NGS’ NG/LNG SNAPSHOT – March 2021, VOLUME 1

NGS’ NG/LNG SNAPSHOT – March 2021, VOLUME 1

National News Internatonal News

NATIONAL NEWS

City Gas Distribution & Auto LPG

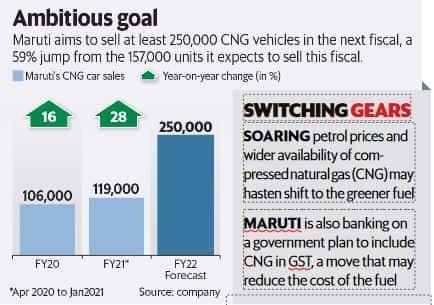

Maruti eyes boom in CNG-run car sales

Maruti Suzuki India Ltd expects sales of its natural gas-powered cars to jump 59% in the next fiscal year as more buyers embrace the greener fuel amid soaring petrol prices and

Maruti Suzuki India Ltd expects sales of its natural gas-powered cars to jump 59% in the next fiscal year as more buyers embrace the greener fuel amid soaring petrol prices and

read more

the wider availability of compressed natural gas (CNG). The country’s largest carmaker hopes to sell 250,000-257,000 CNG vehicles in the year beginning 1 April from about 157,000 units that it expects to sell this fiscal through March, Shashank Srivastava, executive director of sales and marketing at Maruti Suzuki, said in an interview. The carmaker is banking on the government’s plan to bring CNG under the ambit of goods and services tax, a move that’s expected to reduce the cost of the fuel. To meet demand, Maruti plans to expand its portfolio of CNG vehicles, Srivastava said. “At the moment, we have around eight products based on CNG. We have a plan to convert more products with the option of CNG,” he said.

The Suzuki Motor Corp. unit, which stopped selling diesel-run vehicles last April, has been pushing customers to opt for the more eco-friendly CNG vehicles, sales of which rose at an annual 15.5% in the five years to March 2020. “If you look at sales of CNG cars, it has increased dramatically. Even this year (April to January), Maruti’s CNG vehicle sales rose about 28% while the overall market is down 16%,” said Srivastava.

A larger portfolio of gas-powered vehicles and a wider network of CNG fuel pumps are likely to convince more buyers to opt for CNG cars, which so far have been mostly used as taxis in cities. Mint reported in February 2019 that Maruti is planning to sell around 200,000 CNG vehicles or more by 2022 to meet fuel efficiency norms aimed at curbing extensive air pollution. In 2020, the government also announced the setting up of 10,000 CNG stations by 2025 to improve availability. One of the factors that has prevented the growth of CNG-based cars is the limited number of fuel stations, which has made customers worried about the availability of gas beyond city limits. “The government has already announced the setting up of new stations, and now they are following it up with actions. If you look at this year, we have crossed 2,400 stations, and by next March, we will have 4,500 stations. In FY25, the projection is 10,000,” said Srivastava. As the number of fuelling stations increase, the penetration of CNG cars will improve significantly, and that’s why Maruti is bullish about the prospects of such vehicles in the near future, he said.

show less

Why Gujarat Gas shares are running ahead of peers this month

Gujarat Gas Ltd’s shares have been running far ahead of its peers in recent weeks. It is expected to be the biggest beneficiary among city gas distribution firms if gas sales are brought under

read more

the ambit of goods and service tax (GST) regime. This is because of its strong exposure to institutional sales. Industrial customers will be able to take input tax credits, thus lowering their gas feedstock cost. Gujarat Gas would also be able to take tax credit on its operating expenses and capex. In the December quarter, Gujarat Gas reported a rebound in volumes, with gas consumption picking up after the easing of covid lockdown norms. The company’s net profits last quarter almost doubled from year-ago levels to ₹392 crore. “(Profit) stood ahead of our and Street estimates, on stronger than estimated sales volume and lower gas cost,” said analysts at Antique Stock Broking. The company’s gas sales volumes came at 11.4 MMSCMD, 23% higher y-o-y. Industrial volumes account for 80% of its total volumes. Rising demand from the Morbi industrial cluster continues to drive volumes, with clients looking for cleaner and cheaper fuels. The company has added 83 CNG stations this fiscal, taking the total to 484, as per analysts’ data. It is planning to add 150 CNG stations every year, three times the earlier target, and this can drive volumes, said analysts

show less

City gas supply companies spar with OMCs over hike in charges

City gas distribution firms have sought the Centre’s intervention following a demand by state-run oil marketing companies (OMCs) for a higher commission on retail sales of compressed natural gas (CNG).

read more

The Petroleum and Natural Gas Regulatory Board had last November barred OMCs, including Bharat Petroleum Corp. Ltd, Hindustan Petroleum Corp. Ltd and Indian Oil Corp. Ltd, from opening CNG dispensing units at their retail fuel outlets. These OMCs have a commission-based arrangement with city gas licensees on CNG sales through their retail outlets. City gas distribution companies, including Mahanagar Gas Ltd, Indraprastha Gas Ltd and Gujarat Gas, have urged the Union government to negotiate with the OMCs after they demanded a 90-100% hike in commissions from the existing ₹4.5 per kg to ₹7-8 per kg. “OMCs have raised the demand for a steep hike in trade discount for filling CNG from their retail outlets. We have sought the intervention of the ministry of petroleum and natural gas in this matter and are hopeful of a resolution soon,” an official at a city gas distribution company said, requesting anonymity. Motilal Oswal said any increase in commission or other costs will be a challenge for city gas distributors. The OMCs have, meanwhile, been hit by rising rentals in metros where the bulk of their retail outlets are based. Officials at OMCs said the ban on retailing CNG by the regulator was a setback as they were planning to scale up the segment to grow revenue. Besides, the sale of petrol and diesel gets affected with buses and three-wheelers—the bulk of customers—opting for CNG, said a senior OMC official, also seeking anonymity. Indian Oil is currently the market leader with 28,237 fuel stations, followed by Hindustan Petroleum at 15,855 and Bharat Petroleum with 15,289.

The OMCs said that according to a recent study by the companies, they have taken into account factors such as marketing efforts by them and the (fuel) substitution impact that their fuel outlets would have when CNG is retailed through them. OMCs also argue that by using their retail outlets, the city gas companies get not only readymade infrastructure but also customers. “All this involves costs,” said the OMC official cited above.

show less

From today, pay more for CNG, piped gas – Gujarat

Adani Total Gas Limited has increased the retail prices of compressed natural gas and domestic piped natural gas in Ahmedabad. The company has raised CNG prices in Kheda,

read more

Surendranagar, Barwala and Navsari geographical areas as well. This is for the second time that the company has revised CNG and PNG prices in these regions over the past one month. For Ahmedabad, the CNG price has been increased by 95 paise per kg. So, it will now cost Rs 54.62/kg instead of Rs 53.67/kg. For Kheda, Surendranagar, Barwala and Navsari, the company has raised the CNG price to Rs 54.46 from Rs 53.51. These revised rates (inclusive of taxes) came into effect from February 17, according to the company’s website. ATGL has further revised PNG prices for its residential consumers in Ahmedabad from Rs 729.09 per metric million British thermal units (MMBTU) to Rs 762.95 per MMBTU. This tariff—exclusive of taxes—is applicable for the bi-monthly consumption upto 2.29 MMBTU. For the bi-monthly consumption above 2.29 MMBTU, the PNG price has been hiked to Rs 915.55 per MMBTU from Rs 874.91/MMBTU. The company, however, has kept CNG and PNG prices in Vadodara unchanged. Am emailed query sent to the company did not elicit any response. The industry sources, however, attributed the rise possibly to the increase in operational, manpower and fixed cost of the company due to the Covid-19 pandemic.

show less

AG&P inks MoU with Government of Tamil Nadu to develop city gas distribution infrastructure in State

Atlantic, Gulf & Pacific Company (AG&P), the global downstream gas and LNG logistics company, and the Government of Tamil Nadu have signed a Memorandum of Understanding (MoU)

read more

for the development of City Gas Distribution (CGD) networks to supply reliable, economical, and environment-friendly natural gas across six districts of Tamil Nadu. The new, world-class CGD infrastructure is being developed under AG&P’s CGD brand in India – AG&P Pratham. The occasion was graced by Shri Thiru Edappadi K. Palaniswami, Hon’ble Chief Minister of Tamil Nadu, who unveiled AG&P’s PNG project in Rameshwaram and dedicated the State’s recently launched first City Gate Station & CNG Mother Station launched by AG&P in Ramanathapuram District.

