NGS’ NG/LNG SNAPSHOT – April 2021, VOLUME 1

NGS’ NG/LNG SNAPSHOT – April 2021, VOLUME 1

National News Internatonal News

NATIONAL NEWS

City Gas Distribution & Auto LPG

Now, vehicles to run on compressed biogas in city

Gas Authority of India Ltd (GAIL) and Ranchi Municipal Corporation (RMC) on Thursday inked an MoU for setting up a plant to produce compressed biogas with the garbage collected from the city. The CBG produced would be used for various purposes

read more

including fuel for running vehicles in the city. The MoU was signed for the construction of a compressed biogas plant for garbage-to-gas production in the premises of Chief Minister Hemant Soren on the Assembly premises. GAIL India Limited will set up an organic waste processing plant of 300 MT / day in two phases in Ranchi. In the first phase, a 150 tonne capacity organic waste processing plant will be built. The plant will produce 5 tonnes of compressed biogas in a day. The age limit of the plant will be more than 20 years. The Ranchi Municipal Corporation will provide the required eight acres of land for the plant on lease rent to GAIL India Limited. The cost of construction of the plant will be around Rs 28.19 crore, which will be borne by GAIL India. Two gas filling plants will also be constructed inside the city and in the outer area of the city. After the implementation of this system, Ranchi Municipal Corporation will be able to save Rs 81 crore in 20 years from the expenditure incurred on the processing of waste. One plot of 3600 square meters for two outlets will be provided by the Municipal Corporation in the city and the other outside the city. During the MoU, apart from Chief Minister Hemant Soren, others present were: Ranchi Mayor Asha Lakra, Deputy Mayor Sanjeev Vijayvargiya, Municipal Development and Housing Department Secretary Vinay Kumar Choubey, Director of State Urban Development Agency Amit Kumar, Municipal Commissioner of Ranchi, Mukesh Kumar, Ashish Chatterjee, Joint Secretary in the Government of India, MV Iyer, Director (BD) GAIL India Ltd, KB Singh, Executive Director (Projects) GAIL and Alok Kumar, General Manager (CGD), GAIL.

show less

After universal LPG penetration, India plans to cover 100% population under city gas network

After achieving nearly 100 percent penetration of liquefied petroleum gas (LPG), India is planning to cover its entire geographical area under the city gas distribution (CGD) coverage, up from 70 percent of the population now.

read more

The Petroleum and Natural Gas Regulatory Board (PNGRB) is likely to come out with the eleventh round of CGD bidding within the next six months, which will cover over 300 districts and may have an estimated investment of Rs 1.2 lakh crore. “Earlier, the plan was to cover 44 geographical areas (GAs) in 120 districts in the eleventh round. However, we are now working on a fresh proposal that will cover the entire country in one go. This would mean 300 plus districts will be covered in a single round of bidding and the CGD network reach will increase to 100 per cent of the population,” said a source close to the development. After the ninth and tenth round of bidding, CGD coverage in the country was extended to 406 districts. The next round is likely to cover another 335 districts. https://www.energyinfrapost.com/after-universal-lpg-penetration-india-plans-to-cover-100-populationunder-city-gas-network/

show less

Two Kolkata city petrol pumps to sell CNG

Car owners in Kolkata will have the option to switch to the cost competitive and greener source of fuel from next week as two petrol pumps of the city plan to start dispensing compressed natural gas (CNG) from their outlets.

read more

A conventional retail outlet of Bharat Petroleum Corporation Ltd (BPCL) at Garia and another of Indian Oil Corporation at Rajarhat have been primed for the task, while plans are underway to add a few more in and around the city and important towns of South Bengal. Separate areas have been earmarked within the two outlets to put up a dispenser and storage tank of CNG. The price of petrol on Friday in Calcutta was Rs 91.35 a litre. Users would also gain in mileage which is said to be higher when run on CNG. Maruti and Hyundai are planning to bring their dual feed models to the city Moreover, existing cars have the option to add CNG kit at a cost of around Rs 42,000. The CNG is being sourced by Bengal Gas Company Ltd (BGCL), a joint venture between GAIL and Greater Calcutta Gas Supply Corp, from the coal bed methane field operated by Essar in Ranigunj. Since BGCL does not have a retail outlet in the city, it would piggyback on the existing oil marketing companies to penetrate the market. This arrangement would hold good till demand picks up, which will happen when consumers feel confident of the availability at their convenience. However, the real change in terms of air quality would be felt when public transport switches from diesel to gas. Even though natural gas is also a fossil fuel, emission of nitrogen oxides and soot are much less from burning of gas. Incidentally, a part of Kolkata’s transport is already using some form of gas as some auto rickshaws are using LPG.

