship Maria Energy, owned by Tsakos Energy Navigation, a major energy mover, was loaded in Calcasieu Pass, USA, at the liquefaction facility of the LNG supplier Venture Global Calcasieu Pass, LLC, on December 19, 2022.

read more

The Maria Energy is fully loaded with approx. 170,000 cubic meters LNG (97,147,000 cubic meters of natural gas) – enough to supply around 50,000 German households with energy for one year.

Mr. Niek den Hollander, Uniper CCO says: “The successful delivery of the first full LNG cargo to the Uniper terminal in Wilhelmshaven is a testament to the strong partnership between Uniper, Venture Global, and Tsakos Energy Navigation. The use of LNG as a reliable energy source is crucial for the Security of Supply for Germany and Europe. We are committed to contribute our part by bringing more LNG to the European market and especially Germany via the Wilhelmshaven and Brunsbüttel Regas Terminals.”

“Venture Global is very proud to supply the first full cargo of LNG ever delivered to Germany, and we congratulate Uniper and the German government for their swift action to build the infrastructure needed to make this historic day possible,” says Venture Global CEO Mike Sabel. “As strategic partners, we look forward to providing long-term security of energy supply to our allies through the continued delivery of clean and reliable US LNG.”

The LNG cargo delivered on board of the Maria Energy forms part of the commissioning process at the Wilhelmshaven terminal. Commercial operations of the Wilhelmshaven terminal are expected to start in mid-January 2023.

The Uniper LNG terminal in Wilhelmshaven was opened on December 17, 2022. Via the Floating Storage and Regasification Unit (FSRU) Höegh Esperanza, about five billion cubic metres of natural gas can be landed in Germany per year.

https://www.koreaherald.com/view.php?ud=20230103000705

show less

Technological Development for Cleaner and Greener Environment Hydrogen & Bio-Methane

USA: Northwest Iowa project pipes cow manure natural gas to Sioux Center

Cow manure from local dairy farms will be run through digesters to generate natural gas that will run through a pipeline to the northwest Iowa town of Sioux Center.

read more

Mr. Aaron Maassen owns one of the three dairy farms involved in the project. He says it will not only expand the town’s capacity for natural gas, it will also capture methane emissions from livestock waste. “Capturing value out of it that would have been lost as a greenhouse gas,” Maassen says. “So, it allows us to capture that without changing the value of the resource that we have for our own operation, and add value to just our local community.”

Maassen says the greenhouse gas emissions eliminated will be equivalent to around 8,800 cars. Sioux Center utilities assistant manager Adam Fedders says the community needs more natural gas capacity. “For a growing community, like Sioux Center, taking advantage of opportunities to receive additional capacity and other locations is something that’s advantageous,” Fedders says, “and then to find an opportunity right in your backyard is even greater.”

The farm digesters are expected to bring in around 350 MMBTUs a day, or around a third of the natural gas typically used in Sioux Center on a summer day. Construction on the pipeline is expected to begin as early as April.

show less