Under the MoU, AG&P will invest INR 2,700 crores over the next eight years to build CGD networks in districts of Kanchipuram, Chengalpattu, Vellore, Ranipet, Thirupathur and Ramanathapuram. The Government of Tamil Nadu is committed to provide support to enable development of the much-awaited CGD infrastructure, that will deliver an uninterrupted supply of PNG to households, commercial and industrial customers, and Compressed Natural Gas (CNG) depots and stations for 24/7 access to CNG for vehicles. AG&P Pratham’s PNG initiative in Rameshwaram, its natural gas Mother Station in Ramanathapuram along with two CNG stations, are spearheading the development of the State’s city gas infrastructure that will drive socio-economic development as more and more people transition to smarter and cleaner fuels.

In 2018, 12 out of 38 districts in Tamil Nadu were awarded licenses by the Petroleum and Natural Gas Regulatory Board (PNGRB) for the development of CGD networks. Of these, AG&P bagged six districts encompassing ~13751 square km, which will be connected to natural gas through 12,000 km of pipeline being laid by the company. Under the licenses, AG&P will sell natural gas exclusively for eight years and operate its CGD facilities exclusively for 25 years. By 2028, AG&P will be supplying PNG to 2 million households, 10,000 commercial establishments, 150 industrial enterprises such as SIPCOT, SIDCO and Mahindra World City, and will operate more than 200 CNG stations across the state.

Source: Business Wire/Indian Oil & Gas [Edited]

show less

PNG supply to households in city from May-end – Mangaluru

The supply of piped natural gas (PNG) for cooking in households in Mangaluru city will begin by the end of this May, according to Chief General Manager (City Gas Distribution-Projects), GAIL Gas Ltd.,

read more

Noida, Kapil Kumar Jain, and General Manager, City Gas Distribution-Projects, Mangaluru, Vilin Zunke. In an informal chat with presspersons after commissioning the first compressed natural gas (CNG) station of Coastal Karnataka at the Netravathi Service Station of Indian Oil Corporation Ltd (IOCL) at Adyar on Tuesday, they said that the Mangaluru City Corporation has permitted the company to lay 60 km long network of pipelines to connect houses. Of this, Mr. Zunke said, 48 km long network of pipelines will have medium density polyethylene (MDPE) pipes and 12 km long network of pipelines will be steel ones. In addition, the National Highways Authority of India (NHAI) has permitted to lay 10 km long steel pipeline on the highway side in the city. The General Manager said that 6.7 km long network of pipelines have been laid in the city. Mr. Zunke said that 54,000 consumers have registered in the city seeking PNG connection. Of them, pipelines have already been laid for 5,300 consumers who are yet to get the gas supply.

show less

City gas distribution firms hike CNG, PNG prices to offset costs

While natural gas prices have stayed benign due to the covid-19 crisis, city gas distribution companies have revised rates citing higher minimum wages, rising operating expenses and commission payments

read more

to oil marketing companies. In Mumbai, Mahanagar Gas Ltd (MGL) on 9 February raised compressed natural gas (CNG) price by ₹1.50 a kg, and domestic piped natural gas (PNG) prices by 95 paise per unit. The move will impact 750,000 autos, taxis and buses plying in Mumbai, and over 700,000 households which use piped gas for cooking. “The hike has been done in order to partially cover the increase in operational, manpower and fixed costs experienced during the pandemic,” an MGL spokesperson said. Indian liquified natural gas (LNG) imports rose 1% year-on-year in December, but declined 7% month-on-month to 2.1 million metric tonnes. Overall natural gas consumption for the month fell 3% year-on-year and 4% month-on-month to 165.7MMSCMD. In Q3FY21, LNG imports rose 10% y-o-y and 2% q-o-q to 97.3MMSCMD. “CNG and residential PNG price was raised from 8 February 2021, despite no rise in domestic gas cost,” said ICICI Securities in a report dated 9 February. City gas distribution firms enjoy the highest priority allocation of domestic natural gas from the government for PNG and CNG consumers. According to MGL, while minimum wages have gone up, operating expenditure on a per-unit basis sold increased from 4.70-4.90 (pre-covid) to 5.50- 5.70. Indraprastha Gas Ltd did not reply to an emailed query till press time. The increase in CNG price comes at a time when retail fuel prices have been climbing for seven consecutive days to touch new highs. While retail petrol price in Delhi was raised by 26 paise to ₹88.99 a litre, in Mumbai it was retailing at ₹95.46 per litre. Diesel price in Delhi was at ₹79.35, up 29 paise from Sunday while in Mumbai, it was ₹86.34 per litre.

However, despite the price revision, CNG will be 62% cheaper compared to petrol and 41% cheaper to diesel at current levels in Mumbai, MGL said.

show less

Aurangabad still waiting for cost effective & green CNG

Amid rising fuel prices, the option of compressed natural gas (CNG) hailed as a cheaper and green fuel continues to elude the residents of Aurangabad. Responding to the long-pending demand,

read more

the petroleum and natural gas regulatory board had granted an authorisation for the supply of CNG and PNG (piped natural gas) in Aurangabad district in September 2018. The things, however, could not move further at the official level in more than two years. Yogesh Dharashivkar, a private professional, said CNG could be considered as a viable alternative to traditional fuels. “The rising fuel prices are burning a hole in the vehicle owners’ pockets. The government should offer CNG supply to Aurangabad and ensure lower levels of air pollution in the city that has several heritage sites,” he said. Nisar Ahmed Khan, the leader of autorickshaw drivers’ union, said CNG should be made available in tier II and III cities in the public interest. “CNG has a wide range of benefits for the consumers as well as the environment. Aurangabad is still deprived of this clean and green fuel due to lack of political will,” he said. As per official data, Aurangabad has over 13 lakh registered motorised vehicles. Rajya Sabha MP Bhagwat Karad, who is following up on the demand for CNG supply in Aurangabad, said the city is likely to get the desired fuel supply in the next few months. “Aurangabad has been shortlisted for the supply of green and clean energy by the Centre. The oil firms concerned have carried out the necessary surveys and the actual supply of CNG and PNG is expected to start in the near future,” he said. While CNG was priced at around Rs 55.50 per kg in metro cities in Maharashtra, offering a mileage either equivalent or more compared to traditional fuel.

show less

Electric Mobility & Bio- Methane

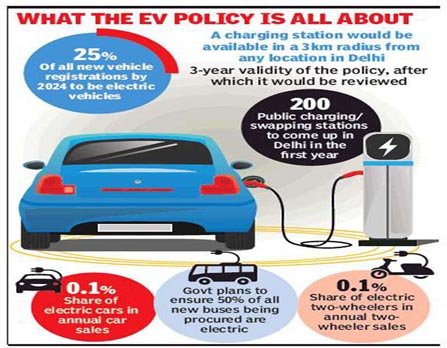

Green foot forward: Only e-vehicles for Delhi govt

Delhi government on Thursday ( Feb25) decided that all vehicles hired by its departments will switch to electric mode within six months. The step was taken to promote the adoption of electric vehicles

Delhi government on Thursday ( Feb25) decided that all vehicles hired by its departments will switch to electric mode within six months. The step was taken to promote the adoption of electric vehicles

read more

by setting an example. Every vehicle hired by Delhi government’s departments, autonomous bodies and grantee institutions under it will switch from petrol, diesel or CNG-run vehicles to electric ones. The government has also decided to gradually replace all its end-of-life vehicles with EVs and made these measures mandatory.

Deputy CM Manish Sisodia said that it was chief minister Arvind Kejriwal’s dream to make the city pollution free. “The decision that all government departments shift to EVs is a historic one,” he said, adding that Delhi will be the first capital in the world where all government departments switch to electric vehicles for road travel. “It is necessary to focus on the challenges related to a sustainable environment. Delhi government has prioritised the issue of curbing environmental distress along with its other major agenda items,” he said, adding that using Delhi as an example, cities of the world ensure that using EVs is an important agenda in the fight to curb pollution. Sisodia pinned faith on the idea that the decision of switching to electric vehicles by all departments of Delhi government will be a key step in encouraging more sustainable practices. “Delhi government’s commitment to switch all its hired cars to electric in six months is unprecedented globally. As the nodal department, transport department will leave no stone unturned to ensure a smooth transition. CM’s call for Switch Delhi marks a start of the EV revolution,” transport minister Kailash Gahlot tweeted. Transport department will be the nodal department to monitor the progress of the transition from existing diesel or petrol vehicle fleet to EVs. All departments will have to show it monthly action reports on the transition to EVs by the fifth of every month. “Delhiites have time and again made efforts towards making our environment, our city green and clean. Switching to electric vehicles will be another effort that all of us together, will take to ensure that we continue this fight towards sustainability” Sisodia said.