https://www.telegraphindia.com/business/two-kolkata-petrol-pumps-to-sell-cng/cid/1810096

show less

Electric Mobility & Bio- Methane

The future of Electric Vehicles in India

Electric vehicles are slowly becoming visible everywhere. They are cleaner and more effective, and surprisingly fun! Indians are known for being value-conscious. This is the reason buyers love diesel vehicles, regardless of their higher MRP

read more

and contamination as compared to their petroleum partners. Indeed, even at the present oil costs, running a diesel vehicle can cost about Rs 4.8 per kilometer versus petroleum’s Rs 6.8. On the other hand, CNG costs generally Rs 1.94/km, however, it’s not accessible every where. The EV cost relies upon power value, which differs fundamentally and is certainly more practical in the long term. The catch is the upfront expenditure. EVs are costly, principally because of the battery. Indeed, even with an eight-year shelf life and a 12% interest rate, advocating the battery costs on per kilometer investment funds alone methods, one would need to roll over 25,000 km each year. Possible, but not for everyone. Be that as it may, when battery costs tumble to $100/kWh, as expected a couple of years out, EVs can turn into a distinct advantage. The power grid is also a critical stakeholder in the ecosystem. Where and when it should be charged? The easiest way is that customers return home after work and connect it simultaneously for charging. One solution is charging buyers a variable rate depending on the schedule of the day, yet that isn’t yet the standard for most clients in India, and surely not families. We have seen enormous changes, especially in technology, but also in individuals’ attitude towards vehicles’ effects on environment and other portability solutions, from the very first electric vehicle set up in 1837 up to right now. Although the electric vehicle market is at present a rewarding objective for organizations and new businesses in India, there are a few obstructions in in its mass production-fabricating electric vehicles locally being one of them. Also, battery manufacturing is basically an expensive endeavour. The Indian Government should focus its energies on sorting out these difficulties.

https://www.nationalheraldindia.com/india/the-future-of-electric-vehicles-in-india

show less

India and Chile to discuss (Preferred trade agreement) PTA expansion, Green Hydrogen and mining next month

Renewable energy is an area the two countries are looking at.Recently the government of India has unveiled a national hydrogen mission. This mission is expected to accelerate plans to get the carbon-free fuel from renewable.

read more

According to a recent report of The Energy and Resources Institute (TERI), by 2050, nearly 80 per cent of India’s hydrogen is projected to be green – produced by renewable electricity and electrolysis. The report has stated that green hydrogen will become the most competitive route for hydrogen production by around 2030.Chile could produce 160 million tons of green hydrogen per year, according to an estimate of International Energy Agency. Chile’s energy ministry’s figures indicate that green hydrogen could contribute up to 20% of the country’s cumulated carbon emissions reduction by 2050.

show less

Reliance affiliate picks 3/4th of gas from own CBM block at $6 price

Reliance Industries Ltd has sold three-fourth of the gas from coal seams in Madhya Pradesh to an affiliate of the company at a price of just over $6 at current oil prices. State-owned gas utility

read more

GAIL India Ltd cornered 0.17 mmscmd while 0.03 mmscmd was picked by Reliance Gas Pipeline – the entity that transports gas from the coal-bed methane (CBM) blocks in Madhya Pradesh to consumers.

The price bid was 9.2 per cent of the prevailing rate of Brent crude oil price, which translated into a rate of over $6 per million British thermal units at current oil prices, they said.

India Gas Solutions Private Limited, a 50: 50 joint venture of RIL and UK’s bp, bought 0.62 million standard cubic meters per day out of 0.82 mmscmd gas bid out in an auction last week, three people with knowledge of the matter said.

Reliance had last month bids for 0.82 mmscmd of coal gas from the Sohagpur coal-bed methane (CBM) block for one year beginning April 1, 2021, according to a notice inviting offer (NIO).

show less

Gas/ Pipelines/ Company News

Adani Welspun strikes gas in Mumbai offshore

New Delhi: A joint venture of Adani Group and Welspun Enterprises Ltd has discovered natural gas reserves in an area off the Mumbai coast, the two firms said in a statement Monday. The first-ever gas discovery was made in the NELP-VII block MB-OSN-2005/2,

read more

Adani Welspun Exploration Ltd (AWEL) said. Spread across 714.6 square kilometers, the block is located in the prolific gas-prone Tapti-Daman sector of the Mumbai Offshore basin where production is already underway by other operators. “The pay zones and flow rates encountered have exceeded the company’s initial estimates,” the statement said without giving details. AWEL was awarded the block under the New Exploration Licensing Policy’s (NELP) seventh bid round. “Early indications pointed to the occurrence of gas-bearing reservoirs within the sandstone reservoirs of the Mahuva and Daman formations,” the firm said. The drilling of the current well in March 2021 has confirmed the presence of substantial quantities of gas and condensate in the block. While the first object yielded a flow of 9.7 million standard cubic feet per day (mmscfd) of gas along with 378 barrels a day of condensate, the second object also yielded a similar flow 9.1 mmscfd of gas along with 443 barrels a day of condensate.

show less

ONGC’s share in India’s oil, gas production rises to 70% from 53%

State-owned ONGC, which is often perceived as a drag on the crude oil and natural gas produced in the country, has actually seen its contribution to the national production jump to over 70 per cent from under 53 per cent a decade back, petroleum ministry data showed.

