NGS’ NG/LNG SNAPSHOT – Apr 16-30, 2023

NGS’ NG/LNG SNAPSHOT – Apr 16-30, 2023

National News Internatonal News

NATIONAL NEWS

City Gas Distribution & Auto LPG

CONCOR orders 100 LNG trucks at Blue Energy Commercial Vehicles

NEW DELHI : Container Corporation of India Ltd (CONCOR) has placed an order for 100 liquefied natural gas (LNG) trucks at Pune-based Blue Energy Commercial Vehicles Pvt Ltd as the state-owned company takes first steps to cut hazardous emissions and align with the government’s larger climate change goals.

NEW DELHI : Container Corporation of India Ltd (CONCOR) has placed an order for 100 liquefied natural gas (LNG) trucks at Pune-based Blue Energy Commercial Vehicles Pvt Ltd as the state-owned company takes first steps to cut hazardous emissions and align with the government’s larger climate change goals.

more presentation

Separately, Concor has ordered 100 trailers at Raigarh, Chhattisgarh-based Jagdamba Trailers Pvt Ltd, that will carry the steel containers on the LNG trucks, sources said. Concor declined to divulge details of the order. During the earnings call on the third quarter financial results held on 24 January, V Kalyana Rama, Chairman and Managing Director, Concor, revealed the company’s plan to introduce LNG trucks for the first and last mile movement of containers.

“We will be experimenting with LNG transfers at our major hub Kathuwas and then we will be expanding it to all the terminals,” Kalya Rama said on 24 January.

“All these new things we are bringing…because the demand is there in domestic sector and also to encourage more and more domestic traffic into containers and to add value-added services and to make it a complete business solution which will increase our margins so that the overall margin pressure will not be too much,” he added.

A zero-emission truck technology start-up, Blue Energy Commercial Vehicles – known by its brand name Blue Energy Motors – is a portfolio company of Exponentia Ventures, a Dubai-based fund run by Anshuman Ruia, a second generation of the Ruia family that founded Essar Group.

FPT Industrial, the global Powertrain brand of Iveco Group, has a minority stake in Blue Energy Motors.

Globally, logistics contributes to 14-15 percent of carbon emissions and in that the contribution of heavy-duty trucking is about 90 percent.

The trucking industry is one of the most significant polluters, producing up to 450 million tonnes per annum of CO2, as well as significant noise, particulate matter, and pollutants each year.

Therefore, LNG trucks are poised to upend the sector and hasten the shift to “green transportation, Blue Energy said on its website.

Compared to diesel trucks, an LNG truck emits up to 28 percent less carbon dioxide (CO2) and up to 30 percent less noise. It can also raise an organization’s scores on the environmental social and governance (ESG) ratings.

When appropriately utilised with trained drivers, LNG trucks have the potential to reduce particulate material (PPM) by up to 91 percent.

To combat the rapidly rising climate change, LNG is seen as an immediate, versatile, mature, and scalable solution to make the long-haul trucking industry sustainable, says Blue Energy Motors. It’s a cleaner and greener fuel, which reduces sulphur oxide (SOX) up to 100 percent and nitrogen oxide (NOX) up to 59 percent.

LNG Trucks have seen a great deal of success in the Chinese and European markets.

India is looking to transition to a gas-based economy by 2030, increasing gas’s current share of the energy mix from 6 percent to 15 percent.

https://indiashippingnews.com/concor-orders-100-lng-trucks-at-blue-energy-commercial-vehicles/

show less

City gas distribution networks achieve tenfold increase in districts’ coverage

New Delhi: The government on Monday said its city gas distribution (CGD) networks achieved a tenfold increase in its districts’ coverage, which grew from 66 in 2014 to 630 in 2023.With this, the number of domestic PNG connections from a merely 25.40 lakh in 2014 went up a whopping 103.93 lakh in 2023.

more presentation

The government said 78 lakh PNG connections provided in the last nine years, according to a statement from the Ministry of Information and Broadcasting.The city gas distribution (CGD) networks are an interconnected system of underground natural gas pipelines for supplying piped natural gas (PNG) and compressed natural gas (CNG).

While CNG is predominantly used as auto-fuel, PNG is used in domestic, commercial and Industrial segments. These networks are a part of the government’s efforts to promote sustainable growth and to reduce greenhouse gas emissions and pollution.According to the statement, this creation of a natural gas ecosystem is in sync with the government of India’s thrust on promoting a gas-based economy that will reduce environmental pollution and act as a catalyst for overall economic development.The central government is promoting alternative fuels which inter alia include Liquified Natural Gas (LNG), Green Hydrogen, Compressed Bio-Gas (CBG), ethanol, for the reduction in greenhouse gas emissions. City Gas Distribution Network takes massive strides to offer convenient and affordable fuel.

A strong emphasis has been laid on the expansion of city gas distribution (CGD) networks across the country, with a potential to make gas accessible to over 70 per cent of the population, according to the website of the Ministry of Petroleum and Natural Gas. The distribution networks would enable the supply of cleaner cooking fuel, like, PNG, to households, industrial and commercial units as well as transportation fuel such as CNG to vehicles.

show less

Assam CM Himanta Biswa Sarma opens CNG station, gas pipeline in Golaghat

GUWAHATI: Chief minister Himanta Biswa Sarma on Friday inaugurated the CNG station and gas pipeline at Hazarigaon well site at Naharbari in Golaghat district as a part of state government’s step towards popularising green energy in the state

more presentation

Sarma, in a tweet, said, “Setting up of CNG stations is a step towards popularising green energy in Assam. In the past two years, there is peace and a positive atmosphere in our state. We will be soon able set new milestones in industrialisation in Assam.”

Gas from the Hazarigaon block will be one of the prime contributors to the 100 CNG buses initiative run by the state government in Guwahati and will also support tea growers across the state.

Cairn Oil & Gas has signed a gas sales agreement with Assam Gas Company Limited (AGCL) to sell 3.5 million standard cubic feet per day (MMSCFD) of gas from the Hazarigaon field.

Cairn Oil & Gas stated that the Hazarigaon filed awarded in the DSF-II auction is the first Discovered Small Fields (DSF) block in the northeast.Commenting on the new production asset, Nick Walker, CEO of Cairn Oil & Gas, said, “We are delighted to become the first company to commence operations from a DSF block in the northeast region.”

show less

Karnataka struggles to meet Centre’s PNG target

With the upcoming elections, the public is anxiously seeking assurance from candidates about obtaining piped natural gas (PNG) connectivity to their apartments or houses in their respective localities.

more presentation

As PNG, which is cheaper and more convenient than LPG cylinders, gains popularity, the state government has drafted a new policy on City Gas Distribution (CGD) aimed at clearing hurdles that hinder the expansion of the gas pipeline network and increasing gas utilisation in the state.

The policy gains significance as Karnataka lags behind the Centre’s target of achieving 92 lakh PNG connections to households in the next seven years, and the Government of India (GOI) aims to increase the share of natural gas in the country’s primary energy mix from 6.2 per cent to 15 per cent by 2030.

Some key features of the policy include uniform permission charges in the state for laying gas pipeline networks, similar to the permission charges for laying optic fiber cables already fixed by the state, time-bound granting of permissions for laying gas pipelines, making available Civic Amenity (CA) land for CNG infrastructure (such as CNG dispensing stations, City Gate Stations, DRS, etc) after receiving applicable payments, banning polluting fuels in industrial areas, and promoting CNG vehicles in the state.

According to a CGD expert, “Some provisions, such as time-bound grant of permissions, are currently applicable only to GAIL Gas Ltd, which operates in districts such as Bengaluru (Urban & Rural) and Dakshina Kannada. While this has helped GAIL Gas to meet its Minimum Work Programme (MWP) in Bengaluru, the seven other entities, including BPCL, Maharashtra Natural Gas Limited (MNGL), AG&P, Mega Engineering Ltd, Indian Oil Adani Gas Ltd, Adani Total Gas Ltd, Unison, etc, whose geographical areas cover the rest of Karnataka, have not made much progress due to various hindrances faced by them in the districts.”Like water and electricity, CGD projects are categorised as public utility projects.”PNG and CNG are considered economic, eco-friendly, safe, and convenient fuels, but the general public has yet to reap these benefits due to the delay in expanding the network. We believe the new policy will address existing gaps. It will also help the state address the problem of carbon emission,” said the expert.