Source: ET Auto

show less

We see hydrogen as ‘Future Energy’, says Dharmendra Pradhan

Petroleum and Natural Gas Minister Dharmendra Pradhan recently witnessed the signing of a statement of intent between IndianOil Corp and Greenstat Hydrogen India for setting up of Centre of Excellence on Hydrogen.

read more

Speaking on the occasion, the minister talked about the importance that the government is giving to the exploration of new and emerging forms of energy. “We see hydrogen as the future energy,” he said.

He also expressed happiness at the encouraging results shown by the pilot project under which 50 buses in Delhi are running on hydrogen-CNG fuel. According to an official release, the minister said India is the third-largest energy consumer with growing energy demand, “making it the place to be, for any energy entrepreneur in any part of the globe”. He called for greater synergy between science, technology and entrepreneurship to create win-win for all. Greenstat Hydrogen India Pvt. Ltd is a subsidiary of Greenstat Norway. The release said that association between IndianOil Corp and Greenstat Hydrogen India aims to develop a Centre of Excellence on Hydrogen (CoE-H) including CCUS and fuel cells for clean energy in cooperation with Indo-Norwegian hydrogen cluster companies and organizations. The CoE-H will facilitate transfer and sharing of technology, know-how and experience through the green hydrogen value chain and other relevant technologies including hydrogen storage and fuel cells. The release said CoE-H will be a vehicle for promoting R&D projects in green and blue hydrogen between Norwegian and Indian R&D institutions and universities. Working closely with Industry and Governments on both sides, CoE-H will be levering its intellectual strengths in developing cost-efficient and scalable and sustainable technological solutions. The CoE will also pilot fuel cell research. The institute will also act as a think-tank towards developing codes and standards for best industrial practices, safety, product protocols and regulations in the area of hydrogen and fuel cells, the release said. (ANI)

show less

Ampere Electric to invest INR 700 crore in EV manufacturing plant in Tamil Nadu

Ampere Electric, the wholly-owned electric mobility subsidiary of Greaves Cotton Ltd, on Tuesday (Feb 16) announced a phased investment potential of INR 700 crore over 10 years to

read more

set up an e-mobility manufacturing plant in Ranipet, Tamil Nadu. The company signed a Memorandum of Understanding (MoU) with Tamil Nadu for the proposed Ranipet manufacturing plant which will be spread over 1.4 million square feet. It will have the potential to start manufacturing 100,000 units in its first year of operation. It can be scaled up to 1 million units a year. To be built on the principles of Industry 4.0, the Ranipet plant will have an advanced automation process for advanced manufacturing capabilities. “When ready, the plant will be one of the largest state-of-the-art e-mobility manufacturing plants in the country”, Ampere Electric said. Greaves Cotton has already invested INR 250 crore to acquire Ampere and e-three wheeler company ELE and on their scale-up, since January 2019, said the statement. Nagesh Basavanhalli, group CEO and MD, Greaves Cotton Limited, said, “This is a historic milestone for Greaves Cotton, as we outline our investment to transform the clean mobility landscape in India. This plant is dedicated to the State of Tamil Nadu and our nation. This move aligns with our mission of decarbonising last-mile transportation for a cleaner planet and uninterrupted mobility.” Roy Kurian, COO, e-mobility business (2W & 3W), Ampere Electric, said, “The manufacturing facility in Ranipet will help us expand our offerings to an ever-increasing customer base not just in India but also in other parts of the world.” This announcement rides on the back of a 35% growth in Ampere sales volumes for Q3 FY21 amidst a challenging business environment triggered by the COVID-19 pandemic.

Source: ET Auto

show less

Navi Mumbai: NMMT to run only CNG and electric buses, phase out diesel-run

Navi Mumbai Municipal Transport (NMMT), an undertaking of NMMC will phase out diesel-run buses, proposed in the budget for the financial year 2021-22.

read more

The civic transport wing will use only CNG and electric buses to minimize the generation of carbon. While presenting the NMMT budget, civic chief Abhijit Bangar said that the transport undertaking will use its asset for revenue generation. The NMMT is developing a commercial complex at its bus depot at sector 9 in Vashi. Similarly, the space available at Belapur, Ghansoli, and Airoli bus depots will be developed for commercial purposes. Real Estate expert feels that the step will a boost for the sector as working spaces will come up at prime locations. Bangar presented a Rs 379.49 crores budget estimate of NMMT with Rs 5.35 lakhs surplus for the financial year 2021-22. Under the central government’s Faster Adoption and Manufacturer of Hybrid Electric Vehicles (FAME II) India scheme, the NMMT will have 100 electric buses. Of the 100 electric buses, it will receive 30 buses by May 2021, and the remaining 70 buses by August 2021. Due to the pandemic, NMMT buses were available mostly for government services, and it impacted on overall revenue generation as well as spending. The revised budget for 2020-21 of NMMT was Rs 223.16 crores while the budget estimate was Rs 383.75 crores. During 2021-22, the NMMT will receive Rs 150 crores from NMMC and estimated to generate Rs 73.11 crores revenue by running its buses. Under the JnNURM-II, it will get Rs 45.41 crores.

show less

Gas/ Pipelines/ Company News

ONGC sees peak gas output of 15 million cubic metres per day from east coast block in 2024

India’s top exploration company Oil and Natural Gas Corp hopes to produce 15 million cubic metres of gas a day (MMSCMD) in 2024 from its block in the Krishna Godavari (KG) basin, off

read more

India’s east coast, its head of finance Subhash Kumar said on Monday (Feb 15). India, the world’s fourth biggest importer of liquefied natural gas, wants to boost local gas output as Prime Minister Narendra Modi has set a target to raise the share of the cleaner fuel in the country’s energy mix to 15% by 2030 from the current 6%. Most of the future gas production is expected from the Krishna Godavari basin, where ONGC and Reliance Industries operate blocks. Reliance aims to produce 30 MMSCMD gas by 2023 from its assets in the basin. ONGC will ramp up production from its KG basin block to about 3-3.5 MMSCMD from May, which will be further raised to 8.5 MMSCMD in 2022/23 before hitting peak rate in 2024, Kumar said. Combined output of Reliance and ONGC will be about 60% of the average 77 MMSCMD Indian companies produced in April-December 2020. To make its gas business profitable ONGC has floated a new subsidiary and expects government to raise local prices. Current local gas prices of $1.79/MMBtu have hit ONGC’s revenue. The company’s production cost is $3.5-$3.7/MMBtu, he said. The company will spin-off its entire gas business into the new subsidiary. ONGC holds stake in downstream gas assets and overseas gas blocks either directly or through its subsidiaries. Kumar said the new subsidiary will bid for gas produced by ONGC for use in the group’s refining and petrochemical plans. “As far as coming years are concerned the story of gas is going to unfold which is going to be critical for the sustained positive performance of the company,” Kumar said.

show less

Essar signs MoU with IIT, Dhanbad for R&D in CBM exploration

Essar Oil and Gas Exploration and Production Ltd (EOGEPL), India’s leading coal seam gas producer, on Wednesday said it has signed a pact with IIT Dhanbad (Indian School of Mines) to jointly

read more

carry out research and development on coal bed methane (CBM) technologies. The Memorandum of Understanding for collaboration provides for finding “an effective solution for various technological and operational challenges faced during CBM exploration and production,” the company said in a statement. EOGEPL, an investee company of Ruia-family owned Essar Global Fund Limited (EGFL), operates West Bengal’s Raniganj CBM block, producing over 1 million standard cubic meters per day of gas. IIT(ISM), a premier institute of national importance located at Dhanbad, was founded in 1926. The institute is located at the heart of Damodar Valley Coalfields (Dhanbad) and about 100 km from the Raniganj CBM block. “It is a unique milestone for us as it is the best partner in the country to join hands with when it comes to R&D in the oil and gas sector,” said Santosh Chandra, CEO, EOGEPL. EOGEPL has already invested over Rs 40 billion in the Raniganj East CBM Block towards drilling wells, setting up supply infrastructure, and laying customer pipelines to Durgapur and nearby industrial areas. Raniganj has 1.1 trillion cubic feet (TCF) of certified CBM reserves. EOGEPL aims to double its reserve base in the next few years, the statement said.