read more

While Oil and Natural Gas Corporation (ONGC) maintained production levels, output by other operators has dropped, leading to an overall fall in India’s output and a sharp rise in import dependency. Its standalone production at 47.51 million tonnes of oil and oil equivalent gas in 2010-11 was 52.8 per cent of a total of 89.91 million tonnes of oil and gas produced in the country that year, the data showed. ONGC is focused on finding oil and gas reserves in Category II and III Basins, which do not have established hydrocarbon proficiency. This helped accrete inplace reserves of 2,246 million tonnes of oil between 2002 and 2015 and ultimate accretion of 1,014 million tonnes, the data presented at the review showed. Of this, ONGC realised 830 million tonnes of oil and oil equivalent gas as production. It has approved 14 schemes for developing 135 million tonnes of reserves. ONGC’s share in national production rose from 52.8 per cent in 2010-11 to 54.9 per cent in the following year and to 58.7 per cent in 2012-13, 62.2 per cent in 2013-14, 62.3 per cent in 2014-15, 62.9 per cent in 2015-16 and 65.3 per cent in 2016-17. In subsequent years it was 67 per cent, 68.4 per cent and 70.3 per cent in 2019-20 — the latest year for which data was presented at the review. During this 10-year period, India’s dependence on imported crude oil to meet its demand rose from about two-third to 85 per cent.

https://www.hellenicshippingnews.com/ongcs-share-in-indias-oil-gas-production-rises-to-70-from-53/

show less

GAIL set to kick off asset monetisation in oil sector by end of 2021-22

InvIT to be floated by the end of next fiscal year. An InvIT is like a mutual fund that allows multiple small and large investors to invest in a project and get proportional returns from the profits the asset makes.

The first oil-sector infrastructure investment trust (InvIT) is expected to be floated by GAIL (India) by the end of 2021-22. According to a top petroleum ministry official, Indian Oil Corporation (IOCL), Hindustan Petroleum Corporation (HPCL),

read more

and GAIL (India) will be going for three separate InvITs as part of the central government’s asset monetisation plan. “GAIL (India) will be the first to float the InvIT. In all, Rs 15,000-20,000 crore is expected to be raked in via this route. The money will be utilised by the companies for capital expenditure,” said the official. This is expected to augur well for the companies since any extra money in their kitty is usually given to the Centre in the form of dividend. HPCL and GAIL (India) will be floating InvITs for their pipelines, while IOCL will be hiving off its hydrogen-producing units and pipelines into an InvIT. Sitharaman further said a national asset monetisation pipeline of potential brownfield infrastructure assets would be launched. An asset monetisation dashboard would also be created for tracking the progress and provide visibility to investors. Assets of the National Highways Authority of India, Power Grid Corporation of India, Airports Authority of India, freight corridors of Indian Railways, warehousing assets of central public sector enterprises, and sports stadia, among others, were also mentioned by Sitharaman for asset monetisation.

show less

BPCL to merge Bharat Gas with itself

The board of privatisation-bound Bharat Petroleum Corporation Ltd (BPCL) on Monday approved the merger of its gas subsidiary, BGRL with itself in a bid to streamline corporate structure.

read more

BGRL is a 100 per cent subsidiary of BPCL and its main business is gas sourcing and retailing.

The merger will streamline the corporate structure and consolidate the assets and liabilities of BGRL within BPCL. Also, it will help in “availing easier financial support for the business” of BGRL and “more efficient utilisation of capital for enhanced development and growth of the consolidated business in one entity,” BPCL said.

It will also improve management oversight and bring in operational efficiencies, cost savings and reduction of administrative responsibilities.

https://www.businesstoday.in/sectors/energy/bpcl-to-merge-bharat-gas-with-itself/story/434575.html

show less

Policy Matters/ Gas Pricing/Others

‘Tackle CNG vehicle cost, bring it under GST’

India needs to bring CNG under the GST regime and tackle challenges such as high vehicle cost and limited boot space for the growth of the natural gas vehicle market, according to a report by Nomura Research Institute (NRI)

read more

Consulting & Solutions India. The report on ‘natural gas vehicle (NGV) market’ stated that the CNG vehicle market has seen a compounded annual growth rate of 7% to 33.76 lakh units in March 2020 from March 2016, mainly driven by passenger vehicles (cars and taxis). The demand for such vehicles, however, is concentrated in five States/UTs of Maharashtra (30%), Gujarat (29%), Delhi (23%), Uttar Pradesh (9%), and Haryana (5%). “India has large domestic reserves of natural gas as compared to crude oil. India has explored about 5 TCM of recoverable reserves, of which less than 0.5% is used as fuel in the current CNG fleet,” it said, adding that high vehicle volumes and favourable conditions in the Indian automotive market presented an opportunity to promote widespread adoption of NGVs. For CNG vehicles, the report said the government and other stakeholders needed to work on attractive financing rates, simplification of land acquisition laws for pipeline and station development, bringing CNG under GST or a uniform pricing policy and tax structure across States, and create a detailed roadmap and implementation plan for realising the full potential of domestic natural gas production. It also suggested localisation of cryogenic cylinders, which are currently being imported, to further bring down the cost of LNG trucks and set up adequate LNG fuel stations to cater to the demand by long-haul trucks operating in India. Currently, China leads the world with the largest NGV fleet driven by robust infrastructure, government policies and availability of natural gas, followed by Iran, India, Pakistan, Argentina, Brazil and the U.S.