The CGD entities have been requesting the state government to come up with a policy by taking cues from other states that have come up with progressive policy measures to support the CGD project.

https://www.deccanherald.com/city/karnataka-struggles-to-meet-centres-png-target-1212393.html

show less

Cairn Oil & Gas commences gas flow from Hazarigaon field in North-Eas

Cairn Oil & Gas, a unit of Vedanta Ltd, on Friday said it has commenced test production from its Hazarigaon field in Assam that it had won in a discovered small field (DSF) bid round. “The gas produced by Cairn Oil & Gas is evacuated through a main trunk pipeline, and a gas cascading system to AGCL,” the firm said in a statement.

more presentation

“The gas evacuation from the field will be used by tea growers among other industries.” Additionally, the gas cascading system will enable gas from Hazarigaon to be a prime contributor in fueling 100 CNG buses that will be plying in Guwahati as part of the clean energy initiative of the Government of Assam. Commenting on the new production asset, Nick Walker, CEO of Cairn Oil & Gas, said, “We are delighted to become the first company to commence operations from a DSF block in the North-East region. The region holds significant potential and is a key focus for us at Cairn Oil & Gas as we move towards our goal of doubling production and supporting energy security for the country.”

Assam, he said, has a significant potential for unlocking hydrocarbon reserves and with government support, infrastructure, and fast-tracked approvals to continue exploration activities, the region can support India’s vision to be self-reliant in oil and gas. The company plans to drill 5 to 10 exploration wells in the next two years across the Golaghat, Jorhat and Tinsukia districts of Assam. Cairn holds 7650 square kilometres of acreage in Assam-Arakan Basin with 12 Open Acreage Licensing Policy (OALP) and 3 Discovered Small Fields (DSF) blocks.

“The acreage has a significant resource potential of up to 1 billion barrels of oil equivalent,” the statement said. Cairn has also conducted large-scale airborne gravity magnetic and seismic survey for exploration. Cairn Oil & Gas entered into a gas sales agreement (GSA) with AGCL that laid down the infrastructure for distribution of cleaner fuel to the industry through pipelines. The company is working closely with AGCL and other infrastructure companies to make gas accessible to industries in Assam. “By the end of April, evacuation of gas in Hazarigaon is expected to ramp up as tea industry demand increases,” it added.

show less

Natural Gas/ Pipelines/ Company News

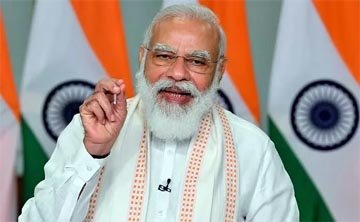

PM Narendra Modi hails gas pipeline under Brahmaputra

PM Narendra Modi hailed the major milestone in the Northeast Gas Grid project with the construction of a 24-inch-diameter natural gas pipeline through the HDD method under the Brahmaputra River.

PM Narendra Modi hailed the major milestone in the Northeast Gas Grid project with the construction of a 24-inch-diameter natural gas pipeline through the HDD method under the Brahmaputra River.

more presentation

NEW DELHI: Prime Minister Narendra Modi hailed the major milestone in the Northeast Gas Grid project with the construction of a 24-inch-diameter natural gas pipeline through the HDD method under the Brahmaputra River today.

Sharing a tweet by the Ministry of Petroleum and Natural Gas about setting a record for the longest hydrocarbon pipeline river crossing in Asia and the second-longest in the world, the Prime Minister tweeted: ”Exemplary!”

According to sources, the natural gas pipeline will link Jorhat and Majuli, marking a significant milestone in constructing the Northeast Gas Grid to connect the Northeast to the national gas grid. With the completion of the Brahmaputra HDD, Indradhanush Gas Grid Ltd. has achieved more than 71 percent physical progress on the Northeast Gas Grid Project.

The length of the pipeline across the main water channel of the Brahmaputra river is 4080 metres. The total cost of the project is Rs 9265 crore.

Indradhanush Gas Grid Ltd. is a joint venture between IOCL, ONGC, GAIL, and OIL. It is implementing the North East Gas Grid Project connecting the major cities and demand centres on the Northeast with the National Gas Grid.

show less

MGL to expand into CBG, LNG & EV segments

In a bid to diversify its portfolio, state-run city gas distributor (CGD) Mahanagar Gas Ltd (MGL) is planning to expand into business areas other than city gas distribution (CGD), a senior executive said.

more presentation

The company is planning to enter the compressed biogas (CBG) segment, the electric vehicles market, equipment manufacturing for CGD companies and retailing LNG as fuel for long-haul transportation.

“We have some cash on our balance sheet and we would like to expand our portfolio in terms of seeing how we can make its best use,” said Ashu Shinghal, managing director, MGL. “Our net worth is around ₹4,000 crore. We are a zero-debt company, so we can also take a loan in case required,” added Shinghal.

Last month, MGL acquired 100 percent shareholding of Unison Enviro Pvt. Ltd. (UEPL) for ₹531 crore to enter new geographical areas for pursuing inorganic growth opportunities. MGL said Unison Enviro would become a subsidiary and would be rebranded.

show less

Reliance Industries Ltd to pump up more gas

Reliance and its partner, UK supermajor BP, are now nearing start of production from their giant MJ deep-water project

more presentation

Reliance Industries Ltd will commence natural gas production from its deepest discovery in the KG-D6 block this quarter, meeting 15 per cent of India’s gas demand.

KG-D6 off the Andhra coast is India’s only deepwater block under production.

The block averaged 20 million standard cubic meters per day (mscmd) of production in the January-March quarter, the company told investors post-presentation of the March quarter earnings.

Reliance and its partner, UK supermajor BP, are now nearing the start of production from their giant MJ deep-water project, which will significantly boost gas output from the prized east coast asset.

“MJ field is expected to commence production in 1Q FY24 (April 2023 to March 2024),” it said.

The company, which is the operator of the block, earlier planned to start production in the December quarter, but it was delayed by three months.

Reliance and BP are spending about $5 billion on further developing KG-D6 through three different projects, aimed at rejuvenating gas production from the offshore asset. While the first two developments — R-cluster and Satellite Cluster — have started gas production, MJ is now nearing completion.

Start of MJ will take KG-D6 gas production to 30 mscmd in FY24, Reliance said in the presentation.

“Testing and commissioning underway in the MJ field,” it said. “One well opened as part of the ongoing testing of the integrated production system.”

The company has already sold 6 mscmd of gas to companies in the city gas, power and fertiliser sectors.

The two partners plan to use a floating production system at high-sea in the Bay of Bengal to bring to production the deepest gas discovery in the KG-D6 block.

The MJ-1 gas find is located about 2,000 metres directly below the Dhirubhai-1 and 3 (D1 and D3) fields —the first and the largest fields in KG-D6 block. MJ-1 is estimated to hold a minimum of 0.988 trillion cubic feet of contingent resources.

https://www.telegraphindia.com/business/reliance-industries-ltd-to-pump-up-more-gas/cid/1931819

show less

Urja Ganga pipeline benefits cheaper rates to consumers

The “Urja Ganga” pipeline, which is India’s largest initiative to bring environmentally friendly gas to hitherto untapped regions, has brought the advantages of cheaper natural gas costs to the hinterland, aiding in the expansion of the use of the cleaner fuel, according to official sources.

more presentation

Since only the Western and Northern regions of the country had pipelines connecting the fuel’s source to consumers, natural gas was previously only available in these regions for use as a fuel to produce electricity, fertiliser, or convert into CNG and cooking gas.A 2,655-km pipeline that would run from Jagdishpur in Uttar Pradesh to Haldia in West Bengal, Bokaro in Jharkhand, and Dhamra in Odisha began construction in October 2016.

To transport the petroleum to previously unconnected states in the East, a 726 km line from Barauni in Bihar was constructed to Guwahati in Assam.

The Pradhan Mantri Urja Ganga pipeline, also known as the Jagdishpur-Haldia-Bokaro-Dhamra Pipeline (JHBDPL), is now prepared to deliver gas to the eastern states of Bihar, Jharkhand, Odisha, and West Bengal, according to official sources.

Following the government’s decision to lower the price of input natural gas, has enabled consumers in these areas to reap the benefits of lower CNG and piped cooking gas prices. Consumers in 20 hinterland towns and cities have now benefited from a rate cut of about Rs 5-7.The least expensive way to transport gas is by pipeline. According to sources, the state-owned gas utility GAIL (India) Ltd was given permission to lay JHBDPL in order to transport gas to the eastern states of India. For JHBDPL’s construction, the government paid a viability gap funding of 40 per cent, totalling Rs 51.76 billion.