Source: Economic Times/Indian Oil & Gas

show less

Energy major GAIL India’s share buyback offer to open on February 25

Energy major GAIL India will open its buyback on February 25 for up to 6.97 crore fully paid-up equity shares of face value Rs 10 each. This represents 1.55 per cent of the total number of

read more

equity shares in issued, subscribed and paid-up equity share capital of the company. The company will buy back shares from all existing shareholders and beneficial owners as on record date — which is January 28 — on a proportionate basis. GAIL said this will be done through the tender offer process at a price of Rs 150 per equity share for an aggregate consideration not exceeding Rs 1,046.35 crore. The share buyback will close on March 10. The funds for the buyback will be met out of internally-generated cash resources, GAIL added. GAIL is India’s leading natural gas company with diversified interests across the natural gas value chain of trading, transmission, LPG production and transmission, LNG re-gasification, petrochemicals, and city gas. It owns and operates a network of around 12,500 km of high-pressure trunk pipelines. (ANI)

show less

Policy Matters/ Gas Pricing/Others

Centre committed to bringing natural gas under GST regime; plans to spend Rs 7.5 lakh crore on infrastructure: PM Modi

Asserting that the central government is committed to bringing natural gas under the Goods and Service Tax (GST) regime, Prime Minister Narendra Modi on Wednesday (Feb 17) said that

read more

centre plans to spend Rs 7.5 lakh crore on creating oil and gas infrastructure over five years. While dedicating and laying the foundation of key oil and gas projects in Tamil Nadu, Prime Minister in his address through video-conferencing said that Indian oil and gas companies are present in 27 countries with an investment worth about Rs 2.70 lakh crore. “We have plans to spend Rs 7.5 lakh crore in creating oil and gas infrastructure over five years. A strong emphasis has been laid on the expansion of the city gas distribution network by covering 470 districts. About 65.2 MMT of petroleum products have been exported. This number is expected to rise even further. Our companies have ventured overseas in the acquisition of quality oil and gas assets,” PM Modi said. “We are committed to bringing natural gas under the GST regime. I want to tell the world to come and invest in India‘s energy sector,” he added. Prime Minister said that India will generate 40 per cent of all its energy from renewable sources by 2030. “India is increasing its share of energy from renewable sources today. By 2030, 40 per cent of all energy will be generated from green energy sources. We are eager to increase the share of gas in our energy basket from 6.3 per cent currently to 15 per cent,” he said. PM Modi said that India is looking to cut energy import dependence and diversify imports. PM Modi dedicated Ramanathapuram-Thoothukudi Natural Gas pipeline to the nation. He also dedicated Gasoline Desulphurisation Unit at Chennai Petroleum Corporation Limited, Manali. He laid the foundation stone of the Cauvery Basin Refinery at Nagapattinam. Dharmendra Pradhan, Union Minister for Petroleum and Natural Gas, and Edappadi K. Palaniswami, Chief Minister of Tamil Nadu, joined the event through video conferencing. (ANI)

https://energy.economictimes.indiatimes.com/news/oil-and-gas/centre-committed-to-bringing-natural-gas-under-gst-regime-plans-to-spend-rs-7-5-lakh-crore-on-infrastructure-pm-modi/810816277[Edited]

show less

Cairn invites bids for gas in Rajasthan unit

Vedanta Ltd. on Monday (Feb 15) invited bids for the sale of natural gas from its Rajasthan block at rates equivalent to the price of imported LNG from the spot market or Brent oil price.

read more

Cairn Oil & Gas, Vedanta’s oil and gas arm, produces about 3.5 million standard cubic meters per day of gas from the block. “The company invites EoI from interested parties with proven capabilities and demonstrated presence in the natural gas business to participate in the national competitive e-auction process,” the firm said.

show less

Britain’s Cairn files case in U.S. to push India to pay $1.2 bln award

Cairn Energy has filed a case in a U.S. district court to enforce a $1.2 billion arbitration award it won in a tax dispute against India, a court document showed,

read more

ratcheting up pressure on the government to pay its dues.

In December, an arbitration body awarded the British firm damages of more than $1.2 billion plus interest and costs. The tribunal ruled India breached an investment treaty with Britain and said New Delhi was liable to pay.

Cairn asked the U.S. court to recognise and confirm the award, including payments due since 2014 and interest compounded semi-annually, according to the Feb. 12 filing seen by Reuters. The case marked a first step in Cairn’s efforts towards recovering its dues, potentially by seizing Indian assets, if the government did not pay, a source with knowledge of the arbitration case told Reuters. “If Cairn wins the case, it will be a step towards attaching and seizing Indian assets overseas, especially in the U.S.,” the source said. Reuters reported last month that Cairn was identifying India’s overseas assets, including bank accounts and even Air India planes or Indian ships, that could be seized in the absence of a settlement. Cairn declined to comment but pointed to a Feb. 9 Twitter post where it said Chief Executive Simon Thomson was looking forward to meeting India’s Finance Minister in Delhi next week. “We would request, along with others, that the Indian government move swiftly to adhere to the award that has been given,” Thomson said in the video posted on Twitter by Cairn. “It is important for our shareholders who are global financial institutions and who want to see a positive investment climate in India. I am sure that in working together with the government we can swiftly draw this to conclusion and reassure those investors,” he said. India’s finance and external affairs ministries did not immediately respond to requests for comment. Cairn aims to enforce the award under international arbitration rules, commonly called the New York Convention, and recover losses caused by India’s “unfair and inequitable treatment of their investments”, the court filing showed. The company has registered its claim against India in the Netherlands and France, telling regulators in the two countries that they may receive court orders to seize of some Indian assets, and the firm was preparing to do the same in Canada and United States, Reuters reported last month. India lost another major international arbitration case last year against Vodafone over a $2 billion retrospective tax dispute. The government has challenged the arbitration verdict in the Vodafone case. It has yet to say how it will proceed in Cairn’s case where it has to make a significant payment.

show less

LNG Development and Shipping

Shell’s Indian arm set to begin retail sales of LNG

The India unit of Royal Dutch Shell is planning to start retail sales of liquefied natural gas (LNG) in the country, a top company executive said. Last June, the Petroleum and

read more

Natural Gas Regulatory Board (PNGRB) opened up LNG retailing to all eligible entities, aiming to promote LNG as an alternative fuel for heavy vehicles, and reduce India’s dependence on imported oil. “We have an aspiration to build a number of retail sites which will be able to dispense LNG,” Ajay Shah, vice-president, Shell Energy Asia said in an interview. Shell already retails petrol and diesel in India. Shah refused to mention the number of LNG sites planned, but said Shell is exploring partnerships with other entities and holders of LNG capacity to expand its reach. Infrastructure is currently a bottleneck in the country and it needs partnerships and willingness to take risks, Shah noted. Shell is one of the few international oil companies operating in India. In addition to its presence across upstream, integrated gas, downstream and renewable energy in the country, Shell also operates the Shell Technology Centre Bengaluru (STCB), one of its three global hubs for technology, after Houston and Amsterdam. After the pandemic, China and India led the recovery in demand for LNG. Shah also sees trucked LNG as an attractive segment for Shell’s presence. Last month, the company launched the operation of its small-scale truck-loading unit at its LNG import terminal at Hazira in Gujarat. The truck-loading unit will augment Shell’s natural gas supply offerings in India to include the supply of LNG via trucks. “Today, there are no LNG trucks in India, but we anticipate it will grow. Like in China, a decade ago there were no LNG trucks but today there are 13 million tonnes of LNG being sold into transportation in China,” added Shah.

https://www.livemint.com/companies/news/shell-india-to-enter-lng-retailing-11614351824588.html

show less

Draft liquefied natural gas policy aims to run more trucks on LNG

The government has already announced plans to have 1,000 LNG retail outlets, entailing investment of Rs 10,000 crore, in the next five years, and the policy will work towards the target.

read more

The Union ministry of petroleum and natural gas has prepared a draft liquefied natural gas (LNG) policy which aims to set up a framework for the promotion of gas and find ways for LNG adoption in sectors which currently does not use it as a fuel. To make LNG the fuel of the future for heavy transport, the policy targets to convert 10% of long haul heavy duty trucks to ply on LNG. The timeline to achieve the target has not been specified in the draft document. The automotive companies will be incentivised towards manufacturing LNG-based heavy vehicles and creating ancillary manufacturing units through tax exemptions and green certifications, the draft policy said. There is also a plan to create enabling infrastructure for the operation of a virtual gas pipeline for transporting LNG through railways and trucks. To accommodate this, the policy envisages promotion of dedicated highways with extensive LNG infrastructure. The government has already announced plans to have 1,000 LNG retail outlets, entailing investment of Rs 10,000 crore, in the next five years, and the policy will work towards the target. On a per-kilometre basis, taking into account engine efficiency and other factors, there is savings of 30-40% for LNG-fuelled transportation vehicles. As the mileage is better, lesser retail outlets for LNG is required to cater to LNG trucks. One fill of LNG can take a loaded LNG truck to around 900 km, while a diesel truck needs a fuel refilling station after every 400-500 km. The policy aims to create LNG terminals with more than 100 MMTPA along the coastal regions to increase the share of gas in the energy basket to 15% by 2030 from the current level of 6%. Currently, the total capacity of operational LNG import terminals in the country is 42.5 MMTPA. The policy also aims to create 70 MMTPA of regasification terminals by 2030 and 100 MMTPA by 2040. Stakeholders have been asked to furnish their comments on the proposed policy within 15 days.

show less

Upcoming terminals in Gujarat to lower utilization of Dahej import terminal

The upcoming gas import terminals in Chhara and Jafrabad in Gujarat will likely lower the utilization levels of Petronet LNG’s Dahej station, analysts say. Noting that customers who import gas

read more

through the Dahej terminal have already started reserving volumes in the Swan terminal (Jafrabad), analysts at ICICI Securities estimate Dahej volumes to fall to 15.8 MMT, implying 90% utilization in FY22-24. Dahej, with a capacity of 17.5 MMTPA, is currently the largest gas import terminal in the country. It operated at 97.3% of its nameplate capacity in Q3FY21. Analysts also noted regasification charges of Petronet’s Kochi terminal are 38-61% higher than at recently commissioned Ennore and Mundra terminals. If the firm plans to match Kochi regasification rates with the Rs 60.25 per MMBtu tariff offered by Ennore, Petronet’s earning per share can dip by 2% by FY22 end. The 5-MMTPA Kochi terminal operated at 19.9% capacity in the quarter ended December, but the newly commissioned Kochi-Mangalore gas pipeline is expected to boost its utilisation level of the Kochi terminal to 30% in 2021. The Dahej and Kochi terminals have already been losing market share to Shell’s Hazira and Mundra terminals.