https://www.thehindu.com/business/tackle-cng-vehicle-cost-bring-it-under-gst/article34086199.ece

show less

India to cut Saudi Arabian oil imports after OPEC ignores India demand

New Delhi: India’s state refiners are considering purchasing fewer barrels from Saudi Arabia in May after the OPEC ignored New Delhi’s call for higher supplies to calm international crude oil prices.

read more

They have yet to take a final call as the move risks a Saudi retaliation and souring of decades-old ties between the two countries. The extended output cut by Saudi and its allies, which has pushed up prices by a third this year to above $68 a barrel on Wednesday, has driven Indian fuel prices to record highs. Indian Oil Corporation, HPCL, BPCL and MRPL have discussed the possibility of reducing Saudi oil purchase for May and have until April 5 to inform Riyadh about this, said people with knowledge of the matter. Weaker demand due to increasing Covid-19 cases or regular maintenance shutdowns may also contribute to lower purchase from Saudi Arabia in May, they said.

show less

India cities to be greener with E20 fuel-run transport network

New Delhi: This is one reform initiative that is set to be a big positive change in the use of fossil fuel to run countrys transportation sector. The central government has proposed to advance the deadline for blending 20 per cent ethanol in

read more

petrol from the earlier announced 2030 to 2024. The use of 20 per cent doped petrol or E20 decreases the carbon monoxide and hydrocarbons emissions significantly, compared to normal gasoline in two-wheelers and four-wheelers. The increased blending will also reduce use of polluting fossil fuel in the country. The Ministry of Road Transport and Highways has already notified the use of E20 and issued mass emission standards for the same. Now it is up to the oil companies and automobile companies to build capacities for both production and use of E20. The next two years would also give sugar mills time to convert excess sugarcane or sugar for producing higher quantity of ethanol required for blending with petrol. The use of 20 per cent ethanol blended petrol will also test the ability of vehicles to use this bio fuel. Auto companies will come out with compatibility studies of vehicles for using the bio fuel that will help in reducing emissions of carbon dioxide, hydrocarbons. Vehicles will also display their compatibility by wearing a clear mark through a sticker.

show less

Making India Energy Powerhouse

Posted On: 23 MAR 2021 4:07PM by PIB Delhi: India has emersed from power deficit in 2013 to power surplus. The installed generation capacity is around 379 Giga Watt which is more than adequate to serve the electricity peak demand of 190 GW.

read more

The Government has also made plans to have sufficient generation capacity to meet future demand of electricity.

The all India power generation installed capacity by the end of 2026-27 is estimated to be 6,19,066 MW which includes 2,38,150 MW Coal, 25,735 MW Gas, 63,301 MW Hydro, 16,880 MW Nuclear and 2,75,000 MW Renewable Energy Sources to fully meet the electricity demand projected as per the 19th Electric Power Survey on All India basis.

As per the recent study carried by Central Electricity Authority on Optimal Generation Capacity mix for 2029-30, the likely All India installed capacity in 2029-30 is estimated to be 8,17,254 MW which includes 2,66,911 MW Coal, 25,080 MW Gas, 71,128 MW Hydro, 18,980 MW Nuclear and 4,35,155 MW Renewable Energy Sources.

The focus of Government is to increase the share of renewable energy which is available in plenty within the country to meet the requirement of the country and also export to our neighbouring countries.

The Minister Of State (independent charge) for Power, New & Renewable Energy and the Minister of State for Skill Development & Entrepreneurship Shri. R.K. Singh stated this in a written reply in Rajya Sabha.

show less

Cabinet approves Memorandum of Understanding between India and France on Renewable Energy Cooperation

Posted On: 03 MAR 2021 1:04PM by PIB Delhi

The Union Cabinet, chaired by the Prime Minister, Shri Narendra Modi has approvrd of the signing of Memorandum of Understanding (MoU) between India and French Republic in the field of renewable energy cooperation. The MoU was signed in January 2021.

read more

The objective of the MoU is to establish the basis for promotion of bilateral cooperation in the field of new and renewable energy on the basis of mutual benefit, equality and reciprocity. It covers technologies relating to solar, wind, hydrogen and biomass energy.

The MoU entails:

- exchange and training of scientific and technical personnel;

- exchange of scientific and technological information and data;

- organization of workshops and seminars; transfer of equipment, know-how and technology;

- development of joint research and technological projects.

This MoU will help in the development of technological know-how in the field of Renewable Energy and thereby aid the process of attaining the ambitious target of 450 GW of installed Renewable Energy capacity by 2030.

show less

OPINION: India’s maiden approach towards liberalized price discovery for natural gas producers

The Government of India (GOI) had introduced various natural gas marketing reforms last year, where IGX became the first gas exchange in India to receive authorisation from Petroleum and Natural Gas Regulatory Board (PNGRB),

read more

and marketing freedom has also been provided to private companies for sale of gas by auctioning through an e-bidding portal, where they can invite bids from the prospective buyers of natural gas. This was a major step taken by GOI for ease of doing business.