Additionally, GAIL is building the Barauni-Guwahati pipeline as part of JHBDPL. This pipeline will serve as a source for the North East Gas Grid and is being built with 60 per cent viability gap funding, or Rs 55.59 billion, in order to connect all of the North Eastern states to natural gas sources and supply gas to all areas of the nation.

The Pradhan Mantri Urja Ganga pipeline will link all of the regions (more than 90) that are dispersed over the Indian states of Uttar Pradesh, Bihar, Orissa, West Bengal, and farther to the country’s north-eastern region.With the completion of this project, they claimed, the North Eastern and Eastern regions of India will become an essential element of the gas-based economy, enjoying the advantages of both the cheapest gas transportation via Urja Ganga and gas pricing reforms.

The transportation rate has been reduced by almost 50 per cent to Rs 99.90 per million British thermal units for the eastern sections under the unified pricing regulations recently announced by the industry regulator Petroleum and Natural Gas Regulatory Board (PNGRB), making the clean fuel cheaper.

The updated domestic natural gas pricing rules for gas generated from nominated fields controlled by the state-owned Oil and Natural Gas Corporation (ONGC) and Oil India were approved by the Cabinet Committee on Economic Affairs last week.

The cost of such natural gas shall be announced on a monthly basis and shall equal 10 per cent of the monthly average of the Indian crude basket. There will be a floor price and a ceiling for gas generated from ONGC/OIL’s nomination fields. As a result, petrol is now less expensive per mmBtu, at $ 6.5 instead of $ 8.57.They added that the reforms will result in a significant drop in the cost of compressed natural gas (CNG) for transportation as well as piped cooking gas for homes, as well as a reduction in the burden of fertiliser subsidies and support for the domestic energy sector.

show less

Policy Matters/ Gas Pricing/ Others

New pricing norms cut earnings downside for gas producers: S&P

New Delhi: India’s new gas pricing regime will offer greater downside protection for earnings of gas companies such as Oil and Natural Gas Corp (ONGC) and Oil India Ltd, S&P Ratings said on Friday. The new norms will not affect the pricing for gas produced from difficult fields that companies like Reliance Industries Ltd operate.

New Delhi: India’s new gas pricing regime will offer greater downside protection for earnings of gas companies such as Oil and Natural Gas Corp (ONGC) and Oil India Ltd, S&P Ratings said on Friday. The new norms will not affect the pricing for gas produced from difficult fields that companies like Reliance Industries Ltd operate.

more presentation

Under the new guidelines announced on April 6, 2023, the government will set prices for domestically produced gas on a monthly basis; the rate will be 10 per cent of the average price of the Indian crude basket in the preceding month. The price will have a floor of USD 4 per million British thermal unit (mmbtu) and a ceiling of USD 6.5 per mmBtu.

“We expect the new gas pricing terms to result in more fluid market price revisions,” said S&P Global Ratings credit analyst Shruti Zatakia.

Under the earlier regime, prices were reset semi-annually and were linked to gas prices in key international trading hubs.

The pricing mechanism for gas production from deep water, ultra-deep water, high-temperature, and high-pressure fields is unchanged. This means companies such as ONGC and RIL that operate such fields will maintain marketing and pricing freedom, subject to a ceiling price that is revised semi-annually.”The floor price means ONGC will be able to generate a minimum of USD 4 per mmBtu on its gas production even if international natural gas prices decline to historical lows. The company’s realizations averaged USD 2 per mmBtu-USD 3 per mmBtu during low hydrocarbon prices in 2020,” S&P said in a statement.

The price ceiling will restrict earnings’ upside for ONGC, particularly amid current elevated prices. The price cap of USD 6.5 per mmBtu for the next two years is lower than the administered price of USD 8.57 for October 2022-March 2023. In contrast, the ceiling price for output from difficult fields remains unchanged at USD 12.11 per mmBtu for April 2023-September 2023.The gas pricing reforms are intended to ensure more stable and affordable gas prices, and therefore fuel demand for natural gas. They also align with India’s ambitions of increasing the share of natural gas in the energy mix to 15 per cent by 2030 from 6.5 per cent now. Gas accounts for almost 50 per cent of ONGC’s production volume.”We believe the gas price reforms and the currently favourable crude oil prices will incentivise ONGC to scale up capital investments over the coming 12-18 months,” said Zatakia.

“This will be critical given the company’s crude oil production has been hit by ageing oilfields and delays and cost escalations on new discoveries.”Geopolitical issues in international markets in fiscal 2023 (ended March 31, 2023) exacerbated the problem. The new guidelines allow ONGC and OIL to charge a premium of 20 per cent over the administered price for gas produced from new wells and from technology interventions in existing wells.

ONGC will likely maintain some cushion in its current stand-alone credit profile (SACP) assessment of ‘BBB+’.”Under our forecasts, the company’s ratio of funds from operations to debt ratio will be 45-50 per cent in fiscal 2024 and fiscal 2025 under the new price regime. This is even if international crude oil prices retreat to mid-cycle levels of about USD 55 per barrel. ONGC is also unlikely to breach our 40 per cent threshold for a lower SACP even if its annual capital expenditure is Rs 50,000-55,000 crore in such a scenario over the period,” S&P said.

show less

Hardeep Singh Puri confident of meeting 20 % ethanol blending target next fiscal

Oil minister Hardeep Singh Puri on Monday exuded confidence of meeting the target of supplying petrol mixed with 20 per cent ethanol by 2025, five years earlier than the previously planned roll-out in 2030. Petrol blended with 20 per cent ethanol was rolled out at select petrol pumps in 11 states and Union Territories in February as part of a programme to increase use of biofuels to cut emissions as well as dependence on foreign exchange-draining imports.

more presentation

At present, 10 per cent ethanol is blended in petrol (10 per cent ethanol, 90 per cent petrol) and the government is looking to double this quantity by 2025. “I am sure we will be able to supply 20 per cent ethanol blended petrol by next (fiscal) year,” he said.

India saved as much as Rs 41,500 crore in forex outgo from 10 per centblending besides benefiting the farmers, he said at a biofuels conference here.Puri said India achieved blending of 10 per cent ethanol in petrol in June2022, five months ahead of the schedule.”We also advanced the availability of E20 blended petrol to 2025, five yearsfrom earlier planned in 2030,” he said.Use of ethanol, extracted from sugarcane as well as broken rice and other agriproduce, will help the world’s third largest oil consumer and importingcountry cut its reliance on overseas shipments. India currently is 85 per centdependent on imports for meeting its oil needs. Also, it cuts carbon emissions.

Use of E20 leads to an estimated reduction of carbon monoxide emissions byabout 50 per cent in two-wheelers and about 30 per cent in four-wheelerscompared to E0 (neat petrol). Hydrocarbon emissions are estimated to reduceby 20 per cent in both two-wheelers and passenger cars.India spent USD 120.7 billion on import of crude oil in 2021-22 fiscal (April2021 to March 2022). During first 11 months of 2022-23 fiscal it spent USD211.6 billion on crude oil imports.As much as 440 crore litre of ethanol was blended in petrol during the supplyyear ending November 30, 2022. For the next year, 540 crore litresprocurement is being targeted with an eye to start larger volumes of blending.The target of achieving average 10 per cent blending was achieved in June,2022, much ahead of the target date of November, 2022. Encouraged by thesuccess, the government advanced the target of 20 per cent ethanol blendingin petrol from earlier 2030 to 2025.

https://economictimes.indiatimes.com/industry/energy/oil-gas/harshdeep-puri-confident-of-meeting-20-pc-ethanol-blending-target-next-fiscal/articleshow/99559459.cms

show less

LNG Use / LNG Development and Shipping

Gas-based power plants ready to meet peak demand

By Manish Gupta

Gas-based power plants are ready to meet any power deficit during the peak demand period this summer, and availability of natural gas is being ensured by state-owned GAIL India and country’s top gas importer Petronet LNG Ltd

Gas-based power plants are ready to meet any power deficit during the peak demand period this summer, and availability of natural gas is being ensured by state-owned GAIL India and country’s top gas importer Petronet LNG Ltd

more presentation

Both GAIL and Petronet have issued several tenders to import liquefied natural gas (LNG) last week for deliveries in May and June. Sector analysts believe the underutilised gas-based power plants will be used to fill any shortage.

“Idea is to improve the energy generation so as to meet the spike in the energy demand that we are anticipating because of the heat wave… You may see some improvement in capacity utilisation of gas-based power plants.

“To meet the peak deficit, respective utilities can tap this (gas) power on high price day ahead basis from the power exchange market,” said Girishkumar Kadam, senior vice president and co-group head, ICRA.