Source: Financial Express/Indian Oil & Gas

show less

Kolkata inks Kukrahati LNG Terminal deal

The Syama Prasad Mookerjee Port (SMP), Kolkata, has signed an MoU with the Hirnandani Group of Companies on Monday for a jetty-based LNG Terminal along the River Hooghly at Kukrahati in East Midnapore.

read more

The storage and re-gasification terminal will have a capacity of 5 MMTPA. SMP is considering this development as a part of the 2nd Maritime India Summit (MIS) that is going to be held virtually from March 2-4. Being organised by the Ministry of Ports, Shipping and Waterways, the Summit will be inaugurated by Prime Minister Narendra Modi.

“As a part of MIS-2021, the MoU was signed between Vinit Kumar, chairman, SMP, Kolkata and Darshan Hirnandani, CEO, Bengal Concession, a subsidiary of Hirnandani Group of Companies. The total project cost is about Rs 3,900 crore with an economic value of about Rs 6,000 crore. It is expected to provide about 250 direct jobs and another 750 indirect ones,” a senior SMP official said. While environmental clearance had already been obtained for the project, SMP has granted the NOC with mutually agreed terms and conditions. The project is coming up on about 38 acres of land acquired from the Haldia Development Authority (HDA). However the waterfront area comes under the jurisdiction of SMP, Kolkata. Apart from onshore LNG storage and re-gasification terminal the project also comprises a 125 km long pipeline from Kukrahati to Itinda in Bangladesh and a 225-km-long one from Kanaichatta to Shrirampur. Also 20 LCNG stations will be commissioned in West Bengal under this project, aiding in the availability of clean fuel to people. Once commissioned, in July 2024, LNG can be used as bunker fuel for ships and barges in the Hooghly River. It will also cater to the requirements of West Bengal and nearby states. “While the land belongs to the company, SMP will be providing marine services and maintain the channel. We are also working on a smaller LNG project at Haldia. Hopefully, coal and other fossil fuel will be replaced by LNG, even in the industrial belt around Haldia in the future,” Kumar said.

show less

Natural Gas / Transnational Pipelines/ Others

Israel to link Leviathan gas field to Egypt LNG plants, minister says

Israel and Egypt have agreed to build a pipeline to connect Israel’s offshore Leviathan natural gas field to liquefied natural gas (LNG) terminals in northern Egypt, the Israeli minister said on Sunday (Feb 21).

read more

The Palestinians also said they had signed an agreement with Egypt’s energy minister, who visited Israel and the occupied West Bank, on developing a gas field off the coast of Gaza. Israeli Energy Minister Yuval Steinitz hosted a meeting with Egypt’s Tarek El Molla as both countries look for new ways to expand the development of east Mediterranean natural gas. Israel’s Leviathan field, located 130 km (80 miles) off Israel’s coast, already supplies the Israeli domestic market and exports gas to Jordan and Egypt. Its shareholders include Chevron and Delek Drilling. Leviathan’s partners have been exploring options to expand the project, including a floating LNG facility or a subsea pipeline to link up with LNG terminals in Egypt that have been idled or run at less than their potential capacity. Steinitz said the two governments were moving ahead with the pipeline plan and were working on a formal agreement. “The two ministers agreed on the construction of (an) offshore gas pipeline from the Leviathan gas field to the liquefaction facilities in Egypt, in order to increase the gas exports to Europe through the liquefaction facilities in Egypt,” Steinitz’s office said in a statement. Molla signed a memorandum of understanding for Egypt to help develop the Gaza Marine field with the project’s two partners, the Palestine Investment Fund, the sovereign fund of the Palestinian Authority, and Consolidated Contractors Company. Gaza Marine sits about 30 km (19 miles) off the Palestinian enclave’s coast and is estimated to hold over 1 trillion cubic feet of natural gas.

Source: LNG Global

show less

Oil prices climb as deep freeze shuts U.S. oil wells, curbs refineries

Oil prices rose on Tuesday (Feb 16) as a cold front shut wells and refineries in Texas, the biggest crude producing state in the United States, the world’s biggest oil producer.

read more

Prices also gained as Yemen’s Iran-aligned Houthi group said it struck airports in Saudi Arabia with drones, raising supply concerns in the world’s biggest oil exporter, and on optimism for a global economic recovery amid accelerated COVID-19 vaccine rollouts. Brent crude was up 11 cents, or 0.2%, at $63.41 a barrel at 0144 GMT, after rising to its highest since January 2020 in the previous session. U.S. West Texas Intermediate (WTI) crude futures gained 62 cents, or about 1%, to $60.09 a barrel. WTI did not settle on Monday because of a U.S. federal holiday. Prices will settle at the close of trading on Tuesday. “The unexpected U.S. supply disruption provides another short term price recovery bridge that has likely taken oil prices to a level where markets were eventually heading but just a little bit quicker than expected,” Stephen Innes, chief global markets strategist at Axi said in a note on Tuesday.

The cold weather in the U.S. halted Texas oil wells and refineries on Monday and forced restrictions on natural gas and crude pipeline operators. The rare deep freeze prompted the state’s electric power suppliers to impose rotating blackouts, leaving nearly 3 million homes and businesses without power. Texas produces roughly 4.6 million barrels of oil per day and is home to 31 refineries, the most of any U.S. state, according to Energy Information Administration data, including some of the country’s largest. In the Middle East, Yemen’s Iran-aligned Houthi group said on Monday it had struck Saudi Arabia’s Abha and Jeddah airports with drones.

The Saudi-led coalition fighting the Houthis in Yemen said early on Monday morning it had intercepted and destroyed an explosive-laden drone fired by the Houthis toward the kingdom. The World Health Organization (WHO) on Monday listed AstraZeneca and Oxford University’s COVID-19 vaccine for emergency use, widening access to the relatively inexpensive shot in the developing world.

show less

Growing industrial consumption and exports support future US natural gas market growth

The U.S. Energy Information Administration’s (EIA) Annual Energy Outlook 2021 (AEO2021) Reference case projects that growth in natural gas consumption in the United States between 2020 and 2050 will be driven by

read more

exports and industrial use; consumption growth from the other sectors will increase slowly or stay flat. In the Reference case projection, U.S. natural gas production will increase to 43.0 trillion cubic feet (Tcf) in 2050 as consumption increases to 35.7 Tcf. EIA expects natural gas prices will remain low compared with historical levels, and that low price drives the AEO2021 Reference case’s projection of increased production. EIA expects that exports will rise as production outpaces consumption throughout the projection period. With economic growth driving U.S. industrial output, natural gas consumption by the industrial sector will increase by 3.6 Tcf, or 35%, from 2020 to 2050 and account for more than 75% of the 4.6 Tcf growth in U.S. natural gas consumption from all sectors during that period. Relatively low natural gas prices drive a growing U.S. chemicals industry, the largest domestic natural gas-consuming industry because it uses natural gas as a raw material (feedstock) as well as for heat and power. According to the AEO2021 Reference case, the bulk chemical industry will account for 45% of the industrial sector’s increased natural gas consumption, or 1.6 Tcf, through 2050. Natural gas consumption in the U.S. power sector will reach 12.1 Tcf in 2050, up 0.4 Tcf (4%) from 2020. In 2020, natural gas consumption in the power sector increased by 4% from 2019 to 11.7 Tcf because of relatively low natural gas prices and COVID-19-related disruptions in the power sector’s coal supplies. Amid higher natural gas prices in 2021, EIA projects that consumption of natural gas by the power sector will decrease by 16% to 9.9 Tcf. Natural gas consumption will then increase slowly until 2027 because of projected growth in natural gas-fired generation and because of new, more energy-efficient combined-cycle turbine systems. These systems limit growth in power consumption because they use less fuel to produce each kwh of electricity than older combined-cycle units or other fossil-fueled generators. Beyond 2036, EIA projects that consumption of natural gas in the U.S. power sector will continue to steadily increase. The AEO2021 projects growth in natural gas consumption by other end-use sectors as well. Beyond 2040, natural gas consumption in the U.S. transportation sector increases as natural gas becomes a more predominant fuel for heavy-duty vehicles and freight rail. The residential sector’s natural gas consumption remains nearly flat, and commercial buildings show low-to-moderate growth because of energy efficiency improvements (particularly commercial energy management controls and sensors) in space heating.