Recently, Reliance and its partner British Petroleum (BP) auctioned 7.5 million standards cubic metres per day (MMSCMD) of incremental gas from the Krishna Godavari block (KG-D6) where it started its production in December last year. The recent auction was held under the liberalized price discovery rules, wherein the majority went to Reliance O2C Ltd amounting to 4.8 MMSCMD, whereas PSU behemoth GAIL and other entities were awarded smaller volumes [2]. The bidding process was carried out in accordance with the guidelines notified by the GOI in October last year, through an online web-based electronic platform with an independent agency empaneled by the Directorate General of Hydrocarbons (DGH), the upstream regulator.

This approach by GOI will not only attract investments but provide the necessary impetus to increase gas production in the country by two-and-a-half times by 2030. These reforms also mark the shift in GOI’s role from being a market participant to only the regulator owing to the tweaks in policy framework, thereby reducing India’s dependence on natural gas imports in the long run. Furthermore, International Energy Agency’s (IEA) 2021 outlook highlighted that India’s LNG imports are expected to quadruple to about 61 per cent of overall gas demand.

show less

LNG Development and Shipping

India’s GSPC seeks LNG cargoes for March to November delivery

SINGAPORE: India’s GSPC is seeking 6 liquefied natural gas (LNG) cargoes for delivery over March to November through two separate tenders, two industry sources said.

read more

It is seeking one cargo for delivery over March 23 to 31 on a delivered ex-ship (DES) basis, in a tender that closed on March 3 and valid until March 4, they said. It is also seeking five cargoes for delivery over April to November, also on a DES basis, in a separate tender that closes on March 4 and valid until March 5, they added.

show less

Natural Gas / Transnational Pipelines/ Others

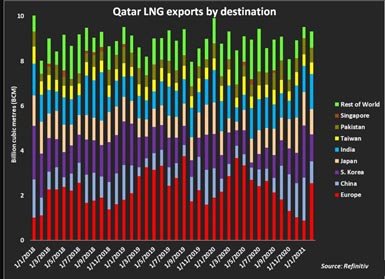

Qatar tightens global gas market grip with bold expansion moves

Qatar Petroleum, the world’s top liquefied natural gas (LNG) producer, is cranking up the pressure on high-cost rivals with bold expansion plans that will boost supplies over the coming decade and potentially push prices down further.

Qatar Petroleum, the world’s top liquefied natural gas (LNG) producer, is cranking up the pressure on high-cost rivals with bold expansion plans that will boost supplies over the coming decade and potentially push prices down further.

read more

As competitors struggle to break even due to lower prices, the Qatari firm last month announced it will boost LNG output by about 40 per cent to 110 million tonnes per annum (mtpa) by 2026 in phase one of its expansion of North Field LNG, the largest single LNG project ever sanctioned.

The company is expected to announce second phase expansion plans this year which will lift LNG capacity by 2027 to 126 mtpa, enough to meet the total import needs of both Japan and South Korea – the world’s top and third largest LNG importers respectively.

https://cyprus-mail.com/2021/03/16/qatar-tightens-global-gas-market-grip/

show less

Global LNG Development

Repsol completes LNG bunkering in Spain

Repsol has carried out a new supply of LNG to a ship for use as fuel in the port of Cartagena in Spain. The bunkering was carried out at the Enagás facilities, with the support of the Port Authority of Cartagena and the Maritime Captaincy of Cartagena.

read more

The uniqueness of the operation is that this is the first time that Repsol, as a supplier of LNG, has guaranteed the compensation of the total CO2 emissions associated with the consumption of this LNG. The bunkering has been carried out for the Swedish-flagged vessel Fure Vinga, owned by Furetank Rederi from Donsö, Sweden. This chemical tanker, with a length of 150 m and a beam of 23 m, has received 420 m3 of LNG. The tanker arrived from China and is continuing with its route to Rotterdam, the Netherlands, after her call in Cartagena. The operation, which lasted approximately four hours, has been carried out using the Enagás facilities in the port of Cartagena.

This is a further step towards the goal of becoming a zero net emissions company by 2050, offering ship owners the possibility of making their commercial routes more efficient and environmentally friendly. LNG is an increasingly valued alternative for shipowners for use in shipping. This fuel reduces emissions and complies with IMO 2020, the International Maritime Organization (IMO) regulation that came into force on 1 January 2020. This operation has been possible thanks to the developments and adaptations performed under the CORE LNGas Hive project, co-financed by the European Commission, led by The Spanish Port Authority, Puertos del Estado, and co-ordinated by Enagás. This initiative promotes the supply of LNG as a transport fuel, especially for the maritime sector, and has led to the adaptation of Spanish regasification terminals for the supply of LNG to ships.