India’s electricity demand saw an all-time of 218 GW last week on April 18, of which the power sector could meet record demand of 216 GW, leaving a deficit of 2,021 MW. Last year, the highest demand met was 212 GW on June 10.

Gas-based power plants of NTPC Ltd, India’s largest power producer, are all set to start power production when required, an official said. NTPC has 6,511 MW of gas-based power capacity and has assured gas supply from GAIL.

While NTPC is directed by the ministry of power to run 5,000 MW gas-based power stations during the crunch period, its subsidiary NTPC Vidyut Vyapar Nigam Ltd will procure 4,000 MW gas power from other state-run plants.

There are more than 60 gas-based power plants in the country with a total capacity of about 25 GW, which is slightly above 6% of India’s total installed power generation capacity. The government wants the share to rise to 15%.

However, 28 gas-based plants with about 10 GW capacity had zero generation and the overall plant load factor (PLF) of all gas-based power plants was below 15% in FY23 due to lack of domestic gas and high price of imported gas.

With barely half of the current gas consumption coming from local production, which mostly feeds the fertilizer sector and city gas distributors, dependence on gas-based power plants can only be interim and not a long term solution.

“Gas-based power plants can only provide temporary relief during the summer months. Imported gas is not favourable in terms of cost economics,” said Kadam.

https://www.financialexpress.com/industry/gas-based-power-plants-ready-to-meet-peak-demand/3059337/

show less

India’s Dhamra LNG Terminal Receives First Cargo

Total Energies said Monday its co-owned Dhamra LNG terminal in the Indian state of Odisha had received its first liquefied natural gas (LNG) cargo ahead of startup, a project recently overshadowed by fraud allegations against partner Adani Group.

more presentation

“This delivery enables the gradual commissioning of the terminal, which is expected to start commercial operations at the end of May 2023”, the French energy giant said in a press release.

TotalEnergies has acquired the Dhamra facility and other Adani Group assets in a partnership deal it announced 2019. Adani Total Pvt. Ltd., a 50-50 venture between TotalEnergies and Adani Group, operates the terminal on the east coast of India.

While the Dhamra project has progressed toward startup, TotalEnergies earlier said it had paused a transaction to buy an interest in Adani New Industries Limited following allegations of stock manipulation and accounting fraud against Adani Group.

“With regasification capacity of 5 million metric tons of LNG per year, the Dhamra LNG terminal adds more than 10% to India’s regasification capacity, strengthening the country’s position as the world’s fifth largest LNG importer and allowing it to increase the share of natural gas in its energy mix from 8% to 15% by 2030 to reduce its carbon intensity”, said Monday’s announcement of the consignment from Qatar.

Thomas Maurisse, TotalEnergies senior vice-president for LNG, commented, “India wants to develop the use of natural gas to reduce the carbon intensity of its energy mix by replacing coal, and LNG can therefore meet growing domestic demand”.

The partnership with Adani Group that TotalEnergies unveiled 2019 involves two LNG depots and Adani Gas Ltd., “one of the 4 main distributors of city gas in India of which Adani holds 74.8% and of which Total will acquire 37.4%”, the Paris-based company said in a news release October 14, 2019. TotalEnergies will supply LNG to Adani Gas, now Adani Total Gas, as part of the deal. A joint venture with Adani Group is also planned to market LNG in India and Bangladesh.

The acquisitions amounted to a net cost for TotalEnergies of around $600 million over 2019 and 2020, TotalEnergies said in the partnership announcement.

Adani Troubles

TotalEnergies and Adani Group broadened their relationship in 2020 with the former acquiring a 20 percent minority interest in Adani Green Energy Ltd. (AGEL23) and a 50 percent stake in AGEL’S solar assets.

But TotalEnergies said it was delaying its purchase of a 25 percent interest in Adani New Industries Ltd., after India’s Supreme Court ordered an investigation into Adani Group over revelations by Hindenburg Research.

USA-based Hindenburg Research, which describes its work as “forensic financial research”, published January 24 what it said were the results of a two-year probe in which it found Adani Group “has engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades”.

Adani Group said the report by Hindenburg Research was “unsubstantiated”. It said in a January 26 statement it was examining remedial and punitive options under Indian and USA laws.

An article by French newspaper Le Monde published March 23 stated that Hindenburg Research founder Nathan Anderson “believes TotalEnergies has ‘at best turned a blind eye, and at worst, been complicit’ to the ‘issues’ of Adani Group in connection with the manipulation of the share price of two of its subsidiaries”.

TotalEnergies dismissed the French report. It said in a statement the same day, “TotalEnergies invested in Adani Gas to develop our LNG sales in India, not to generate stock market gains. The share price trend was therefore never a consideration for TotalEnergies, and it had no impact on the strategy or financial performance of Adani Gas, since the company did not issue any new shares” when TotalEnergies bought a 37.4 percent interest in Adani Gas in 2019.

TotalEnergies earlier said in a statement February 3 its assets in Adani Group businesses represented only $3.1 billion or 2.4 percent of the French company’s employed capital as of year-end 2022.

TotalEnergies said Adani Group’s difficulties posted no reason for the former to “halt assets in production or projects under construction” in India.

“Our investment in India is industrial, not financial”, it insisted in its reply to Le Monde.

show less

GAIL(India) seeks LNG cargo for May delivery to Dhamra terminal

NEW DELHI : GAIL (India) has issued a swap tender offering one liquefied natural gas (LNG) cargo for loading in the United States in exchange for another cargo for delivery to India, according to sources.

more presentation

India’s largest gas distributor is seeking the cargo for delivery on a delivery ex-ship (DES) basis at the Dhamra terminal between May 16-25.

It is offering the cargo for May loading from the Sabine Pass terminal, also on a DES basis, the sources said, adding that the tender will close on April 13.

Adani Total, in which French oil and gas major TotalEnergies has a 50 per cent stake, has a 20-year take-or-pay contract to provide regasification services to state-run Indian Oil Corp (IOC) for 3 million tonnes of LNG per year at the Dhamra terminal. GAIL has a similar deal for 1.5 million tonnes per year.

The terminal received its first LNG cargo on April 1, Karan Adani, Chief Executive of Dhamra Port owner Adani Ports and Special Economic Zones, said in a LinkedIn post.

In March IOC issued a tender seeking eight LNG cargoes to be delivered to the Dhamra terminal between June 2023 and May 2024.

GAIL has 20-year deals to buy 5.8 million tonnes a year of US LNG split between Dominion Energy‘s Cove Point plant and Cheniere Energy’s Sabine Pass site in Louisiana

https://indiashippingnews.com/gailindia-seeks-lng-cargo-for-may-delivery-to-dhamra-terminal/

show less

India looks to procure more LNG as heat wave boosts power demand

India is looking to procure more natural gas from abroad as a heat wave pushes the nation’s power demand to record levels.

more presentation

Companies including GAIL India Ltd. and Petronet LNG Ltd. released several tenders this week to buy liquefied natural gas shipments for delivery from early May to June, according to traders with knowledge of the matter. Some of that gas will go to power generation, they said.

The move is abnormal, since gas makes up a small portion of India’s coal-dominated power mix, and indicates the nation is working to ensure electricity keeps flowing to customers. Peak demand hit an all-time high earlier this week as blazing summer temperatures forced citizens to crank up their air conditioning.

Heat wave warnings are in place for parts of the nation’s east including Odisha, according to a bulletin from the India Meteorological Department. Maximum temperatures were in a range of 40C-44C (104F-111F) over many parts of the eastern region on Thursday, the bureau said.

NTPC Ltd., India’s largest electricity producer, was asked by the government to increase gas-fired power generation to meet peak demand during April and May. Gail is being tapped to help secure the fuel, Bloomberg reported last month. The company already purchased an LNG shipment for early May this week.

India started to buy more LNG from the spot market this year due in part to a slump in prices. With assistance from Ben Sharples/Bloomberg

show less

Electric Mobility/ Hydrogen/ Bio- Methane

IGGL completes Asia’s largest underwater hydrocarbon pipeline across Brahmaputra: CEO

Guwahati: Asia’s largest underwater hydro-carbon pipeline, below the river Brahmaputra connecting Jorhat and Majuli in Assam has been completed by the Indradhanush Gas Grid Limited (IGGL), the company’s CEO Ajit Kumar Thakur said on Saturday.

more presentation

The challenging task of laying a 24-inch diameter hydrocarbon pipeline beneath the mighty Brahmaputra river by Horizontal Directional Drilling (HDD) method was completed on Friday, marking the completion of a major milestone in the construction of the North East Gas Grid (NEGG) connecting North East India to the National Gas Grid.