Source: EIA/LNG Global

show less

Global LNG Development

Asia to drive 75% of LNG demand growth by 2040: Shell LNG outlook

Asia is expected to drive nearly 75% of demand for Liquefied Natural Gas (LNG) by 2040 as domestic gas production declines and LNG substitutes higher emission energy sources,

read more

tackling air quality concerns and meeting emissions targets, says Shell’s LNG Outlook 2021. Natural gas emits between 45% and 55% fewer greenhouse gas emissions and less than one-tenth of the air pollutants than coal when used to generate electricity. According to the outlook, as demand grows, a supply-demand gap is expected to open in the middle of the current decade with less new production coming on-stream than previously projected. “Just 3 MMT in new LNG production capacity was announced in 2020, down from an expected 60 MMT,” the outlook said, adding that over half of future LNG demand will come from countries with net-zero emissions targets. Post the outbreak of the pandemic, China and India led the recovery in demand for LNG. China increased its LNG imports by 7 MMT to 67 MMT, an 11% increase for the year. Additionally, China’s announcement of a target to become carbon neutral by 2060 is expected to continue driving up its LNG demand through the key role gas can play in decarbonising hard-to-abate sectors, namely buildings, heavy industry, shipping and heavy-duty road transport. India also increased imports by 11% in 2020 as it took advantage of lower-priced LNG to supplement its domestic gas production. “Two other major Asian LNG-importing countries – Japan and South Korea – also announced net-zero emissions targets in 2020. To meet its net-zero target, South Korea aims to switch 24 coal-fired power plants to cleaner-burning LNG by 2034,” the outlook added. Globally, the demand in Europe, alongside flexible US supply, helped to balance the LNG market in the first half of 2020. However, supply outages in other basins, structural constraints and extreme weather later in the year resulted in higher prices.

show less

Petronas Floating LNG DUA produces first LNG

Petronas announced today their second FLNG facility, PFLNG DUA, recently achieved the milestone of fisrt LNG production. PFLNG DUA is expected to deliver its first cargo to customers by

Petronas announced today their second FLNG facility, PFLNG DUA, recently achieved the milestone of fisrt LNG production. PFLNG DUA is expected to deliver its first cargo to customers by

read more

middle of March 2021. Petronas will become the first global energy company to own and operate two floating LNG production facilities. Petronas Vice President of LNG Asset Zakaria Kasah said: “ Despite operating in a challenging environment which is exacerbated by COVID-19 pandemic, we managed to commission this megastructure and achieve the first production in 7 days upon first gas in. This is a record achievement, and a great milestone for Petronas and the LNG industry”. PFLNG can reach gas fields in water depths upto 1500 meters and produces 1.5 MMT of LNG per year.

Source: LNG Global

show less

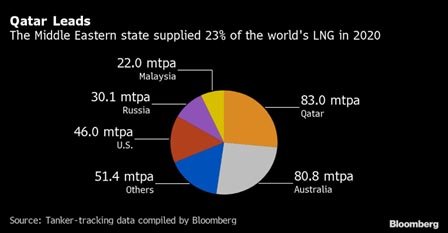

Qatar lays out ambition to be LNG King for at least two decades

Qatar aims to be the world’s biggest producer of liquefied natural gas for at least the next two decades, capitalizing on rising demand as the world transitions from oil and coal to cleaner energy.

Qatar aims to be the world’s biggest producer of liquefied natural gas for at least the next two decades, capitalizing on rising demand as the world transitions from oil and coal to cleaner energy.

read more

Qatar will spend billions of dollars expanding its LNG capacity more than 50% to 126 MMTPA. That’s a level other countries will struggle to match, Energy Minister Saad Al-Kaabi said in an interview with Bloomberg Television.

The Persian Gulf state is already the world’s main supplier of the super-chilled fuel, but new projects elsewhere — especially in Australia and the U.S. — have eroded its dominance. The nation will be able to produce LNG from the first phase of the expansion so cheaply that it will be viable even if oil prices fall below $20 a barrel, said Al-Kaabi. “This is one of the most competitive, if not the most competitive, projects on the planet,” he said. Oil prices collapsed last year, but have soared more than 60% since the start of November to around $64 a barrel with the roll-out of coronavirus vaccines. State producer Qatar Petroleum took a final investment decision on the North Field East Project last week. It’s likely to be the only project in the world to pass this milestone in 2021, after just one was sanctioned to move ahead last year, according to Bloomberg NEF. The lack of new supply from other countries will benefit Qatar, said Al-Kaabi, who is also chief executive officer of QP. “With less projects coming online, our expansion is very timely,” he said.

Al-Kaabi downplayed the idea among some analysts that demand for LNG is, like that for oil, close to peaking. Energy companies looking to produce more renewable energy will still need gas to offset the intermittency of green power, he said. “Renewables will definitely happen — we’re doing a lot ourselves — but you need gas to complement that,” he said. “Gas is sort of in a Catholic marriage with renewables. They would need to stay together for a very long time for you to have the transition successfully.” For a country that built its wealth on natural gas, continued demand for LNG is crucial. Qatar is one of world’s richest countries, with a per capita gross domestic product of $53,000 last year, according to the International Monetary Fund. QP has booked capacity at units that turn LNG back into gas in Belgium, France and the U.K. It’s also looking to build on its 70% stake in Britain’s largest LNG import terminal by investing in more regasification plants, said Al-Kaabi.

Though LNG is a cleaner-burning fuel than coal and oil, most supply agreements are still based on the price of crude. Al-Kaabi doubts that will change. “There is this fallacy that LNG is traded like a commodity and you can have an almost endless spot market,” he said. “It’s not true.” QP will continue to favor years-long contracts tied to oil and will sell only around 10% of the new gas via the spot market, the minister said. “Long-term is the best approach for both sides,” he said. “It gives certainty.” LNG spot rates have swung wildly over the past year, falling heavily around April as the pandemic raged and surging in mid-January amid a cold snap in Asia. The volatility created “big spikes that are not good for the buyer or the seller,” said the minister.

Source: LNG Global/Bloomberg

show less

Annual US LNG exports forecast to exceed pipeline exports by 2022

According to the U.S. Energy Information Administration’s (EIA) February 2021 Short-Term Energy Outlook (STEO), EIA forecasts that U.S. liquefied natural gas (LNG) exports will exceed natural gas exports by

read more

pipeline in the first and fourth quarters of 2021 and on an annual basis in 2022. Monthly U.S. LNG exports exceeded natural gas exports by pipeline by nearly 1.2 billion cubic feet per day (Bcf/d) in November 2020, according to EIA’s Natural Gas Monthly. LNG exports have only exceeded natural gas exports by pipeline once since 1998—in April 2020—by 0.01 Bcf/d. U.S. LNG exports set consecutive monthly records of 9.4 Bcf/d in November and of 9.8 Bcf/d in both December 2020 and January 2021, according to EIA’s estimates based on the shipping data provided by Bloomberg Finance, L.P. EIA forecasts that U.S. LNG gross exports will average 9.7 Bcf/d in February 2021 before declining to seasonal lows in the shoulder months of the spring and fall seasons. EIA forecasts LNG exports to average 8.5 Bcf/d in 2021 and 9.2 Bcf/d in 2022, compared with average gross pipeline exports of 8.8 Bcf/d in 2021 and 8.9 Bcf/d in 2022. Since November 2020, all six U.S. LNG export facilities have been operating near full design capacity. In December, the Corpus Christi LNG facility in Texas commissioned its third and final liquefaction unit six months ahead of schedule, bringing the total U.S. liquefaction capacity to 9.5 Bcf/d baseload (10.8 Bcf/d peak) across six export terminals. The November–January increase in U.S. LNG exports has been driven by rising international natural gas and LNG prices, particularly in Asia, and lower global LNG supply because of unplanned outages at several LNG export facilities worldwide. U.S. pipeline exports to Mexico increased by 6.4% in the first eleven months of 2020 compared with the same period in 2019 as a result of the completion of a new segment of the Wahalajara pipeline system in June and the Cempoala compressor station in September. The completion of Mexico’s Samalayuca-Sásabe pipeline (0.47 Bcf/d capacity) in January 2021 and the expected completion of Tula-Villa de Reyes pipeline (0.89 Bcf/d capacity) later this year are expected to further increase U.S. pipeline exports to Mexico.

