CIBC Revises Aggressive LNG Export Assumption to 6.5 Bcf/d, but Headwinds are No Problem for the U.S.

Expectations of North American LNG exports lowered to 5.5-6.5 Bcf/d by 2022

The future for natural gas liquefaction (LNG) is not as bright as many had hoped as demand in China begins to slow and an excess of LNG prepares to come on the market, says CIBC’s Head of Commodities Strategy Katherine Spector. A “double whammy of surplus global LNG supply and lower oil prices” has led the bank to lower its North American LNG export expectations to 5.5-6.5 billion cubic feet per day (bcf/d), down from what CIBC admits was an optimistic 12 bcf/d by 2022.

Both in the U.S. and the OECD, demand growth has become sluggish, while renewables continue to take up an increasingly large portion of the pie, and cheap coal challenges gas in growing markets, Spector said. “Growth in U.S. industrial demand for gas may yet be a bright spot, but is unlikely to match the shortfall in power generation demand for gas relative to initial expectations,” she added.

While China’s demand is expected to grow to 12.8 bcf/d of imported gas by 2020 from 5.2 bcf/d in 2014, it is still not as much as experts had initially predicted before the economic slowdown in the country. Pipeline gas from Russia, Turkmenistan and other Eurasian countries will likely be able to meet the demand growth as well, leaving little room for North American LNG.

India remains a wildcard though, says Spector. “India has shown itself to be a very price sensitive energy consumer in recent years, which on the one hand could bode well for – now significantly cheaper – natural gas, but so far has mostly been a boon for even cheaper coal,” said the CIBC analyst.A familiar refrain: supply could be the real issue

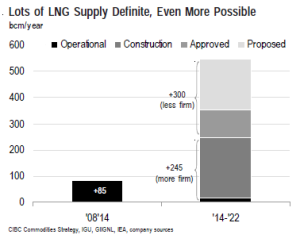

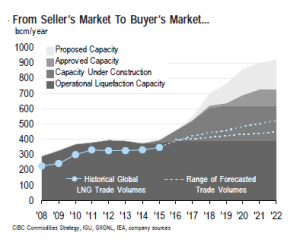

Despite demand around the world looking lower than many had hoped for, the real issue for LNG may be the overabundance of supply. From now to 2022, there is approximately 245 bcm/year of liquefaction capacity that is likely to come online around the world, and an additional 300 bcm/year that has been either approved or proposed.

The largest additions in future capacity are expected from Australia, Russia and the United States. Much of the production in Australia is already a done deal, said Spector, while a majority of the future export capacity in the U.S. remains theoretical. Russia represents the supply wildcard, said Spector, with the country expected to have significant spare gas production capacity, even if and when new LNG export capacity and pipeline capacity to China is operational.

“The bottom line, though,” said Spector, “is that even a conservative projection of future LNG supply against a high-end estimate of future LNG trade volumes points to an LNG surplus that will grow through at least 2018, and may or may not moderate thereafter depending on how many approved projects start construction in the next two years.”

U.S. LNG has competitive advantages

Despite the downgrade on CIBC’s view for the future of the global LNG market, the U.S. continues to have some competitive advantages, said Spector. “The U.S. looks to be the one-eyed man in the room of blind men, largely because so many of the planned liquefaction projects are brownfield conversions of existing regasification terminals, and because of well-developed domestic infrastructure, particularly in the U.S. Gulf,” the CIBC note read.

“Headwinds are good,” Cheniere (ticker: LNG) President and CEO Charif Souki told Oil & Gas 360 during an exclusive interview. “If it were easy, everybody would do it.” Souki credited the United States shale boom with creating the approaching U.S. LNG export market.

“It has nothing to do with us, it has to do with the wonderful capacity of producers in this country,” he said, adding the extensive infrastructure in place increases its efficiency and gives Cheniere a competitive advantage. “Our costs are $600 to $700 per ton compared to other places that are $2,500 to $3,000 per ton, so we have a very significant advantage.”

Cheniere energy is positioned to become the first company in the U.S. to export LNG from its Sabine Pass liquefaction plant in Louisiana. One of the significant advantages to Cheniere’s model is that its contracts offer more flexibility than traditional LNG purchasing agreements.

The company has established several long term contracts (most consisting of 20 years) with its consumers for the rights to its terminal, which creates a much different scenario than overseas competitors that leave their customers vulnerable to commodity swings. Consumers with ties to Cheniere can take or leave the LNG prices, depending on the market environment.

Even as LNG contracts linked to oil prices become more favorable for buyers, flexibility in contracts will be king, said Spector. “Buyers now value contract flexibility above all else, and that is unlikely to change.”

With the cheap natural gas production from the U.S. shale boom and flexibility in its contracts, Cheniere believes it is positioned to capture its share of the global LNG market, even as estimates for the overall size of the market through the next decade shrink. Media outlets have reported fuel deliveries at Cheniere’s Sabine Pass export facility, based on data from Genscape.

Louisiana newspapers reported this week that “Cheniere has begun the commissioning process, the testing that makes sure the Cameron Parish facility is working correctly. Sabine Pass is the first LNG export facility built in the United States in more than 40 years.”

Jordan Cove LNG

The Federal Energy Regulatory Commission (FERC) gave its final environmental approval for the Jordan Cove LNG project and the Pacific Connector Gas Pipeline in Oregon on September 30, allowing the facility to move ahead with development. Landlocked states like Colorado are excited to have access to an LNG plant on the West coast that will allow them to send their gas to liquefaction plants, and then on the Asian markets.

“If we have this facility, it cuts nine days off the shipping time to Asian markets,” Bonnie Petersen, executive director of the Associated Governments of Northwest Colorado, said.

Final overall approval is expected by the end of this year, with a notice to proceed from the commission by the middle of next year. Developers have said gas is not likely to begin flowing until 2019.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.