The total length of the pipeline in this single HDD crossing is 4,080 metre across the main water channel of Brahmaputra river.

This is the longest river crossing by any hydrocarbon pipeline of size 24-inch diameter and above in Asia and the second longest in the world, he claimed.This one of a kind HDD river crossing was executed by intersection method, where two HDD rigs simultaneously started drilling from the two sides of Brahmaputra with intersection of the two drilling heads in the middle at 30 metre beneath the river bed.

The laying of 4,080 metre pipeline section was completed by overcoming numerous hurdles faced mainly due to monsoon rains and flood, he said.

The total length of HDD crossing across the Brahmaputra river considering all major and minor water channels is 5,780 metre.

The pipeline was laid in three separate HDD sections of length 1000 M, 4080 M and 700 M with the first and the third sections completed earlier.

The next step will be tie-in of the three sections at two points, which will be located at 15 M and 8 M below Natural Ground Level (NGL).

“With the completion of the Brahmaputra HDD, IGGL has achieved more than 71 per cent physical progress of the NEGG Project and will be able to complete the Guwahati-Numaligarh section of the project by February 2024”, Thakur said.

He thanked the Assam government for being extremely supportive in implementing the project.

Indradhanush Gas Grid Limited, is a joint venture company of five major Oil PSUs – IOCL, ONGC, GAIL, OIL and NRL. It is implementing the North East Gas Grid Project connecting the major cities and demand centres of North East India with the National Gas Grid.

The 1656 km long natural gas pipeline is constructed at a project cost of Rs 9,265 crore.

show less

All-electric MG Comet EV launched in India

The much-awaited MG Comet electric car is now officially on sale in India at Rs 7.98 lakh ex-showroom. The MG Comet EV is the carmaker’s second all-electric offering after the MG ZS EV, which was first launched in 2020. With the Comet, MG is targeting the mass market.

more presentation

The MG Comet features a quirky design, with a boxy overall look, small wheels, a large windscreen, rectangular windows, and vertically stacked headlights. The Comet is sure to stand out compared to any other car in the Indian market today.

Bookings for the MG Comet will commence from May 15 and deliveries will begin the same month itself, however, in select cities.

Targeted to be an urban commuter, the MG Comet EV gets a 17kWh battery pack that offers a range of 230km. The car is powered by an electric motor on the rear axle and takes around 8.5 hours to charge fully with an AC charger.

The MG Comet’s primary rival in the Indian market will be the Tata Tiago EV, which is powered by a 19.2kWh battery pack, or a larger 24kWh pack, which offers a range of over 300km. However, unlike the Comet, the Tiago EV features fast charging, which can juice up the battery to 80 percent in 57 minutes.

However, MG is clear that the Comet is targeted at customers in the city and is not for those who travel more than 100km every day and for those who go on long trips.

Inside, the MG Comet EV gets two 10.25-inch displays, one being the infotainment system and the other an instrument cluster. The Comet offers wireless smartphone connectivity, connected car tech, over 100 voice commands, and the ability to use your smartphone as the key.

The carmaker also offers several personalisation kits in the form of bodywork and decals to make the Comet stand out from not just any other car, but other Comets as well.

show less

INTERNATIONAL NEWS

Natural Gas / Transnational Pipelines/ Others

US: Biden administration OKs Alaska natural gas exports, drawing progressive ire

The Biden administration on Thursday greenlit natural gas exports from a facility in Alaska, drawing ire from progressives who were already frustrated over the administration’s prior approval of a major oil drilling project in the state.

The Biden administration on Thursday greenlit natural gas exports from a facility in Alaska, drawing ire from progressives who were already frustrated over the administration’s prior approval of a major oil drilling project in the state.

read more

The Energy Department reaffirmed a Trump-era decision to allow a company called Alaska LNG to export liquified natural gas (LNG) produced in the state to countries with which the U.S. doesn’t have a free trade agreement.

The department had previously agreed to a request from the Sierra Club to conduct further study of the project’s environmental impacts, saying that it would either reaffirm, alter or “set-aside” the Trump-era order.

It ultimately found, however, that the environmental impacts it identified “are not sufficient” to change the past determination approving the exports.

But it does add an environmental stipulation: Alaska LNG will have to certify every month that it did not use a practice called venting in which excess gas is released into the air and contributes to climate change.

In a statement, the department characterized its move as “amending a 2020 decision to impose new environmental requirements.”

But the reaffirmation still rankled both environmental advocates and congressional progressives.

“Allowing LNG exports is yet another way @POTUS is putting our kids’ futures in jeopardy,” tweeted Rep. Jamaal Bowman (D-N.Y.)

“The recent choices of this administration have been reckless, irresponsible, and uninformed. Our kids deserve a livable future and you are throwing it away.”

It comes after the Biden administration last month approved the Willow Project – which will allow ConocoPhillips to drill for 576 million barrels of oil in Alaska over a 30-year period.

“This is not the climate presidency that Joe Biden promised,” said Lukas Ross, program manager at Friends of the Earth. “Does the administration intend to rubber stamp a carbon bomb every month?”

Last year, the Biden administration also expanded LNG exports to Europe as part of an effort to counter Russia, the world’s second largest producer of natural gas.

https://www.aol.com/pro-desantis-pac-drops-ad-030440329.html

show less

Finland: Eesti Gaas signs agreement to buy Latvian gas network

Eesti Gaas will acquire the Latvian gas distribution network owned by Gaso, a subsidiary of Latvijas Gaze, for €120 million.

read more

Eesti Gaas, the largest privately owned energy company in the Baltic and Finnish region, signed an agreement on Friday.

The transaction is subject to approval from the Latvian Competition Authority and permission from the Latvian government, as Gaso is considered a strategic asset.

The Latvian gas network is almost four times larger than Estonia’s, serving about 400,000 consumers, Ain Hanschmidt, chairman of the board of Eesti Gaas, said in a statement.

“We see a future in gas and know how to do this business and grow it. We hope that we can share our experience as a gas network operator and that the change of ownership will help the company continue to grow and provide the best service to Latvian gas consumers,” he said.

“Like the rest of Europe, we see gas playing an important role as a transition fuel and a supporter of renewable energy. The prospect of gas use encourages us to invest in gas networks – we have signed the agreement and are waiting for the decision of the Latvian government,” Hanschmidt added.

Eesti Gaas operates in Finland, Latvia, Lithuania and Poland under the Elenger brand.

Eesti Gaas provides natural gas to customers in the form of pipeline gas, compressed natural gas (CNG) and liquefied natural gas (LNG) and manages the largest gas network in Estonia.

https://news.err.ee/1608948701/eesti-gaas-signs-agreement-to-buy-latvian-gas-network

show less

Australia plans to extend natural gas price cap to 2025

Major LNG exporter Australia plans to extend the cap on domestic natural gas prices until July 2025 in a bid to ensure Australian gas supply at “reasonable prices,” the government said on Wednesday.

read more

Energy companies operating in Australia are rattled by last year’s cap on domestic gas prices, which has already led to at least one investment project being put on hold. The cap, introduced in December, was initially intended to last until the end of 2023 as a measure to curb spiking gas prices.

Now the government plans to extend the cap through the middle of 2025, exempting small producers from the price cap if they supply gas only to the domestic market. Larger producers can also be exempted from the price cap if they make supply commitments to provide enough natural gas for the domestic market.

The government’s draft proposal, the so-called Gas Code, is now open for consultation until May 12, 2023.

“The Gas Code will ensure sufficient supply of Australian gas for Australian users at reasonable prices, give producers the certainty they need to invest in supply, and LNG producers to meet their export commitments,” the government said.

Still, Australia’s main energy trade partners and allies are increasingly concerned about the latest proposals for energy market interventions in Australia, which could also undermine new investment plans in Australian natural gas and other energy resources. Earlier this year, the Australian government proposed reforms to the Australian Domestic Gas Security Mechanism (ADGSM), “to ensure that there is a sufficient supply of natural gas to meet the forecast needs of Australian gas consumers by controlling, if necessary, LNG exports.”

The imposition of a gas price cap and the proposal that the government has a say in LNG export volumes could be challenged by foreign investors, global law firm White & Case warned in February.