https://www.lngindustry.com/liquid-natural-gas/18032021/repsol-completes-lng-bunkering-in-spain/

show less

Brazil authorizes Shell, Gerdau to import LNG

SAO PAULO: The Brazilian government has authorized the local unit of energy company Royal Dutch Shell to import liquefied natural gas (LNG) from several countries into the Brazilian market, according to a notice in the official gazette on Wednesday.

read more

The authorization was granted by the Mines and Energy Ministry for a total volume of up to 36.5 million cubic meters. The permit is valid through March 31, 2024 and limited to liquefied gas, the notice said. Royal Dutch Shell is expected to import LNG by sea and sell the product to operators of thermal power plants, gas distributors and consumers in the unregulated natural gas market. Other companies also received authorization to import LNG, including a unit of Brazilian steelmaker Gerdau SA.

show less

PGPCL says no NAB inquiry against LNG terminal

KARACHI: The Pakistan GasPort Consortium Limited (PGPCL), a wholly-owned subsidiary of Pakistan GasPort Limited (PGPL) which owns and operates the 750mmcfd, Pakistan’s only greenfield LNG import terminal at Port Qasim.

read more

Since its operations three years back, the terminal has delivered over 400 billion cubic feet of natural gas to the Sui network to curb gas and electricity shortages that were crippling the national economy, and saved over a $1 billion annually in foreign exchange arising from the benefits of switching over from furnace oil to natural gas. In rebutting the claims published in The News on March 19, 2021 in an article penned by Mr. Ali Zaidi, the Federal Minister for Maritime Affairs, “LNG: Delivering on Our Promises,” the PGPCL spokesperson noted that “Mr. Zaidi started his article by striving to explain why a minister for maritime affairs would be writing on a subject that does not fall under his purview and which in fact is a subject of the Petroleum Ministry.” The company spokesperson of PGPCL emphasized that “the minister’s article, unfortunately, contains certain ‘facts’ and information that are not only fake, imaginary and conjectural, but also highly slanderous and misleading.” The Group would also like to clarify that its arbitration proceedings against the Pakistan LNG Terminals Limited regarding the LNG Terminal delays and damages are pending in the London Court of International Arbitration, and are in accordance with the Agreement PGPCL and PLTL signed in 2016. The Group maintains the right to protect its interests, and its insistence on its due rights under agreements with PQA and PLTL (now PLL), is in line with the public interest. It is unfortunate that such malicious and false accusations are being levelled against a Group that has served Pakistan faithfully, and brought about, with innovative solutions, a meaningful transformation to Pakistan’s energy sector. It is hoped that the government will take notice of these bottlenecks, which are contrary to its announced pro-business policies, and support the upcoming project as it will bring a significant investment at no cost or risk to the government. The spokesperson reiterated “that such baseless allegations by a sitting minister will not deter us from contributing to the efforts of the government to overcome the energy crisis and provide affordable and cost-effective options to all consumers across Pakistan.”

https://www.thenews.com.pk/print/806922-pgpcl-says-no-nab-inquiry-against-lng-terminal

show less

Texan LNG Project Axed

Annova LNG has announced the immediate discontinuation of its liquified natural gas (LNG) export facility under development in Brownsville, Texas, “due to changes in the global LNG market”.

read more

“The entire Annova team is very grateful to the greater Brownsville community for having supported this project for several years,” Annova LNG said in a statement posted on its website.

The project had proposed building a 6.5 million ton per annum export facility on the Port of Brownsville and was being jointly developed by its majority owner Exelon Corporation and minority owners Black & Veatch Corporation, Kiewit Energy Group Inc, and Enbridge Inc. The purpose of the Annova LNG facility was to receive natural gas from the Agua Dulce, Texas region, provide any treatment necessary, chill the gas until it condensed into LNG, store LNG pending loading for tanker transport, and load LNG onto LNG tankers for export to other countries.

https://www.rigzone.com/news/texan_lng_project_axed-23-mar-2021-164960-article/

show less

Natural Gas / LNG Utilization

Italy: Snam’s new partnership will promote LNG and bio-LNG mobility

Snam and SIAD, chemical group in the production and supply of industrial gases, have signed a framework agreement to start a technological collaboration to develop small-scale and mid-scale plants for the liquefaction of natural gas and biomethane,

read more

on behalf of third-party customers. The aim of the agreement is to foster the use of LNG and bio-LNG as alternative fuels for sustainable mobility and other end uses. The facilities proposed by Snam and SIAD will be modular and standardized, with capacities ranging from 50 ktpa (kilo-tons per year) to 100 ktpa in the case of small-scale plants and from 200 ktpa upwards for mid-scale plants. They will use Italian technology, based on an energy-optimized cryogenic nitrogen cycle through the use of two machines (expanders/compressors). The savings compared to a traditional solution can be as much as 30% of the cost of the plant. As part of the collaboration between Snam and SIAD, a project will be launched in Campania in 2021, with a capacity of 50 ktpa (small-scale), which has already obtained European funding. The plants, which will be operated by Snam, will also ensure the security of LNG and bio-LNG supply to other regions of Southern Italy, shortening the chain between supply and end users and serving a rapidly growing market. LNG trucks have registered quite an increase in Italy in the last five years from fewer than 100 to about 3,000 units and there are now around 90 filling stations.