Source: LNG Global/EIA

show less

Qatar Petroleum in deal for LNG supply to Bangladesh

Qatar Petroleum has entered into a long term Sale and Purchase Agreement (SPA) with Vitol for the supply of 1.25 MMTPA of liquefied natural gas (LNG) to Vitol’s final customers in Bangladesh.

read more

Under the agreement, LNG deliveries will commence later this year, further demonstrating the State of Qatar’s continued commitment to meeting the growing needs of its customers for reliable LNG supplies. Saad Sherida Al-Kaabi, the Minister of State for Energy Affairs, the President and CEO of Qatar Petroleum, said: “We are pleased to sign this SPA with Vitol, and we look forward to commencing deliveries under the SPA to further contribute to meeting Bangladesh’s energy requirements.” “This SPA also highlights our strong ability to meet the requirements of our partners and customers. We are proud to continue to be the supplier of choice for our customers and partners around the globe,” he added.

https://tradearabia.com/news/OGN_379165.html

show less

Qatar strikes LNG supply deal with Pakistan

Qatar Petroleum (QP) has signed a 10-year deal to supply up to 3mn metric tons/year of LNG to Pakistan State Oil Co, the LNG exporter said on February 26, with supplies due to start in 2022.

read more

The latest agreement builds on a 15-year supply contract signed in 2016 between Qatari and Pakistani entities, covering 3.75mn mt/yr of LNG. Pakistan is looking to expand gas use in power generation, so it can decommission dirtier and more expensive oil-fired capacity and overcome energy shortages. “With a well-established gas market and distribution system, Pakistan is a strategically important market for Qatar LNG,” QP CEO and Qatari energy minister Saad Sherida Al-Kaabi said in a statement. “We are encouraged by Pakistan’s exceptional growth and excellent economic potential as well as by the prospect of it being one of the world’s fastest growing LNG markets.” Pakistan began importing LNG in 2015, after the launch of the 4.5 MMTPA Engro Elengy terminal. The 5 MMTPA Pakistan GasPort terminal was brought on stream two years later. Both facilities are in Port Qasim. Pakistan also buys LNG on a spot basis, with QP recently filing a winning bid for the supply of a cargo in mid-April, linked to crude oil. Asian spot prices spiked in January as a result of a winter freeze, strengthening the case among buyers for long-term contracts linked to crude. Pakistan earlier this week secured a $1.1bn loan from the International Islamic Trade Finance Corp to cover the purchase of oil, LNG and refined petroleum products..

https://www.naturalgasworld.com/qatar-strikes-lng-supply-deal-with-pakistan-85878

show less

Natural Gas / LNG Utilization

British logistics company invests in sustainability with Volvo LNG trucks

Armstrong Logistics (UK) has taken delivery of its first new Volvo FH LNG trucks as part of the business’s strategy to reduce its carbon emissions and improve the long-term sustainability of its operation.

Armstrong Logistics (UK) has taken delivery of its first new Volvo FH LNG trucks as part of the business’s strategy to reduce its carbon emissions and improve the long-term sustainability of its operation.

read more

The five 6×2 tractor units have been specified with 155 kg LNG tanks for maximum range, and benefit from 12-speed I-Shift automated gearboxes to increase fuel efficiency further. “As a business, we have embarked on a number of projects to reduce our carbon footprint and these new LNG-powered trucks play an important part in that,” said Marcus Fischer, Finance & Commercial Director at Armstrong Logistics. “We did our research from articles in the press, spoke to key contacts in our sector and then held informal talks with three manufacturers, before deciding to go with Volvo.” The FH LNGs each benefit from Volvo’s unique approach to gas engine technology, using small amounts of diesel to initiate ignition of the air-fuel mixture. This enables the Volvo G13C engine to deliver the same 460 hp and 2,300 Nm of torque as its diesel-only counterpart, with matching drivability, reliability and service intervals. Plus, Volvo’s natural gas powertrain provides engine braking just like a regular diesel – and without requiring a separate retarder which adds weight and complexity. Expected to cover 200,000 km per year, the new trucks will be used on longer set runs – delivering a variety of goods from the business’s three consolidated logistics centers in Hinckley, Lutterworth and Doncaster. They will refuel at Gasrec’s flagship site at Daventry International Rail Freight Terminal (DIRFT). Armstrong Logistics worked closely with Volvo dealer Truck and Bus Wales and West, as well as Gasrec to ensure the infrastructure and support was in place to make the move financially viable.

show less

Total puts into operation France’s largest CNG & bio-CNG station

Total has opened France’s largest filling station exclusively dedicated to natural gas and biomethane vehicles. Located at the heart of the logistics platform of Gennevilliers,

Total has opened France’s largest filling station exclusively dedicated to natural gas and biomethane vehicles. Located at the heart of the logistics platform of Gennevilliers,

read more

the second largest fluvial port in Europe, this facility is now open 24/7 to professionals (B2B) and B2C customers, and will become a strategic site for the Grand Paris area (including the city of Paris & its 130 surrounding cities), supporting the development of new transportation in the Île-de-France. The natural gas station will be operated by Total for the next 10 years, and concession has been attributed by Sigeif Mobilités (a semi-public company founded by Sigeif and the Caisse des Dépôts) through a tender. This opening will complete the existing Total network in France and allow a growing number of transportation and logistics professionals of the Greater Paris area to convert to CNG in optimized conditions. This new facility will distribute CNG, which will be supplied to the site by GRTgaz, for the first time in France through its high-pressure gas delivery network. The station will be able to distribute up to 100% of bio-CNG, as users have the possibility to choose and adjust -directly at the pump and contractually for B2B customers- between several rates of biomethane incorporation. “This opening of France largest CNG and bio-CNG station is a source of pride for our teams,” said Guillaume Larroque, President of Total Marketing France. “Our ambition is clear: to become a leader in CNG and bio-CNG distribution in Europe, with 450 Total-operated stations by 2025 including 110 in France. This station is also a model for our future developments in Europe where Total is committed to achieve carbon neutrality by 2050 or sooner, for the products used by our customers. Our objective of a 50% rate of biomethane incorporation will directly contribute to it.” Jean-Jacques Guillet, President of Sem Sigeif Mobilités, commented: “This station within the Port of Gennevilliers is an essential infrastructure, fitting into the ongoing plan to improve air quality in the Île-de-France region. The companies located at the Port have now the possibility to use a clean fuel for their urban deliveries in Paris and its western neighboring cities, all to be covered by a Low-emission Zone currently under implementation.”

Jean-Baptiste Djebbari, Minister Delegate for Transport, also said: “I salute the opening of France’s largest CNG and bio-CNG station for trucks. Companies dedicated to the transportation by road of goods and people are in constant search for alternatives solutions to diesel for their own energy mix. Beyond the steep reduction in CO2 emissions, the advantage of NGV technologies is their immediate availability, widespread among all segments. We have renewed the support policies for these vehicles until end-2024, in order to provide companies with visibility and to allow them to engage in this transition.”

show less

Albuquerque’s new CNG station will be able to refuel +100 buses in 2032

The city of Albuquerque is extending its clean-air commitment by adding a new natural gas station, which will be designed, built and maintained by Houston-based Trillium, to refuel its bus fleet.

read more

The new turn-key CNG station marks the beginning of a 20-year partnership between the city and Trillium, which operates over 200 CNG stations across the country. Albuquerque first began purchasing CNG buses in 1997. The city’s fleet currently has 41 CNG buses, but the station could service up to 101 NGVs by 2032. If the city chooses to increase their fleet even further, Trillium’s design allows for an additional CNG compressor to accommodate expansions. Construction of the new facility will begin in October. “In 1997, the alternative fueling landscape had less offerings than it does today,” said Danny Holcomb, transit director for Albuquerque. “Currently, the city of Albuquerque is still determining what the fueling source of its fleet will be in the coming years and thankfully we will have the infrastructure in place if the decision to pursue all or some CNG buses is made.” “We are excited to support the city of Albuquerque in their transition toward a more sustainable public transportation network,” said JP Fjeld-Hansen, vice president of Trillium. “Trillium’s hard-working team will be sure to provide residents with a green commute for the next 20 years.” This will be the second CNG station in New Mexico for Love’s Travel Stops, the parent company of Trillium. Its existing station, located on Interstate 40 at exit 149, serves heavy-duty transit customers on the westside of Albuquerque.