“The imposition of such measures is not without risk for Australia, which is a signatory to several investment treaties where key LNG companies are incorporated,” White & Case says.

show less

Mexico seeks to rehabilitate 36 gas pipelines

Mexico’s gas network operator Cenagas will carry out more than 20 pre-investment studies to determine the feasibility of a rehabilitation program for 36 gas pipelines in the northeast, southeast and center.

read more

Rehabilitating the 9,000km network is crucial because it is outdated and at risk of creaking, Cenagas said in funding requests to the finance ministry, which approved 52.4mn pesos (US$2.9mn) to start the studies.

The program will also help meet the demand forecast for 2030. According to Cenagas, demand will jump from 1.9Bf3/d (billion cubic feet per day) to 2.9Bf3/d.

Structural failures at the “high-risk critical sections” may also cause “a reduction of the current existing supply of natural gas that is currently available, reflecting a social, ecological and economic impact,” it said.

Most of the high-risk stretches are in Veracruz state, but also in Tamaulipas, Coahuila, Mexico state, Nuevo León and Tlaxcala.

Part of the pre-investment studies are engineering studies, designs and work calendars.

Cenagas also said the studies are related to the plan to build a 3.6bn-peso gas pipeline to replace the one that crosses Tamaulipas state capital Reynosa.

On April 13, Cenagas awarded a 3.8mn-peso feasibility study, including for a new 56km line bypassing the urban area amid safety concerns, to BH&A, Proyectos, Consultoría y Supervisión de Infraestructura. Contract signing is planned for April 28, after which the company has 112 days to complete the study.

https://www.bnamericas.com/en/news/mexico-seeks-to-rehabilitate-36-gas-pipelines

show less

Nigeria completes gas pipeline without chinese funds

The Nigerian National Petroleum Corporation (NNPC) has used around $1.1 billion of its own funds so far and has completed work on 70% of a large natural gas pipeline in Nigeria even after a Chinese loan for the project failed to materialize.

read more

Nigeria’s federal government announced in July 2020 that the Bank of China and Sinosure had agreed to finance part of the costs for constructing the Ajaokuta-Kaduna-Kano (AKK) gas pipeline to the economic hub in the north, Kano. In the summer of 2021, reports started swirling that Chinese lenders were reluctant to increase their exposure and finance part of the gas pipeline project estimated to cost $2.8 billion.

Nigeria has started to look for alternative funding for at least US$1 billion of the pipeline’s cost and has started to approach other lenders, including export-import credit institutions, sources told Reuters two years ago.

This week, NNPC Group chief executive, Mele Kyari, said on a site inspection that the AKK Gas Pipeline project was nearly 70% completed, and more than $1.1 billion has been released so far to finance the project. The pipeline is planned to run for 614 kilometers (382 miles) and is currently being financed by NNPC.

The AKK Gas Pipeline line will flow 2 Bscf/d and will power industries and power plants and create gas-based industries, Kyari said. By the third quarter of this year, NNPC will complete the entire welding job on this line, he said while visiting a construction site along the pipeline’s route.

“We have so far spent over $1.1 billion on this project from our cashflow,” NNPC’s Kyari said.

“We are a commercial company today. We have inter-company loans within our company now. This company can fund this project, so we do not need any support to deliver this project now.”

show less

Turkey: $1 billion worth of gas found in Turkish gabar: Erdogan

(MENAFN- Trend News Agency) Türkiye discovered natural gas reserves valued at $1 billion in the southeastern Gabar mountain, President Recep Tayyip Erdogan said on April 23, trend reports citing hurriyet daily news .

read more

“We discovered $1 billion of natural gas in Gabar, and we will extract it as well,” he said at the opening ceremony of Akyazı Recep Tayyip Erdogan Sports Complex.

He recalled that Türkiye commissioned its first multi-purpose Amphibious Assault Ship TCG Anadolu recently, and subsequently launched the country’s first delivery from a Black Sea gas reserve.

Türkiye will build an aircraft carrier twice the size of TCG Anadolu he stated, adding that they would display the vessel in Izmir in the coming days.“Hopefully, if you give us this task on May 14, we held preliminary talks with certain countries for the ship, which is twice the size of this vessel,” he said.

“It would be beneficial for it to stay in İzmir for the last one week-10 days. Hopefully, we will send different messages from there with TCG Anadolu. Seventy to 80 thousand people, who visited our ship, gave the good answer to the table of seven,” he said referring to the opposition parties.

“I wish that all natural gas consumption in the houses for one month and the consumption of kitchen and hot water for one year free of charge will be beneficial for our nation once again. My Lord has blessed us, and we are placing the Black Sea gas at the disposal of our nation,” he said.

The government is establishing the mothers, young people, family and youth bank, he said and added,“With this bank, which will take its source from the natural riches of our country such as the Black Sea, we will provide the financing of many studies from here.”

He reminded that Norway uses a certain proportion of its own natural gas and oil and dedicates it to its youth.

“We will do the same in our country. We will support the retirement of our housewives. We will expand scholarship opportunities at all levels of education. We will facilitate the employment of our youth by ensuring that at least one person from each household is employed,” he stated.

Citing the period before the rule of his Justice and Development Party (AKP), Erdogan said Türkiye has developed far beyond 1999 and is now“healing” the wounds of the Feb. 6 earthquakes faster.

“We will completely revive our earthquake cities by building 650,000 new houses. We are carrying out comprehensive urban transformation projects to prepare our whole country for earthquakes,” he explained.

Criticizing the Nation Alliance presidential candidate Kemal Kılıçdaroglu, Erdogan said the opposition Republican People’s Party (CHP) leader pledged to“release” the former co-chair of Peoples’ Democratic Party (HDP) Selahattin Demirtaş and leader of illegal PKK group Abdullah Öcalan from prison.

“He was going to take out Selo, who killed 51 of our citizens in Diyarbakır, and he would take out the terrorist leader Öcalan. This country is not a terrorist state,” Erdoğan said.

https://menafn.com/1106074406/1-Billion-Worth-Of-Gas-Found-In-Turkish-Gabar-Erdogan

show less

Natural Gas / LNG Utilization

Qatar embarking on significant wave of LNG fleet expansion

Qatar is embarking on another significant wave of fleet expansion, to underpin its domestic expansion of the North Field project, as well as investments in the Golden Pass LNG terminal in the US Gulf Coast region according to Gas Exporting Countries Forum (GECF) annual gas market report 2023.

Qatar is embarking on another significant wave of fleet expansion, to underpin its domestic expansion of the North Field project, as well as investments in the Golden Pass LNG terminal in the US Gulf Coast region according to Gas Exporting Countries Forum (GECF) annual gas market report 2023.

read more

To accomplish this, it has been reported that Qatar has secured booking slots at all of the major South Korean shipbuilding yards over the next five years, for orders of around 100 new carriers.

The cost of newbuild LNG carriers has increased in excess of $250m, which is around $20m more than the average price during 2021. This increasing cost in recent years has been attributed to rising expenses related to construction materials, mainly steel, as well as shortages in the number of available shipyards, the report further said.

It added, concerning this point, it has led to vessel owners exploring other options outside the traditional world-leading shipyards for newbuild orders. In particular, with the Hyundai, Daewoo, and Samsung shipyards of South Korea becoming fully booked until after 2025, manufacturers in China are growing in importance, already securing at least 36 of the vessels on the orderbook for orders, which the ownership details are already known.

In 2022, the number of LNG cargoes traded globally reached 6,210, increasing 2 percent over the total number of shipments in 2021. This continued the trend of more cargoes being traded annually in each of the past five years, except during the initial breakout of the pandemic in 2020. Compared with 2021, the number of LNG shipments per month was greater for most of 2022; over the year, the monthly average number of cargoes was 518 compared with 506 in 2021.

For the fourth consecutive year, Australia delivered the highest number of LNG cargoes. In 2022, just as in 2021, the US, Qatar, Russia, and Malaysia completed the top five exporters by number of shipments. The US also had the highest increase in number of cargoes, recording an additional 81 more shipments in 2022 than in 2021.

The second highest increase was attributed to Norway, which loaded 49 cargoes from the restarted Hammerfest LNG terminal since June 2022. GECF Countries Equatorial Guinea and Peru registered the largest percentage increases in cargo exports in 2022, with 32% and 21%, respectively. In addition, another GECF Country, Mozambique, joined the league of LNG exporters with three loadings from the Coral South FLNG terminal at the end of 2022.

The increasing trend in global LNG shipments is expected to continue in 2023 as per the overall growth in LNG demand. Furthermore, LNG shipping would be boosted by the restart of the Freeport LNG plant in the US, and increased cargo imports in Europe and Asia Pacific. However, the LNG shipping market may experience tightness due to new IMO regulations in 2023 and further ahead.