show less

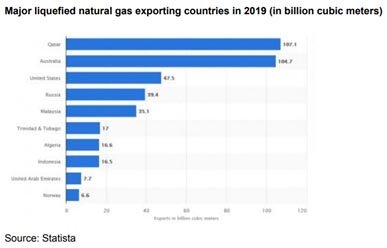

The 3 Nations Vying For Global LNG Dominance

Last year was an unprecedented year for natural gas and liquefied-natural-gas (LNG) markets. Whereas natural gas demand declined by 3%, LNG demand proved to be more resilient and managed to grow 1%. Nevertheless, the LNG market was extremely volatile,

Last year was an unprecedented year for natural gas and liquefied-natural-gas (LNG) markets. Whereas natural gas demand declined by 3%, LNG demand proved to be more resilient and managed to grow 1%. Nevertheless, the LNG market was extremely volatile,

read more

with periods of extreme oversupply alternating with periods of extreme tightness during the year. According to global management consulting firm McKinsey, natural gas is set to become the strongest-growing fossil fuel, with demand expanding 0.9% per annum from 2020 to 2035. While that kind of growth is nothing to write home about, natural gas will be the only fossil fuel expected to grow beyond 2030, peaking in 2037 thanks to the strong clean energy momentum. From 2035 to 2050, demand is expected to decline modestly by 0.4% per annum due to hard-to-replace gas use in the chemical and industrial sectors as natural gas continues to replace coal in power generation. Meanwhile, LNG is set for much stronger growth, with McKinsey predicting that domestic supply in key gas markets will be unable to keep up with demand growth. Global LNG demand is expected to grow 3.4% per annum to 2035, calling for some 100 million metric tons of additional capacity to meet both demand growth and replace decline from existing projects. LNG demand growth will slow markedly from 2035 to 2050 to just 0.5% per annum but still call for more than 200 million metric tons of new capacity by 2050. The U.S. also scored a crucial win after Turkey ditched Russia in favor of the United States as its primary LNG supplier, with experts pointing fingers at the political tussle between Ankara and the Kremlin in Syria and Libya as being to blame for the growing bad blood between Turkey and Russia.

https://oilprice.com/Energy/Natural-Gas/The-3-Nations-Vying-For-Global-LNGDominance.html

show less

LNG as a Marine Fuel/Shipping

QATAR PETROLEUM LAUNCHES LNG VESSELS TENDER

State-run Qatar Petroleum issued an invitation to tender for the chartering of LNG carriers for its future LNG shipping requirements, including its ongoing expansion projects in the North Field, it said on March 20.

read more

The invitation to tender, which was issued “to a large group of LNG ship owners”, also covers the requirements for the LNG volumes that will be produced from the Golden Pass LNG export project in the US. It also includes options to replace time charters for a number of Qatar’s LNG carriers that will expire in the next few years. Qatar Petroleum said that upon receiving the responses to the tender, it will review bidders’ technical and commercial capabilities with the objective of assigning selected ship owners to the shipyards’ construction slots, which were previously reserved at a number of Chinese and Korean shipyards. The company in February 2020 had reserved capacity at China’s Hudong-Zhonghua shipyard to build LNG carriers. In June it struck a trio of deals worth $19bn to reserve capacity for the construction of LNG carriers at South Korean shipyards. Under the deals, it book “a major portion” of the LNG shipbuilding capacity of South Korea’s top three yards, Daewoo Shipbuilding and Marine Engineering, Hyundai Heavy Industries and Samsung Heavy Industries, through 2027. Qatar Petroleum and ExxonMobil are developing the 18mn mt/year Golden Pass export terminal which is expected to be operational by the middle of this decade.

https://www.naturalgasworld.com/qatar-petroleum-launches-lng-vessels-tender-86552

show less

Wärtsilä to support Japanese LNG carriers

The agreements are designed to maximise operational availability and ensure long-term maintenance cost predictability through the utilisation of data input to optimise all maintenance procedures.

read more

The agreements also include Wärtsilä’s Expert Insight, a predictive maintenance product that leverages artificial intelligence (AI) and advanced diagnostics to monitor equipment and systems in real-time. Specialists at Wärtsilä Expertise Centres are thus able to support the customer proactively with advice and appropriate resolutions to avoid potential operational disturbances and thus increase the vessels’ uptime and availability.

The technical support provided by Wärtsilä and the application of the company’s digital technology will both enhance the reliability of the ships’ operations, and allow accurate budgeting of the long-term maintenance costs.

“As part of our Lifecycle Solutions approach, these agreements are designed to improve our customers’ business performance and competitiveness. By including Expert Insight into our offering, we are adding considerable value to the proposition since it takes predictive maintenance to a completely new level,” says Henrik Wilhelms, Director, Agreement Sales, Wärtsilä Marine Power.

