GAS STATISTICS REVIEW Apr 2024) (**)

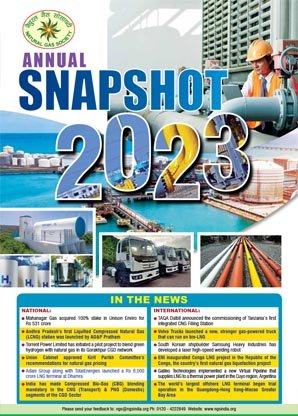

ANNUAL SNAPSHOT

Annual Snapshot 2023 || DIGITAL

Annual Snapshot 2023 || DIGITAL

UPCOMING EVENTS

FUTURE ENERGY ASIA 2024

Powering a resilient and low carbon energy future

15 – 17 MAY 2024, Queen Sirikit National, Convention Center, Bangkok, Thailand

READ MORE

CONFERENCE / WORKSHOP / WEBINAR

India Energy Week 2024

India Energy Week 2024

February 6 – 9, 2024, Goa

6th Natural Gas Operations & Maintenance Conference

April 17-18, 2023, New Delhi

The First Gyanaanubhav Prawaah Sahyatra (GPS)

March 24, 2023

1st Natural Gas (NG) Summit

August 5, 2022

Why every car owner should consider CNG conversion

GAIL reduces CNG price by Rs 2.50 per kg in the country

GAIL organised CBG Workshop for stakeholders under aegis of MoPNG

Indicative Prices of crude oil, Brent, and Natural gas

Data source – https://tradingeconomics.

Top News From Gas Industry * * *

NATIONAL NEWS

LNG import volume up 17.5% in FY24 as consumption rises

Indian Biogas Association joins hands with HAI to promote hydrogen

LNG import volume up 17.5% in FY24 as consumption rises

INTERNATIONAL NEWS

FG To Launch CNG Initiative Before May 29

Morocco considers three regasification units

Philippines nears comprehensive energy security with landmark LNG collaboration