At the end of 2022, the global LNG carrier fleet stood at 677 vessels. Although the total has gradually increased, only 28 new vessels were commissioned in 2022. This represented growth of 4 percent, which was the lowest increase since 2013. As observed in the recent historical trend since 2010, the years in which there is a sharp increase in the fleet growth rate are typically followed by a drop in the subsequent year, the annual report noted.

Accordingly, this was repeated in 2022, with just over 4,600,000 cubic metres of LNG carrier capacity entering into service, merely half of the capacity commissioned in 2021.

© Dar Al Sharq Press, Printing & Distribution. All Rights Reserved. Provided by SyndiGate Media Inc. (Syndigate.info).

show less

U.S. stresses importance of LNG for Europe

Russian President Vladimir Putin belied that his invasion of Ukraine in 2022 would go largely unopposed by the U.S. and its allies for the same reason that he was able to invade the country in 2014 and annex Crimea.

read more

That is, that the non-U.S. part of the North Atlantic Treaty Organization (NATO) – Europe – would not to risk being cut off from the cheap and plentiful supplies of Russian gas that they had been using for decades to power their economies. He was wrong this time, for a variety of reasons analysed in my new book on the new global oil market order. Not only were the NATO allies not prepared to roll over this time in favour solely of their own interests but Putin’s actions in Ukraine have re-energised the U.S.-led security, economic, and energy alliance comprising most European countries and many Asian ones as well. To safeguard these gains, the U.S. last week stressed the necessity for the allies to ramp up investments in gas to ensure that never again would the alliance be hostage to the weaponised energy supplies of Russia.

Speaking at a G7 ministers’ meeting on climate, energy and environment in Japan, U.S. Assistant Energy Secretary, Andrew Light, highlighted the need for continued investments by the allies in new gas supplies. He also stressed that U.S. liquefied natural gas (LNG) supplies remain critical to European energy security as it continues to reduce its reliance on Russian gas. He added that the U.S. is not concerned about Russia still being able to sell its oil and gas, despite sanctions, as it is allowing countries to buy energy at lower prices. This feeds into the idea that the price cap on Russian energy sales is also part of the U.S.’s broader policy of keeping oil and gas prices down, and with the ‘Trump Oil Price Range’, as also analysed in my new book on the new global oil market order. This is not only for the U.S.-centric economic and political reasons examined in the book, but also because rising energy prices drive inflation higher, in turn pushing fuelling the interest rates used to combat it, and increasing the prospect of recession in many of the U.S.’s allies. Interestingly as well, and in keeping with the geopolitical realignment evident since Russia’s invasion of Ukraine, Light also underlined that the U.S. and its allies are also looking to diversify the supply chains of materials that have long been dominated by China. “We don’t want to be at the mercy of China and put them in the same position vis a vis the rest of the world as Russia has been with Europe,” Light concluded.

Prior to Russia’s invasion of Ukraine, the only real flurry of activity in terms of a concerted effort by any group within the European Union (EU) was aimed at ensuring that Russia did not stop supplying its member states with either oil or gas, due to their not being able to pay in the way Moscow preferred. This followed the 31 March 2022 decree signed by President Vladimir Putin that required EU buyers to pay in roubles for Russian gas via a new currency conversion mechanism or risk having supplies suspended. According to an official guidance document sent out to all 27 EU member states on 21 April by its executive branch, the European Commission (EC): “It appears possible [to pay for Russian gas after the adoption of the new decree without being in conflict with EU law],… EU companies can ask their Russian counterparts to fulfil their contractual obligations in the same manner as before the adoption of the decree, i.e. by depositing the due amount in euros or dollars.’” The EC added that existing EU sanctions against Russia also did not prohibit engagement with Russia’s Gazprom or Gazprombank beyond the refinancing prohibitions relating to the bank. Several EU member states made it plain that they would veto any EU proposal to ban Russian gas (or oil) imports – and all 27 EU member states must vote in favour of such a ban for it to come into effect.

However, under considerable ‘encouragement’ from the U.S., Germany – the de facto leader of the EU – performed a 180-degree turnaround in its previously fiercely pro-Russian energy stance, bolstered in the first instance by a U.S.-led deal for LNG supplies from Qatar. LNG remains the most flexible form of gas for buyers, being readily available in the spot markets and able to be moved very quickly to anywhere required, unlike gas sent through pipelines. Unlike pipelined gas as well, the movement of LNG does not require the time- and money-intensive build-out of vast acreage of pipelines across varied terrains and the associated heavy infrastructure that supports it. In essence, LNG supplies are the ‘swing gas supply’ in any global gas supply emergency, as was the case back then in the first half of 2022. May of that year, then, saw Qatar sign a declaration of intent on energy cooperation with Germany aimed at becoming its key supplier of LNG. These new supplies of LNG from Qatar would come into Germany through existing importation routes augmented by new infrastructure approved by the German Bundestag on 19 May. This would include the deployment of four floating LNG import facilities on its northern coast, and two permanent onshore terminals, which were under development.

These plans would run in parallel with, but were likely to be finished significantly sooner than, the plans for Qatar to also make available to Germany sizeable supplies of LNG from the Golden Pass terminal on the Gulf Coast of Texas. QatarEnergy holds a 70 per cent stake in the project, with the U.S.’s ExxonMobil holding the remainder. The Golden Pass terminal’s estimated send-out capacity is projected to be around 18 million metric tonnes per annum (mtpa) of LNG and the facility is expected to be operational in 2024. Also heavily linked in with the U.S. was a very similar announcement in December 2022 of two sales and purchase agreements between QatarEnergy and the U.S.’s ConocoPhillips to export LNG to Germany for at least 15 years from 2026. These two deals between Berlin and Doha will provide Germany with 2 million mtpa of LNG, sent from Ras Laffan in Qatar to Germany’s northern LNG terminal of Brunsbuettel. Crucially as well to the solidarity of the NATO alliance, QatarEnergy’s chief executive officer (also Qatar’s Energy Minister), Saad al-Kaabi, stressed the long-term nature of this new energy arrangement. He said: “[The two sales and repurchase agreements] mark the first ever long-term LNG supply agreements to Germany, with a supply period that extends for at least 15 years, thus contributing to Germany’s long-term energy security.”

Around one month after the declaration of intent on energy cooperation with Germany was signed by Qatar, other major new gas deals started being signed by flagship energy companies from Europe, as also analysed in my new book on the new global oil market order. Qatar, in the first instance, signed new partnership deals with France’s TotalEnergies and Italy’s Eni for the US$30 billion North Field Expansion project. TotalEnergies also signed a partnership agreement with the Abu Dhabi National Oil Co. (ADNOC) that included cooperation in trading, product supply, and carbon capture, utilisation and storage. It then signed a massive four-pronged US$27 billion energy deal with Iraq. In the meantime, it was announced that Eni was to sign an agreement with Libya’s state-owned National Oil Corporation (NOC) that would see it invest around US$8 billion to produce about 850 million cubic feet per day (mmcf/d) from two offshore gas fields in the Mediterranean Sea. Eni had another huge success around the same time – in conjunction with U.S. hydrocarbons giant, Chevron – with a major new gas discovery in the 1,800 square kilometre Nargis offshore area concession in Egypt. The broader importance of these deals between European companies and previously largely overlooked gas suppliers was subtly acknowledged in TotalEnergies’ official comments on the UAE deal. ‘[The agreement includes] the development of oil and gas projects in the UAE to ensure sustainable energy supply to the markets and contribute to global energy security,’ it said.

For the U.S., the onus – aside from facilitating more deals between Europe and Middle East and North Africa suppliers – remains on ensuring plentiful and reasonably priced supplies of its LNG,. The omens for this are extremely encouraging, with the Energy Information Administration (EIA) in March forecasting that U.S. LNG exports will average 12.1 billion cubic feet per day (Bcf/d) in 2023, a 14 per cent (1.5 Bcf/d) increase compared with last year. The agency also expects LNG exports to increase by an additional 5 per cent (0.7 Bcf/d) next year. These forecasts are based almost exclusively on continued high global demand for LNG to displace pipeline natural gas exports from Russia to Europe.

https://oilprice.com/Energy/Natural-Gas/US-Stresses-Importance-Of-LNG-For-Europe.html

show less

LNG-powered MSC Euribia completes deep-water trials, prepares for inaugural season

MSC Cruises’ liquefied natural gas (LNG)-powered ship MSC Euribia has completed deep-water intensive systems tests during a four-day trial in the Atlantic Ocean, and will next receive her finishing touches at the Chantiers de l’Atlantique shipyard in Saint Nazaire, France, before being officially delivered to MSC Cruises on 31 May 2023.

read more

According to MSC Cruises, MSC Euribia will be the 22 ship to join its fleet and it will be able to accommodate up to 6,327 passengers.