The full scope of the agreements includes all scheduled parts, workshop services, field services, maintenance planning, remote operational support, Expert Insight’s asset diagnostics and anomaly detection, and dynamic maintenance planning.

https://www.lngindustry.com/lng-shipping/23032021/wrtsil-to-support-japanese-lng-carriers/

show less

Tokyo port to waive entry fee for ships powered by LNG, hydrogen

Japan’s port of Tokyo will waive an entry fee from next month for ships powered by liquefied natural gas (LNG) and hydrogen, as well as LNG bunkering ships, in a bid to promote the use of cleaner marine fuels, authorities said on Friday.

read more

The exemption runs for five years from April 1, and an official of the Tokyo metropolitan government said the neighbouring ports of Yokohama and Kawasaki would also apply it to LNG-powered and LNG bunkering ships.

The entry fee now stands at 2.7 yen ($0.025) per gross tonne for ocean-going vessels and 1.35 yen per gross tonne for coastal vessels, the official said. ($1=109.2600 yen)

show less

Technological Development for Cleaner and Greener Environment Hydrogen & Bio-Methane

World’s First Zero-Emission Wind and Hydrogen Power Cargo Ship

A Norwegian partnership is moving forward with the development of what they are calling the world’s first zero-emission cargo ship. After a six-month competition, with more than 31 ship owners bidding on the project, the contract for the construction has been awarded.

A Norwegian partnership is moving forward with the development of what they are calling the world’s first zero-emission cargo ship. After a six-month competition, with more than 31 ship owners bidding on the project, the contract for the construction has been awarded.

read more

The team expected to complete the design this year so that the vessel can enter service by 2024.

The ship concept has the project name “With Orca” – Powered by Nature, as a significant part of the energy required to operate the vessel will be harvested directly from nature through two large rotor sails. The plan calls for the vessel to sail mostly in open waters in the North Sea, where wind conditions are optimal for wind-assisted propulsion.

The wind energy will be in addition to a hydrogen-fueled internal combustion engine. The design concepts, which will be further developed in 2021, call for the hydrogen to be stored aboard the vessel in compressed form.

Egil Ulvan Rederi and Norwegian Ship Design are working jointly to present technical solutions with a focus on energy efficiency and reduced fuel costs. They have also been meeting with DNV to develop the designs for the ship. The current designs for the self-loading bulker call for a length of 289 feet with a deadweight of approximately 5,500 tons.

show less

Saudi Arabia offers Europe ‘green’ hydrogen by pipeline

DUBAI: Saudi Arabia is offering to transport “green” hydrogen by pipeline to Europe in the next stage of the Kingdom’s strategy to combat climate change.

DUBAI: Saudi Arabia is offering to transport “green” hydrogen by pipeline to Europe in the next stage of the Kingdom’s strategy to combat climate change.

read more

“If Europe would like to buy more hydrogen, Saudi green hydrogen, we would be more than happy, and even, if the economics allow for it, even piping it all the way to somewhere in Europe,” Saudi Energy Minister Prince Abdul Aziz bin Salman said.

He also hinted at major developments to come in solar energy production. “I believe in the next month or so we’ll dazzle the world with how cheaply we can get our solar electricity,” he said.

Prince Abdul Aziz was speaking at a virtual meeting of the International Energy Forum and the European Union hosted in Riyadh, at which he added detail to the Kingdom’s strategy to control harmful greenhouse gas emissions.

https://www.arabnews.com/node/1816761/business-economy

show less

Is The World’s Most Controversial Pipeline About To Pivot To Hydrogen?

Keeping the position of key energy supplier to the Old Continent comes at a price. And it looks like it’s a price Russia is ready to pay it. Moscow is silently investing in the production of hydrogen, potentially aiming to make it flow

read more

through its new NordStream 2 pipeline. While the future of the controversial project still fuels debates and uncertainties, Russia decided to adapt to its neighbor’s needs for cleaner energy sources, and in particular for hydrogen, which the European Commission put at the forefront of its recovery agenda.

A dialog between Berlin and Moscow is currently underway to produce green hydrogen on a large scale. That information was revealed during a conference held at the German-Russian Chamber of Commerce on February 16th. But as surprising as it may appear, this narrative is not new. Firstly, mentioned in 2018, the hydrogen option for Nord Stream 2 was then put on the table by Uniper who, in March 2020, envisioned the ability of the pipeline to transport up to 80% hydrogen.

“One of the key arguments against NordStream 2 is that adding natural gas contradicts the decarbonization objectives of Europe. Here, Russia’s counter-argument is that NordStream 2 also has a hydrogen potential, and can fulfill those decarbonization objectives”, according to Luca Franza, a researcher on EU-Russia gas relations.

However, nothing is less certain than the fact that Russia will be Europe’s most competitive supplier. Moscow does not yet possess sufficient hydrogen production capacity to become price-competitive. Thus, it will not be likely to meet European demand, estimated to reach 700TWh in the “business-as-usual” scenario (or 8% of total energy demand) by 2050 according to the EU Hydrogen Roadmap.

Projections are even more difficult to make in a market that does not yet exist and will be created only based on political will. “We tend to live in the future concerning hydrogen: Europe has ambitious projections concerning hydrogen demand, but we act like we are already there”, says Luca Franza.

show less