show less

Russian mining company will switch trucks to LNG dual fuel operation

Nornickel’s management will develop a project to produce LNG on the site of the company’s former Nickel plant. This initiative is part of a large-scale comprehensive environmental program implemented by Nornickel.

read more

By producing LNG, the company will transfer heavy mining equipment to dual fuel consumption, with diesel and LNG. Nornickel is currently developing the technical scope of the LNG plant. A pilot project to re-equip dump trucks for dual fuel operation using LNG is also underway. Trials have been scheduled for the second half of 2021. Four BelAZ mining dump trucks have been chosen and their engines will be upgraded to operate in diesel and LNG modes. The trucks will be tested at the open pit of the Zapolyarny Mine at the Medvezhy Ruchey enterprise (part of Nornickel). The trials have been designed to identify whether it is possible to replace 40% of diesel fuel with LNG. Experts estimate that the application of this technology will significantly reduce emissions of carbon monoxide and dioxide, nitrogen oxides, sulfur oxide and dioxide, as well as carbon. Consequently, levels of gas accumulation in the quarry will decrease. Replacing diesel fuel with LNG also minimizes the cost of fuel for mining equipment, which will result in reduced transportation costs per ton of overburden/ore. Following the outcome of the trial, the decision will be made whether to re-equip the entire fleet of dump trucks used in the development of the quarry. This covers a fleet of approximately 30 vehicles. The decision to re-equip mining dump trucks used for other large-scale projects, such as the extraction of limestone from the Verkhnaya-Tomulakhskaya area as part of the company’s Sulfur Program (approximately 60 units), will also be revised. The cost of re-equipping one dump truck under the pilot project amounts to around 11 million roubles. If the modernization process covers large fleets of quarry trucks, costs of the works will be significantly lower. The construction of the LNG plant is expected to take place between January 2022 and March 2023.

show less

Gasrec built bioLNG facility for one of UK largest private transport firms

Logistics business Gregory Distribution has continued its drive towards a more sustainable and environmentally-friendly operation by installing its first bio-LNG refueling station.

read more

Last year, the company began a trial to test the suitability of biomethane to replace diesel in its fleet of more than 1,000 trucks – initially running seven Volvo FH LNG 6×2 tractor units as part of its operations in Bristol and Magor. The success of that trial has now seen the company make the next move, installing the station – owned and operated by Gasrec – at its Cullompton depot, to fuel a further order of 13 Volvo FH LNG vehicles. Gregory Distribution predominantly uses its LNG fleet to deliver palletized goods, often double-shifted on long-haul journeys to maximize the environmental benefits. “The transition to alternative fuels is a key part of our long-term strategy and this new facility is a continuation on that journey,” said Paul Jefferson, Group Legal, Risk and Sustainability Director at Gregory Distribution. “We put our first LNG trucks on the road last September and the reduction in carbon emissions have been clear to see. Right now, for our long-distance trunking work, bio-LNG is the best option to help reduce our carbon footprint.” Gasrec delivered the skid-mounted facility – used as a temporary solution for fleets exploring the option of bio-LNG – straight from frozen food distribution business Reed Boardall, which has recently upgraded to a permanent on-site refueling station. “We have installed a pumped mobile refueling station which we use to seed new locations where we want to get bio-LNG into an area quickly. The plan is to get a more permanent refueling station at Cullompton, but the fast-moving nature of this industry requires a flexible approach,” said James Westcott, Chief Commercial Officer of Gasrec.

show less

LNG as a Marine Fuel/Shipping

Samsung Heavy Industries grabs $710 mn LNG-fueled container ship order

South Korea’s Samsung Heavy Industries Co. has bagged a 781 billion won ($710 million) order to build five container vessels powered by liquefied natural gas (LNG)

read more

for a Hong Kong-based shipping company. Samsung Heavy Industries said in a disclosure on Monday that it signed a 781.2 billion won contract with an Asian shipping company to deliver five units of 15,000 twenty-foot equivalent unit (TEU) LNG-fueled container ship. The total value of the contract could reach up to 1.5 trillion won when including options to build five more vessels. Samsung Heavy Industries plans to deliver the five vessels in order from July 2023. Shares of Samsung Heavy Industries were trading 0.6 percent higher at 6,710 won on Tuesday (Feb 16) morning. The ships – which reportedly will be delivered to Hong Kong-based ship owner Seaspan Corp. – are environment-friendly vessels powered by LNG fuel that meet marine fuel standards such as sulfur content and carbon dioxide emissions set by the International Maritime Organization. The vessels will be equipped with various fuel saving devices and SVESSEL, the shipbuilder’s next-generation smart ship system, which enhances operation economy. Samsung Heavy Industries is a dominant leader in the crude oil carrier industry after it has grabbed 22 LNG-fueled vessel orders or 73 percent of the total. It has widened its footstep to container vessel industry based on its LNG-fueled vessel technology. An unnamed official from Samsung Heavy Industries said that the company expects more green and high-efficient container vessel orders to be made on an anticipated hike in demand to replace old vessels with new ones this year. The company will expand its market dominance by preemptively developing customized products for clients based on differentiated environmentally-friendly technology. So far this year, the shipbuilder has secured 10 orders – one LNG carrier and nine container ships. The total value reaches $1.3 billion, which is 17 percent of its annual goal of $7.8 billion.

https://pulsenews.co.kr/view.php?sc=30800021&year=2021&no=151388

show less

Gasum will supply natural gas to eco ferry covering Finland-Sweden route

Gasum has signed an agreement with the City of Vaasa, NLC Ferry Oy and Wärtsilä Finland Oy to build a customer terminal in Vaskiluoto in Vaasa, from where the company will flexibly supply LNG with

Gasum has signed an agreement with the City of Vaasa, NLC Ferry Oy and Wärtsilä Finland Oy to build a customer terminal in Vaskiluoto in Vaasa, from where the company will flexibly supply LNG with

read more

tanker trucks to cargo and passenger shipping company Wasaline’s new LNG-fueled ferry M/S Aurora Botnia, which will start operating later this year. It will also supply Wärtsilä’s new Smart Technology Hub, a place for research, product development and engineering, which will be completed in the fall. Gasum will also be able to serve other customers through the terminal. “In the City of Vaasa’s Energy and Climate program, the ambition is for the city to be carbon-neutral in the 2020s. The city is committed to the goal of reducing emissions between different actors in the urban area. It’s good news that this cooperation helps us to increase the availability of gas across the Vaasa region. Our cooperation is also an example of how we in Vaasa are combining our expertise in the energy industry and creating cleaner energy solutions,” explained Tomas Häyry, Mayor of Vaasa.”The new ferry, M/S Aurora Botnia, which will operate the Vaasa-Umeå route, is nearing completion. Our ship will be the most eco-friendly passenger and car ferry currently under construction. The ship’s engines will run on LNG and moving forward also on renewable biogas. The ferry will accommodate 800 passengers and have a cargo capacity of 1,500 lane meters for trucks and cars. Sustainability is increasingly important to our customers and also to the entire Vaasa region,” commented Peter Ståhlberg, CEO of Wasaline.

show less

Technological Development for Cleaner and Greener Environment Hydrogen & Bio-Methane

Chevron unveils projects in Arizona & Michigan to sell biogas for vehicles

Brightmark LLC and Chevron U.S.A. Inc. announced the expansion of their previously announced joint venture, Brightmark RNG Holdings LLC, to own projects across the United States to produce

read more

and market dairy renewable natural gas. Brightmark RNG Holdings LLC’s subsidiaries currently own biomethane projects in Western New York, Western Michigan, Central Florida and South Dakota. Additional equity investments by each company in the joint venture will fund construction of infrastructure and commercial operation of five new projects in Michigan and Arizona. Chevron will purchase renewable natural gas produced from these projects and market the volumes for use in vehicles operating on CNG. “Working with Brightmark to add new projects underpins our commitment to supplying the world with affordable, reliable and ever-cleaner energy,” said Andy Walz, president of Chevron’s Americas Fuels & Lubricants. “It’s an exciting time for Chevron as we continue to help advance the energy transition and help industries and consumers that use our products build a lower carbon future.” “We are delighted to expand our partnership with Chevron to further accelerate Brightmark’s mission to reimagine waste and ambition of achieving a global net-zero carbon future,” said Bob Powell, Founder and CEO of Brightmark. “The joint venture’s current renewable natural gas projects are on track to become fully operational as planned, and with this additional investment, we look forward to extending the reach of our lifecycle carbon negative projects throughout the U.S., with plans for future international expansion.”

show less

Chart & Ballard plan liquid hydrogen solution for heavy-duty transport

Ballard Power Systems signed a non-binding Memorandum of Understanding (MOU) with Chart Industries, Inc. for the joint development of integrated system solutions that

read more