The ship will be officially named on 8 June in Copenhagen, Denmark, before sailing a maiden inaugural season in Northern Europe from her homeport in Kiel, Germany.

MSC Cruises said the vessel will feature innovative and advanced marine technology, as well as LNG fuel to minimise its environmental footprint, adding it will also strike a new silhouette with a customised fresco painted on her exterior that celebrates MSC Cruises’ commitment to protect and preserve the marine environment.

The ship will also feature shore power plug-in connectivity to reduce carbon emissions in port, the most advanced wastewater treatment systems designed in line with the United Nations’ shipping body the International Maritime Organisation, comprehensive waste recycling, underwater radiated noise management system to help limit disturbance to marine life, and a comprehensive range of onboard energy efficient equipment to optimise engine use and hotel energy needs to further reduce emissions, MSC Cruises further informed.

German graphic artist Alex Flämig, the vessel’s hull artwork designer, commented: “To witness my design finally come to life across MSC Euribia’s hull is an incredibly proud moment and even more so, to soon have my artwork sailing the world’s oceans. I hope it can serve not only as a testament to MSC Cruises’ commitment to protecting the important marine ecosystem but also as an inspiration for those working on finding innovative solutions to safeguard the future of the ocean.”

To remind, for delivery between 2022 and 2025, MSC Cruises ordered three LNG-powered vessels, including MSC Euribia. The first vessel MSC World Europa was christened in 2022, and the construction of the third ship is to start in 2023.

show less

Global LNG Development

Canada: Kitimat LNG project hits another milestone

The LNG Canada project in Kitimat has reached a new milestone with the installation of its first bridge module.

The LNG Canada project in Kitimat has reached a new milestone with the installation of its first bridge module.

read more

The module’s primary function is to connect utilities to LNG processing train 1, and it also supports the transportation of LNG from train 1 to the storage tank.

JGC Fluor Joint Venture (JFJV), the prime contractor of the LNG Canada project, said the installation is significant, describing the project as “a culmination of many years of planning and collaboration between JGC and Fluor engineering teams, bringing together elements from separate fabrication yards using single weld hook-ups in a dramatically different environment from where they were built.”

To remind, in 2018, the JV partners in LNG Canada took a final investment decision (FID) and said the development of the project will cost about $14 billion.

When completed, the facility is expected to consist of a natural gas receiving and LNG production unit, a marine terminal with the capacity to accommodate two LNG carriers, a tugboat dock, and LNG loading lines. It will also include LNG processing units, storage tanks, a rail yard, a water treatment facility, and flare stacks.

https://www.offshore-energy.biz/kitimat-lng-project-hits-another-milestone/

show less

China: PetroChina signs LNG deal with Malaysia’s Petronas

PetroChina International Co Ltd said it has signed a sales and purchase agreement with Malaysia’s Petronas to buy liquefied natural gas (LNG).

read more

The deal, signed on April 17, is the pair’s first medium-to-long-term LNG sales and purchase agreement, PetroChina said in a statement on Tuesday without providing further deal details.

Petronas did not immediately respond to a request for comment.

China was the world’s top LNG importer in 2021, shipping in 78.8 million tonnes of the super-chilled fuel. It was overtaken by Japan last year amid high spot prices and after stringent COVID-19 containment measures curbed economic activity and energy demand, with imports slipping to 63.4 million tonnes.

An executive at PetroChina Co Ltd 601857.SS, 0857.HK, the listed arm of state-run China National Petroleum Corp and China’s biggest gas importer, in March said China’s natural gas demand is likely to grow this year as the economy recovers, but that any import rebound would be dependent on spot prices.

https://www.hellenicshippingnews.com/petrochina-signs-lng-deal-with-malaysias-petronas/

show less

Congo: ENI inaugurates Congo LNG project in the Republic of the Congo

The President of the Republic of the Congo, Denis Sassou Nguesso, and the Chief Executive Officer of ENI, Claudio Descalzi, today laid the foundation stone of Congo LNG, the country’s first natural gas liquefaction project and one of Eni’s core supply diversification initiatives.

read more

The project is expected to reach an overall liquefied natural gas (LNG) production capacity of 3 million tons per year (approximately 4.5 billion cubic meters/year) from 2025.

Congo LNG will exploit the huge gas resources of Marine XII, fulfilling the country’s power generation needs while also fuelling LNG exports, supplying new volumes of gas to international markets focusing on Europe.

The project, made though an accelerated development schedule and a zero-flaring approach, will see the installation of two floating natural gas liquefaction plants (FLNG) at the Nenè and Litchendjili fields – already in production – and at the fields yet to be developed. The first FLNG plant, currently under conversion and with a capacity of 0.6 million tonnes per year (MTPA), will begin production in 2023. The second FLNG plant – already under construction – will become operative in 2025 with a capacity of 2.4 MTPA.

Claudio Descalzi, Eni’s Chief Executive Officer, commented: “Today we celebrate the launch of one of Eni’s main projects, made possible by the collaboration with the Republic of the Congo and destined to significantly contribute to both Italy and Europe’s energy security and industrial competitiveness. This outcome speaks to the importance of long-term collaboration with our African partners at a time when important strategic choices need to be made in regards to future diversification of supply routes and European energy mixes, in the direction of energy accessibility and availability and progressive decarbonisation.”

Eni has been operating in Congo for over 50 years and – to date – is the only company active in the development of its gas resources, guaranteeing 70% of national electricity production through the Centrale Electrique du Congo (CEC).

Eni is strongly committed to promoting energy transition in the country. Recently, the Oyo Center of Excellence for Renewable Energy and Energy Efficiency was handed over to the Ministry of Higher Education, Scientific Research and Technological Innovation of the Republic of the Congo, which will manage it together with UNIDO (United Nations Industrial Development Organization). Furthermore, the company is developing agri-feedstock production initiatives destined for biorefining and not in competition with the food supply chain.

https://www.hellenicshippingnews.com/eni-inaugurates-congo-lng-project-in-the-republic-of-the-congo/

show less

Azerbaijan agrees to boost gas transfers via four EU countries

Four European Union nations signed a deal with Azerbaijan Monday for broader gas distribution to the bloc, with the Eurasian partner targeting to raise gas supply to Europe to 423.78 billion cubic feet (12 billion cubic meters) this year.

read more

The memorandum of understanding (MOU) for the so-called Solidarity Ring initiative paves the way for gas transfers from the State Oil Company of the Azerbaijan Republic (SOCAR) via existing infrastructure, separate press releases from parties to the agreement said. Supplies would be delivered by pipeline networks of Bulgaria’s state-owned Bulgartransgaz EAD, Hungary’s FGSZ Ltd., Romania’s state-owned Transgaz SA and Slovakia’s Eustream, also government-controlled.

The agreement inked during a meeting between Azerbaijan President Ilham Aliyev and his Bulgarian counterpart Rumen Radev follows a 2022 pact between the 27-member bloc and Baku for increased oil and gas shipments to the EU. The Memorandum of Understanding on a Strategic Partnership in the Field of Energy passed July 18, 2022 includes a commitment to double the capacity of the Southern Gas Corridor to at least 706.29 billion cubic feet (20 billion cubic meters) in yearly transfers to the EU by 2027, according to a European Commission announcement of the deal.

“The MoU signed today, when implemented, will definitely strengthen energy security in Europe, and allow Azerbaijan to export more gas to many more European countries”, Aliyev told the signing ceremony in Bulgaria, according to a transcript on the Azerbaijan presidential website.

“In 2021, we delivered 8 billion cubic meters to Europe. And this year, our target is 12”, he added. “So, that will be almost half of our total export, which we plan for this year at the level of 24.5 billion cubic meters”.

Azerbaijan plans to deliver its first gas exports to Hungary and Slovakia this year “if all necessary interconnectors are in place”, the president said, noting in Europe his country already supplies Bulgaria, Georgia, Greece, Italy and Türkiye.

Azerbaijan’s gas export to Romania has also started this year, he said. SOCAR and state-owned Romgaz SA finalized February an agreement proposed last year for the transport of up to 35.31 billion cubic feet (one billion cubic meters) of natural gas to Romania.